Revenue Nebraska Govsales and Use Tax FormsSales and Use Tax FormsNebraska Department of Revenue 2021-2026

Understanding Nebraska Vehicle Sales Tax

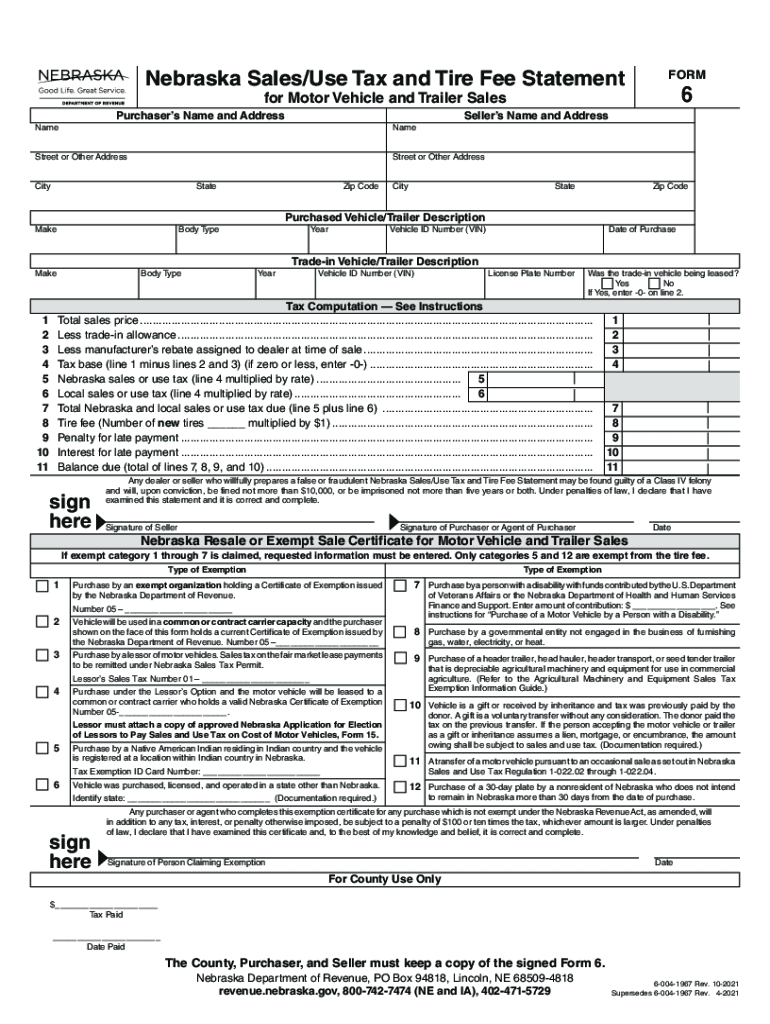

The Nebraska vehicle sales tax is a crucial component of vehicle transactions within the state. This tax applies to the purchase price of a vehicle, including any additional fees that may be associated with the sale. The rate is set by the state of Nebraska and can vary based on specific circumstances, such as the type of vehicle being purchased. Understanding this tax is essential for both buyers and sellers to ensure compliance with state regulations.

Steps to Complete the Nebraska Vehicle Sales Tax Form

Filling out the Nebraska vehicle sales tax form requires careful attention to detail. Here are the steps to complete it:

- Obtain the Nebraska Department of Revenue Form 6, which is specifically designed for reporting vehicle sales tax.

- Fill in your personal information, including your name, address, and contact details.

- Provide details about the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the purchase price of the vehicle and any trade-in value, if applicable.

- Calculate the sales tax based on the current Nebraska vehicle sales tax rate.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the Nebraska Vehicle Sales Tax Form

The Nebraska vehicle sales tax form must be used in accordance with state laws. It is essential for documenting the sale of a vehicle and ensuring that the appropriate taxes are collected. Failure to properly complete and submit this form can result in penalties or fines. The form serves as a legal record of the transaction, which may be required for future reference, such as when registering the vehicle or during audits.

State-Specific Rules for Nebraska Vehicle Sales Tax

Each state has its own regulations regarding vehicle sales tax, and Nebraska is no exception. In Nebraska, the sales tax applies to all motor vehicles, trailers, and ATVs purchased within the state. There are specific exemptions and rules that may apply, such as for certain non-profit organizations or government entities. It is important to familiarize yourself with these rules to ensure compliance and avoid any potential issues during the transaction.

Required Documents for Nebraska Vehicle Sales Tax

When completing the Nebraska vehicle sales tax form, several documents may be required to support your submission:

- The bill of sale, which provides proof of the purchase price and transaction details.

- The vehicle title, which confirms ownership and is necessary for registration.

- Any trade-in documentation, if applicable, to verify the value of the traded vehicle.

- Identification documents, such as a driver's license, to establish your identity.

Form Submission Methods for Nebraska Vehicle Sales Tax

Submitting the Nebraska vehicle sales tax form can be done through various methods, ensuring convenience for all users. The form can be submitted online via the Nebraska Department of Revenue's website, allowing for quick processing. Alternatively, you can mail the completed form to the appropriate state office or submit it in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete revenuenebraskagovsales and use tax formssales and use tax formsnebraska department of revenue

Complete Revenue nebraska govsales and use tax formsSales And Use Tax FormsNebraska Department Of Revenue effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Revenue nebraska govsales and use tax formsSales And Use Tax FormsNebraska Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to alter and eSign Revenue nebraska govsales and use tax formsSales And Use Tax FormsNebraska Department Of Revenue effortlessly

- Locate Revenue nebraska govsales and use tax formsSales And Use Tax FormsNebraska Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Revenue nebraska govsales and use tax formsSales And Use Tax FormsNebraska Department Of Revenue and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuenebraskagovsales and use tax formssales and use tax formsnebraska department of revenue

Create this form in 5 minutes!

How to create an eSignature for the revenuenebraskagovsales and use tax formssales and use tax formsnebraska department of revenue

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is Nebraska vehicle sales tax?

Nebraska vehicle sales tax is the tax applied to the sale of vehicles in Nebraska. This tax is calculated based on the purchase price of the vehicle and is typically collected at the time of registration. It's important for buyers to understand this tax to properly budget for the total cost of their vehicle.

-

How is the Nebraska vehicle sales tax calculated?

The Nebraska vehicle sales tax is calculated by taking a percentage of the purchase price of the vehicle. As of now, the state imposes a vehicle sales tax rate of 5.5%, though local taxes may also apply. Buyers should check with local authorities to understand any additional fees that may accompany the state tax.

-

Are there any exemptions for Nebraska vehicle sales tax?

Yes, there are certain exemptions for the Nebraska vehicle sales tax. For instance, vehicles purchased for agricultural, nonprofit, or governmental purposes may be exempt from sales tax. It's advisable to consult with a tax professional or the Nebraska Department of Revenue for specific guidance on exemptions.

-

How does airSlate SignNow streamline vehicle sales tax documentation?

AirSlate SignNow simplifies the documentation process related to Nebraska vehicle sales tax by providing an easy-to-use eSigning solution. This allows both buyers and sellers to quickly and securely sign necessary documents online, reducing delays and enhancing efficiency. Utilizing SignNow can help ensure all tax-related papers are properly executed.

-

Can airSlate SignNow estimate vehicle sales tax amounts for transactions?

While airSlate SignNow doesn't directly calculate Nebraska vehicle sales tax, it facilitates the documentation process where calculations can be included in the forms. Users can create custom templates that track the purchase price and include reminders about tax obligations. This ensures that all necessary calculations are readily available during transactions.

-

What features does airSlate SignNow offer for managing vehicle sales transactions?

AirSlate SignNow offers a variety of features tailored for managing vehicle sales transactions, including document templates, secure eSigning, and automated workflows. These features enable users to efficiently handle the paperwork required for Nebraska vehicle sales tax and other related documents, ensuring a smooth transaction experience.

-

Is integration with accounting software available for managing vehicle sales tax?

Yes, airSlate SignNow integrates with popular accounting software, which helps users manage financial records, including Nebraska vehicle sales tax documentation. This integration allows for seamless transfer of data, making it easier to track sales tax obligations and maintain accurate financial statements.

Get more for Revenue nebraska govsales and use tax formsSales And Use Tax FormsNebraska Department Of Revenue

- Essential documents for the organized traveler package connecticut form

- Essential documents for the organized traveler package with personal organizer connecticut form

- Postnuptial agreements package connecticut form

- Letters of recommendation package connecticut form

- Ct package 497301352 form

- Connecticut construction or mechanics lien package corporation connecticut form

- Storage business package connecticut form

- Child care services package connecticut form

Find out other Revenue nebraska govsales and use tax formsSales And Use Tax FormsNebraska Department Of Revenue

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation