St 12 Form 2015

What is the St 12 Form

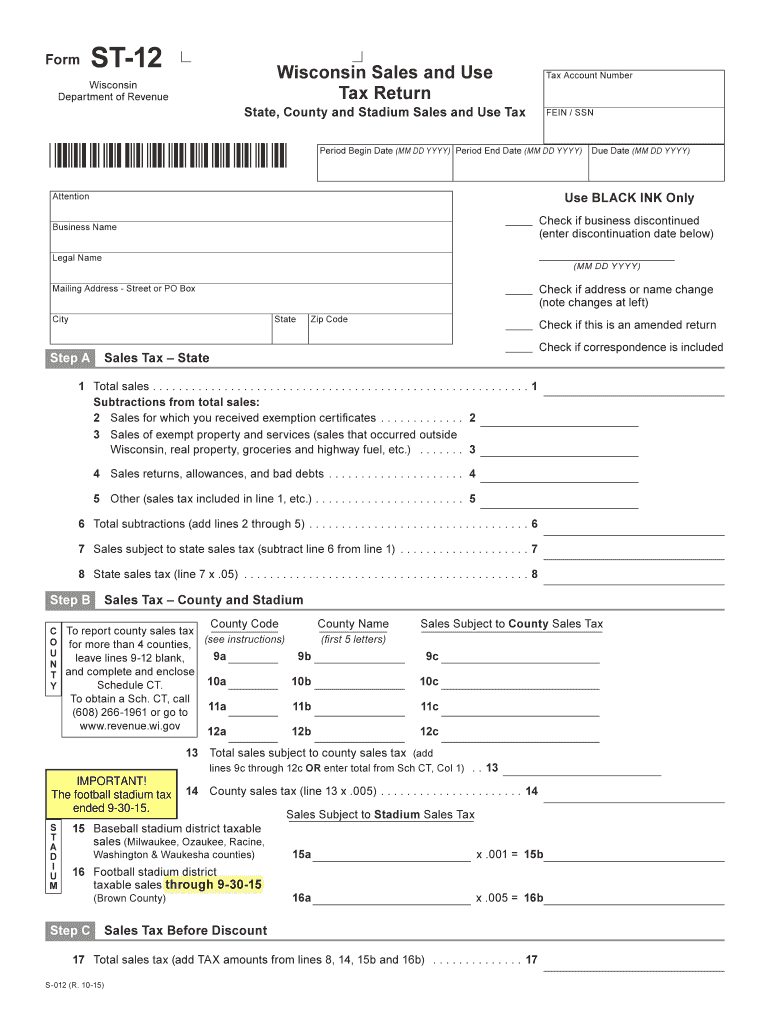

The St 12 Form is a Wisconsin sales and use tax exemption certificate. It allows eligible purchasers to buy items or services without paying sales tax, provided they meet specific criteria outlined by the Wisconsin Department of Revenue. This form is primarily used by businesses and individuals who qualify for tax-exempt purchases, such as non-profit organizations or government entities. Understanding the purpose and application of the St 12 Form is essential for ensuring compliance with state tax regulations.

How to use the St 12 Form

To use the St 12 Form effectively, individuals or businesses must complete it accurately before making a tax-exempt purchase. The form requires information such as the purchaser's name, address, and the reason for the exemption. Once filled out, the purchaser presents the St 12 Form to the seller at the time of purchase. It is important to retain a copy of the completed form for record-keeping purposes, as sellers may request proof of exemption during audits.

Steps to complete the St 12 Form

Completing the St 12 Form involves several straightforward steps:

- Download the St 12 Form from the Wisconsin Department of Revenue website or obtain a physical copy.

- Fill in the required information, including the purchaser's name, address, and the specific reason for claiming the exemption.

- Sign and date the form to certify that the information provided is accurate and complete.

- Provide the completed form to the seller at the time of purchase.

Ensure that all information is accurate to avoid complications during tax audits or disputes.

Legal use of the St 12 Form

The legal use of the St 12 Form is governed by Wisconsin state tax laws. It is critical that the form is only used by eligible purchasers who meet the exemption criteria. Misuse of the St 12 Form, such as using it for ineligible purchases, can result in penalties, including the requirement to pay the owed sales tax along with potential fines. Therefore, understanding the legal implications and ensuring compliance is vital for all users of the form.

Required Documents

When completing the St 12 Form, certain documents may be required to support the exemption claim. These can include:

- Proof of tax-exempt status, such as a letter from the IRS for non-profit organizations.

- Documentation showing the nature of the purchases being made, which qualifies for the exemption.

- Identification or business registration details to verify the purchaser's eligibility.

Having these documents ready can streamline the process and ensure compliance with state regulations.

Filing Deadlines / Important Dates

While the St 12 Form itself does not have a specific filing deadline, it is important to use it correctly at the time of purchase to avoid paying sales tax. Additionally, businesses must be aware of the deadlines for filing their sales and use tax returns, which typically occur on a monthly, quarterly, or annual basis, depending on the volume of sales. Keeping track of these deadlines is essential for maintaining compliance with Wisconsin tax laws.

Quick guide on how to complete st 12 2015 2019 form

Your assistance manual on how to prepare your St 12 Form

If you are curious about how to generate and submit your St 12 Form, here are a few straightforward guidelines to make tax declarations less challenging.

To begin, you only need to set up your airSlate SignNow profile to reinvent how you handle documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, draft, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, returning to modify information as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and easily manageable sharing.

Follow the instructions below to complete your St 12 Form in just a few minutes:

- Establish your account and start managing PDFs in moments.

- Explore our catalog to find any IRS tax form; navigate through versions and schedules.

- Press Get form to open your St 12 Form in our editor.

- Populate the necessary fillable sections with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Preserve changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to return discrepancies and slow down refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct st 12 2015 2019 form

FAQs

-

Are there any chances to fill out the improvement form for 2019 of the RBSE board for 12 class?

Hari om, you are asking a question as to : “ Are there any chancesto fill out the improvement form for 2019 of the RBSE Board for 12 class?”. Hari om. Hari om.ANSWER :Browse through the following links for further details regarding the answers to your questions on the improvement exam for class 12 of RBSE 2019 :how to give improvement exams in rbse class 12is there a chance to fill rbse improvement form 2019 for a 12th class studentHari om.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the st 12 2015 2019 form

How to generate an eSignature for the St 12 2015 2019 Form in the online mode

How to make an eSignature for your St 12 2015 2019 Form in Chrome

How to generate an electronic signature for signing the St 12 2015 2019 Form in Gmail

How to create an eSignature for the St 12 2015 2019 Form straight from your smartphone

How to generate an electronic signature for the St 12 2015 2019 Form on iOS

How to generate an eSignature for the St 12 2015 2019 Form on Android devices

People also ask

-

What is the St 12 Form used for?

The St 12 Form is a specific document often required for tax exemption purposes. Businesses use the St 12 Form to signNow that purchases are exempt from sales tax, making it essential for maintaining compliance and optimizing their tax obligations.

-

How can airSlate SignNow help me with the St 12 Form?

airSlate SignNow simplifies the process of completing and signing the St 12 Form electronically. With our intuitive platform, you can fill out, send, and eSign the St 12 Form securely, ensuring it is processed efficiently and in compliance with regulations.

-

Is there a cost to use airSlate SignNow for the St 12 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution provides access to features that streamline the creation and signing of the St 12 Form, making it a valuable investment for any organization.

-

Can I integrate airSlate SignNow with other applications for managing the St 12 Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows you to manage the St 12 Form alongside your existing workflows, enhancing productivity and document management.

-

What features does airSlate SignNow offer for the St 12 Form?

Our platform includes features such as customizable templates, secure eSigning, and automated workflows specifically designed for the St 12 Form. These tools help streamline document handling, ensuring you can efficiently manage tax exemption paperwork.

-

How secure is the St 12 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption and secure cloud storage to protect your St 12 Form and other documents, ensuring that your sensitive information remains confidential and safe.

-

Can I track the status of my St 12 Form in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents, including the St 12 Form. You can monitor when the form is sent, viewed, and signed, keeping you informed throughout the entire process.

Get more for St 12 Form

- Individual statement of authorship la trobe university latrobe edu form

- Store samhsa form

- T3010 2015 form

- Regarding felony form

- Practon group form

- 656 2015 form

- Florida supreme court approved family law form 12993a supplemental final judgment modifying parental responsibility visitation

- Nghp correspondence cover sheet form

Find out other St 12 Form

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online