Instructions for Form 1098 Internal Revenue Service

What is the Instructions For Form 1098 Internal Revenue Service

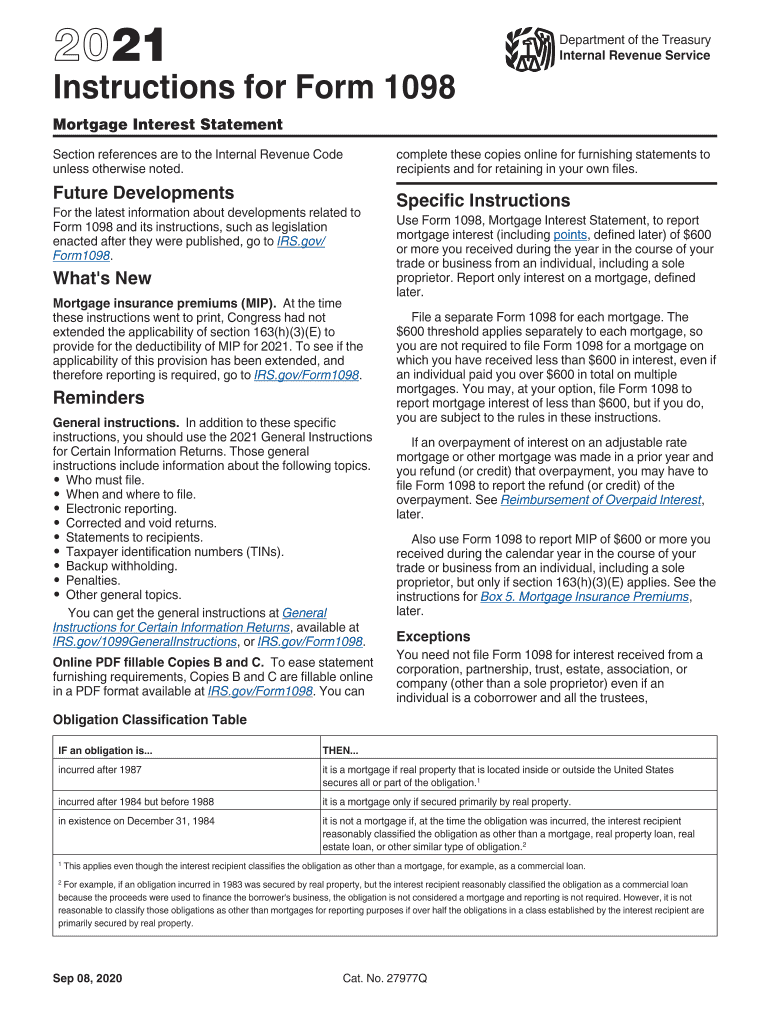

The Instructions for Form 1098 provide detailed guidance on how to complete the form, which is used to report mortgage interest received by a lender from an individual. This form is essential for taxpayers who wish to claim mortgage interest deductions on their federal tax returns. The instructions outline the specific information required, including borrower details, loan information, and interest amounts. Understanding these instructions is crucial for ensuring accurate reporting and compliance with IRS regulations.

Steps to complete the Instructions For Form 1098 Internal Revenue Service

Completing the Instructions for Form 1098 involves several key steps:

- Gather necessary documents, including loan agreements and interest statements.

- Fill in borrower information, including name, address, and social security number.

- Provide details about the mortgage, such as the loan amount and the interest paid during the year.

- Ensure accuracy in reporting any points paid on the loan, as these can affect tax deductions.

- Review the completed form for any errors before submission.

Legal use of the Instructions For Form 1098 Internal Revenue Service

The legal use of the Instructions for Form 1098 is vital for compliance with tax laws. The IRS mandates that lenders provide this form to borrowers who paid $600 or more in mortgage interest during the tax year. By following the instructions carefully, lenders can avoid penalties and ensure that borrowers receive accurate information for their tax filings. The form serves as an official record of interest payments, which can be critical during audits or tax reviews.

Filing Deadlines / Important Dates

Filing deadlines for the form are crucial for both lenders and borrowers. Generally, lenders must provide the completed form to borrowers by January 31 of the year following the tax year. Additionally, the form must be submitted to the IRS by February 28 if filed by paper or March 31 if filed electronically. Missing these deadlines can result in penalties for the lender and complications for the borrower’s tax filings.

Who Issues the Form

The Form 1098 is typically issued by mortgage lenders, including banks, credit unions, and other financial institutions. These entities are responsible for reporting the mortgage interest received from borrowers. It is important for borrowers to ensure they receive this form from their lenders, as it is essential for accurately claiming mortgage interest deductions on their tax returns.

Examples of using the Instructions For Form 1098 Internal Revenue Service

Examples of using the Instructions for Form 1098 include scenarios where a borrower is claiming mortgage interest deductions for their primary residence. For instance, if a borrower paid $10,000 in mortgage interest over the year, they would use the 1098 form to report this amount on their tax return. The instructions guide the borrower on how to accurately reflect this deduction, ensuring compliance with IRS regulations.

Quick guide on how to complete instructions for form 1098 2021internal revenue service

Complete Instructions For Form 1098 Internal Revenue Service effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form 1098 Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and simplify any document-focused task today.

How to modify and eSign Instructions For Form 1098 Internal Revenue Service with ease

- Locate Instructions For Form 1098 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant portions of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Instructions For Form 1098 Internal Revenue Service and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1098 2021internal revenue service

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF document on Android OS

People also ask

-

What is the 1098 2021 form and why is it important?

The 1098 2021 form is a tax document used to report mortgage interest that you have paid during the year. It is important because it can provide signNow tax benefits by deducting interest payments on your tax return. Knowing how to utilize the 1098 2021 form is essential for homeowners to maximize their tax deductions.

-

How can airSlate SignNow help with the 1098 2021 form?

airSlate SignNow simplifies the process of managing the 1098 2021 form by allowing you to securely send and eSign documents electronically. This saves time and reduces errors associated with paper forms. With our platform, you can streamline your tax documentation process effortlessly.

-

Is airSlate SignNow a cost-effective solution for managing the 1098 2021 form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 1098 2021 form. Our affordable pricing plans are designed to meet the needs of businesses of all sizes, allowing you to handle multiple documents without breaking the bank. This ensures you can manage your tax forms efficiently without incurring high costs.

-

What features does airSlate SignNow offer for the 1098 2021 form?

airSlate SignNow includes features like customizable templates, real-time collaboration, and tracking. These features enhance the efficiency of completing the 1098 2021 form, ensuring your documents are accurately filled and submitted on time. Additionally, our secure platform makes it easy to store and retrieve important tax documents as needed.

-

Can airSlate SignNow integrate with other software for the 1098 2021 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when managing the 1098 2021 form. Whether you are using accounting software or CRM tools, our integrations streamline document management, making it easier to handle your tax obligations.

-

What benefits can I expect from using airSlate SignNow for the 1098 2021 form?

By using airSlate SignNow for the 1098 2021 form, you gain signNow benefits such as increased efficiency, reduced paperwork, and improved accuracy in your tax filing process. Our platform allows you to eSign and send documents securely, minimizing delays and enhancing your overall productivity during tax season.

-

How secure is airSlate SignNow for handling the 1098 2021 form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance standards to ensure that your 1098 2021 form and other sensitive documents are handled securely. You can trust that your information is protected while using our platform.

Get more for Instructions For Form 1098 Internal Revenue Service

- Beneficiary deed form

- Notice of labor or materials provided by corporation or llc arkansas form

- Affidavit of lien account individual arkansas form

- Quitclaim deed by two individuals to corporation arkansas form

- Warranty deed from two individuals to corporation arkansas form

- Ar corporation 497296370 form

- Release of lien individual arkansas form

- Quitclaim deed from individual to corporation arkansas form

Find out other Instructions For Form 1098 Internal Revenue Service

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement