Fillable Form 599 Request for Copy of Income Tax Return 2021-2026

What is the Fillable Form 599 Request For Copy Of Income Tax Return

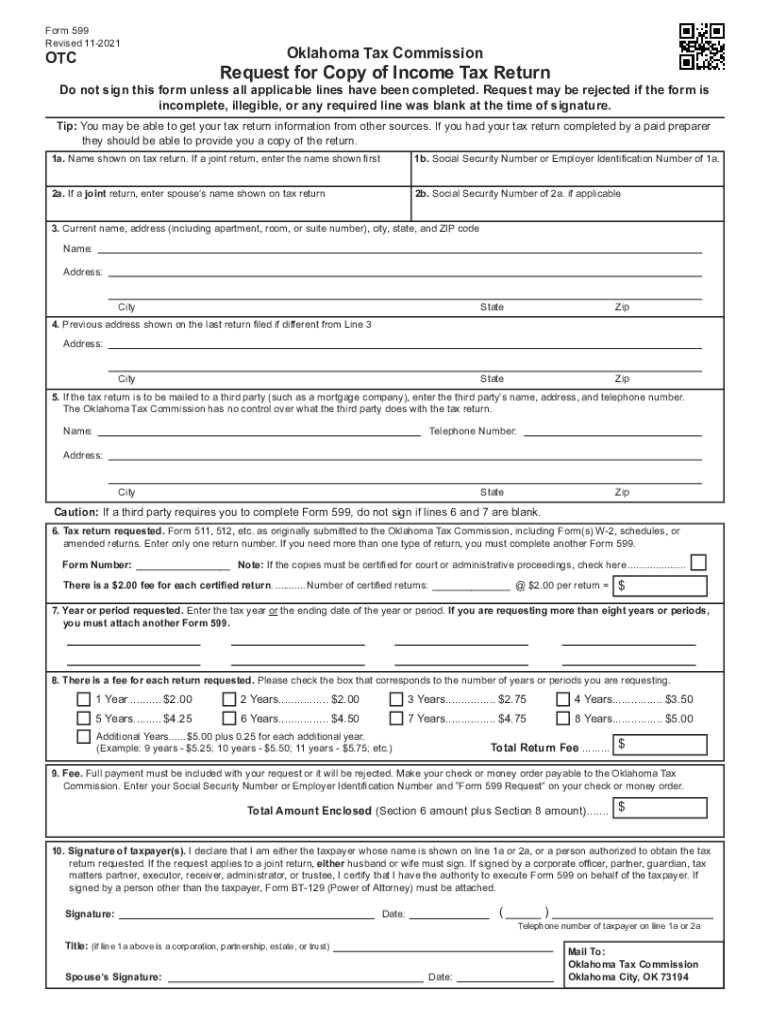

The Fillable Form 599 is a request form used by individuals in Oklahoma to obtain a copy of their income tax return. This form is essential for those who need to access their past tax information for various purposes, such as applying for loans, verifying income, or preparing for audits. It serves as a formal request to the Oklahoma Department of Revenue, allowing taxpayers to retrieve their tax documents efficiently.

How to use the Fillable Form 599 Request For Copy Of Income Tax Return

Using the Fillable Form 599 is a straightforward process. First, download the form from the Oklahoma Department of Revenue website or access it through a reliable source. Fill in the required information, including your name, Social Security number, and the tax year for which you are requesting the return. Ensure that all details are accurate to avoid delays. Once completed, submit the form according to the instructions provided, either online, by mail, or in person.

Steps to complete the Fillable Form 599 Request For Copy Of Income Tax Return

Completing the Fillable Form 599 involves several key steps:

- Download the form from a trusted source.

- Provide your personal information, including your full name and address.

- Enter your Social Security number and the specific tax year you need.

- Sign and date the form to validate your request.

- Submit the form through the designated method outlined in the instructions.

Key elements of the Fillable Form 599 Request For Copy Of Income Tax Return

The Fillable Form 599 includes several critical elements that must be completed for a successful request. These elements include:

- Personal Information: Your name, address, and contact details.

- Identification: Your Social Security number or taxpayer identification number.

- Tax Year: The specific year for which you are requesting the return.

- Signature: Your signature and the date of the request to confirm authenticity.

Legal use of the Fillable Form 599 Request For Copy Of Income Tax Return

The legal use of the Fillable Form 599 is governed by state regulations that ensure the protection of personal information. When submitted correctly, the form allows individuals to obtain copies of their tax returns legally. This is particularly important for maintaining accurate records and fulfilling obligations related to financial transactions, such as loan applications or legal proceedings.

Form Submission Methods (Online / Mail / In-Person)

The Fillable Form 599 can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: If available, this method allows for quick processing.

- Mail: Print the completed form and send it to the appropriate address listed in the instructions.

- In-Person: Deliver the form directly to the local Oklahoma Department of Revenue office for immediate assistance.

Quick guide on how to complete fillable form 599 request for copy of income tax return

Complete Fillable Form 599 Request For Copy Of Income Tax Return effortlessly on any device

Digital document management has become increasingly popular with organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Administer Fillable Form 599 Request For Copy Of Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The easiest way to modify and electronically sign Fillable Form 599 Request For Copy Of Income Tax Return without strain

- Obtain Fillable Form 599 Request For Copy Of Income Tax Return and click on Get Form to begin.

- Make use of the tools at your disposal to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors that require the generation of new copies. airSlate SignNow meets your requirements in document management in just a few clicks from your chosen device. Alter and electronically sign Fillable Form 599 Request For Copy Of Income Tax Return and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form 599 request for copy of income tax return

Create this form in 5 minutes!

How to create an eSignature for the fillable form 599 request for copy of income tax return

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

What is the 2012 form 599, and why is it important?

The 2012 form 599 is a vital document used for tax reporting in certain jurisdictions. It is essential for businesses to file this form accurately to ensure compliance with state tax laws and to avoid potential penalties. airSlate SignNow simplifies the eSigning and submission process of the 2012 form 599, making it easier for businesses to focus on their core activities.

-

How can airSlate SignNow help with completing the 2012 form 599?

With airSlate SignNow, users can easily upload, fill, and eSign the 2012 form 599 online. Our intuitive platform streamlines the document management process, reducing the chances of errors and ensuring that your form is submitted on time. Plus, the ability to track document status gives peace of mind throughout the submission process.

-

Is there a cost associated with using airSlate SignNow for the 2012 form 599?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, which include features tailored for managing forms like the 2012 form 599. Prices are competitive and designed to provide a cost-effective solution for document signing and eSignature needs. You can start with a free trial to see if it fits your requirements.

-

What features does airSlate SignNow offer for the 2012 form 599?

AirSlate SignNow boasts features that enhance the handling of the 2012 form 599, including customizable templates, in-app editing, and secure storage. Users can also enjoy features like reminders and notifications to ensure timely submission of their forms. This helps businesses streamline their workflow and minimize delays.

-

Can I integrate airSlate SignNow with other tools for the 2012 form 599?

Absolutely! airSlate SignNow offers seamless integrations with various applications to enhance your workflow related to the 2012 form 599. Whether you're using CRM tools, cloud storage services, or workflow automation platforms, our solution can fit effortlessly into your existing tech stack.

-

What are the benefits of using airSlate SignNow for the 2012 form 599?

Using airSlate SignNow for the 2012 form 599 provides numerous benefits, including increased efficiency, enhanced security, and accessibility from any device. The solution helps reduce paper usage and manual work, making it an eco-friendly choice. Furthermore, the ease of use can signNowly save time for businesses during the tax filing season.

-

Is airSlate SignNow secure for submitting the 2012 form 599?

Yes, airSlate SignNow prioritizes security and confidentiality when it comes to submitting documents like the 2012 form 599. Our platform employs advanced encryption technology to protect sensitive information throughout the signing process. This ensures that your data remains secure while also complying with industry regulations.

Get more for Fillable Form 599 Request For Copy Of Income Tax Return

- Florida repairs form

- Letter landlord tenant 497302957 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession florida form

- Fl illegal form

- Letter from landlord to tenant about time of intent to enter premises florida form

- Florida notice rent form

- Letter from tenant to landlord about sexual harassment florida form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children florida form

Find out other Fillable Form 599 Request For Copy Of Income Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors