Rhode Island T 79 Form 2016

What is the Rhode Island T 79 Form

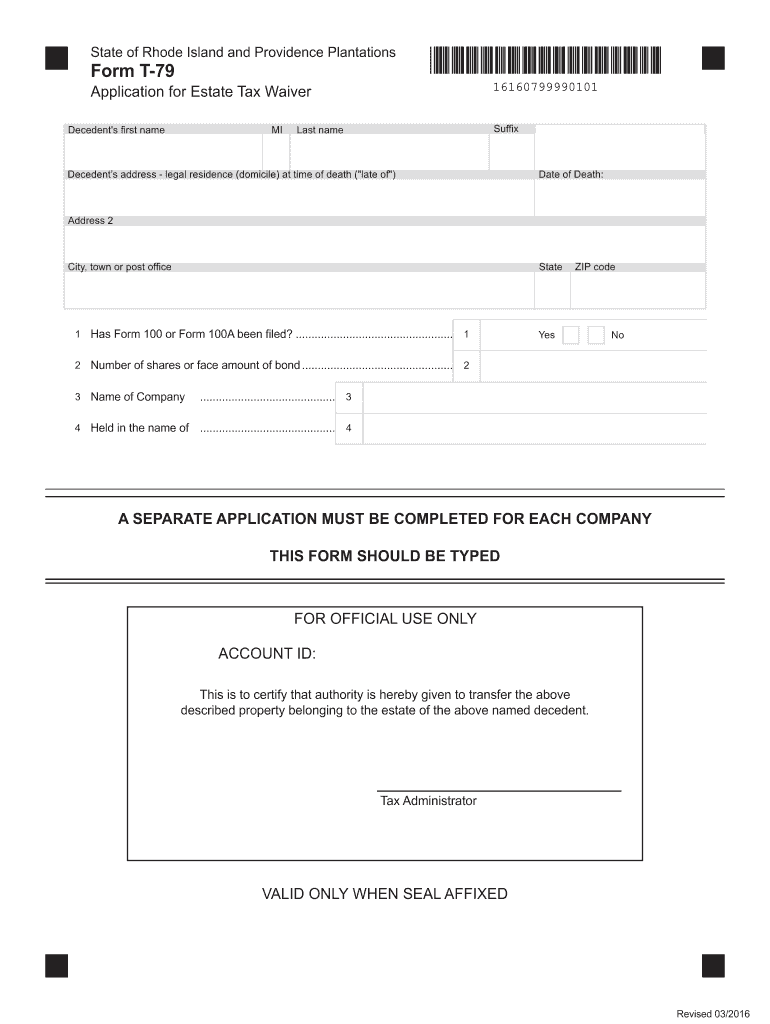

The Rhode Island T 79 tax form, also known as the Rhode Island 79 tax form, is primarily used to apply for a tax waiver on estate taxes in the state of Rhode Island. This form is essential for individuals or estates seeking relief from certain tax obligations under specific conditions. The T 79 form serves as an official request to the Rhode Island Division of Taxation, allowing applicants to provide necessary information about the estate and its beneficiaries.

How to obtain the Rhode Island T 79 Form

The Rhode Island T 79 form can be obtained through several means. It is available on the official Rhode Island Division of Taxation website, where users can download a printable version. Additionally, individuals may request a physical copy by contacting the Division of Taxation directly. It is important to ensure that you have the most current version of the form to avoid any issues during the application process.

Steps to complete the Rhode Island T 79 Form

Completing the Rhode Island T 79 form involves several key steps:

- Gather necessary documentation, including details about the estate and its assets.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form to validate your request.

- Submit the completed form to the Rhode Island Division of Taxation, either online or by mail.

Legal use of the Rhode Island T 79 Form

The Rhode Island T 79 form is legally recognized when filled out and submitted according to state regulations. To ensure its validity, the form must be signed by the appropriate parties, and any required supporting documents should accompany it. Compliance with the legal requirements is essential for the waiver to be considered by the tax authorities.

Eligibility Criteria

Eligibility for using the Rhode Island T 79 form typically includes specific conditions related to the estate's value and the relationship of the applicant to the deceased. Generally, individuals who are beneficiaries or administrators of the estate may apply for a tax waiver. It is crucial to review the guidelines provided by the Rhode Island Division of Taxation to confirm eligibility before proceeding with the application.

Form Submission Methods

The Rhode Island T 79 form can be submitted through various methods, offering flexibility to applicants. Options include:

- Online submission through the Rhode Island Division of Taxation's e-filing system.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, where assistance may be available.

Required Documents

When submitting the Rhode Island T 79 form, certain documents may be required to support the application. These typically include:

- A copy of the death certificate of the deceased.

- Documentation detailing the assets and liabilities of the estate.

- Any relevant legal documents, such as wills or trust agreements.

Quick guide on how to complete rhode island t 79 form

Accomplish Rhode Island T 79 Form seamlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can obtain the correct format and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Rhode Island T 79 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Rhode Island T 79 Form effortlessly

- Find Rhode Island T 79 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically offers for this task.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and hit the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes requiring you to print new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from a device of your choice. Modify and electronically sign Rhode Island T 79 Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rhode island t 79 form

Create this form in 5 minutes!

How to create an eSignature for the rhode island t 79 form

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the Rhode Island 79 tax form?

The Rhode Island 79 tax form is a state-specific tax document required for certain tax filings. It is primarily used by businesses and individuals to report taxable income, deductions, and credits to the Rhode Island Division of Taxation. Understanding the Rhode Island 79 tax form is essential for accurate tax compliance.

-

How can airSlate SignNow help with the Rhode Island 79 tax form?

airSlate SignNow offers a seamless way to eSign and send the Rhode Island 79 tax form electronically. Our platform ensures that your document is securely stored and easily accessible, making it simple to manage your tax filings. With airSlate SignNow, you can expedite the process and reduce paperwork hassle.

-

Is there a fee to use airSlate SignNow for the Rhode Island 79 tax form?

Yes, using airSlate SignNow to manage the Rhode Island 79 tax form incurs a subscription fee. However, our pricing is competitive and tailored to fit various business needs, ensuring you get value for your money while handling important documents efficiently. Explore our pricing plans to find the best fit for you.

-

What features does airSlate SignNow offer for managing the Rhode Island 79 tax form?

airSlate SignNow provides features like document templates, cloud storage, and customizable workflows specifically for the Rhode Island 79 tax form. Users can easily create, edit, and manage their tax documents within a secure environment. Additionally, our platform supports multiple file formats, making it versatile for all kinds of tax-related paperwork.

-

Can I integrate airSlate SignNow with other software to help with the Rhode Island 79 tax form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software. This integration allows for easy sharing and management of the Rhode Island 79 tax form alongside your other financial documents. Our platform supports popular applications, enabling efficiency in your tax preparation process.

-

What are the benefits of using airSlate SignNow for the Rhode Island 79 tax form?

Using airSlate SignNow for the Rhode Island 79 tax form offers several benefits, including time savings, enhanced security, and improved document accuracy. The ability to eSign quickly means you can submit your tax forms promptly, reducing the risk of penalties. Additionally, our platform ensures your data is protected with top-notch security measures.

-

Is airSlate SignNow user-friendly for filing the Rhode Island 79 tax form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to eSign and submit the Rhode Island 79 tax form. With a simple interface and step-by-step guidance, even those new to digital forms will find it intuitive and efficient.

Get more for Rhode Island T 79 Form

Find out other Rhode Island T 79 Form

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement