Www Irs Govpubirs Pdf2021 Form 8854 Internal Revenue Service

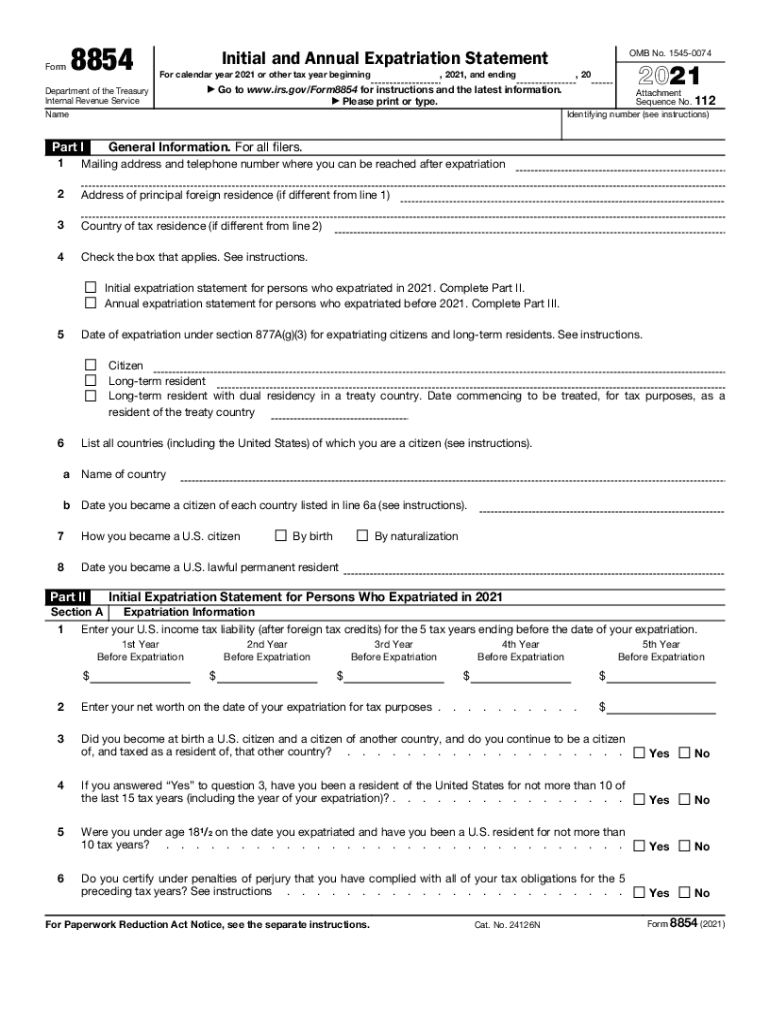

What is the IRS Exit Tax Form 8854?

The IRS Exit Tax Form 8854 is a crucial document for U.S. citizens and long-term residents who are expatriating or relinquishing their citizenship. This form is used to report information related to the expatriation tax, which may apply under Section 877A of the Internal Revenue Code. Completing Form 8854 is essential for determining any potential exit tax liabilities and ensuring compliance with U.S. tax laws. The form requires detailed financial information, including the individual's net worth and tax obligations, which helps the IRS assess any taxes due upon expatriation.

Steps to Complete the IRS Exit Tax Form 8854

Completing the IRS Exit Tax Form 8854 involves several important steps:

- Gather necessary documentation, including financial statements and tax returns for the past five years.

- Determine your net worth, as this will be a key component of the form.

- Fill out the required sections of Form 8854, ensuring all information is accurate and complete.

- Review the form for any potential errors or omissions before submission.

- Submit the completed form to the IRS by the deadline, which is typically the same as the tax filing deadline.

Filing Deadlines for Form 8854

Filing deadlines for the IRS Exit Tax Form 8854 are aligned with the annual tax return deadlines. Generally, the form must be submitted by the due date of your tax return for the year in which you expatriate. If you are unable to file by the deadline, you may apply for an extension, but it is crucial to ensure that Form 8854 is submitted timely to avoid penalties.

Required Documents for Form 8854

When completing the IRS Exit Tax Form 8854, you will need to gather several key documents, including:

- Your most recent tax return.

- Financial statements that detail your assets and liabilities.

- Documentation of any foreign tax credits or other relevant tax information.

- Records of any gifts or inheritances received during the tax year.

Penalties for Non-Compliance with Form 8854

Failure to file the IRS Exit Tax Form 8854 can result in significant penalties. If you do not submit the form, the IRS may impose a penalty of $10,000 for each year you fail to file. Additionally, if you do not report your expatriation correctly, you may be subject to further tax liabilities and complications regarding your status with the IRS.

Eligibility Criteria for Filing Form 8854

To determine if you need to file the IRS Exit Tax Form 8854, you must meet specific eligibility criteria. Generally, you are required to file if:

- You are a U.S. citizen or long-term resident who has expatriated.

- Your average annual net income tax for the five years preceding expatriation exceeds a certain threshold.

- Your net worth is $2 million or more on the date of expatriation.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 8854 internal revenue service

Complete Www irs govpubirs pdf2021 Form 8854 Internal Revenue Service effortlessly on any device

The management of online documents has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Execute Www irs govpubirs pdf2021 Form 8854 Internal Revenue Service on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-based process today.

The most effective method to modify and eSign Www irs govpubirs pdf2021 Form 8854 Internal Revenue Service easily

- Acquire Www irs govpubirs pdf2021 Form 8854 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools provided to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Disregard lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Www irs govpubirs pdf2021 Form 8854 Internal Revenue Service and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 8854 internal revenue service

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the IRS exit tax form 8854?

The IRS exit tax form 8854 is a key document that certain individuals must file when they expatriate from the United States. This form helps the IRS determine if you owe any tax upon leaving the country. Understanding and correctly filing the IRS exit tax form 8854 is essential to avoid potential penalties.

-

Who needs to file the IRS exit tax form 8854?

Individuals who relinquish their U.S. citizenship or long-term residents who abandon their green cards must file the IRS exit tax form 8854. It is important to assess your tax liability accurately. Consulting a tax professional can help ensure compliance.

-

How does airSlate SignNow assist with filing IRS exit tax form 8854?

airSlate SignNow simplifies the process of signing and submitting the IRS exit tax form 8854 electronically. Our platform offers an intuitive interface that allows you to handle sensitive documents securely and efficiently. Leveraging advanced eSignature features, you can easily manage your expatriation paperwork.

-

What are the benefits of using airSlate SignNow for IRS exit tax form 8854?

Using airSlate SignNow to manage your IRS exit tax form 8854 provides several benefits, including enhanced security and ease of use. Our cost-effective solution makes it simple to eSign documents at your convenience, ensuring timely filing. Additionally, our platform minimizes the risk of errors during the process.

-

Is airSlate SignNow compliant with IRS regulations for filing the exit tax form 8854?

Yes, airSlate SignNow is fully compliant with IRS regulations when handling the IRS exit tax form 8854. We prioritize data security and incorporate features necessary for legal compliance, making our platform a trusted choice for expatriates. You can confidently trust us to manage your sensitive tax documents.

-

What integrations does airSlate SignNow offer for handling IRS exit tax form 8854?

airSlate SignNow integrates seamlessly with various accounting and document management systems, facilitating the handling of the IRS exit tax form 8854. These integrations streamline your workflow, reduce manual entries, and enhance productivity. Utilizing our platform alongside your existing tools makes the filing process much more manageable.

-

How much does it cost to use airSlate SignNow for the IRS exit tax form 8854?

AirSlate SignNow offers competitive pricing plans tailored to different needs, making it affordable for managing the IRS exit tax form 8854. Whether you're an individual or a business, our solutions are designed to save you time and resources. You can select a plan that best fits your requirements without overspending.

Get more for Www irs govpubirs pdf2021 Form 8854 Internal Revenue Service

Find out other Www irs govpubirs pdf2021 Form 8854 Internal Revenue Service

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe