Contractor Direct Deposit Form 2013

What is the Contractor Direct Deposit Form

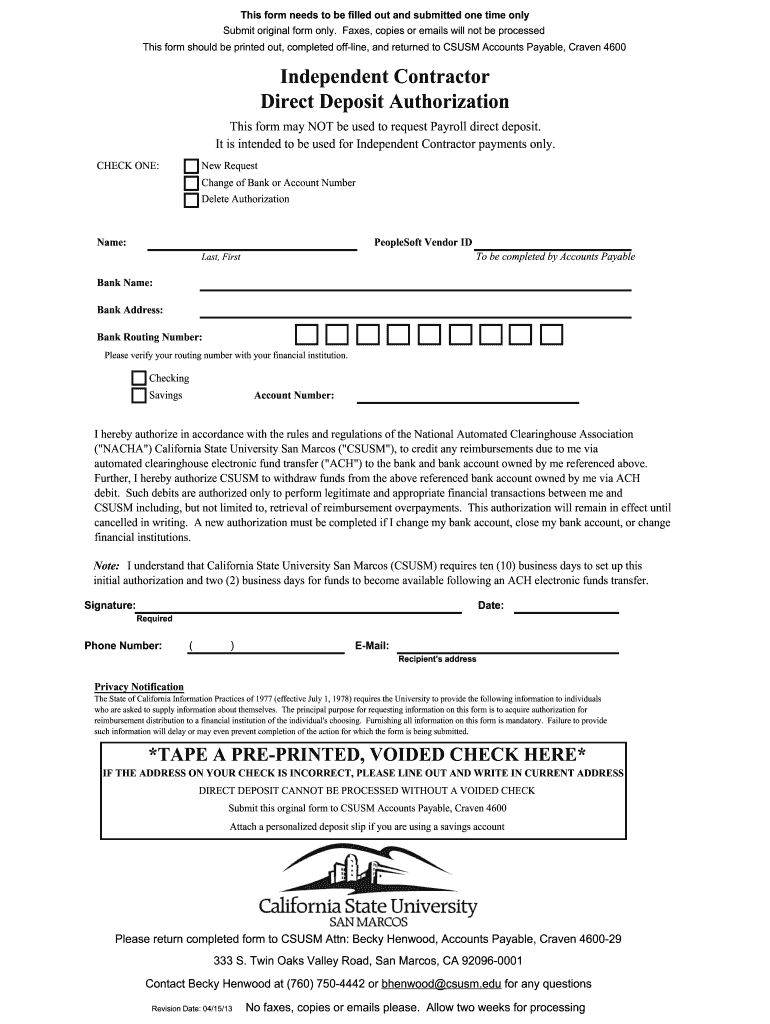

The contractor direct deposit authorization form is a document that allows independent contractors to authorize their clients or employers to deposit payments directly into their bank accounts. This form typically includes essential information such as the contractor's name, address, bank account details, and the type of payment being authorized. By using this form, contractors can ensure timely and secure payments without the need for physical checks. It streamlines the payment process, making it more efficient for both parties involved.

How to use the Contractor Direct Deposit Form

Using the contractor direct deposit authorization form involves several straightforward steps. First, the contractor must fill out the form with accurate personal and banking information. This includes the contractor's name, address, bank name, account number, and routing number. After completing the form, the contractor should review it for accuracy and then sign it to confirm authorization. Once signed, the form should be submitted to the employer or client responsible for processing payments. This ensures that future payments are deposited directly into the contractor's designated bank account.

Steps to complete the Contractor Direct Deposit Form

Completing the contractor direct deposit form requires careful attention to detail. Here are the steps to follow:

- Obtain the contractor direct deposit authorization form from your employer or client.

- Fill in your personal information, including your full name and address.

- Provide your bank account details, including the bank name, account number, and routing number.

- Indicate the type of payment you are authorizing for direct deposit.

- Review all information for accuracy to avoid payment delays.

- Sign and date the form to confirm your authorization.

- Submit the completed form to your employer or client.

Key elements of the Contractor Direct Deposit Form

The contractor direct deposit authorization form contains several key elements that are essential for its validity. These elements include:

- Contractor Information: Full name, address, and contact details.

- Banking Information: Name of the bank, account number, and routing number.

- Payment Authorization: Specification of the payments being authorized for direct deposit.

- Signature: The contractor's signature, which confirms their consent to the direct deposit arrangement.

- Date: The date on which the form was signed.

Legal use of the Contractor Direct Deposit Form

The contractor direct deposit authorization form is legally binding once signed by the contractor. It serves as a formal agreement between the contractor and the employer or client regarding the method of payment. To ensure compliance with legal standards, it is important that both parties retain a copy of the signed form for their records. This documentation can be crucial in case of any disputes regarding payments or authorization.

Form Submission Methods (Online / Mail / In-Person)

The contractor direct deposit authorization form can be submitted through various methods, depending on the preferences of the employer or client. Common submission methods include:

- Online Submission: Many employers offer secure online portals where contractors can upload their completed forms.

- Mail: Contractors can print the form and send it via postal mail to the designated address provided by the employer.

- In-Person: Some contractors may choose to deliver the form in person, ensuring immediate processing.

Quick guide on how to complete contractor deposit authorization form

The optimal method to discover and execute Contractor Direct Deposit Form

On the scale of your entire organization, ineffective procedures concerning document authorization can consume a signNow amount of work time. Signing documents such as Contractor Direct Deposit Form is a fundamental aspect of operations across various sectors, which is why the effectiveness of each agreement’s lifecycle heavily influences the overall efficiency of the organization. With airSlate SignNow, signing your Contractor Direct Deposit Form can be as straightforward and fast as possible. This platform provides you with the most recent version of nearly any document. Additionally, you can sign it instantly without needing to install third-party applications on your computer or printing any hard copies.

Steps to obtain and sign your Contractor Direct Deposit Form

- Browse our collection by category or utilize the search function to find the document you require.

- Check the form preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your form and add any required information using the toolbar.

- Once finished, click the Sign tool to sign your Contractor Direct Deposit Form.

- Select the signature method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything necessary to handle your documentation efficiently. You can find, fill out, modify, and even dispatch your Contractor Direct Deposit Form in a single tab without any trouble. Enhance your workflows with one intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct contractor deposit authorization form

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

How can I fill out the authorization form in Wipro's synergy?

By authorisation form I assume that you mean LOA. Just download the pdf and sign it with stylus or get a printout,sign it and scan the copy.Now upload it!If I my assumption is wrong please provide little clear picture!Thank you!Allah maalik!

-

What does the authorization form in Wipro’s Synergy need to be filled out?

I don't exactly remember how the form was looking like in synergy portal. But I hope it is Authorizing Wipro to do background verification on all the details provided by candidate. It needs your name and signature with date.

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

Is it legal to fill out a deposit slip and deposit a DD in someone else's bank account without seeking permission/authorization? Does it constitute operating a bank account without authorization and what liabilities (civil/criminal) would it attract?

Banks accept deposits from a third party either in cash or through bank draft if the instrument is in order otherwise. However, if any suspicious deposit is made, the account holder should bring it to the notice of bank for such irregular transactions. If he withdraws the money or fails to file details in IT returns if any he will be liable for consequences for such deposits.

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

Create this form in 5 minutes!

How to create an eSignature for the contractor deposit authorization form

How to create an electronic signature for the Contractor Deposit Authorization Form online

How to create an electronic signature for your Contractor Deposit Authorization Form in Chrome

How to create an electronic signature for signing the Contractor Deposit Authorization Form in Gmail

How to create an electronic signature for the Contractor Deposit Authorization Form right from your smartphone

How to create an electronic signature for the Contractor Deposit Authorization Form on iOS devices

How to create an electronic signature for the Contractor Deposit Authorization Form on Android OS

People also ask

-

What is a Contractor Direct Deposit Form?

A Contractor Direct Deposit Form is a document that allows businesses to electronically deposit payments directly into a contractor's bank account. This form streamlines the payment process, ensuring timely and secure transactions. By using airSlate SignNow, you can easily create and sign a Contractor Direct Deposit Form, enhancing your payment efficiency.

-

How can I create a Contractor Direct Deposit Form using airSlate SignNow?

Creating a Contractor Direct Deposit Form with airSlate SignNow is simple. You can customize a template or start from scratch, adding the necessary fields for contractor information and banking details. Once completed, you can send the form for electronic signatures, making the process quick and efficient.

-

What are the benefits of using airSlate SignNow for Contractor Direct Deposit Forms?

Using airSlate SignNow for your Contractor Direct Deposit Forms offers numerous benefits, including enhanced security, faster processing times, and reduced paper waste. The platform allows for easy tracking of document statuses and provides a seamless experience for both businesses and contractors. This means getting your payments processed without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for Contractor Direct Deposit Forms?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs. The cost for using the platform to manage Contractor Direct Deposit Forms is competitive and depends on the features you require. It's worth exploring the pricing options to find a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software for Contractor Direct Deposit Forms?

Absolutely! airSlate SignNow provides integrations with various business applications, allowing you to streamline your workflows. This means you can connect your Contractor Direct Deposit Forms with accounting software, CRM systems, and more, ensuring a cohesive operational process.

-

How secure is the information in my Contractor Direct Deposit Form?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards. Your Contractor Direct Deposit Form information is protected throughout the signing process, ensuring that sensitive data remains confidential and secure from unauthorized access.

-

Can I track the status of my Contractor Direct Deposit Form submissions?

Yes, airSlate SignNow allows you to easily track the status of your Contractor Direct Deposit Form submissions. You can see when forms are sent, viewed, signed, and completed, giving you full visibility over the process and helping you manage your payments effectively.

Get more for Contractor Direct Deposit Form

- Pcci weekly summary of experience hours option 2 pcci weekly summary of experience hours option 2 bbs ca form

- Business license form

- California enrollment agreement form

- Ca abc price posting form

- Denver electronic monitoring form

- Apply for irs check cashing license form

- Ct deepnwco form

- Dcra neighborhood notification form

Find out other Contractor Direct Deposit Form

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney