About Schedule R Form 1040, Credit for the Elderly or

Understanding Schedule R Form 1040, Credit for the Elderly or Disabled

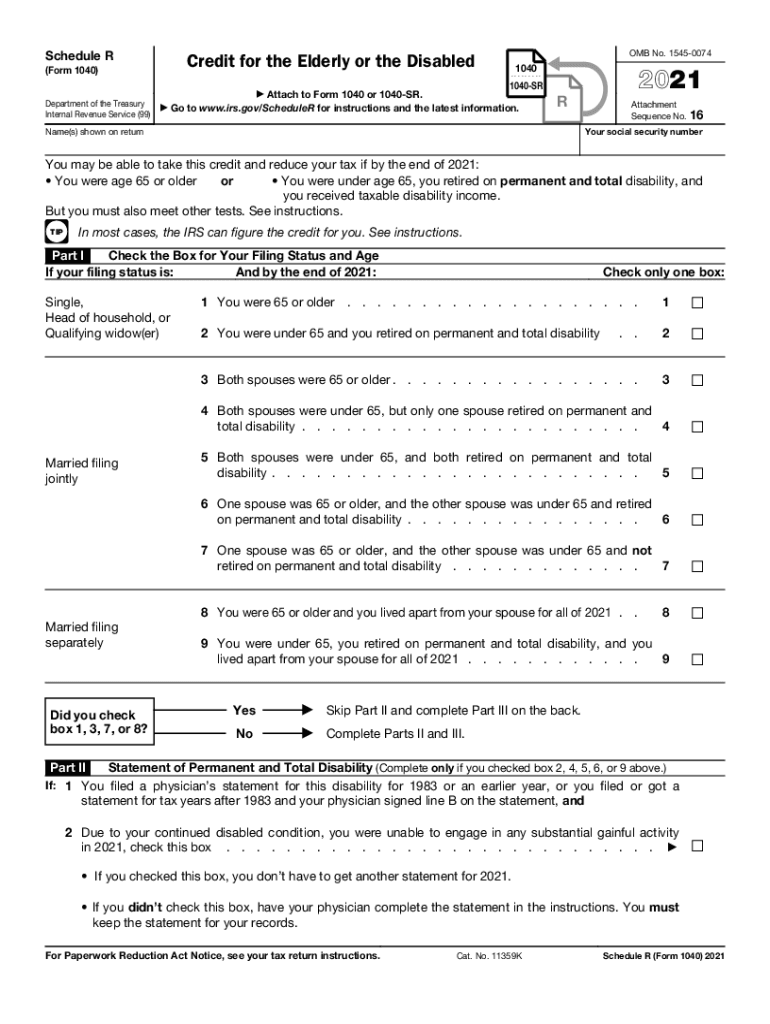

The Schedule R Form 1040 is specifically designed for taxpayers seeking to claim a credit for the elderly or disabled. This form allows eligible individuals to reduce their tax liability, providing financial relief for those who qualify. The credit is available to individuals aged sixty-five or older, or those who are permanently and totally disabled. Understanding the eligibility criteria and the purpose of this form is essential for maximizing potential tax benefits.

Steps to Complete Schedule R Form 1040

Completing the Schedule R Form 1040 involves several key steps to ensure accurate submission:

- Gather necessary documentation, including proof of age or disability.

- Review the eligibility criteria to confirm that you qualify for the credit.

- Fill out the form accurately, providing all required information, including income details and filing status.

- Calculate the credit amount based on the provided instructions and your financial situation.

- Attach the completed Schedule R to your Form 1040 when filing your tax return.

Eligibility Criteria for Schedule R Form 1040

To qualify for the credit on Schedule R, taxpayers must meet specific eligibility criteria:

- Must be aged sixty-five or older by the end of the tax year.

- Alternatively, must be permanently and totally disabled, regardless of age.

- Must have a qualifying income level, which may vary based on filing status and other factors.

- Must be a U.S. citizen or resident alien for the entire tax year.

IRS Guidelines for Schedule R Form 1040

The IRS provides detailed guidelines for completing and submitting Schedule R. It is crucial to follow these instructions closely to avoid errors that could delay processing or result in penalties. The guidelines outline the necessary documentation, eligibility requirements, and specific calculations needed to determine the credit amount. Taxpayers should refer to the IRS website or the official instructions accompanying the form for the most accurate and up-to-date information.

Filing Deadlines for Schedule R Form 1040

Timely filing of the Schedule R Form 1040 is essential to ensure that taxpayers receive their credits without delay. The standard deadline for filing individual tax returns is typically April fifteenth of each year. However, taxpayers may request an extension if needed. It is important to note that any extensions apply only to the filing date and not to the payment of taxes owed.

Digital vs. Paper Version of Schedule R Form 1040

Taxpayers have the option to complete the Schedule R Form 1040 either digitally or on paper. Using digital tools can streamline the process, allowing for easier calculations and error-checking. Additionally, electronic filing often results in faster processing times and quicker refunds. Conversely, some individuals may prefer the traditional paper method for its simplicity and familiarity. Regardless of the method chosen, ensuring accuracy is paramount for successful submission.

Quick guide on how to complete about schedule r form 1040 credit for the elderly or

Complete About Schedule R Form 1040, Credit For The Elderly Or seamlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage About Schedule R Form 1040, Credit For The Elderly Or on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to alter and electronically sign About Schedule R Form 1040, Credit For The Elderly Or without hassle

- Locate About Schedule R Form 1040, Credit For The Elderly Or and click on Get Form to initiate.

- Employ the tools we offer to complete your document.

- Highlight crucial sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to preserve your edits.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and electronically sign About Schedule R Form 1040, Credit For The Elderly Or and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about schedule r form 1040 credit for the elderly or

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

How to create an e-signature for a PDF document on Android

People also ask

-

What is airSlate SignNow, and how does it support 2021 r?

airSlate SignNow is a leading eSignature platform that empowers businesses to streamline their document workflows and enhance productivity. With its user-friendly interface and comprehensive features, it allows organizations to eSign documents securely, making it an ideal solution for anyone looking to leverage the efficiencies of 2021 r.

-

How much does airSlate SignNow cost for 2021 r services?

airSlate SignNow offers flexible pricing plans designed to suit various business needs, including options that specifically cater to the requirements of 2021 r. Depending on the features and volume of documents processed, businesses can find a plan that is not only cost-effective but also delivers exceptional value in digital document management.

-

What features does airSlate SignNow provide that are relevant for 2021 r?

airSlate SignNow includes a range of advanced features perfect for 2021 r, such as customizable templates, real-time tracking, and secure cloud storage. These functionalities ensure that businesses can effectively manage their eSigning processes while maintaining compliance and security for their documents.

-

Can airSlate SignNow be integrated with other tools for 2021 r?

Yes, airSlate SignNow easily integrates with numerous third-party applications to enhance the efficiency of your document signing processes related to 2021 r. Seamless integration with popular tools like Google Drive, Salesforce, and Microsoft Office enables businesses to create a cohesive workflow that improves productivity.

-

What are the benefits of using airSlate SignNow for 2021 r?

By utilizing airSlate SignNow for 2021 r, businesses can signNowly reduce turnaround times for document approvals and enhance their overall operational efficiency. The platform's ease of use, along with robust security measures, ensures that users can focus on their core activities while maintaining the integrity of their documents.

-

How does airSlate SignNow ensure the security of documents for 2021 r?

Security is a top priority for airSlate SignNow, especially for users dealing with sensitive documents related to 2021 r. The platform employs advanced encryption protocols and complies with industry standards, ensuring that all eSigned documents are secure and protected from unauthorized access.

-

What types of documents can I eSign using airSlate SignNow for 2021 r?

airSlate SignNow allows users to eSign a variety of document types for 2021 r, including contracts, invoices, and consent forms. This versatility makes it suitable for businesses across different industries looking to digitize their document management processes.

Get more for About Schedule R Form 1040, Credit For The Elderly Or

- Expedited eviction instructions idaho form

- Idaho affidavit service form

- Correction statement and agreement idaho form

- Closing statement idaho form

- Flood zone statement and authorization idaho form

- Name affidavit of buyer idaho form

- Name affidavit of seller idaho form

- Non foreign affidavit under irc 1445 idaho form

Find out other About Schedule R Form 1040, Credit For The Elderly Or

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure