Disclosure of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure of Loss Reportable Transactions I

Understanding Form 8918

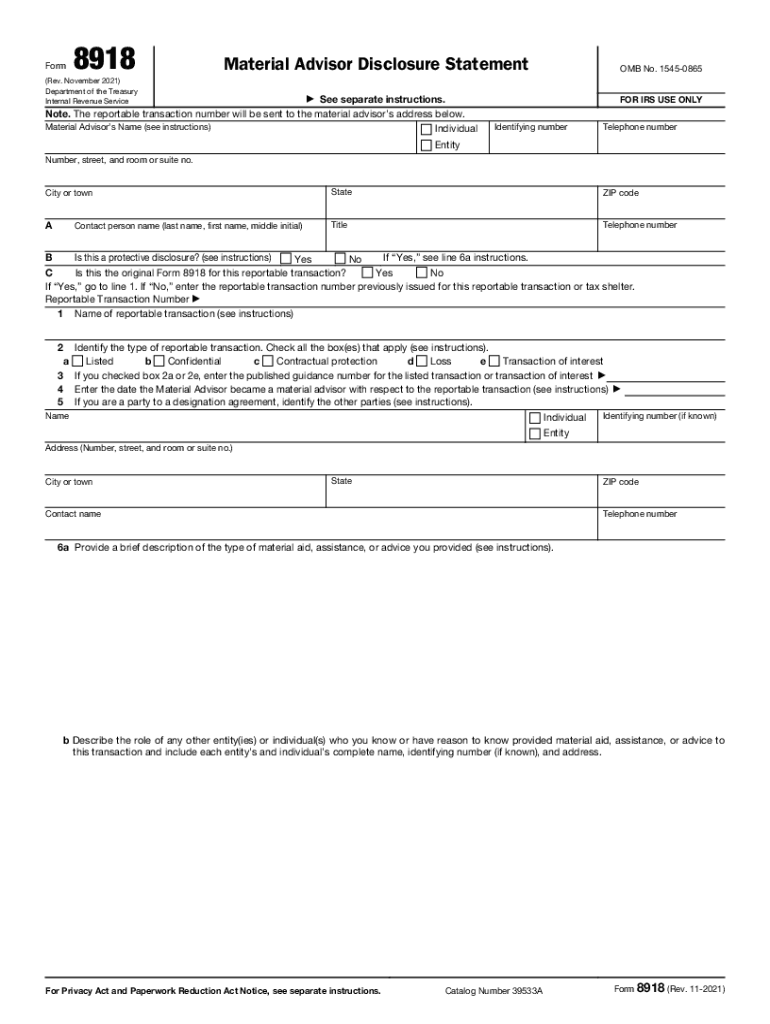

The IRS Form 8918, also known as the Disclosure of Loss Reportable Transactions, is essential for taxpayers who have engaged in specific reportable transactions that resulted in losses. This form is designed to provide the IRS with detailed information about these transactions, ensuring compliance with tax regulations. Understanding the purpose and requirements of Form 8918 is crucial for accurate tax reporting.

Who Must File Form 8918?

Taxpayers who have participated in reportable transactions that lead to a loss must file Form 8918. This includes individuals and entities that have engaged in transactions that the IRS considers to be tax avoidance schemes. It is important for taxpayers to assess their transactions to determine if they fall within the reporting requirements, as failure to file can result in penalties.

Steps to Complete Form 8918

Completing Form 8918 involves several key steps:

- Gather necessary documentation related to the reportable transactions.

- Provide detailed descriptions of the transactions, including dates and amounts.

- Disclose any relevant financial information that supports the reported losses.

- Review the completed form for accuracy before submission.

Taking these steps ensures that the form is filled out correctly, reducing the risk of errors that could lead to compliance issues.

Legal Use of Form 8918

Form 8918 serves a legal purpose in the context of tax compliance. By filing this form, taxpayers disclose their participation in reportable transactions, which is a requirement under U.S. tax law. The information provided helps the IRS monitor and regulate tax avoidance practices. Therefore, understanding the legal implications of this form is vital for taxpayers seeking to adhere to tax regulations.

Filing Deadlines for Form 8918

Taxpayers must be aware of the filing deadlines for Form 8918 to avoid penalties. Generally, the form should be filed along with the taxpayer's income tax return for the year in which the reportable transaction occurred. It is advisable to check the IRS guidelines for specific deadlines, as these can vary based on individual circumstances.

Penalties for Non-Compliance

Failing to file Form 8918 when required can lead to significant penalties. The IRS may impose fines for each instance of non-compliance, which can accumulate quickly. Additionally, not disclosing reportable transactions could lead to further scrutiny of a taxpayer's overall tax situation, resulting in potential audits or additional penalties. Understanding these consequences emphasizes the importance of timely and accurate filing.

Quick guide on how to complete disclosure of loss reportable transactions irs tax formswho must file irs tax formsdisclosure of loss reportable transactions

Complete Disclosure Of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure Of Loss Reportable Transactions I effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Disclosure Of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure Of Loss Reportable Transactions I on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Disclosure Of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure Of Loss Reportable Transactions I with ease

- Obtain Disclosure Of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure Of Loss Reportable Transactions I and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Disclosure Of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure Of Loss Reportable Transactions I and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the disclosure of loss reportable transactions irs tax formswho must file irs tax formsdisclosure of loss reportable transactions

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the significance of using IRS form material within airSlate SignNow?

Using IRS form material within airSlate SignNow ensures compliance with federal regulations and facilitates seamless document management. This helps businesses streamline their processes while reducing the risk of errors. Leveraging IRS form material allows users to efficiently collect signatures and enhance workflow efficiency.

-

Can I customize IRS form material in airSlate SignNow?

Yes, airSlate SignNow allows users to customize IRS form material to fit their specific business needs. You can easily add fields, modify text, and include branding elements to create a professional appearance. Customizing your IRS form material makes it easier for clients to understand and interact with the documents.

-

What are the pricing options for airSlate SignNow that includes IRS form material?

airSlate SignNow offers several pricing plans that cater to different business sizes and needs, including those needing IRS form material. Each plan provides comprehensive features, including document templates and eSignature capabilities. To find the right pricing option for incorporating IRS form material, visit our pricing page.

-

How does airSlate SignNow ensure the security of IRS form material?

airSlate SignNow prioritizes the security of IRS form material by utilizing advanced encryption protocols and secure cloud storage. This helps protect sensitive information while maintaining compliance with legal standards. You can trust that your IRS form material is safeguarded against unauthorized access.

-

What features does airSlate SignNow provide for managing IRS form material?

AirSlate SignNow offers a range of features for managing IRS form material, including templates, eSigning, and automated workflows. These features streamline the document handling process, making it efficient and easy to track progress. Users can also collaborate on IRS form material in real-time, ensuring everyone is on the same page.

-

Can I integrate other tools with airSlate SignNow to handle IRS form material?

Absolutely! airSlate SignNow supports integrations with various tools and platforms, making it easy to handle IRS form material alongside your existing workflows. Popular integrations include Google Drive, Salesforce, and Slack. This interoperability enhances productivity by allowing seamless data flow across applications.

-

How does using airSlate SignNow improve the efficiency of handling IRS form material?

Using airSlate SignNow signNowly boosts the efficiency of handling IRS form material by reducing manual tasks and automating workflows. The eSigning feature allows documents to be signed quickly, eliminating delays. This leads to faster turnaround times and improved overall productivity for your business.

Get more for Disclosure Of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure Of Loss Reportable Transactions I

- Drainage contractor package connecticut form

- Tax free exchange package connecticut form

- Landlord tenant sublease package connecticut form

- Buy sell agreement package connecticut form

- Option to purchase package connecticut form

- Amendment of lease package connecticut form

- Annual financial checkup package connecticut form

- Connecticut bill sale form

Find out other Disclosure Of Loss Reportable Transactions IRS Tax FormsWho Must File? IRS Tax FormsDisclosure Of Loss Reportable Transactions I

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself