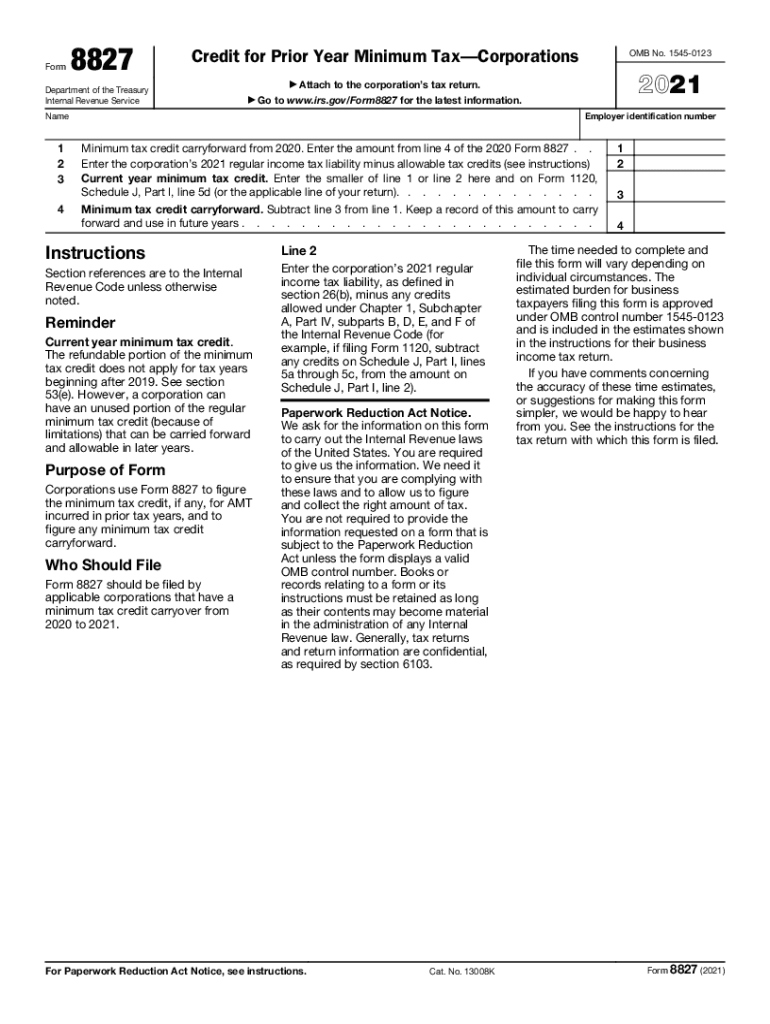

Form 8827 Credit for Prior Year Minimum TaxCorporations

Understanding IRS Form 8827 for Prior Year Minimum Tax Corporations

IRS Form 8827 is specifically designed for corporations that are eligible to claim a credit for prior year minimum tax. This form allows businesses to recover some of the taxes they paid in previous years when they were subject to the alternative minimum tax (AMT). The credit is particularly beneficial for corporations that may have overpaid their taxes due to AMT provisions. By utilizing this form, corporations can effectively reduce their tax liability in the current year.

Steps to Complete IRS Form 8827

Completing IRS Form 8827 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents from the previous tax year, including your corporate tax return and any records related to minimum tax payments. Next, fill out the form by providing your corporation's identifying information and detailing the amount of prior minimum tax paid. Be sure to calculate the credit accurately based on the guidelines provided by the IRS. Finally, review the form for completeness before submitting it with your current year tax return.

Eligibility Criteria for Form 8827

To qualify for the credit claimed on IRS Form 8827, a corporation must have paid alternative minimum tax in a prior year. Additionally, the corporation must meet specific criteria set by the IRS, including being a C corporation and having a valid tax identification number. It's essential to ensure that all eligibility requirements are met before filing the form, as ineligible claims may result in penalties or delays.

Filing Deadlines for IRS Form 8827

Corporations must adhere to specific filing deadlines when submitting IRS Form 8827. Typically, the form should be filed along with the corporation's annual tax return. For most corporations, this means the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. It is crucial to be aware of these deadlines to avoid late filing penalties and ensure timely processing of the credit.

Legal Use of IRS Form 8827

The legal use of IRS Form 8827 requires adherence to IRS guidelines and regulations. This form must be completed accurately and submitted in accordance with the law to ensure that the claimed credit is valid. Corporations should maintain thorough records of their prior minimum tax payments and any supporting documentation that substantiates their claim. Failure to comply with legal requirements may result in audits or penalties from the IRS.

Obtaining IRS Form 8827

IRS Form 8827 can be obtained directly from the IRS website or through tax preparation software that includes the form in its offerings. Corporations may also consult tax professionals for assistance in acquiring the form and understanding the requirements for completion. Ensuring you have the correct version of the form for the applicable tax year is vital for accurate filing.

Quick guide on how to complete 2021 form 8827 credit for prior year minimum taxcorporations

Complete Form 8827 Credit For Prior Year Minimum TaxCorporations effortlessly on any gadget

Online document organization has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Form 8827 Credit For Prior Year Minimum TaxCorporations on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and electronically sign Form 8827 Credit For Prior Year Minimum TaxCorporations seamlessly

- Obtain Form 8827 Credit For Prior Year Minimum TaxCorporations and then click Get Form to initiate.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 8827 Credit For Prior Year Minimum TaxCorporations and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 8827 credit for prior year minimum taxcorporations

The way to create an e-signature for your PDF online

The way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 8827 for 2020?

The IRS Form 8827 for 2020 is used to claim the credit for small employer pension plan startup costs. This form allows businesses to apply for tax credits, making it essential for those looking to enhance their retirement plans for employees. Completing this form accurately can help reduce your tax liability signNowly.

-

How can airSlate SignNow assist with IRS Form 8827 2020?

airSlate SignNow streamlines the process of completing and eSigning IRS Form 8827 for 2020 by offering an easy-to-use platform. Our solution allows users to fill out forms digitally and get them signed quickly, ensuring compliance and timely submission. This helps businesses focus on their operations rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8827 2020?

Yes, airSlate SignNow offers various pricing plans, catering to different business needs when working with IRS Form 8827 for 2020. We provide a cost-effective solution that generally saves time and reduces the hassle of traditional document handling. Potential savings could outweigh the minimal costs involved in subscription.

-

What features does airSlate SignNow offer for processing IRS Form 8827 2020?

airSlate SignNow includes features such as document templates, customizable workflows, and advanced eSignature capabilities specifically for IRS Form 8827 for 2020. These features make the document management process more efficient, ensuring that all parties can quickly review and sign needed documentation. Additionally, you can securely store and manage your forms within our platform.

-

Can I integrate airSlate SignNow with other tools for handling IRS Form 8827 2020?

Absolutely! airSlate SignNow offers integrations with a variety of software tools, enhancing your workflow for processing IRS Form 8827 for 2020. By connecting with your existing systems, you can ensure seamless document handling and improve overall productivity in your business activities.

-

What are the benefits of using airSlate SignNow for IRS Form 8827 2020?

Using airSlate SignNow for IRS Form 8827 for 2020 provides several benefits, including increased efficiency in document processing, reduced turnaround times, and enhanced security for sensitive information. Our platform ensures that your forms are completed accurately and submitted on time, which can help you stay compliant with IRS regulations. This ultimately allows you to focus on growing your business rather than getting bogged down by paperwork.

-

Is airSlate SignNow user-friendly for completing IRS Form 8827 2020?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete IRS Form 8827 for 2020 without a steep learning curve. Our intuitive interface guides users through the eSigning and document management process, ensuring a smooth experience. This accessibility is particularly beneficial for small businesses or those new to eSigning.

Get more for Form 8827 Credit For Prior Year Minimum TaxCorporations

- Mutual wills or last will and testaments for unmarried persons living together with minor children georgia form

- Non marital cohabitation living together agreement georgia form

- Paternity law and procedure handbook georgia form

- Bill of sale in connection with sale of business by individual or corporate seller georgia form

- Georgia final decree form

- Ga final decree form

- Office lease agreement georgia form

- Georgia petition divorce form

Find out other Form 8827 Credit For Prior Year Minimum TaxCorporations

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed