5305a Sep 2006-2026

What is the 5305a SEP

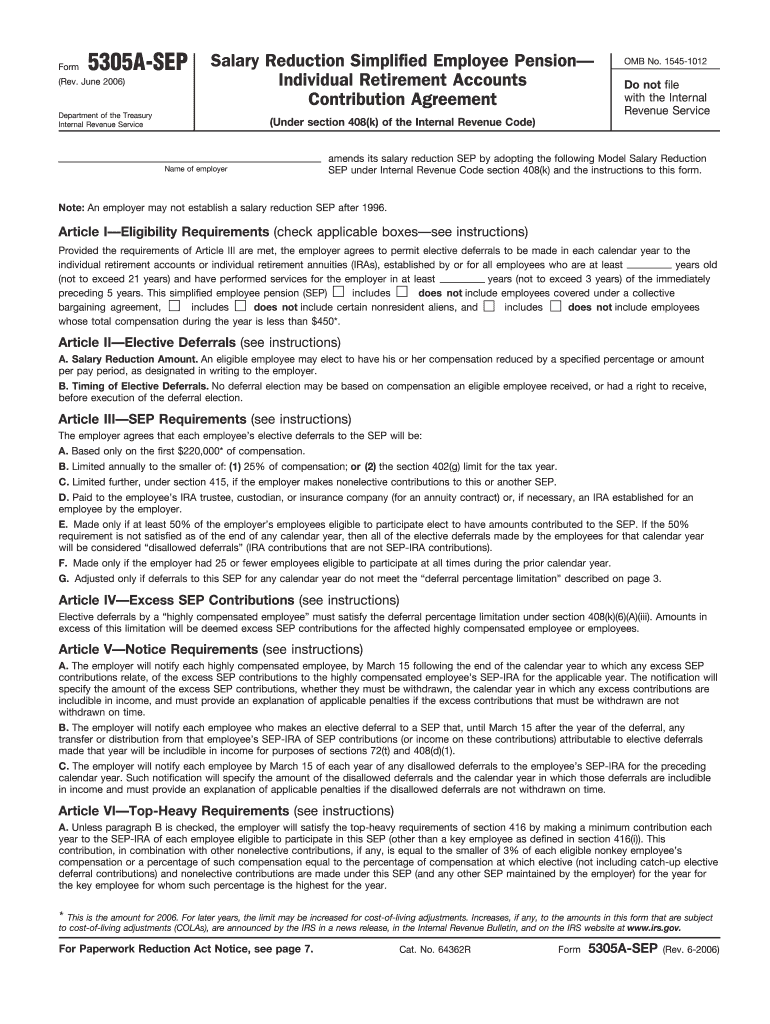

The 5305a SEP is a simplified employee pension plan that allows employers to make contributions to their employees' retirement savings. This form is specifically designed for use by small business owners and self-employed individuals. The 5305a version is an IRS-approved template that outlines the terms of the SEP plan. It is essential for establishing a SEP IRA, as it provides the necessary legal framework for contributions and distributions.

How to use the 5305a SEP

To utilize the 5305a SEP, an employer must complete the form accurately and keep it on file. This form does not need to be submitted to the IRS but must be retained for records. Employers should provide a copy to each eligible employee, ensuring they understand their rights and the benefits of the SEP plan. Contributions can then be made based on the guidelines established in the form, allowing for tax-deferred growth of retirement savings.

Steps to complete the 5305a SEP

Completing the 5305a SEP involves several key steps:

- Determine eligibility: Ensure that all employees meet the eligibility criteria outlined in the form.

- Fill out the form: Provide accurate information regarding the employer, employees, and contribution amounts.

- Distribute the form: Give a copy of the completed form to each eligible employee.

- Maintain records: Keep the form and any related documents on file for future reference.

Legal use of the 5305a SEP

The 5305a SEP must be used in accordance with IRS regulations to ensure its validity. This includes adhering to contribution limits, eligibility requirements, and distribution rules. Employers should regularly review the plan to ensure compliance with any changes in tax laws or regulations. Proper use of the form protects both the employer and employees, ensuring that the retirement plan remains valid and effective.

Filing Deadlines / Important Dates

While the 5305a SEP itself does not require submission to the IRS, employers must be aware of important deadlines related to contributions. Generally, contributions must be made by the employer's tax filing deadline, including extensions. This ensures that contributions can be deducted on the employer's tax return for that year. Staying informed about these dates is crucial for maximizing tax benefits.

Eligibility Criteria

Eligibility for the 5305a SEP is determined by several factors, including age, employment status, and length of service. Generally, employees must be at least 21 years old, have worked for the employer for at least three of the last five years, and have received a minimum amount of compensation during the year. Employers have the flexibility to set additional criteria, but they must be clearly outlined in the plan documentation.

Quick guide on how to complete sep ira 2006 2018 form

Discover the simplest method to complete and sign your 5305a Sep

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to complete and sign your 5305a Sep and similar forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to manage documents swiftly and in compliance with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing features all available within an easy-to-use interface.

Only a few steps are needed to complete and sign your 5305a Sep:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to include in your 5305a Sep.

- Move between fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Blackout portions that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using any method you prefer.

- Place the Date next to your signature and finalize your work with the Done button.

Store your completed 5305a Sep in the Documents section of your profile, download it, or export it to your preferred cloud storage. Our solution also offers versatile form sharing options. There's no need to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct sep ira 2006 2018 form

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

Do we need to fill out a separate form for NMIMS Mumbai, or will it be included in the NMAT 2018 exam form?

Yes!! You need to fill separate form for NMIMS Mumbai after filling in the NMAT application form.And not only this! You need to apply again separately on NMIMS website if you wish to appear for another window in a season.As NMAT can be appeared 3 times in a year when the exam season starts , so u need to apply every single time on NMAT by Gmac website and on NMIMS website separately or else your score in NMAT exam will not be considered by the institute.All the best

-

How do I fill out forms for an MS at US universities for semesters starting in August - September 2018?

Go to the websites of respective universities.In that go under apply tab and see the dates available for application. Every single information is there about everything you will need.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

Is there any separate form to fill out for participating in the COMEDK counselling 2018? My COMEDK rank is 10,359.

No.There is no need of filling any form in order to participate in COMEDK counselling round. You just have to report to the counselling venue as per the day and time, on the basis of your Comedk rank. Just bring all the original documents along with two attested photocopies and DD of 55000/-

Create this form in 5 minutes!

How to create an eSignature for the sep ira 2006 2018 form

How to make an electronic signature for your Sep Ira 2006 2018 Form online

How to make an eSignature for the Sep Ira 2006 2018 Form in Google Chrome

How to create an eSignature for putting it on the Sep Ira 2006 2018 Form in Gmail

How to make an electronic signature for the Sep Ira 2006 2018 Form straight from your smartphone

How to generate an eSignature for the Sep Ira 2006 2018 Form on iOS

How to generate an electronic signature for the Sep Ira 2006 2018 Form on Android OS

People also ask

-

What is a SEP IRA and how does it work?

A SEP IRA, or Simplified Employee Pension Individual Retirement Account, is a retirement savings plan that allows business owners to make tax-deductible contributions for themselves and their employees. They are easy to set up and manage, enabling employers to contribute to employee retirement accounts without the complexities of traditional pension plans. The SEP IRA is ideal for self-employed individuals and small business owners looking to boost their retirement savings.

-

What are the contribution limits for a SEP IRA?

For 2023, the contribution limit for a SEP IRA is 25% of an employee's compensation or $66,000, whichever is less. This flexibility allows business owners to adjust their contributions based on their financial situation. It's a great way to maximize retirement savings while taking advantage of the tax benefits associated with a SEP IRA.

-

How does airSlate SignNow integrate with SEP IRA management?

airSlate SignNow can simplify the document management process for setting up and administering a SEP IRA. By providing eSignature capabilities, it allows businesses to sign and share important retirement plan documents securely and efficiently. This integration ensures your SEP IRA processes are streamlined, making it easier to comply with IRS requirements.

-

What are the tax benefits of a SEP IRA?

One of the primary benefits of a SEP IRA is that contributions made by an employer are tax-deductible, reducing taxable income for the business. Additionally, the money invested in a SEP IRA grows tax-deferred until withdrawal, which means you won't pay taxes on the accumulated earnings until retirement. This offers a signNow tax advantage compared to other retirement savings options.

-

Can I open a SEP IRA if I am self-employed?

Yes, self-employed individuals can open a SEP IRA. Being self-employed is one of the key advantages of a SEP IRA, as it allows you to contribute to your retirement while benefiting from substantial contribution limits. This makes it an excellent option for freelancers and small business owners looking to save for the future.

-

What are the eligibility requirements for a SEP IRA?

To qualify for a SEP IRA, employees must be at least 21 years old, have worked for the employer in at least three of the last five years, and have earned a minimum amount, which is set each year. These requirements ensure that the SEP IRA is accessible only to employees who have been with the company long enough to make signNow contributions. Employers have the discretion to include additional conditions for their plans.

-

How can I withdraw funds from my SEP IRA?

Withdrawals from a SEP IRA can be made at any time, but they may be subject to taxes and penalties if taken before the age of 59 ½. It's important to understand the implications of early withdrawals to minimize tax impacts. Plan for retirement needs and work with a financial advisor to strategize timely withdrawals, especially considering the benefits of keeping funds invested until retirement.

Get more for 5305a Sep

- Pets in transition form

- Application for contract form

- South pacific county humane society application form

- Waggin tails dog rescue inc pre adoption application waggintailsdogrescue form

- Generic dog adoption application form

- Adoption application please return boston buddies bostonbuddies form

- I want to adopt a dog in houston form

- Audit location street address form

Find out other 5305a Sep

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample