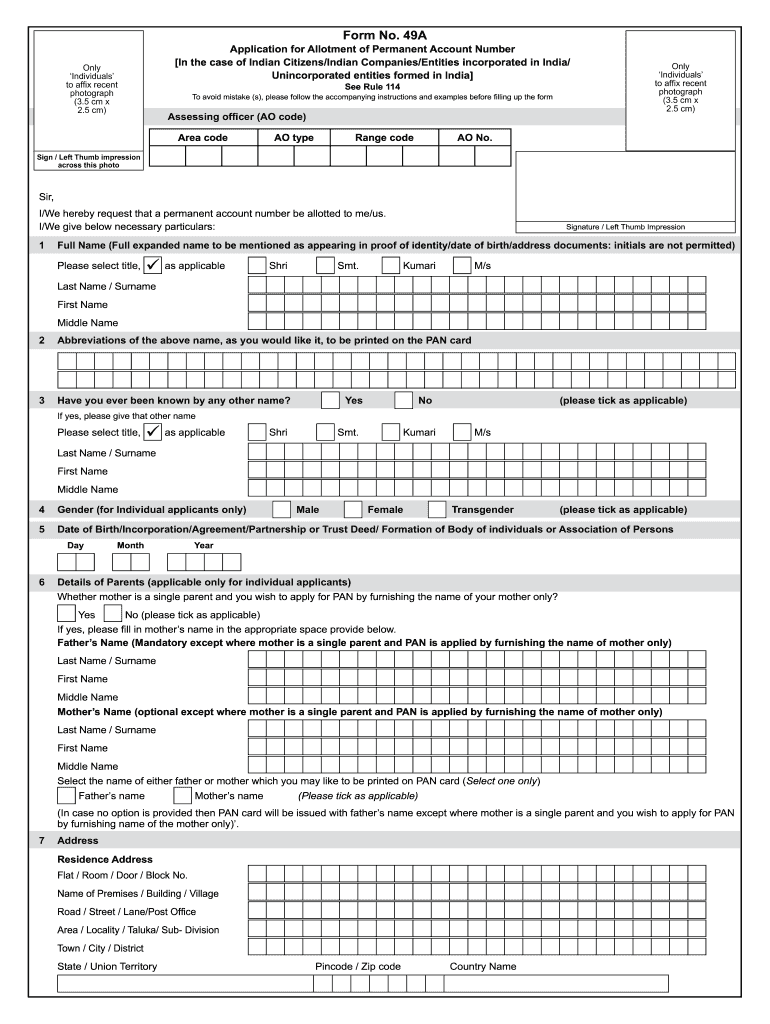

Form No 49A Application for Allotment of Permanent Account

What is the Form No 49A Application For Allotment Of Permanent Account

The Form No 49A is an essential document used for the allotment of a Permanent Account Number (PAN) in the United States. This form is primarily utilized by individuals and entities who need to obtain a PAN for tax purposes. The PAN serves as a unique identifier for taxpayers, enabling them to efficiently manage their tax obligations and comply with federal regulations. Completing this form accurately is crucial, as it ensures that the taxpayer's information is correctly recorded and processed by the IRS.

Steps to complete the Form No 49A Application For Allotment Of Permanent Account

Completing the Form No 49A involves several important steps to ensure accuracy and compliance. Follow these steps to fill out the application:

- Gather necessary documents, including proof of identity, address, and date of birth.

- Download the Form No 49A from the official IRS website or authorized sources.

- Fill in personal details such as name, address, and contact information accurately.

- Provide information regarding the type of applicant, such as individual, company, or partnership.

- Sign and date the form to validate the application.

- Submit the completed form along with required documents to the appropriate IRS office.

Required Documents

When applying for a PAN using Form No 49A, certain documents are mandatory to support your application. These typically include:

- Proof of identity, such as a driver's license or passport.

- Proof of address, which can be a utility bill or lease agreement.

- Proof of date of birth, like a birth certificate or government-issued ID.

It is important to ensure that all documents are current and clearly legible to avoid delays in processing your application.

Form Submission Methods (Online / Mail / In-Person)

The Form No 49A can be submitted through various methods, depending on your preference and convenience:

- Online Submission: Many applicants choose to submit their forms electronically through the IRS website, which offers a streamlined process.

- Mail Submission: You can print the completed form and send it via postal service to the designated IRS office.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at an IRS office is also an option.

Eligibility Criteria

To be eligible for a PAN, applicants must meet certain criteria. These include:

- Individuals or entities conducting business or financial transactions that require tax identification.

- U.S. citizens, resident aliens, and non-resident aliens who meet specific tax obligations.

- Businesses, including corporations, partnerships, and sole proprietorships, needing a PAN for tax reporting.

It is essential to review these criteria before applying to ensure compliance with IRS regulations.

Legal use of the Form No 49A Application For Allotment Of Permanent Account

The Form No 49A is legally recognized as a valid document for obtaining a PAN, which is crucial for fulfilling tax responsibilities. The information provided in this form must be accurate and truthful, as any discrepancies can lead to legal ramifications. The PAN is used in various financial transactions, including filing tax returns, opening bank accounts, and conducting business activities. Therefore, understanding the legal implications of this form is vital for all applicants.

Quick guide on how to complete form no 49a application for allotment of permanent account

Effortlessly Complete Form No 49A Application For Allotment Of Permanent Account on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without interruptions. Handle Form No 49A Application For Allotment Of Permanent Account on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Form No 49A Application For Allotment Of Permanent Account with Ease

- Obtain Form No 49A Application For Allotment Of Permanent Account and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from your preferred device. Modify and eSign Form No 49A Application For Allotment Of Permanent Account to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 49a application for allotment of permanent account

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to create an e-signature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an e-signature for a PDF document on Android devices

People also ask

-

What is a PAN card new and why do I need one?

A PAN card new is a permanent account number card issued by the Indian government for tax purposes. It is essential for individuals and businesses to ensure compliance with tax regulations and conduct financial transactions. Having a PAN card new also helps in availing various services, such as applying for loans and filing taxes.

-

How can I apply for a PAN card new?

To apply for a PAN card new, you can visit the official National Securities Depository Limited (NSDL) or UTI Infrastructure Technology and Services Limited (UTIITSL) websites. The process involves filling out an online application form, paying the required fee, and submitting necessary documents. Once completed, you will receive your PAN card new by mail.

-

What are the costs associated with obtaining a PAN card new?

The cost for obtaining a PAN card new typically varies depending on whether you are applying from within India or abroad. Generally, the fee for Indian residents is around INR 110, while for applicants from outside India, it may cost around INR 1,020. Ensure to check the official website for the latest pricing details.

-

What features does airSlate SignNow offer for managing PAN card new applications?

airSlate SignNow allows users to send and eSign documents related to PAN card new applications securely. Its robust features include customizable templates, document tracking, and efficient collaboration tools, streamlining the application process. This makes it easier and faster to handle all paperwork required for obtaining a PAN card new.

-

How can airSlate SignNow benefit my business in handling PAN card new applications?

Using airSlate SignNow helps businesses manage PAN card new applications more efficiently. The platform's cost-effective solutions allow for quick document signing, reducing turnaround time. Enhanced security features also ensure that sensitive information is protected throughout the application process.

-

Does airSlate SignNow integrate with other software for PAN card new processes?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to incorporate your existing systems into the PAN card new application workflow. Whether you are using CRM platforms or document management systems, these integrations help in seamless operations. This versatility empowers businesses to optimize their application processes.

-

What are the benefits of using eSignatures for PAN card new applications?

eSignatures provide a fast and secure way to sign PAN card new applications without the need for physical documents. They are legally recognized and help reduce paper usage, making the entire process environmentally friendly. Plus, eSigning via airSlate SignNow ensures that you can sign documents anytime, anywhere, enhancing convenience.

Get more for Form No 49A Application For Allotment Of Permanent Account

- Illinois limited company form

- Affidavit of heirship illinois form

- Notice trespass property form

- Illinois notice form 497306071

- Illinois quitclaim deed form

- Illinois husband wife 497306073 form

- Estoppel affidavit and agreement for deed in lieu of foreclosure illinois form

- Illinois husband wife 497306075 form

Find out other Form No 49A Application For Allotment Of Permanent Account

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free