Sales Refund Used Form 2021-2026

What is the Sales Refund Used Form

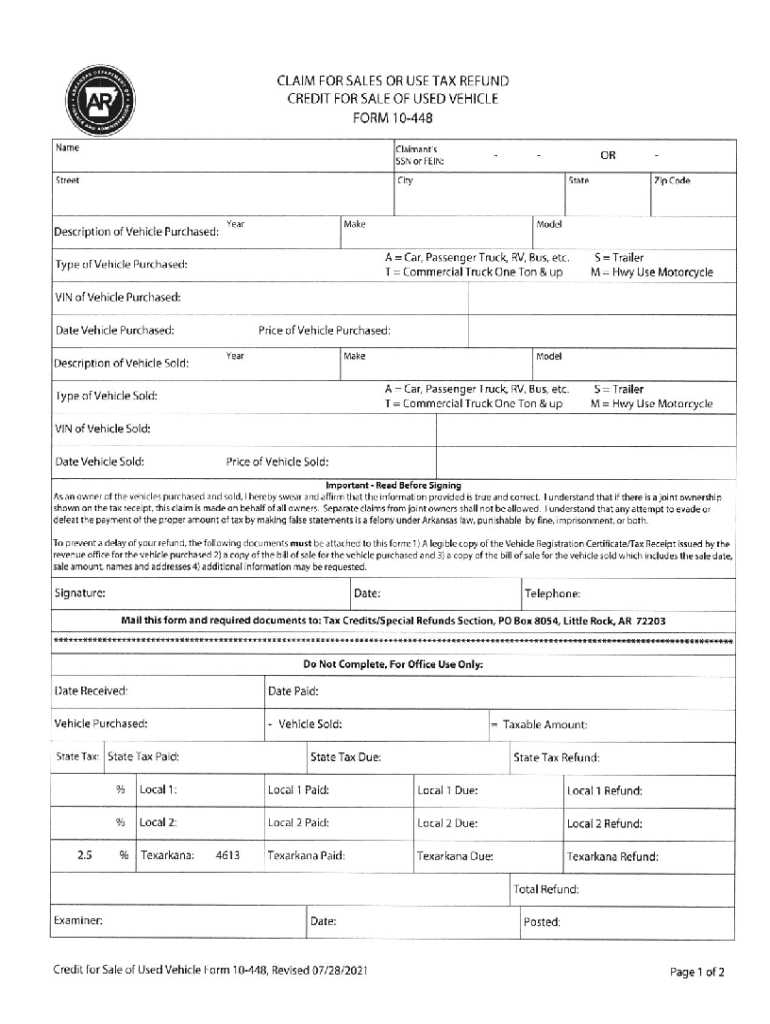

The Sales Refund Used Form is a document utilized in Arkansas for claiming a refund on sales tax that has been paid on items that were subsequently returned or used in a manner that qualifies for a refund. This form is essential for individuals and businesses who wish to recover sales tax on eligible purchases, including vehicles and other taxable goods. By submitting this form, taxpayers can ensure they are compliant with state tax regulations while reclaiming funds that are rightfully theirs.

How to use the Sales Refund Used Form

Using the Sales Refund Used Form involves a straightforward process. First, gather all necessary documentation, including receipts and proof of payment for the items you are claiming a refund for. Next, accurately fill out the form, providing details such as the purchase date, item description, and the amount of sales tax paid. Once completed, the form must be submitted to the appropriate state tax authority for processing. It is advisable to keep copies of all submitted documents for your records.

Steps to complete the Sales Refund Used Form

Completing the Sales Refund Used Form requires attention to detail. Follow these steps for a smooth process:

- Collect all relevant receipts and documentation related to the purchase.

- Download the Sales Refund Used Form from the official Arkansas Department of Finance and Administration website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the items for which you are claiming a refund, including purchase dates and amounts.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form along with any required documentation to the designated state office.

Legal use of the Sales Refund Used Form

The Sales Refund Used Form is legally binding when completed correctly and submitted according to state regulations. It is crucial to ensure that all information is accurate and that the form is submitted within the designated time frames to avoid penalties. The form must comply with the Arkansas tax laws, which outline the eligibility criteria for refunds. Misrepresentation or errors on the form can lead to delays or denial of the refund request.

Required Documents

When submitting the Sales Refund Used Form, certain documents are required to support your claim. These typically include:

- Original receipts or proof of purchase for the items being returned or used.

- Any correspondence related to the purchase or refund request.

- Documentation proving the reason for the refund, such as a return authorization.

Having these documents ready will facilitate a smoother review process by the state tax authority.

Form Submission Methods (Online / Mail / In-Person)

The Sales Refund Used Form can be submitted through various methods, depending on the preferences of the taxpayer. Options include:

- Online: Some taxpayers may have the option to submit the form electronically through the Arkansas Department of Finance and Administration's online portal.

- Mail: Completed forms can be mailed to the designated address provided by the state tax authority. Ensure that you use the correct postage and allow sufficient time for delivery.

- In-Person: Taxpayers may also choose to submit the form in person at their local tax office, where they can receive immediate assistance if needed.

Quick guide on how to complete sales refund used form

Complete Sales Refund Used Form effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the needed form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Sales Refund Used Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Sales Refund Used Form with minimal effort

- Find Sales Refund Used Form and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools designated by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device you prefer. Adjust and eSign Sales Refund Used Form and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales refund used form

Create this form in 5 minutes!

How to create an eSignature for the sales refund used form

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an e-signature for a PDF document on Android OS

People also ask

-

What is the claim dfa arkansas form?

The claim dfa arkansas form is a document required for individuals seeking specific benefits or services in Arkansas. This form helps streamline the application process and ensures all necessary information is submitted correctly. By using airSlate SignNow, you can complete and eSign your claim dfa arkansas form easily and securely.

-

How can I fill out the claim dfa arkansas form using airSlate SignNow?

Filling out the claim dfa arkansas form with airSlate SignNow is straightforward. You can upload the form to our platform, fill in the necessary fields, and then eSign it electronically. This eliminates the need for printing, saving you time and effort.

-

Is airSlate SignNow affordable for processing claim dfa arkansas forms?

Yes, airSlate SignNow offers cost-effective solutions for processing the claim dfa arkansas form. Our pricing plans are designed to fit businesses of all sizes, allowing you to manage documents without breaking the bank. We provide a free trial to help you evaluate our services risk-free.

-

What features does airSlate SignNow offer for managing the claim dfa arkansas form?

airSlate SignNow provides various features to enhance the management of your claim dfa arkansas form. These include templates for quick access, eSigning capabilities, and cloud storage for easy document retrieval. Additionally, our platform allows for real-time tracking of document status.

-

Can I integrate airSlate SignNow with other applications for my claim dfa arkansas form?

Absolutely! airSlate SignNow offers integrations with various popular applications, making it easy to manage your claim dfa arkansas form alongside your other business tools. This flexibility enhances your workflow and improves productivity without extra hassle.

-

What are the benefits of using airSlate SignNow for the claim dfa arkansas form?

Using airSlate SignNow for the claim dfa arkansas form provides numerous benefits, such as improved efficiency, reduced errors, and enhanced security of your information. Our solution allows for quick eSignatures and streamlined processes, making it easier for you to get your claims processed faster.

-

Is my information secure when I use airSlate SignNow for the claim dfa arkansas form?

Yes, your information is secure when using airSlate SignNow. We utilize advanced encryption technology to protect your data while filling out and submitting your claim dfa arkansas form. This ensures that your personal information remains confidential and secure at all times.

Get more for Sales Refund Used Form

- Findings and orders after in home status review hearing child placed with previously noncustodial parent california form

- Six month prepermanency attachment child reunified california form

- Twelve month permanency attachment child reunified california form

- Twelve month permanency attachment reunification services continued california form

- Eighteen month permanency attachment child reunified california form

- Consent medical dental form

- Appearance hearing application form

- Ca paternity 497299247 form

Find out other Sales Refund Used Form

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word