NCDOR Offer in CompromiseNCDOR Offer in CompromiseOffer in CompromiseInternal Revenue Service IRS Tax FormsOffer in CompromiseIn

Understanding the North Carolina Offer In Compromise

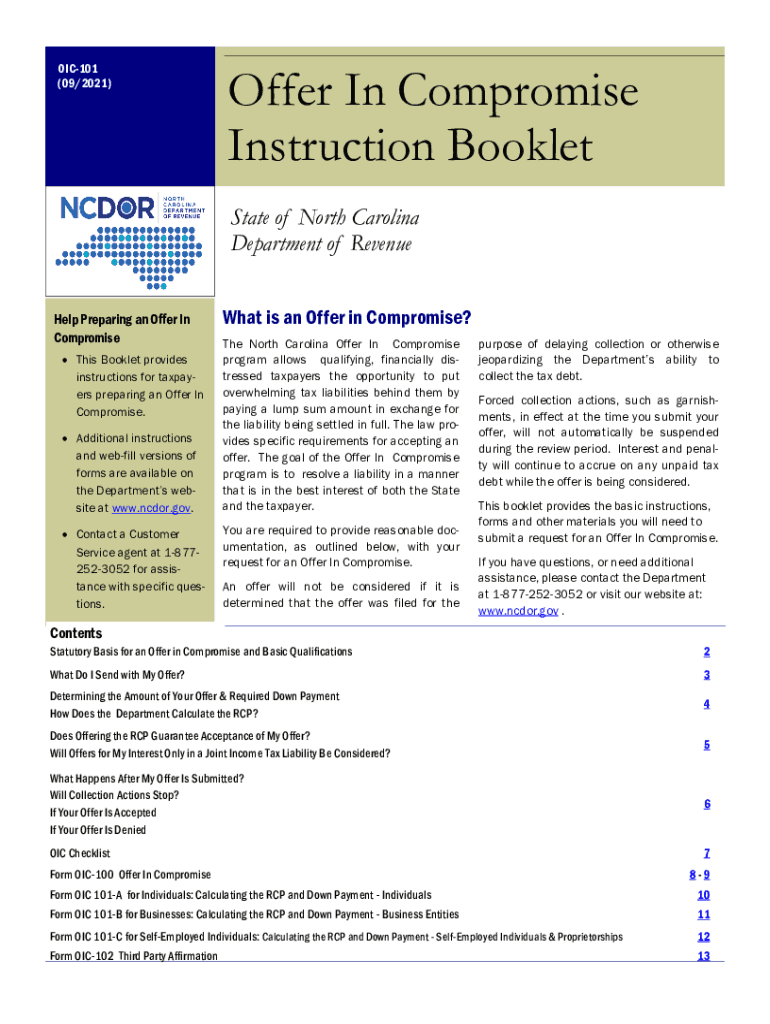

The North Carolina Offer In Compromise (OIC) is a program designed to assist taxpayers who are unable to pay their full tax liabilities. This program allows eligible individuals to settle their tax debts for less than the total amount owed. The NCDOR (North Carolina Department of Revenue) evaluates each application based on the taxpayer's financial situation, including income, expenses, and assets. This process aims to provide a manageable solution for those facing financial hardship while ensuring compliance with state tax laws.

Steps to Complete the North Carolina Offer In Compromise

Completing the North Carolina Offer In Compromise involves several key steps. First, taxpayers must gather necessary financial documentation, including income statements, expense records, and asset information. Next, individuals should fill out the OIC application form accurately, ensuring all required fields are completed. After submitting the form, the NCDOR will review the application and may request additional information. It is crucial to respond promptly to any inquiries to avoid delays in the process. Once the review is complete, the NCDOR will issue a decision regarding the offer.

Eligibility Criteria for the North Carolina Offer In Compromise

To qualify for the North Carolina Offer In Compromise, taxpayers must meet specific eligibility criteria. Individuals must demonstrate an inability to pay their tax liabilities in full, which often involves providing detailed financial information. Additionally, applicants must be current with all tax filings and payments. This means that any outstanding tax returns must be submitted before applying for the OIC. The NCDOR assesses each case on its own merits, taking into account the taxpayer's unique financial circumstances.

Required Documents for the North Carolina Offer In Compromise

Submitting a North Carolina Offer In Compromise requires several key documents to support the application. Taxpayers should prepare the following:

- Completed OIC application form

- Financial statements detailing income and expenses

- Proof of assets, such as bank statements or property deeds

- Copies of recent tax returns

- Any additional documentation requested by the NCDOR

Having these documents ready can streamline the application process and improve the chances of a successful outcome.

Legal Use of the North Carolina Offer In Compromise

The North Carolina Offer In Compromise is legally binding once accepted by the NCDOR. This means that the agreed-upon settlement amount will satisfy the taxpayer's obligations for the specified tax liabilities. It is essential for applicants to understand that accepting an OIC does not eliminate future tax responsibilities. Taxpayers must remain compliant with all tax laws moving forward to avoid additional penalties or liabilities.

Form Submission Methods for the North Carolina Offer In Compromise

Taxpayers can submit their North Carolina Offer In Compromise applications through various methods. The NCDOR accepts submissions via mail, allowing individuals to send their completed forms and supporting documents directly to the department. Additionally, taxpayers may have the option to submit their applications online through the NCDOR's website, which can expedite the processing time. It is important to follow the submission guidelines provided by the NCDOR to ensure that the application is received and processed correctly.

Quick guide on how to complete ncdor offer in compromisencdor offer in compromiseoffer in compromiseinternal revenue service irs tax formsoffer in

Setup NCDOR Offer In CompromiseNCDOR Offer In CompromiseOffer In CompromiseInternal Revenue Service IRS Tax FormsOffer In CompromiseIn effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the features required to create, alter, and eSign your documents swiftly without delays. Handle NCDOR Offer In CompromiseNCDOR Offer In CompromiseOffer In CompromiseInternal Revenue Service IRS Tax FormsOffer In CompromiseIn on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign NCDOR Offer In CompromiseNCDOR Offer In CompromiseOffer In CompromiseInternal Revenue Service IRS Tax FormsOffer In CompromiseIn with ease

- Locate NCDOR Offer In CompromiseNCDOR Offer In CompromiseOffer In CompromiseInternal Revenue Service IRS Tax FormsOffer In CompromiseIn and click on Get Form to begin.

- Employ the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to apply your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and eSign NCDOR Offer In CompromiseNCDOR Offer In CompromiseOffer In CompromiseInternal Revenue Service IRS Tax FormsOffer In CompromiseIn and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ncdor offer in compromisencdor offer in compromiseoffer in compromiseinternal revenue service irs tax formsoffer in

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the north carolina offer from airSlate SignNow?

The north carolina offer from airSlate SignNow provides businesses in North Carolina with an efficient way to send and eSign documents. This offer includes competitive pricing tailored for local businesses, along with access to all essential features for document management.

-

How much does the north carolina offer cost?

The pricing for the north carolina offer is designed to be cost-effective, ensuring that businesses of all sizes can benefit from our services. We provide flexible plans that cater to different needs, with transparent pricing available on our website.

-

What features are included in the north carolina offer?

The north carolina offer includes a variety of features such as eSignature capabilities, document templates, and real-time tracking. Additionally, it provides robust security measures, ensuring your documents are safe and compliant with industry standards.

-

How can airSlate SignNow benefit my North Carolina business?

The north carolina offer allows your business to streamline document workflows, saving time and reducing operational costs. By adopting our solution, you can enhance productivity and improve customer satisfaction with quick and lawful document signing.

-

Are there any integration options with the north carolina offer?

Yes, the north carolina offer provides seamless integration with various popular platforms such as Google Workspace and Salesforce. This ensures that you can incorporate airSlate SignNow into your existing systems for a smoother workflow.

-

Is there a trial period for the north carolina offer?

Yes, we offer a free trial period for the north carolina offer, allowing businesses to explore the features and benefits of airSlate SignNow. This trial helps you understand how our solutions can specifically suit your document signing needs.

-

Can I customize documents with the north carolina offer?

Absolutely, the north carolina offer allows for extensive customization of documents. You can create templates, add fields, and personalize your documents to match your brand's look and feel.

Get more for NCDOR Offer In CompromiseNCDOR Offer In CompromiseOffer In CompromiseInternal Revenue Service IRS Tax FormsOffer In CompromiseIn

- Connecticut appointment make form

- Ct directives form

- Aging parent package connecticut form

- Sale of a business package connecticut form

- Legal documents for the guardian of a minor package connecticut form

- New state resident package connecticut form

- Como llenar form ct w4p 2021 printable explicamome paso x paso

- Connecticut property 497301291 form

Find out other NCDOR Offer In CompromiseNCDOR Offer In CompromiseOffer In CompromiseInternal Revenue Service IRS Tax FormsOffer In CompromiseIn

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer