State of Rhode Island Division of TaxationMiscellaneous 2020

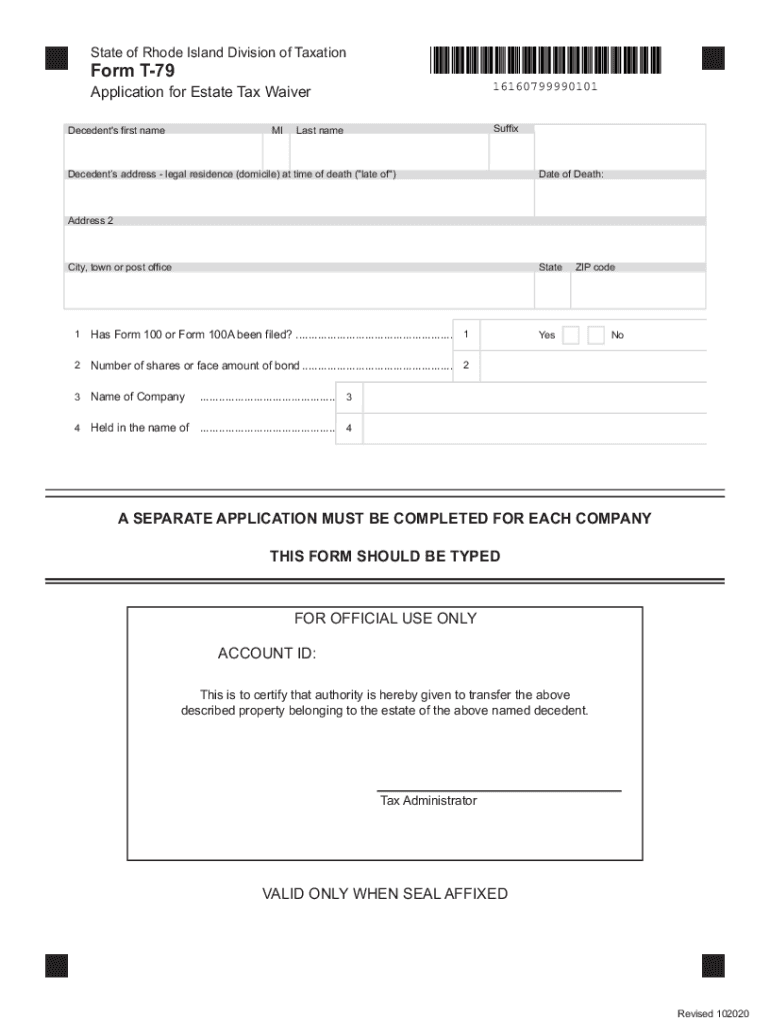

What is the Rhode Island T-79 Estate Tax Form?

The Rhode Island T-79 estate tax form is a crucial document used to report the estate tax due on the transfer of property upon a person's death. This form is specifically designed for estates that exceed a certain value threshold, as defined by Rhode Island state law. It requires detailed information about the deceased's assets, liabilities, and the beneficiaries of the estate. Understanding the T-79 form is essential for executors and administrators to ensure compliance with state tax regulations.

Steps to Complete the Rhode Island T-79 Estate Tax Form

Completing the Rhode Island T-79 estate tax form involves several key steps:

- Gather all necessary documentation, including the deceased's will, property appraisals, and financial statements.

- Calculate the total value of the estate, including real estate, bank accounts, investments, and personal property.

- Identify any debts or liabilities that must be deducted from the total estate value.

- Fill out the T-79 form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

Required Documents for the Rhode Island T-79 Form

When completing the Rhode Island T-79 estate tax form, several documents are required to support the information provided:

- The deceased's will or trust documents.

- Death certificate.

- Property appraisals for real estate and personal property.

- Financial statements from banks and investment accounts.

- Documentation of any debts or liabilities owed by the estate.

Form Submission Methods for the Rhode Island T-79

The Rhode Island T-79 estate tax form can be submitted through various methods:

- Online submission via the Rhode Island Division of Taxation's website, if available.

- Mailing the completed form to the appropriate tax office.

- In-person submission at the Rhode Island Division of Taxation office.

Legal Use of the Rhode Island T-79 Estate Tax Form

The Rhode Island T-79 estate tax form must be filed in accordance with state laws and regulations. It serves as a legal declaration of the estate's value and the taxes owed. Proper completion and timely submission are essential to avoid penalties and ensure that the estate is settled according to the law. Executors and administrators should be aware of their legal responsibilities when handling this form.

Filing Deadlines for the Rhode Island T-79 Form

It is important to be aware of the filing deadlines associated with the Rhode Island T-79 estate tax form. Generally, the form must be filed within nine months of the date of death of the decedent. Extensions may be available under certain circumstances, but it is crucial to apply for these extensions before the original deadline to avoid penalties.

Quick guide on how to complete state of rhode island division of taxationmiscellaneous

Complete State Of Rhode Island Division Of TaxationMiscellaneous effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle State Of Rhode Island Division Of TaxationMiscellaneous seamlessly on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign State Of Rhode Island Division Of TaxationMiscellaneous with ease

- Locate State Of Rhode Island Division Of TaxationMiscellaneous and select Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click on the Done button to save your changes.

- Select your preferred method of delivering your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searching for forms, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign State Of Rhode Island Division Of TaxationMiscellaneous while ensuring outstanding communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of rhode island division of taxationmiscellaneous

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island division of taxationmiscellaneous

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Rhode Island T 79 estate tax form?

The Rhode Island T 79 estate tax form is a document used to report the estate tax liability for estates in Rhode Island. It outlines the gross estate, deductions, and calculates the tax owed. Properly completing the Rhode Island T 79 estate tax form is crucial for compliance with state tax regulations.

-

How can airSlate SignNow help with the Rhode Island T 79 estate tax form?

AirSlate SignNow provides an easy-to-use platform for electronically signing and managing documents, including the Rhode Island T 79 estate tax form. With secure storage and user-friendly interfaces, you can complete and submit your form efficiently. This streamlines the process and ensures your document is handled professionally.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to meet different user needs. Whether you require a single-user license or a solution for a team, the pricing is competitive and designed to fit your budget. Additionally, using airSlate SignNow for the Rhode Island T 79 estate tax form can save you both time and money.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with a variety of platforms including Google Drive, Dropbox, and Salesforce. This allows users to easily access documents like the Rhode Island T 79 estate tax form from their preferred tools. Seamless integration enhances workflow efficiency and document management.

-

What features are included with airSlate SignNow?

AirSlate SignNow includes features such as document templates, real-time notifications, and customizable signing workflows. These tools make it easier to prepare and manage documents like the Rhode Island T 79 estate tax form. Enhanced tracking capabilities also ensure you remain informed throughout the signing process.

-

What benefits does airSlate SignNow offer for eSigning documents?

Using airSlate SignNow for eSigning documents offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. Specifically, for the Rhode Island T 79 estate tax form, you can expedite the signing process while ensuring that all parties are compliant. This helps you avoid delays and potential errors in submission.

-

How secure is the airSlate SignNow platform?

The security of your documents, including the Rhode Island T 79 estate tax form, is a top priority at airSlate SignNow. The platform employs advanced encryption protocols and complies with industry standards to protect your data. This ensures that your sensitive information remains confidential and secure.

Get more for State Of Rhode Island Division Of TaxationMiscellaneous

Find out other State Of Rhode Island Division Of TaxationMiscellaneous

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word