Form W 2AS American Samoa Wage and Tax Statement

What is the Form W-2AS American Samoa Wage and Tax Statement

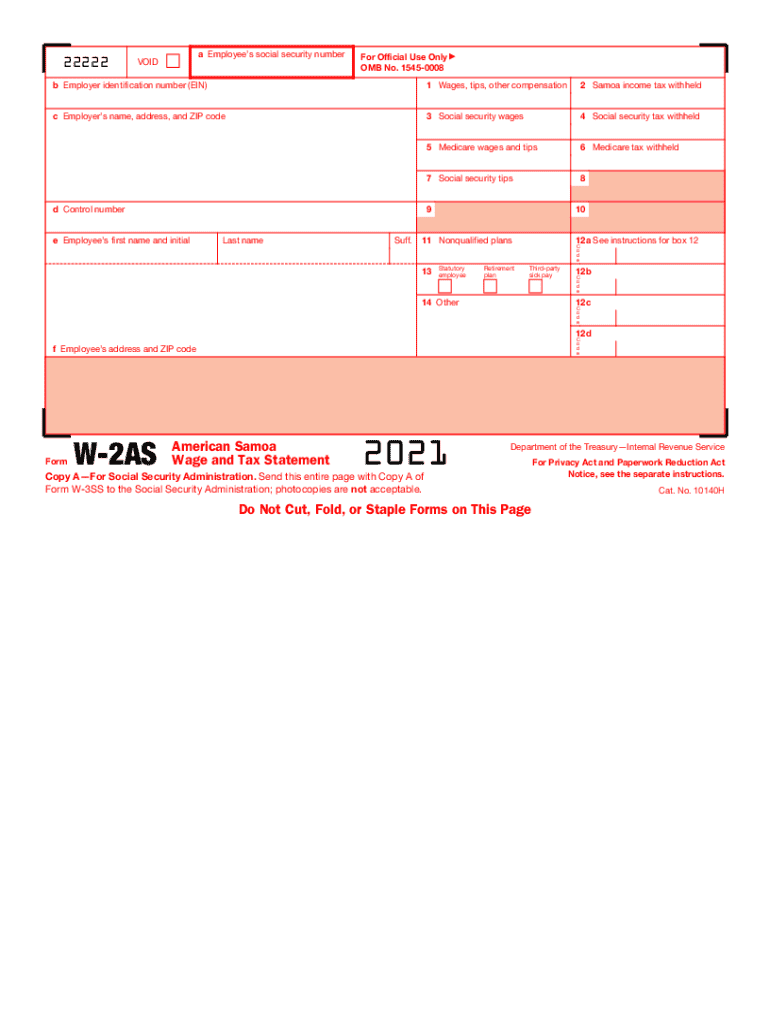

The Form W-2AS is a specific wage and tax statement used by employers in American Samoa to report wages paid to employees and the taxes withheld from those wages. This form is crucial for employees as it provides the necessary information for filing federal and local taxes. It includes details such as the employee's total earnings, Social Security wages, Medicare wages, and any applicable state or local taxes withheld. Understanding this form is essential for ensuring accurate tax reporting and compliance with local regulations.

How to use the Form W-2AS American Samoa Wage and Tax Statement

Using the Form W-2AS involves several steps. First, employers must accurately complete the form with the required information about each employee. This includes the employee's name, address, and Social Security number, along with the total wages paid and taxes withheld. Once completed, employers provide a copy of the W-2AS to each employee by the deadline set by the IRS. Employees then use this information when filing their tax returns to ensure they report their income and tax liabilities correctly.

Steps to complete the Form W-2AS American Samoa Wage and Tax Statement

Completing the Form W-2AS requires careful attention to detail. Here are the steps to follow:

- Gather all necessary employee information, including names, addresses, and Social Security numbers.

- Calculate total wages paid to each employee for the tax year.

- Determine the amount of federal income tax withheld, along with Social Security and Medicare taxes.

- Fill out the form accurately, ensuring all figures are correct and match payroll records.

- Provide copies of the completed form to employees and file with the IRS by the designated deadline.

Legal use of the Form W-2AS American Samoa Wage and Tax Statement

The legal use of the Form W-2AS is governed by IRS regulations, which mandate that employers provide accurate wage and tax information to their employees. This form must be completed correctly to avoid penalties or legal issues related to tax reporting. Employers are required to issue the W-2AS to employees by January thirty-first of the following year, ensuring that employees have the necessary documentation for their tax filings. Compliance with these regulations is essential for both employers and employees to avoid potential disputes with tax authorities.

Key elements of the Form W-2AS American Samoa Wage and Tax Statement

The Form W-2AS contains several key elements that are important for both employers and employees. These elements include:

- Employee's name and address

- Employer's name, address, and Employer Identification Number (EIN)

- Total wages paid to the employee

- Federal income tax withheld

- Social Security wages and tax withheld

- Medicare wages and tax withheld

- State and local tax information, if applicable

Filing Deadlines / Important Dates

Filing deadlines for the Form W-2AS are critical for compliance. Employers must provide the completed form to employees by January thirty-first of the year following the tax year. Additionally, employers must file the W-2AS with the IRS by the same date. It is essential to adhere to these deadlines to avoid penalties and ensure that employees can accurately file their tax returns on time.

Quick guide on how to complete 2021 form w 2as american samoa wage and tax statement

Complete Form W 2AS American Samoa Wage And Tax Statement effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form W 2AS American Samoa Wage And Tax Statement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form W 2AS American Samoa Wage And Tax Statement without hassle

- Find Form W 2AS American Samoa Wage And Tax Statement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from a device of your choosing. Alter and eSign Form W 2AS American Samoa Wage And Tax Statement and guarantee excellent communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form w 2as american samoa wage and tax statement

The best way to make an e-signature for your PDF in the online mode

The best way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is a 2020 W2 form and why is it important?

A 2020 W2 form is a key tax document that employers use to report an employee's annual wages and the taxes withheld from their paychecks. This form is important because it helps employees accurately file their income tax returns. Understanding the 2020 W2 form is crucial for ensuring compliance with tax regulations and maximizing potential refunds.

-

How can airSlate SignNow assist with filling out a 2020 W2 form?

airSlate SignNow provides an intuitive platform that allows users to easily create and complete a 2020 W2 form online. With its user-friendly interface, you can fill in all the necessary fields quickly and conveniently, ensuring accuracy and compliance. Additionally, you can seamlessly eSign and send the completed form directly from the platform.

-

What features does airSlate SignNow offer for managing 2020 W2 forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically designed for managing 2020 W2 forms. These features streamline the documentation process, reduce errors, and enhance overall efficiency. Users can also track document status in real-time to ensure timely submissions.

-

Is airSlate SignNow cost-effective for businesses needing 2020 W2 forms?

Yes, airSlate SignNow is a cost-effective solution for businesses needing 2020 W2 forms. With flexible pricing plans, it ensures that companies of all sizes can access essential eSigning features without breaking the bank. This affordability helps businesses save on paper and postage costs associated with traditional document handling.

-

Can airSlate SignNow integrate with my payroll system for 2020 W2 forms?

Absolutely! airSlate SignNow offers integrations with various payroll systems to streamline the process of generating and sending 2020 W2 forms. These integrations allow for automatic data transfer, reducing manual entry errors and saving time. You can easily manage your payroll and eSign documents all in one place.

-

What are the benefits of using airSlate SignNow for 2020 W2 forms?

The benefits of using airSlate SignNow for 2020 W2 forms include increased efficiency, improved accuracy, and enhanced security. The platform enables fast document exchanges and ensures that sensitive information remains protected during the signing process. Additionally, users can customize workflows to match their specific business needs.

-

How secure is the information on my 2020 W2 form with airSlate SignNow?

Safety is a priority at airSlate SignNow. The platform ensures that all information on your 2020 W2 form is protected by advanced encryption and secure data storage measures. Regular security audits and compliance with industry standards further bolster confidence that your sensitive tax information is safe.

Get more for Form W 2AS American Samoa Wage And Tax Statement

- Georgia prenuptial agreement 497303594 form

- Ga no fault form

- Georgia wage form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497303597 form

- Georgia corporation 497303598 form

- Georgia professional corporation form

- Georgia confidentiality form

- Ga directors form

Find out other Form W 2AS American Samoa Wage And Tax Statement

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free