Form California Tax 2016

What is the Form California Tax

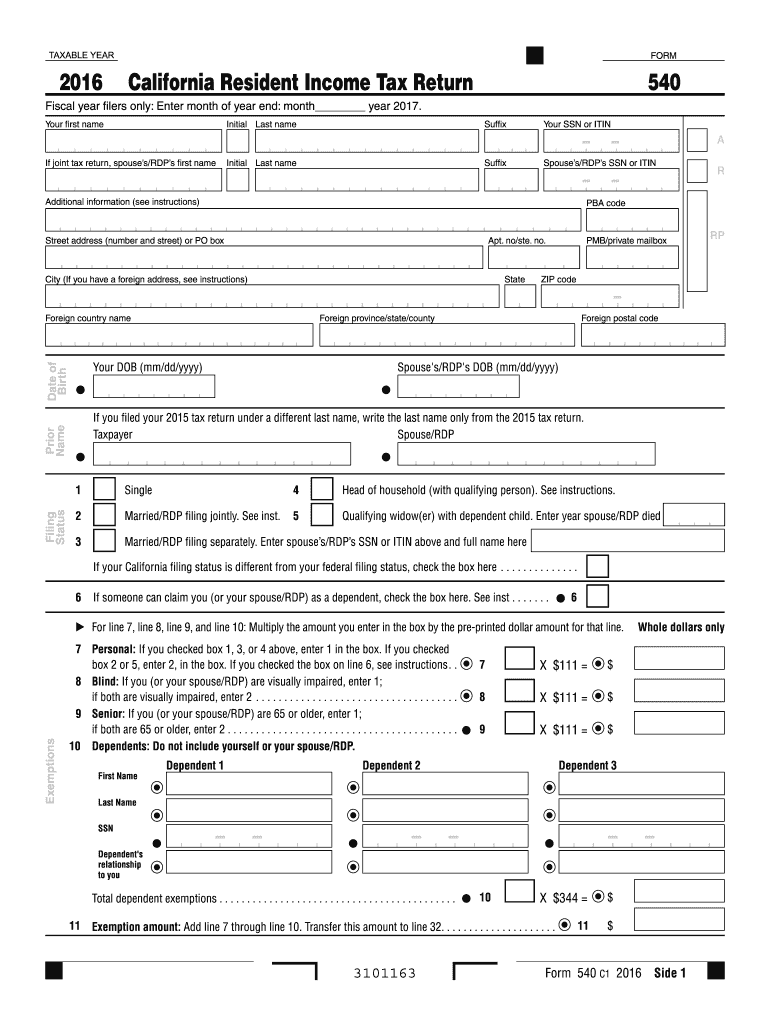

The Form California Tax is a crucial document used by residents and businesses in California to report their income and calculate their state tax obligations. This form is designed to ensure compliance with California tax laws and is essential for both individuals and entities operating within the state. It collects various financial information, including income, deductions, and credits, to determine the amount of tax owed or the refund due.

How to use the Form California Tax

Using the Form California Tax involves several steps to ensure accurate reporting. First, gather all necessary documents, such as W-2s, 1099s, and any records of deductions. Next, fill out the form with accurate financial details, ensuring that all fields are completed. After completing the form, review it for errors before signing and submitting it to the California Franchise Tax Board. This form can be submitted electronically or via mail, depending on your preference and the specific requirements for your situation.

Steps to complete the Form California Tax

Completing the Form California Tax involves a systematic approach:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill in your personal information accurately at the top of the form.

- Report your total income, including wages, interest, and other earnings.

- Claim any deductions and credits you qualify for, which can reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Sign and date the form, confirming the accuracy of the information.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the Form California Tax

The Form California Tax must be used in accordance with state regulations to ensure it is legally valid. This includes providing accurate and truthful information, as any discrepancies can lead to penalties or audits. The form is recognized by the California Franchise Tax Board and adheres to the guidelines set forth by state law. It is essential to understand that misuse or falsification of information on this form can result in legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Form California Tax are critical to avoid penalties. Typically, individual tax returns are due on April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. It is important to stay informed about any changes to these dates, especially during tax season, as the California Franchise Tax Board may announce extensions or modifications based on specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Form California Tax can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the California Franchise Tax Board's e-filing system, which is convenient and often faster. Alternatively, individuals may choose to print the form and mail it to the appropriate address. In-person submissions are also accepted at designated tax offices, providing another option for those who prefer face-to-face assistance.

Quick guide on how to complete form california tax 2016

Your assistance manual on how to prepare your Form California Tax

If you’re wondering how to complete and submit your Form California Tax, here are a few straightforward guidelines on how to make tax processing considerably simpler.

To start, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your tax documents effortlessly. Using its editor, you can toggle between text, checkboxes, and electronic signatures and return to update information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Form California Tax in no time:

- Create your account and start editing PDFs within minutes.

- Utilize our directory to access any IRS tax form; browse through various versions and schedules.

- Click Obtain form to open your Form California Tax in our editor.

- Enter the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to include your legally-binding electronic signature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Please be aware that submitting physically can lead to return errors and postpone refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form california tax 2016

FAQs

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I dissolve a single-member LLC in CA?

If it's just you, only a Form LLC-4/7 is required. A single member LLC does not need to fill out the Form LLC-4/8 or Form LLC-3. As noted by the instructions:Important! To complete the cancellation process, the LLC also must file a Certificate of Cancellation (Form LLC-4/7). Note: This Form LLC-3 is not required when the vote to dissolve was made by all of the members and that fact is noted on LLC Form 4/7.As also noted by the instructions, if (1) the LLC is being dissolved within 12 months from the date the articles of organization were filed with the Secretary of State, (2) the LLC has no debts or liabilities, (3) you promise to file your tax returns, (4) you haven't conducted any business AND (5) you paid back your investors, then you can file a Short Form Certificate of Cancellation (Form LLC-4/8). PLEASE NOTE: California often updates its corporate and LLC forms almost every year. It has new LLC cancellation forms for 2016. Use this link to download the most recent version: http://bpd.cdn.sos.ca.gov/llc/fo... Good luck!Chris

Create this form in 5 minutes!

How to create an eSignature for the form california tax 2016

How to generate an electronic signature for the Form California Tax 2016 online

How to generate an electronic signature for your Form California Tax 2016 in Google Chrome

How to make an electronic signature for putting it on the Form California Tax 2016 in Gmail

How to create an eSignature for the Form California Tax 2016 right from your smart phone

How to create an eSignature for the Form California Tax 2016 on iOS devices

How to generate an electronic signature for the Form California Tax 2016 on Android OS

People also ask

-

What is the process for completing the Form California Tax using airSlate SignNow?

To complete the Form California Tax using airSlate SignNow, start by uploading your document to the platform. You can easily add fields for signatures or other necessary information. Once finalized, you can send it to your recipients for electronic signatures, ensuring a fast and efficient filing process.

-

Can airSlate SignNow help with tracking the status of Form California Tax submissions?

Yes, airSlate SignNow provides features that allow you to track the status of your Form California Tax submissions. You can receive notifications when the document is viewed, signed, or completed. This visibility helps you stay informed and manage your tax documentation effectively.

-

Is airSlate SignNow compatible with other tax software for the Form California Tax?

Absolutely! airSlate SignNow offers integrations with various tax software, making it easier to complete and submit your Form California Tax. These integrations streamline your workflow by allowing seamless document transfers, helping you save time and reduce errors.

-

What are the pricing options for using airSlate SignNow for Form California Tax?

airSlate SignNow offers flexible pricing plans designed to fit different business needs when completing the Form California Tax. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features you require, ensuring cost-effectiveness.

-

How secure is airSlate SignNow when handling Form California Tax documents?

Security is a top priority for airSlate SignNow. When handling your Form California Tax documents, the platform uses advanced encryption and compliance measures to protect sensitive information. You can trust that your data is safe while you manage your tax documents electronically.

-

What benefits can I expect from using airSlate SignNow for Form California Tax?

Using airSlate SignNow for your Form California Tax offers several benefits, including faster processing times, reduced paperwork, and the ability to sign documents electronically from anywhere. This convenience helps streamline your tax management and improves overall efficiency for your business.

-

Can I customize the Form California Tax for my specific needs with airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Form California Tax according to your specific requirements. You can add fields, adjust layouts, and include your branding, ensuring that your tax forms meet your organization's standards while facilitating a professional presentation.

Get more for Form California Tax

Find out other Form California Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors