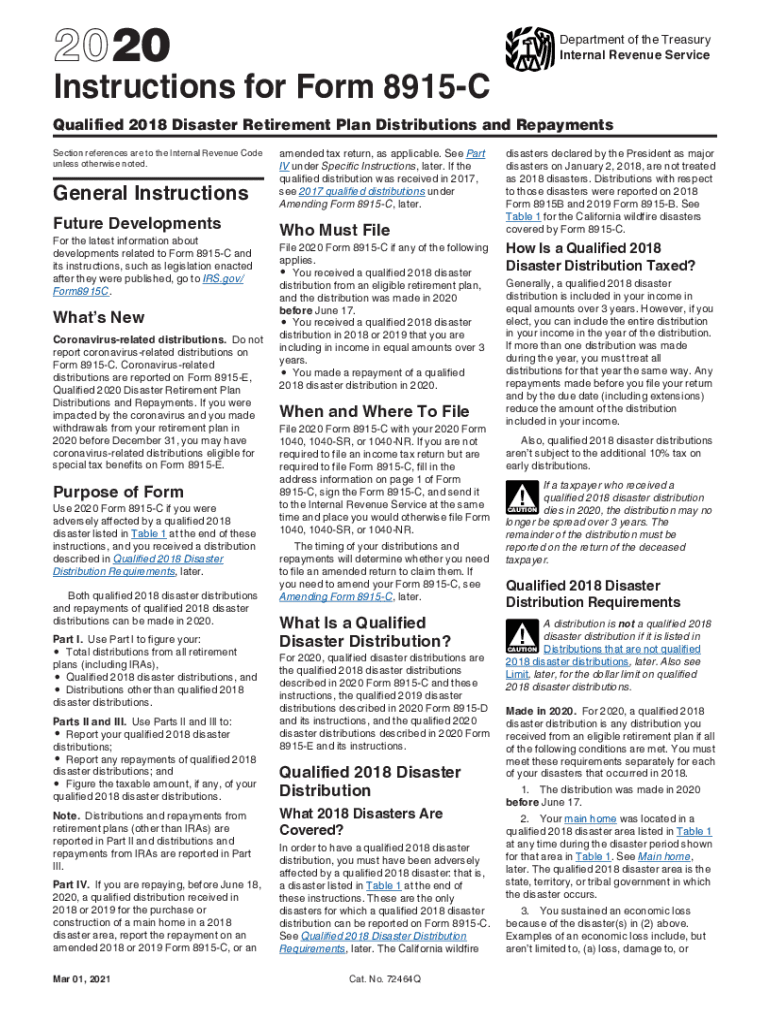

Instructions for Form 8915 C Internal Revenue Service 2020

What is the IRS Instructions for Form 8915 C?

The IRS Instructions for Form 8915 C provide detailed guidance for taxpayers regarding the treatment of qualified disaster distributions from retirement plans. This form is specifically designed for individuals who have taken distributions due to federally declared disasters. The instructions outline eligibility criteria, tax implications, and the proper reporting methods for these distributions. Understanding these instructions is essential for ensuring compliance with IRS regulations and accurately reporting any distributions received.

How to Use the IRS Instructions for Form 8915 C

To effectively use the IRS Instructions for Form 8915 C, taxpayers should first review the eligibility requirements outlined in the document. These instructions guide users through the process of completing the form, ensuring that all necessary information is included. It is advisable to gather all relevant documents, such as tax returns and records of the distribution, before beginning the form. Following the step-by-step directions will help in accurately reporting the distribution and claiming any applicable tax benefits.

Steps to Complete the IRS Instructions for Form 8915 C

Completing the IRS Instructions for Form 8915 C involves several key steps:

- Review the eligibility criteria to confirm that you qualify for reporting a disaster distribution.

- Gather necessary documentation, including records of the distribution and prior tax returns.

- Follow the instructions to fill out the form accurately, ensuring all required fields are completed.

- Double-check the form for accuracy and completeness before submission.

- Submit the form according to the guidelines provided, either electronically or by mail.

Legal Use of the IRS Instructions for Form 8915 C

The IRS Instructions for Form 8915 C are legally binding and must be adhered to by taxpayers who have taken distributions due to qualified disasters. Compliance with these instructions ensures that individuals report their distributions correctly and avoid potential penalties. It is important to be aware of the legal ramifications of misreporting or failing to report these distributions, as the IRS may impose fines or additional taxes.

Filing Deadlines for the IRS Instructions for Form 8915 C

Filing deadlines for the IRS Instructions for Form 8915 C align with the standard tax filing deadlines. Taxpayers should be aware of the specific dates relevant to their tax year to ensure timely submission. Extensions may be available, but it is crucial to file any necessary forms by the established deadlines to avoid penalties. Keeping track of these dates is essential for maintaining compliance with IRS regulations.

Required Documents for the IRS Instructions for Form 8915 C

To complete the IRS Instructions for Form 8915 C, taxpayers will need several key documents:

- Records of the qualified disaster distribution from retirement plans.

- Previous year’s tax returns for reference.

- Any supporting documentation that verifies the disaster declaration and eligibility.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete 2020 instructions for form 8915 c internal revenue service

Complete Instructions For Form 8915 C Internal Revenue Service effortlessly on any device

Web-based document management has gained popularity among companies and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Instructions For Form 8915 C Internal Revenue Service on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Instructions For Form 8915 C Internal Revenue Service without any hassle

- Find Instructions For Form 8915 C Internal Revenue Service and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact confidential information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Instructions For Form 8915 C Internal Revenue Service and ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 8915 c internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 8915 c internal revenue service

The way to make an e-signature for a PDF in the online mode

The way to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The way to make an e-signature for a PDF document on Android OS

People also ask

-

What are IRS instructions 8915?

IRS instructions 8915 provide guidance on how to report certain retirement plan distributions that might have been affected by specific laws. Understanding these instructions is crucial for ensuring compliance and avoiding penalties when filing your taxes.

-

How can airSlate SignNow help with IRS instructions 8915?

airSlate SignNow offers a streamlined process to eSign and send necessary documents related to IRS instructions 8915. Our platform ensures that all your tax documents are securely managed and easily accessible, enhancing your workflow as you navigate tax filing.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow is designed to be compliant with various IRS regulations, including the management of documents related to IRS instructions 8915. We prioritize security and legal compliance, ensuring your sensitive information remains protected.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features like real-time tracking, customizable templates, and secure cloud storage for document management. These capabilities simplify the process of handling documents related to IRS instructions 8915, making it easier for users to stay organized.

-

How much does airSlate SignNow cost for small businesses?

airSlate SignNow offers flexible pricing plans suitable for small businesses, starting at an affordable rate. The cost-effectiveness of our solution allows businesses to eSign documents efficiently, especially when dealing with IRS instructions 8915 and other tax-related paperwork.

-

Can I integrate airSlate SignNow with other software solutions?

Yes, airSlate SignNow easily integrates with various third-party applications, enhancing the efficiency of your workflow. This feature allows businesses to manage their documents related to IRS instructions 8915 alongside other essential tools, streamlining overall operations.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including those related to IRS instructions 8915, brings numerous benefits such as enhanced security, reduced processing time, and improved accuracy. Our platform enables users to manage and sign documents quickly and legally, mitigating the hassle of tax preparation.

Get more for Instructions For Form 8915 C Internal Revenue Service

- Sample transmittal letter 497304163 form

- Rehabilitation workers form

- Georgia registered agent form

- New resident guide georgia form

- Corporation ga form

- Satisfaction release or cancellation of security deed by individual georgia form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy georgia form

- Warranty deed husband and wife to husband and wife georgia form

Find out other Instructions For Form 8915 C Internal Revenue Service

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free