FS Form 7311 Employee's Withholding Certificate for Local

Understanding the Nebraska 9N Form

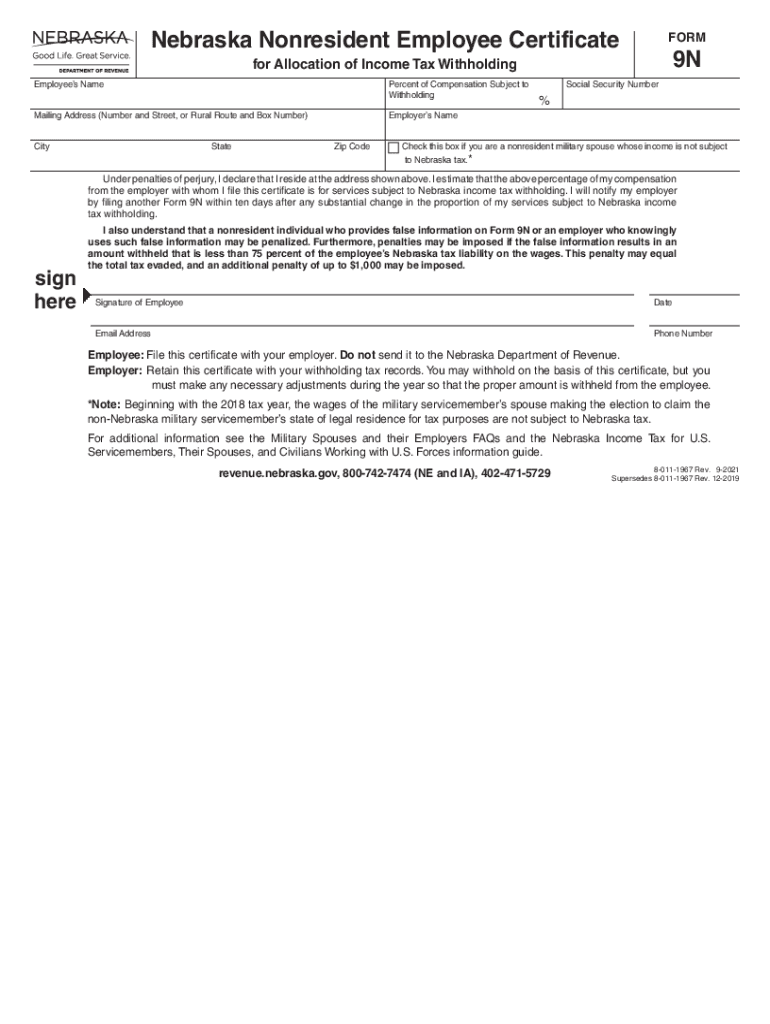

The Nebraska 9N form, also known as the nonresident certificate, is essential for individuals who earn income in Nebraska but reside in another state. This form allows nonresidents to claim a refund for any state income tax withheld from their earnings. It is crucial for ensuring compliance with Nebraska tax laws while providing a means for nonresidents to manage their tax obligations effectively.

Steps to Complete the Nebraska 9N Form

Completing the Nebraska 9N form involves several straightforward steps:

- Gather necessary information, including your personal details and income sources.

- Indicate your residency status and provide information about your home state.

- Detail your Nebraska income, including any withholding amounts.

- Sign and date the form to certify its accuracy.

Ensuring that all sections are filled out accurately is vital for the form's acceptance and for avoiding delays in processing any potential refunds.

Legal Use of the Nebraska 9N Form

The Nebraska 9N form is legally binding when completed correctly and submitted to the appropriate state authorities. It must adhere to the guidelines set forth by Nebraska's Department of Revenue. Compliance with these regulations ensures that the form is recognized for tax purposes and can help avoid legal complications related to tax filings.

Required Documents for the Nebraska 9N Form

To successfully complete the Nebraska 9N form, you will need several documents:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Proof of income earned in Nebraska, such as W-2 forms or pay stubs.

- Documentation of taxes withheld, if applicable.

- Identification proving your residency in another state.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is provided.

Filing Deadlines for the Nebraska 9N Form

It is important to be aware of the filing deadlines associated with the Nebraska 9N form. Typically, the form must be submitted by the same deadline as your state income tax return. This is usually April fifteenth for most taxpayers. However, if you are unable to meet this deadline, you may need to consider filing for an extension to avoid penalties.

Examples of Using the Nebraska 9N Form

The Nebraska 9N form is particularly useful in various scenarios, such as:

- A resident of Iowa who works in Nebraska and has state income tax withheld from their paycheck.

- A contractor from South Dakota performing services in Nebraska and earning taxable income.

- A student from Kansas working a summer job in Nebraska and needing to claim a refund for taxes withheld.

In each of these cases, the Nebraska 9N form serves as a critical tool for managing tax responsibilities and ensuring compliance with state laws.

Quick guide on how to complete fs form 7311 employees withholding certificate for local

Prepare FS Form 7311 Employee's Withholding Certificate For Local seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage FS Form 7311 Employee's Withholding Certificate For Local on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to alter and eSign FS Form 7311 Employee's Withholding Certificate For Local with ease

- Locate FS Form 7311 Employee's Withholding Certificate For Local and click on Get Form to commence.

- Take advantage of the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign FS Form 7311 Employee's Withholding Certificate For Local and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fs form 7311 employees withholding certificate for local

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask

-

What is the Nebraska 9N form?

The Nebraska 9N form is a document specifically designed for businesses operating in Nebraska that need to report certain tax-related information. It is crucial for maintaining compliance with state regulations and ensuring accurate reporting. Using the Nebraska 9N form can simplify the process of filing and help avoid potential errors.

-

How can airSlate SignNow help with the Nebraska 9N form?

airSlate SignNow offers an efficient platform for businesses to complete and electronically sign the Nebraska 9N form. The easy-to-use interface allows users to fill out the form digitally, ensuring accuracy and saving time. With airSlate SignNow, you can streamline the submission process and maintain a record of all signed documents.

-

Is there a cost associated with using airSlate SignNow for the Nebraska 9N form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The pricing structure is transparent, providing various plans that cater to different needs. Investing in airSlate SignNow for the Nebraska 9N form can ultimately save time and improve efficiency.

-

What features does airSlate SignNow provide for the Nebraska 9N form?

airSlate SignNow offers several features to assist with the Nebraska 9N form, including easy document creation, electronic signatures, and automated workflows. These features simplify the process and improve the accuracy of form submissions. Additionally, users can track document status and receive notifications for timely submissions.

-

Are there integrations available for airSlate SignNow when completing the Nebraska 9N form?

Yes, airSlate SignNow provides seamless integration options with popular platforms such as Google Drive, Dropbox, and Salesforce, enhancing your ability to manage the Nebraska 9N form efficiently. This allows businesses to pull in data from these applications directly into the form. Integrations help streamline workflows and save time in the document management process.

-

How secure is the data when using airSlate SignNow for the Nebraska 9N form?

Data security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Nebraska 9N form. The platform employs end-to-end encryption to protect information and complies with industry standards. This ensures that your data is secure during submission and storage.

-

Can I access the Nebraska 9N form on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and complete the Nebraska 9N form on various devices, including smartphones and tablets. This flexibility means you can manage your documents and sign forms on the go, making it convenient for busy professionals.

Get more for FS Form 7311 Employee's Withholding Certificate For Local

- Contractors forms package connecticut

- Power of attorney for sale of motor vehicle connecticut form

- Affidavit force form

- Connecticut statutory form

- Wedding planning or consultant package connecticut form

- Hunting forms package connecticut

- Identity theft recovery package connecticut form

- Statutory durable power of attorney for health care appointment of health care agent and health care instructions connecticut form

Find out other FS Form 7311 Employee's Withholding Certificate For Local

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure