Www Irs Govpubirs Pdf2020 Instructions for Form 1120 REIT Internal Revenue Service

Understanding the IRS 1120REIT Form

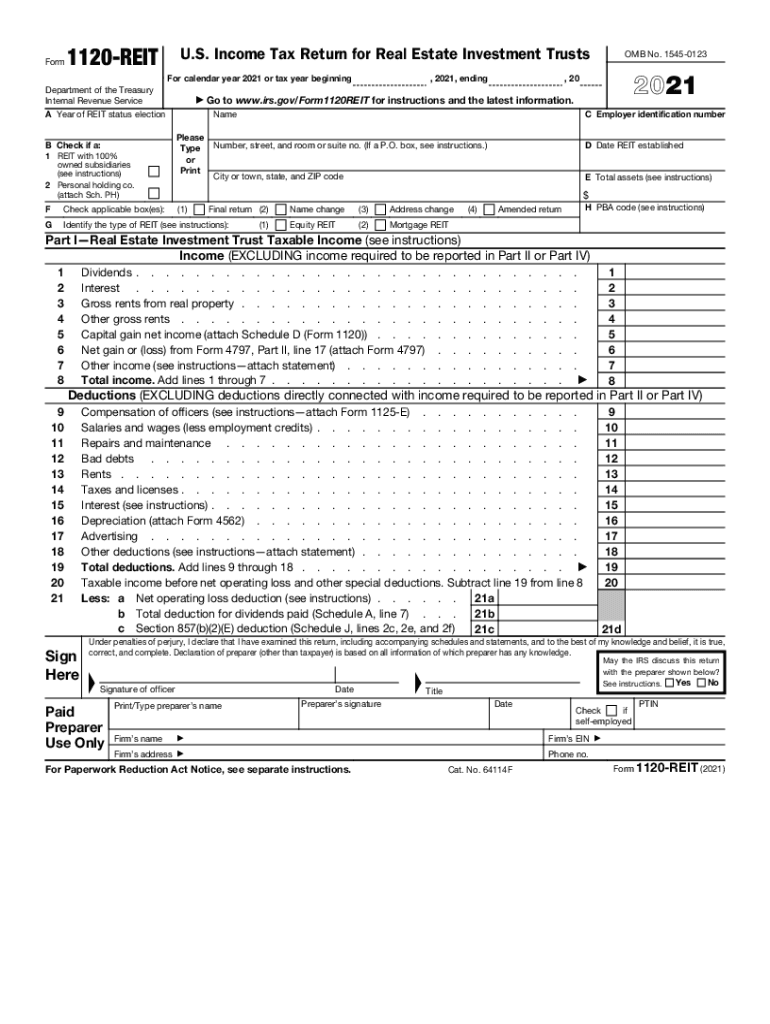

The IRS 1120REIT form is specifically designed for Real Estate Investment Trusts (REITs) to report their income, deductions, and tax liabilities. This form is crucial for REITs as it ensures compliance with federal tax regulations. It outlines the financial activities of the trust and is essential for determining the tax obligations of the entity. Understanding the requirements and implications of this form is vital for any organization operating as a REIT.

Steps to Complete the IRS 1120REIT Form

Completing the IRS 1120REIT form involves several key steps. First, gather all necessary financial documents, including income statements and balance sheets. Next, accurately fill out the form, ensuring that all income, expenses, and deductions are correctly reported. Pay particular attention to the specific sections that pertain to REIT qualifications and distributions to shareholders. After completing the form, review it for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the IRS 1120REIT form is essential to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the tax year. For calendar year filers, this typically falls on April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is advisable to keep track of these deadlines to ensure compliance and avoid late fees.

Required Documents for Submission

To successfully file the IRS 1120REIT form, several documents are required. These include financial statements, records of income and expenses, and any relevant tax documentation. Additionally, documentation proving that the entity meets the REIT qualifications, such as asset and income tests, should be included. Having these documents organized will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to file the IRS 1120REIT form on time or inaccuracies in the submission can lead to significant penalties. The IRS may impose fines based on the length of the delay and the size of the trust. Additionally, non-compliance can result in the loss of REIT status, which can have severe tax implications. It is important to adhere to all filing requirements to avoid these consequences.

Digital vs. Paper Version of the IRS 1120REIT Form

Filing the IRS 1120REIT form can be done either digitally or via paper submission. The digital version allows for easier tracking and faster processing times. Electronic filing is often recommended as it reduces the risk of errors and provides immediate confirmation of submission. However, some entities may prefer the traditional paper method, which requires careful attention to ensure all details are correctly filled out and mailed on time.

Quick guide on how to complete wwwirsgovpubirs pdf2020 instructions for form 1120 reit internal revenue service

Effortlessly Prepare Www irs govpubirs pdf2020 Instructions For Form 1120 REIT Internal Revenue Service on Any Device

Digital document management has gained tremendous popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without any delays. Manage Www irs govpubirs pdf2020 Instructions For Form 1120 REIT Internal Revenue Service on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Simplest Way to Edit and Electronically Sign Www irs govpubirs pdf2020 Instructions For Form 1120 REIT Internal Revenue Service

- Locate Www irs govpubirs pdf2020 Instructions For Form 1120 REIT Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which requires seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Www irs govpubirs pdf2020 Instructions For Form 1120 REIT Internal Revenue Service and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2020 instructions for form 1120 reit internal revenue service

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the IRS 1120REIT form?

The IRS 1120REIT form is a tax form specifically designed for Real Estate Investment Trusts (REITs) to report their income and taxes due. It allows REITs to comply with IRS regulations while optimizing their tax liabilities. Understanding the IRS 1120REIT form is crucial for businesses operating in real estate.

-

How can airSlate SignNow help with the IRS 1120REIT form?

airSlate SignNow simplifies the process of eSigning and sending the IRS 1120REIT form by offering an easy-to-use platform for document management. Users can create, edit, and securely send their forms online, ensuring compliance and efficiency. This can signNowly streamline your filing process.

-

Is there a cost associated with using airSlate SignNow for the IRS 1120REIT form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features that can assist in managing the IRS 1120REIT form effectively. You can choose a plan that best fits your volume of documents and required functionalities.

-

What features does airSlate SignNow offer for IRS-related documents?

airSlate SignNow provides robust features such as templates, customizable workflows, and cloud storage to manage IRS documents, including the IRS 1120REIT form. These features enhance collaboration among team members and ensure documents are securely managed and easily accessible.

-

Can I integrate airSlate SignNow with other software for the IRS 1120REIT form?

Yes, airSlate SignNow offers integrations with various software solutions that can aid in managing the IRS 1120REIT form. This includes accounting software and CRM tools, allowing for seamless data transfer and improved efficiency in your workflow. Integrating with other platforms helps streamline your filing process.

-

What are the benefits of using airSlate SignNow for the IRS 1120REIT form?

Using airSlate SignNow for the IRS 1120REIT form offers benefits such as reduced processing time, enhanced security, and the ability to manage documents from anywhere. Additionally, the platform's user-friendly interface reduces the learning curve, making it accessible for team members of all tech levels.

-

Is airSlate SignNow compliant with IRS regulations for the IRS 1120REIT form?

Absolutely! airSlate SignNow complies with all IRS regulations required for eSigning and submitting the IRS 1120REIT form. This compliance ensures that your documents are legitimate and uphold legal standards, reducing risks associated with tax filings.

Get more for Www irs govpubirs pdf2020 Instructions For Form 1120 REIT Internal Revenue Service

Find out other Www irs govpubirs pdf2020 Instructions For Form 1120 REIT Internal Revenue Service

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple