Form IRS 6252 Fill Online, Printable, Fillable, Blank

What is the Form IRS 6252?

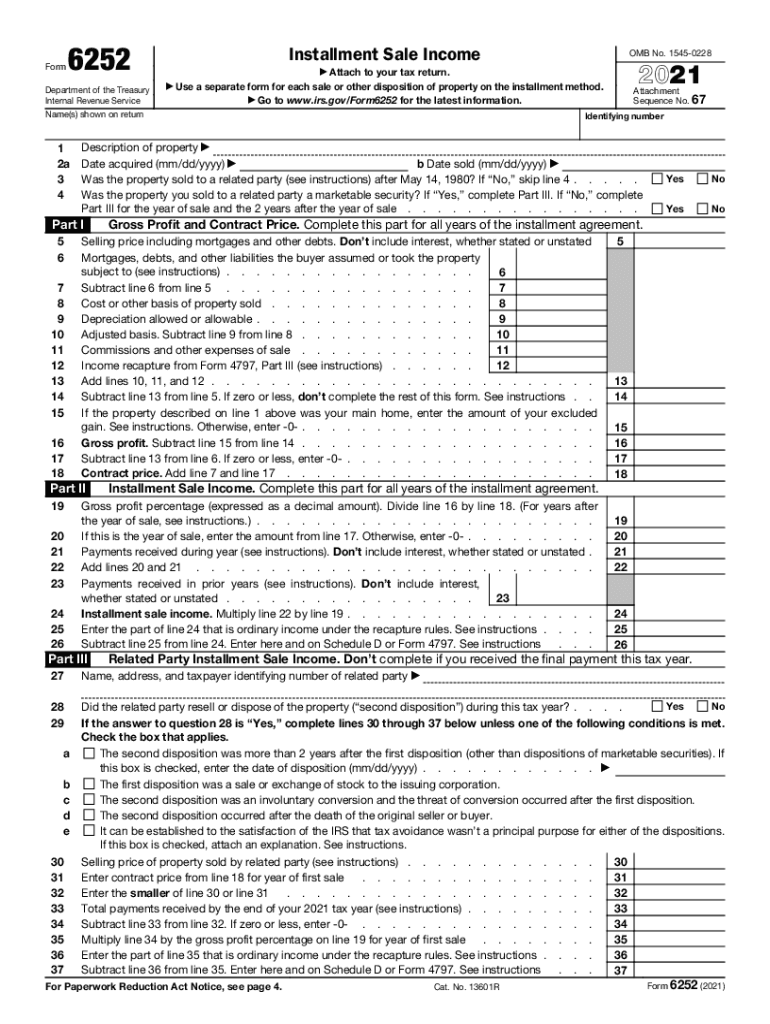

The IRS Form 6252 is used to report income from an installment sale. An installment sale occurs when a seller allows the buyer to make payments over time rather than paying the full purchase price upfront. This form is essential for taxpayers who have sold property and received payments in installments, as it helps to determine the taxable income from the sale over the years of payment. The form includes details about the sale, the buyer, and the amount of income received during the tax year.

Steps to Complete the Form IRS 6252

Completing the IRS Form 6252 involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather Information: Collect all relevant details about the sale, including the selling price, the buyer's information, and the payment terms.

- Fill Out the Form: Start by entering your name, address, and taxpayer identification number. Then, provide the details of the installment sale, including the total selling price and the amount received during the year.

- Calculate Income: Use the form to calculate the taxable income from the installment sale based on the payments received and the gross profit percentage.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return. Ensure you keep a copy for your records.

Legal Use of the Form IRS 6252

The legal use of IRS Form 6252 is crucial for compliance with tax regulations. This form must be filed by taxpayers who engage in installment sales to accurately report their income. The IRS requires that all installment sales be reported to ensure that taxpayers pay the correct amount of tax over the years that they receive payments. Failure to file this form can lead to penalties and interest on unpaid taxes, making it essential to understand its legal implications.

IRS Guidelines for Form 6252

The IRS provides specific guidelines for completing and filing Form 6252. Taxpayers should refer to the IRS instructions for the form, which detail how to report installment sales accurately. These guidelines include information on determining the gross profit percentage, the method for calculating income from the sale, and the necessary documentation required to support the entries made on the form. Following these guidelines ensures compliance and reduces the risk of errors.

Filing Deadlines for Form 6252

Filing deadlines for IRS Form 6252 align with the general tax return deadlines. Typically, individual taxpayers must submit their tax returns, including Form 6252, by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines, as timely submission is crucial to avoid penalties.

Form Submission Methods

IRS Form 6252 can be submitted in various ways to accommodate different taxpayer preferences. The form can be filed electronically through tax software that supports IRS forms, which is often the quickest and most efficient method. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate IRS address. In-person submissions are generally not available for this form, making electronic and mail submissions the primary options.

Quick guide on how to complete 2020 form irs 6252 fill online printable fillable blank

Complete Form IRS 6252 Fill Online, Printable, Fillable, Blank effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Handle Form IRS 6252 Fill Online, Printable, Fillable, Blank on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to edit and eSign Form IRS 6252 Fill Online, Printable, Fillable, Blank seamlessly

- Find Form IRS 6252 Fill Online, Printable, Fillable, Blank and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside worries about lost or misfiled documents, cumbersome form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form IRS 6252 Fill Online, Printable, Fillable, Blank and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form irs 6252 fill online printable fillable blank

How to generate an e-signature for your PDF document online

How to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What are the essential form 6252 instructions 2021?

The essential form 6252 instructions 2021 provide guidance on how to report installment sales for tax purposes. This form outlines how to calculate the gain and the reporting period for both the seller and the buyer. It is crucial for taxpayers to follow these instructions to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with completing form 6252 instructions 2021?

airSlate SignNow simplifies the process of completing form 6252 instructions 2021 by allowing users to easily fill out, sign, and send documents online. The platform provides intuitive templates and eSignature capabilities that streamline your paperwork, making tax reporting less tedious. Users can focus on accuracy while signNowly speeding up the overall process.

-

Are there any costs associated with using airSlate SignNow for form 6252 instructions 2021?

Yes, using airSlate SignNow involves subscription plans that cater to various business needs, offering flexibility based on your usage. While there are costs, many users find that the time saved and ease of use greatly outweighs any subscription fees. Investing in airSlate SignNow can lead to more efficient completion of form 6252 instructions 2021.

-

What features does airSlate SignNow offer for handling tax forms like form 6252 instructions 2021?

airSlate SignNow offers features such as customizable templates, secure eSignature collection, and document sharing, which are invaluable for handling tax forms like form 6252 instructions 2021. Additionally, the platform includes audit trails for compliance, ensuring that you have a clear record of who signed what and when. These features enhance accuracy and reliability in your tax documentation.

-

Can I integrate airSlate SignNow with other tools for form 6252 instructions 2021?

Yes, airSlate SignNow offers integrations with various third-party applications such as CRM systems and cloud storage providers. This allows for seamless transfer of data and documents related to form 6252 instructions 2021, making your workflow more efficient. By integrating with tools you already use, airSlate SignNow enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for form 6252 instructions 2021?

Using airSlate SignNow for form 6252 instructions 2021 offers numerous benefits including cost-effectiveness, time savings, and streamlined collaboration. The intuitive interface makes it easy for users to complete and sign documents without the hassle of paper forms. Additionally, airSlate SignNow ensures that your documents are securely stored and easily accessible throughout the tax filing process.

-

Is eSigning form 6252 instructions 2021 legally binding?

Yes, eSigning form 6252 instructions 2021 using airSlate SignNow is legally binding. The platform complies with eSignature laws such as the ESIGN Act and UETA, ensuring that your electronically signed documents hold the same weight as traditional handwritten signatures. This offers users peace of mind when finalizing their tax documents securely and efficiently.

Get more for Form IRS 6252 Fill Online, Printable, Fillable, Blank

- Warranty deed two individuals to two individuals florida form

- Limited liability company 497302845 form

- Warranty timeshare form

- Quitclaim deed one individual to three individuals florida form

- Fl warranty form

- Limited liability company 497302849 form

- Trust two individual trustees to an individual florida form

- Husband wife two form

Find out other Form IRS 6252 Fill Online, Printable, Fillable, Blank

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement