ARIZONA FORM Individual Amended Income Tax Return 140X 20YY

What is the Arizona Form Individual Amended Income Tax Return 140X?

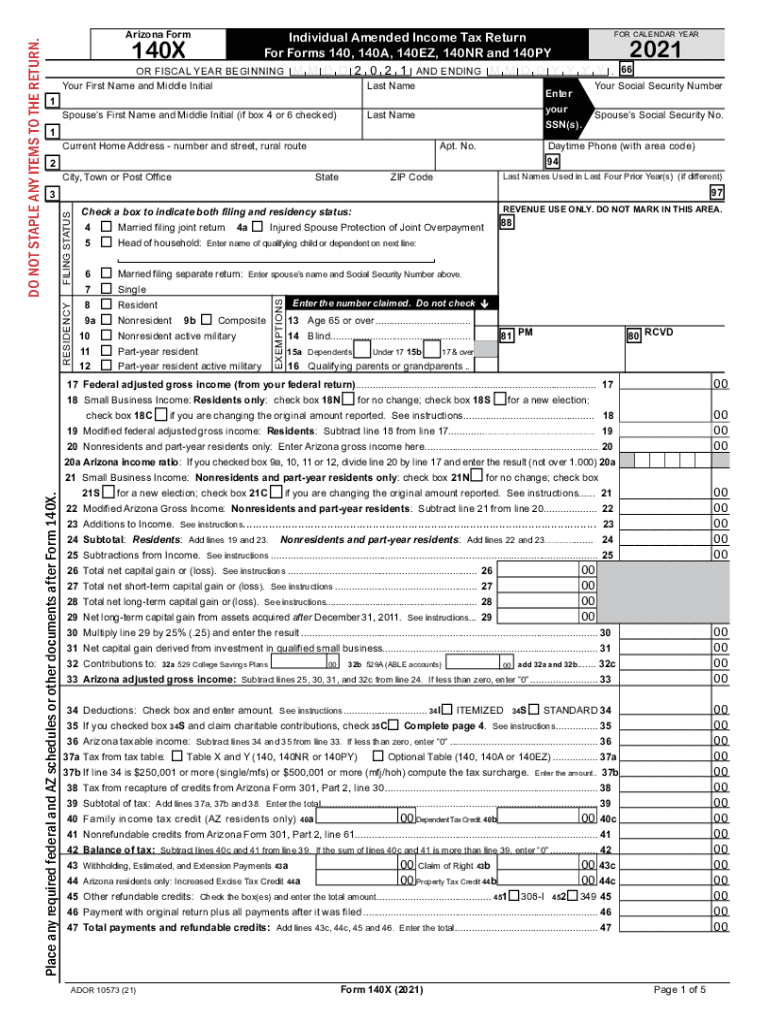

The Arizona Form Individual Amended Income Tax Return 140X is used by taxpayers to amend their previously filed Arizona individual income tax returns. This form allows individuals to correct errors or make changes to their tax filings, ensuring that their tax records are accurate. Common reasons for filing the 140X include correcting income, deductions, or credits that were reported incorrectly on the original return. It is essential for taxpayers to understand the implications of amending their returns, as it can affect their tax liabilities and potential refunds.

Steps to Complete the Arizona Form Individual Amended Income Tax Return 140X

Completing the Arizona Form 140X involves several key steps:

- Obtain the correct version of the 140X form for the tax year you are amending.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details of the original return.

- Clearly outline the changes you are making, including any new income, deductions, or credits.

- Calculate your new tax liability based on the amended information.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the Arizona Department of Revenue.

Legal Use of the Arizona Form Individual Amended Income Tax Return 140X

The Arizona Form 140X is legally recognized for amending tax returns, provided it is completed and submitted in accordance with state regulations. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Arizona Department of Revenue. This includes filing the form within the appropriate time frame, typically within three years from the original filing date or within two years of paying any tax due. Properly using this form helps maintain compliance with state tax laws and can prevent potential penalties or legal issues.

Filing Deadlines / Important Dates

When considering the Arizona Form 140X, it is crucial to be aware of relevant deadlines:

- The amended return must generally be filed within three years of the original due date.

- If you are claiming a refund, the request must be made within two years from the date the tax was paid.

- Check for any specific deadlines related to the tax year you are amending, as these can vary.

Required Documents

To complete the Arizona Form 140X, taxpayers should gather the following documents:

- A copy of the original tax return that is being amended.

- Any supporting documents that justify the changes, such as W-2s, 1099s, or receipts for deductions.

- Documentation of any previous correspondence with the Arizona Department of Revenue regarding the original return.

Form Submission Methods

Taxpayers can submit the Arizona Form 140X through various methods:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address provided by the Department of Revenue.

- In-person submission at local Department of Revenue offices, if applicable.

Quick guide on how to complete arizona form individual amended income tax return 140x 20yy

Prepare ARIZONA FORM Individual Amended Income Tax Return 140X 20YY effortlessly on any device

Online document administration has gained popularity among companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Handle ARIZONA FORM Individual Amended Income Tax Return 140X 20YY on any device with the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

The easiest way to modify and electronically sign ARIZONA FORM Individual Amended Income Tax Return 140X 20YY without exertion

- Find ARIZONA FORM Individual Amended Income Tax Return 140X 20YY and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign ARIZONA FORM Individual Amended Income Tax Return 140X 20YY and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form individual amended income tax return 140x 20yy

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 140x arizona solution offered by airSlate SignNow?

The 140x arizona solution by airSlate SignNow provides businesses with a seamless way to send and eSign documents electronically. This platform is designed to enhance workflow efficiency while ensuring secure document handling. With easy-to-use features, businesses can streamline their processes.

-

How much does the 140x arizona plan cost?

Pricing for the 140x arizona plan varies based on the features and the number of users required. airSlate SignNow offers competitive pricing options for businesses of all sizes. Check our website for detailed pricing plans tailored to meet your specific needs.

-

What features are included in the 140x arizona package?

The 140x arizona package includes features such as customizable templates, real-time tracking, and team collaboration tools. Additionally, users benefit from robust security measures to keep their documents safe. This all-in-one solution aims to simplify the document signing process.

-

Can the 140x arizona solution be integrated with other software?

Yes, the 140x arizona solution seamlessly integrates with numerous software applications, including CRM and project management tools. This flexibility allows businesses to create a unified workflow that meets their operational needs. Enhancing productivity is a key benefit of these integrations.

-

What are the benefits of using the 140x arizona platform?

Using the 140x arizona platform offers signNow benefits such as improving turnaround time for document approvals and reducing paper usage. Additionally, businesses can track document status in real-time, enhancing overall efficiency. The solution is also designed to provide a user-friendly experience for all team members.

-

Is the 140x arizona solution suitable for small businesses?

Absolutely, the 140x arizona solution is designed to cater to both small and large businesses. It offers scalable options that can grow with the business, ensuring that small companies also gain access to advanced eSigning features. This affordability and adaptability make it an ideal choice for small enterprises.

-

How does airSlate SignNow ensure the security of documents in the 140x arizona plan?

airSlate SignNow prioritizes document security in its 140x arizona plan by employing encryption and secure access controls. All signed documents are stored securely, and user authentication processes help prevent unauthorized access. This commitment to security provides peace of mind for businesses handling sensitive information.

Get more for ARIZONA FORM Individual Amended Income Tax Return 140X 20YY

- Divorce dissolution marriage form

- Florida divorce form

- Paternity law and procedure handbook florida form

- Florida property bill of sale forms

- Office lease agreement florida form

- Commercial sublease florida form

- Residential lease renewal agreement florida form

- Exercising option purchase 497303194 form

Find out other ARIZONA FORM Individual Amended Income Tax Return 140X 20YY

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free