Fill Fillable Maryland Department of Assets FOREIGN CORPORATION QUALIFICATION Form 2021

Understanding the Maryland Foreign Corporation Qualification Form

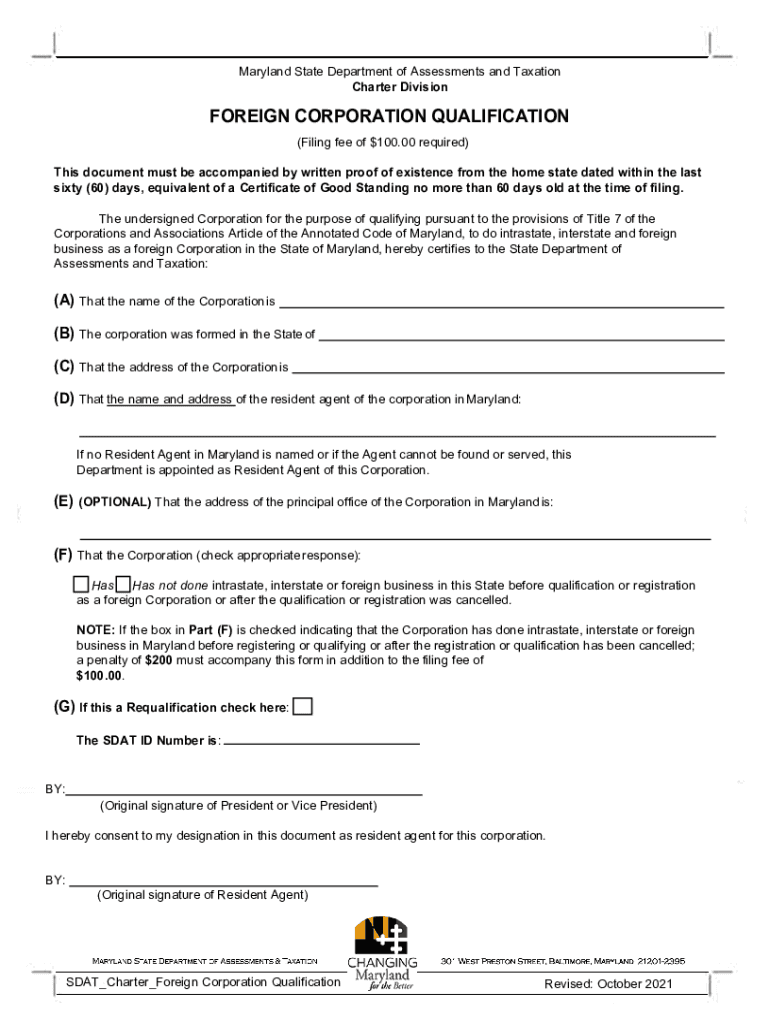

The Maryland Foreign Corporation Qualification Form is essential for businesses looking to operate in Maryland while being incorporated in another state or country. This form is designed to ensure that foreign corporations comply with Maryland's legal requirements for doing business within the state. It includes necessary information such as the corporation's name, state of incorporation, principal office address, and registered agent details. Completing this form correctly is crucial for maintaining good standing and avoiding penalties.

Steps to Complete the Maryland Foreign Corporation Qualification Form

Filling out the Maryland Foreign Corporation Qualification Form involves several key steps:

- Gather Required Information: Collect details about your corporation, including its legal name, state of incorporation, and the address of its principal office.

- Designate a Registered Agent: Choose a registered agent with a physical address in Maryland who can receive legal documents on behalf of your corporation.

- Complete the Form: Accurately fill out the form, ensuring all sections are completed and information is correct.

- Review for Accuracy: Double-check all entries for accuracy to prevent delays in processing.

- Submit the Form: File the completed form with the Maryland Department of Assessments and Taxation, along with the required fee.

Legal Use of the Maryland Foreign Corporation Qualification Form

This form is legally binding and must be used by any foreign corporation wishing to conduct business in Maryland. It serves as a declaration of the corporation's intent to operate within the state and ensures compliance with local laws. Failure to file this form may result in penalties, including fines and the inability to legally conduct business in Maryland.

Filing Deadlines and Important Dates

Understanding filing deadlines is crucial for compliance. Foreign corporations must submit the Maryland Foreign Corporation Qualification Form before commencing business activities in the state. While there is no specific deadline for filing, it is advisable to complete the form promptly to avoid any legal complications. Additionally, annual reports may be required to maintain good standing, with specific due dates set by the Maryland Department of Assessments and Taxation.

Required Documents for Submission

When submitting the Maryland Foreign Corporation Qualification Form, several documents may be required:

- Certificate of Good Standing: Obtain this from the state where the corporation was originally incorporated.

- Identification of Registered Agent: Provide details about the registered agent, including their consent to act in this capacity.

- Filing Fee: Include the appropriate fee for processing the form, as specified by the Maryland Department of Assessments and Taxation.

Penalties for Non-Compliance

Failure to file the Maryland Foreign Corporation Qualification Form can lead to significant penalties. Corporations may face fines, and continued non-compliance can result in the revocation of the corporation's ability to conduct business in Maryland. It is essential for foreign corporations to adhere to the filing requirements to avoid these consequences and maintain their legal status.

Quick guide on how to complete fill free fillable maryland department of assets foreign corporation qualification form

Handle Fill Fillable Maryland Department Of Assets FOREIGN CORPORATION QUALIFICATION Form effortlessly on any device

Digital document management has gained more traction with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Fill Fillable Maryland Department Of Assets FOREIGN CORPORATION QUALIFICATION Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Fill Fillable Maryland Department Of Assets FOREIGN CORPORATION QUALIFICATION Form effortlessly

- Find Fill Fillable Maryland Department Of Assets FOREIGN CORPORATION QUALIFICATION Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and eSign Fill Fillable Maryland Department Of Assets FOREIGN CORPORATION QUALIFICATION Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fill free fillable maryland department of assets foreign corporation qualification form

Create this form in 5 minutes!

How to create an eSignature for the fill free fillable maryland department of assets foreign corporation qualification form

The way to generate an e-signature for your PDF document in the online mode

The way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is form taxation and how does it relate to airSlate SignNow?

Form taxation refers to the various requirements and processes involved in completing and submitting tax forms. airSlate SignNow simplifies this process by allowing businesses to easily eSign and manage their tax-related documents, ensuring compliance and accuracy in form taxation.

-

How can airSlate SignNow help streamline my form taxation process?

airSlate SignNow offers user-friendly tools that enable businesses to create, send, and eSign tax forms effortlessly. This streamlining reduces the time spent managing paperwork and helps ensure that all aspects of form taxation are handled efficiently and securely.

-

What are the pricing options for using airSlate SignNow for form taxation?

airSlate SignNow provides a range of pricing plans to cater to different business needs and sizes. Each plan includes features designed to enhance your form taxation processes, ensuring you receive excellent value while maintaining compliance and efficiency.

-

Are there any specific features in airSlate SignNow that benefit form taxation?

Yes, airSlate SignNow includes specific features like customizable templates, automated reminders, and secure cloud storage, all tailored to enhance your form taxation experience. These features help you minimize errors and streamline the approval workflows associated with tax documents.

-

Can I integrate airSlate SignNow with other tools to assist with form taxation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your form taxation workflows. This integration ensures seamless data transfer and helps maintain accuracy across all platforms.

-

What security measures does airSlate SignNow implement for form taxation?

airSlate SignNow prioritizes security, using encryption protocols and secure cloud storage to protect your sensitive tax information. This commitment to security helps ensure that your form taxation processes are compliant and safeguarded against potential bsignNowes.

-

How can I ensure my team is properly trained to use airSlate SignNow for form taxation?

airSlate SignNow offers a range of training resources, including video tutorials, webinars, and a dedicated support team to help your staff master the platform. By utilizing these resources, your team will be well-equipped to navigate the complexities of form taxation efficiently.

Get more for Fill Fillable Maryland Department Of Assets FOREIGN CORPORATION QUALIFICATION Form

- Agreement for payment of unpaid rent delaware form

- Commercial lease assignment from tenant to new tenant delaware form

- Tenant consent to background and reference check delaware form

- Residential lease or rental agreement for month to month delaware form

- Residential rental lease agreement delaware form

- Tenant welcome letter delaware form

- Warning of default on commercial lease delaware form

- Warning of default on residential lease delaware form

Find out other Fill Fillable Maryland Department Of Assets FOREIGN CORPORATION QUALIFICATION Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors