Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales ?8 2018

What is the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

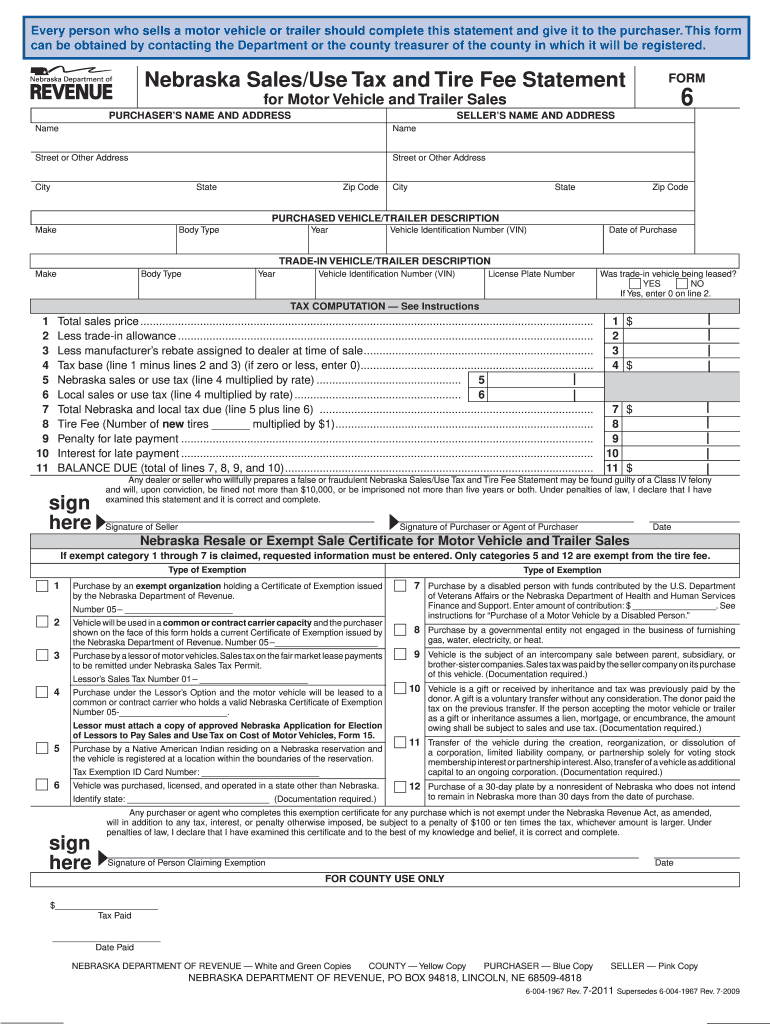

The Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales is a crucial document used in the state of Nebraska for reporting sales tax and tire fees associated with the sale of motor vehicles and trailers. This form is essential for both buyers and sellers, ensuring compliance with state tax regulations. It captures vital information regarding the transaction, including the vehicle or trailer details, purchase price, and applicable fees. Proper completion of this form helps facilitate the registration process and ensures that all necessary taxes are collected and remitted to the state.

How to use the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

Using the Form 6 Nebraska SalesUse Tax And Tire Fee Statement involves several straightforward steps. Initially, the seller must fill out the form accurately, providing details such as the buyer's information, vehicle identification number (VIN), and sale price. Once completed, the seller should present this form to the buyer, who will then use it to register the vehicle or trailer with the Nebraska Department of Motor Vehicles. It is essential to retain a copy of the completed form for record-keeping purposes, as it serves as proof of the transaction and compliance with tax obligations.

Steps to complete the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

Completing the Form 6 Nebraska SalesUse Tax And Tire Fee Statement involves the following steps:

- Gather necessary information, including the buyer's name, address, and driver's license number.

- Collect details about the vehicle or trailer, such as the VIN, make, model, and year.

- Determine the sale price and any applicable tire fees.

- Fill out each section of the form accurately, ensuring all information is complete.

- Review the form for any errors before finalizing it.

- Sign and date the form to validate the transaction.

Legal use of the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

The legal use of the Form 6 Nebraska SalesUse Tax And Tire Fee Statement is paramount for ensuring compliance with state tax laws. This form must be accurately completed and submitted to the appropriate authorities to avoid penalties. It serves as a legal document that verifies the sale of a vehicle or trailer, detailing the taxes collected and any fees paid. Both the seller and buyer should keep copies of the completed form for their records, as it may be required for future reference or in case of audits.

State-specific rules for the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

In Nebraska, specific rules govern the use of the Form 6 SalesUse Tax And Tire Fee Statement. These include guidelines on the correct calculation of sales tax and tire fees based on the vehicle's purchase price. Additionally, the form must be filed within a certain timeframe following the sale to ensure compliance with state regulations. It is important for users to familiarize themselves with any updates or changes to these rules to avoid potential issues during the registration process.

Examples of using the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

There are various scenarios where the Form 6 Nebraska SalesUse Tax And Tire Fee Statement is utilized. For instance, when a private seller sells a used vehicle to an individual, they must complete this form to document the sale and collect the necessary sales tax. Similarly, dealerships use this form when selling new or used vehicles to ensure that all tax obligations are met. Each instance highlights the importance of this document in facilitating legal and compliant vehicle transactions in Nebraska.

Quick guide on how to complete form 6 nebraska salesuse tax and tire fee statement for motor vehicle and trailer sales 82012

Effortlessly prepare Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 effortlessly

- Find Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 and click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether through email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6 nebraska salesuse tax and tire fee statement for motor vehicle and trailer sales 82012

Create this form in 5 minutes!

How to create an eSignature for the form 6 nebraska salesuse tax and tire fee statement for motor vehicle and trailer sales 82012

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8?

The Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 is a crucial document required for the sale of motor vehicles and trailers in Nebraska. It serves as a tax declaration form that helps in assessing sales tax and tire fees for the transfer of ownership.

-

How can airSlate SignNow assist with the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8?

With airSlate SignNow, you can easily upload, send, and eSign the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8. Our platform streamlines the document workflow, saving you time and ensuring compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features that simplify the eSigning process, including handling the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 efficiently.

-

What features does airSlate SignNow offer for managing the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure cloud storage for your Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8. These tools enhance your document management and workflow.

-

Can I integrate airSlate SignNow with my existing applications for the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8?

Absolutely! airSlate SignNow supports a range of integrations with popular applications, allowing you to seamlessly manage the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 alongside your existing software solutions.

-

What are the benefits of using airSlate SignNow for the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8?

Using airSlate SignNow for the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. These advantages lead to faster processing times and improved customer satisfaction.

-

How do I get started with airSlate SignNow for the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8?

Getting started with airSlate SignNow is simple. You can sign up for an account, select the appropriate plan, and begin managing the Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8 right away. Our user-friendly interface ensures a smooth onboarding experience.

Get more for Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

- Nj sgo form

- Field work sheet key termite form

- Hs22x form

- Atoms radiation and radiation protection solution manual form

- Bise bwp form

- Massmutual change of ownership form

- One year action plan for partnerships schedule of school lyonelementary stpsb form

- Delegation of authority radiation safety officer form

Find out other Form 6 Nebraska SalesUse Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales ?8

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT