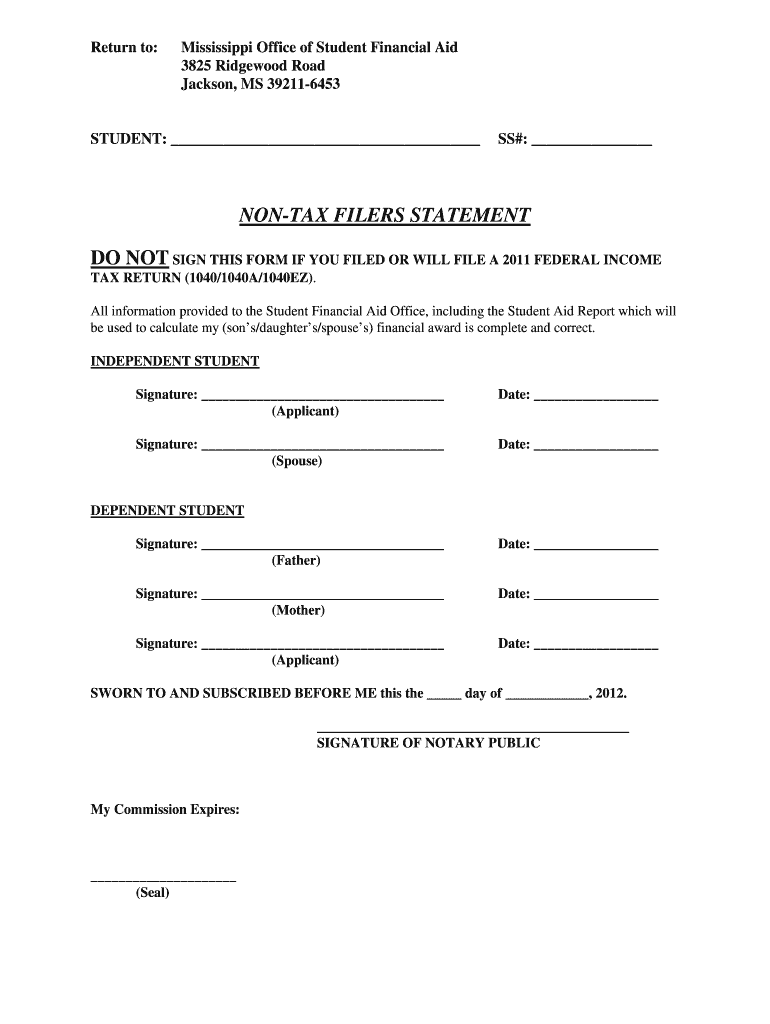

Student Statement Form

What is the Mississippi filers statement?

The Mississippi filers statement is a specific form used by individuals to report their income and tax information to the state of Mississippi. This form is essential for residents who need to comply with state tax regulations. It typically includes personal identification details, income sources, and deductions applicable under Mississippi tax law. Understanding this form is crucial for ensuring accurate tax reporting and avoiding penalties.

Steps to complete the Mississippi filers statement

Completing the Mississippi filers statement involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Then, report your total income, including wages, interest, and dividends. After that, apply any deductions or credits you may qualify for under Mississippi law. Finally, review the form for accuracy before submitting it to the appropriate state agency.

Required documents for the Mississippi filers statement

When preparing to complete the Mississippi filers statement, it is important to have the following documents on hand:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions, such as mortgage interest or educational expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are accurately reported.

Legal use of the Mississippi filers statement

The Mississippi filers statement is legally binding and must be completed accurately to comply with state tax laws. Failure to file this form or providing false information can result in penalties, including fines or legal action. It is important to understand the legal implications of this document and ensure that all information provided is truthful and complete. Consulting with a tax professional can help clarify any uncertainties regarding legal requirements.

Form submission methods for the Mississippi filers statement

There are several methods available for submitting the Mississippi filers statement. You can file the form online through the Mississippi Department of Revenue's website, which offers a convenient and efficient way to submit your information. Alternatively, you can mail a paper copy of the completed form to the designated state office. In-person submissions may also be possible at local tax offices, depending on state guidelines. Each method has its own processing times, so it is important to choose the one that best fits your needs.

Filing deadlines for the Mississippi filers statement

Filing deadlines for the Mississippi filers statement typically align with federal tax deadlines. Generally, individual taxpayers must submit their forms by April 15 of each year. However, it is advisable to check for any updates or changes to these deadlines, as they can vary based on specific circumstances or state regulations. Being aware of these deadlines is crucial to avoid late fees and ensure timely processing of your tax return.

Quick guide on how to complete student statement form

Effortlessly prepare Student Statement Form on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents quickly without issues. Manage Student Statement Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Student Statement Form with ease

- Locate Student Statement Form and click Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize important sections of your documents or redact sensitive data using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Student Statement Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Has anyone surprised you after their death, e.g. receiving an organ from a donor, a sizeable inheritance, or a visit from a friendly ghost?

On January 19, 1979, a big part of me died when my 26-year old brother Danny died due to complications arising after heart surgery. Back in 1979, imaging techniques were not like they are now. The doctors did not understand the morphology of Danny’s heart, and his ticker quit ticking because the pacemaker electrode was placed outside of his heart instead of its intended destination within a heart chamber.Looking back on this story, I instinctively knew that Danny’s death was an inevitability, although to me he was invincible. On the cold January night about a week or two before he died, I remember seeing him put on his jacket and head out the door on his way to the hospital. I was a 15-year old kid, laying on the carpet in front of the TV, watching some show at the time. My 6 foot 2 inch brother seemed extra large that night as he towered over me in his blue jacket as he turned towards me and said he would see me later.The details of his medical condition could fill a text book. He was born with a condition known as dextrocardia situs inversus totalis. This means that his heart was on the right side of his body and other organs were reversed, too.When he was born, he was supposed to die quickly. I guess God had a different plan for him and allowed him to stay with us for over 26 years. Although I spent many days of my life in Chicago’s Children’s Memorial Hospital during his illnesses, I never got tired of laying down with Danny when he got sick. I would place my head on his chest and listen to his heart beat a-rhythmically at over 220 beats per minute. At times it sounded like he had a percussion band inside his chest.With each episode of tachycardia he experienced, additional damage was being done to his heart muscles. The previous January (1978), Danny spent nearly a month in the hospital trying to recover from one of those episodes. The ventilator they used on him caused him to remain hoarse until he died a year later.Now getting back to his heart operation, I was sure Danny was going to survive. The doctors had installed a temporary pacemaker through his groin, and that electrode hit its target. With the aid of this pacemaker, Danny seemed stronger than ever, even though he had to be bedridden during this time.After a team of doctors were assembled and the permanent internal pacemaker was produced, the big day of the surgery arrived on Jan 19, 1979. After his surgery was over, I was relieved. I was able to visit him in his hospital room after the surgery was over and he had reawakened. We talked for a couple of minutes before I told him that I was going to be back to the hospital in a little while to see him. He said, “OK, I’ll see you later.” Those were the last words he ever spoke to me.I had to walk several miles home, through several feet of snow to pick-up radio control airplane equipment that I had ordered. Sometime during that cold and lonely walk, where no cars were driving down the roads due to the snow pack, Danny died. I didn’t know it at the time but I would soon find out when I returned to the hospital.I realized that Danny had died when I finally understood why my family, the nurses and the doctors were all crying in unison. When the truth hit my brain, it went into that high-speed recording mode and my primitive brain took over. I hit the floor, convulsing while I hyperventilated uncontrollably. While the nurses got a bag to place over my face, someone helped pick me up and put me in a chair as the nurses told me to hold my head low and breathe into the bag.After I emerged from the state of hyper-ventilation I was in, I managed to see him in his hospital bed. What I remember most about the moment that I saw him was that he died with a smile on his face. He died in peace and his pain was finally gone.After Danny died, I switched beds and started sleeping in his bed. Three nights later, Danny visited me in our bedroom in the middle of the night. His audible voice came into my bedroom and awoke me. As I sat up in the dark room, we had a conversation as my eyes strained to see his body. Although I’ll save most of the story for later, he told me that he had permission to talk to me because of the grief that I was suffering. He told me to believe that he was in a better place, a beautiful place, and to go on and live a happy life. He said that we would talk again if I never told anyone about this encounter.This event and the other situations I experienced at that time, had a very profound impact on me. My vision of life was completely re-written. I went from being a kid that played multiple sports to bring satisfaction to my Mom and Brother, to a kid that realized the impossibly thin edge that exists between life and death. I saw life passing in seconds, like a sun ray glimmering on a wave in a lake. To this day, I grieve over the loss of my brother and I look forward to the day we get to reunite.P.S.I didn’t tell this story to anyone for many months. Eventually, my immaturity as a 15 year-old coupled with the unbelievable nature of the after-death contact from Danny was too much for me to bear. I ended up sharing this story with my good friend Steve.Since that confession, Danny has never contacted me again. I broke the rules and have paid the price, although I was blessed to have my personal religion solidified for my lifetime.I know that many readers of this story will not believe it, but that is OK with me. I probably wouldn’t believe it either if someone told it to me. However, this encounter was the most profound event of my life and I know that it happened. Those minutes I shared with my deceased brother are with me every day that I live and have given me peace and solitude as I pass through space and time in this wonderful life.

-

What is one thing that shocked you when you attended an Ivy League or a highly prestigious school like Stanford or MIT?

One thing that shocked me when I attended an Ivy League school is the tolerance and encouragement for faculty plagiarism.Before I attended Ivy League graduate school, I believed that higher values of morality existed in the Ivory Towers. I believed that the most brilliant minds knew and acted to preserve what is good, right and true. I know better, now.I attended Yale University Graduate School from 1990–1993. I was shocked that my advisor, Hazel Carby, was allowed to send an unauthorized copy of my original scholarship to her friend at UCLA. The friend actually performed my work at the same conference I did in front of witnesses.The UCLA professor planned to do my work for her Yale Faculty Job Talk, too. A job talk is required for an application to teach at the university. She had to change her talk at the last minute because I had filed a report with an Assistant Dean of the Yale Graduate School, whose name I’ve forgotten, my other advisor, Robert Stepto, and my program Chairman, Gerald Jaynes.After that, I wrote an elaborate Fellowship Application to Harvard University. I didn’t know that Hazel Carby and Henry Louis Gates were friends.He stole my fellowship application ideas and gave them to a Motown family connection, Brent Edwards, currently plagiarizing at Columbia University.By the time Brent got in to Harvard to start working on my Fellowship book outline, I got in Complit at UMass, and out of the Ivy League grapevine. I was determined to keep trying, although I had been blackballed.Since I came in to UMass knowing exactly what I was doing, I had already ordered the one single solitary copy of microfiche in the United States with newspapers published by in France by African Diaspora journalists from the period between WW I and WW II.I was struggling to translate the newspapers without Harvard translators when a request from the now closed Central Repository Library in Illinois that had lent me the only copy of the microfiche sent me a demand to return it because another person wanted it.I was the first person in history to ever ask for that research material. Now, there’s a rush on it?Respecting the gift of a library to society, after talking to library representatives, I sent back the microfiche along with 50.00 USD and my written request for duplication of the material.Months later, they reported the microfiche was missing! They hadn’t had a chance to duplicate it before it went missing!It remained missing for six years or so, until the summer before Brent Edwards released his book using my outline and research materials as his guide.Before I attended an Ivy League School, I thought plagiarism was something for poor students doomed to lives as failures. Before I attended an Ivy League School, I had job prospects and a fine reputation, now, not so much.

-

How can we fight against the NRA regarding gun control?

Are you sure that the NRA is the problem?Oh, I know that the media and the talking heads are all making them out to be some 500 lb gorilla and the reason psychos shoot up school yards, but have you ever bothered to look into the matter beyond the headlines?I’ll give you an example. In 2017, the push was for a “Universal Background Check”. The idea was to be sure that people buying guns were not criminals. Believe it or not, the NRA wholly supports this and in fact was involved with creating the current NICS (National Instant Check System) that is used.But the bill that was proposed was not what you heard in the media. First, it would not plug any “Gunshow Loophole” because there is no such thing. The only sales at a gun show that the bill covered was private sales. Of course, private sales can occur anywhere, not just gun shows.But the bill didn’t make the NICS easier for private sales. They just required all private sales to be conducted through a licensed dealer. Had this actually passed, a gun show would be an ideal location for such sales as there would be access to many dealer. In effect, you would greatly increase the number of private sales at a gun show by this law.So, what is involved with a sale through a dealer? Well, the dealer would have to do the following:1) Record the transfer in their bound book. This is a book where all the transactions of a firearm is recorded via that dealer. The book is auditable by the BATF and many dealers have faced fines for poorly kept records, so many dealers go to great pains to keep their book neat and accurate.2) Fill out the federal form 4473. This is required by all dealer sales of both new and used guns. It asks for the buyer’s name, address, the make and model of the gun, serial number, and then asks a bunch of questions. The dealer can get fined if the person fills out the form wrong. For example, answering a question with “Y” or “N” instead of “Yes” or “No” is a BATF violation. So the dealer has to carefully examine the form for errors and have the person fill out another if errors are found.3) The dealer then calls into the NICS. NICS can come back with a “Proceed”, “Denied” or “Delay”. A delay can take up to 3 days. Typically this is a name that appears similar to a Prohibited Person and requires some research. If this happens, the transfer is on hold. The dealer has no idea when the result of the research is likely to finish. If you are at a gun show, the show could be over before the approval is made.4) All this paperwork, verification, etc takes time. Time is money. So dealers charge for this service. It is typical for a dealer to charge $25-$40 per gun, but sometimes multiple guns get a discount because the dealer can process up to 4 on a single form, but when more than one gun is transferred, the dealer has to fill out Form 3310 which is supposed to help with gun trafficking.All of this is well and good if you are buying a gun from someone you don’t know and many people will require sales be conducted at a dealer for the piece of mind such protections provide. But friends and family typically do not bother with the hassle and expense.One thing you need to realize is that to get a gun dealer license is not an easy process. Since the federal government cracked down on so called “kitchen table” dealers back in the 1980’s, you now must show a commercially zoned storefront with posted business hours to qualify. Many communities don’t want gun shops, and use zoning laws to make them difficult or unattractive. For example the city of Boston does not have any dealers. In fact, the nearest dealer is 3 towns away. Many rural areas don’t have the traffic to keep a dealer in business and you’ll find they are typically only open in the evening or on a Saturday as they work another full time job. Keep this in mind as we get into the next issue.But the bill didn’t stop at sales. It stated that ALL transfers had to be done in this manner. No exceptions. So, two friends out on a hunt would need to go through the whole process listed above just to swap guns for the afternoon. Oh, and they would have to do it all again to give the gun back. It is very common on a range to try out other people’s guns - such a thing would also require the full transfer and back process. Demo guns at a national event by manufacturers? Same thing.Basically any time a gun were to swap hands, the law would apply. There are private shooting clubs where guns are treated like library books and members take whatever they want. Families regularly swap guns. Heck, some shooting courses provide guns for students to use. All of these events would have been impacted by these new transfer requirements.The NRA balked at this. Essentially the rule would curtail many of the traditions and practices that are very common and virtually never result in any kind of criminal activity. In essence it would criminalize things that simply are not crimes.Not only would it create criminals where no criminal intent existed, but the cost to manage the volume of temporary transfers, the staffing needed to take the calls and do the checks would have cost millions each year. All money that would not go toward actually dealing with criminals.When the issue was brought up, many members of Congress agreed the requirements were too restrictive and the whole bill failed to pass. The supporters of the bill did not even attempt to listen to the complaints and work out a manageable fix.Did you hear any of that in the media?But what about catching criminals?Well, the bill didn’t change anything in regards to enforcing the rules to make sure the people who should not own guns were properly entered into NICS. In fact, other than maybe getting fired, there is NO PENALTY for failing to report a person. We have laws that will jail a teacher or coach that fail to report bullies. We have laws that put priests in prison who fail to report potential inappropriate behaviors in other clergy. But we do not have any laws that punish law enforcement agents that fail to do their job and make sure that dangerous people are reported to the background system. And this bill made no effort to change that.NICS is not open to anyone but federally licensed gun dealers. The left are so worried that the system might be used to check people for things other than guns that they refuse to create a means to allow people to verify someone they are selling a gun to. It would be easy to create an app that takes a photo of the buyer and seller’s ID (or just their faces and type in some data) and then return a simple “Proceed” or “Deny” with no other details. You’d have plenty of information to audit for illegal use. And if someone didn’t have an ID, they could then use a dealer. Heck, you can’t file taxes on-line without submitting some kind of ID, so this isn’t anything unique.And yet, the bill did nothing to address the issue of accessing the NICS for easier private sales.Here is the thing. We have 20,000 gun laws in this country. On the federal side, a prohibited person touching a gun could see them in prison for a minimum of 5 years. And yet, we still see cities with high violent crime rates that have virtually no federal cases. Why isn’t law enforcement using those stiff federal laws to get the violent people off the streets? Such a program called “Project Exile” worked wonders in Richmond, VA to reduce violent crime dramatically.OK, back to the “Universal Background Check” bill.I spent a lot of words above explaining what the bill would have required of people and why the situation would have been a nightmare. You never saw any of this in the news and the media pretty much ignored the issue.When the bill was defeated, it was never reported that a “terrible bill that would have cost millions and made criminals out of the innocent was defeated”, instead, all you ever heard was“The NRA used its influence to defeat the Universal Background Check bill that would have closed the gunshow loophole”Almost everything about that statement is false.So, be careful what you want to “Fight Against”. I suspect that most of what you think about the NRA is highly biased due to the way the organization is treated in the media. When you look at the actual facts, many times their concerns are quite valid. And, they have a lot of rank and file law enforcement on their side which helps them represent real world situations. I’ve found their positions in many cases very well presented. Most of the arguments you get on TV news are highly edited and taken out of context to promote an agenda, not facilitate a debate.Make sure you know what you are fighting for. You might be surprised.

-

How difficult is it for a US citizen to get a UK Tier 4 visa?

The Tier 4 visa is the student visa, if your studies will last longer than six months. In order to qualify for a student visa, you need to have secured acceptance from a recognized UK university, either for a degree program or a study abroad program. Once you have this, the university should provide you an ID number to submit with your visa application. This may be outdated as it's been four years since I last applied for my Tier 4 visa. You also have to show that you have the funds for your studies, either through a bank statement, a federal or private loan letter or a scholarship letter, or some combination thereof. You also have a set form you have to fill out, and you need to submit your current passport and any old passports. The visa will be issued as a sticker on your current passport. Finally, you need to go to a place near you (the immigration services site will help you find one) to submit biometric data. The hardest part is getting all of the paperwork and moving parts together. But it's generally very straightforward. If you have your funding and the admissions offer, and don't have a criminal record, getting the actual visa is not difficult. I've done it twice.

-

How can I apply for an internship at IIT Bombay?

Full-scale guide to internship ahead. It will take 3 minutes.During my sophomore year( 2nd Year) of studies I did a lot of research on Internships, how to secure it and how to get a sure-shot success.I have compiled all the questions and how to work on themWhy should I do an internship?Ans: No, you don’t need to do one, internship are not burden that you should do. You can go and learn to play guitar, feel free to explore yourself during vacations.Internships are not only in Education, there are a heck lot of internships for Music, NGOs, Tutors, Dance(Yeah you heard it right). Now for all those in colleges( I mean study focused minded people), internships are a must ( yeah you heard me right, it is must- A recent update in rule suggested that you must have 3 internships).P.S. I have still done only one internship and still in search for 2 more (I completed my recent internship from France, CNRS).2. What internship should I do, I am confused?Ans: First of all you need to find your field of interest, it can be anything, yeah anything you like, it doesn’t depend on your course/career but on your interest.I have interest in Machine Learning , Computer Vision and Embedded Systems and I am in Electronics Branch.So, once you know about your field of interest you are perfect to go ahead to search for an internship.How to find my field of interest? Refer here : “How do I find out what my actual area of interest is?”3. Where to search an Internship and how to proceed?Ans: GOOGLE , it’s all.Nothing can help you more than google. Let me be clear, never go for sites like Internshala,Letsintern,InternXXX (I am not devoting this site, these sites have all startups and local companies and jobs that won’t help your enrichment rather will prepare you for 9–5 jobs believe me, I have experience) before searching them on your own.4. What are per-requisites? What should I have? A good SOP? A good CV?Ans: I will focus on basic things to keep in Mind.a. A good balance between CGPA and Skills will help you a lot. Don’t worry,if you don’t have a good CGPA, you must be talented with so many things then( Guitar, Singing, Dance—- yeah buddy you are talented.)b. Your focus in career, I mean what you want to pursue further.Just make a list of 4–5 topics you want to pursue further.c. Compile a list of projects you have done until the time you are going to fill the form.Put all the details about the project, how it works, under whom you have done it, what is its benefit.Projects can be anything: Have you created an applications based on your interest, a cool DIY project, an electronic game, a computer program—it entirely depends on your choice.I created aa TIC TAC TOE game and I quote it in my CV.d. List of your training and online MOOCs, if you did anything.(I am a regular user of Coursera, udemy, udacity, and edx.I keep on learning new things).Just mention these MOOCs and training wherever you get space.If you have certificates, feel free to include their links.e. The workshops, seminars you have attended.Do you know- Your curricular labs may add a lot to your form, but how? Suppose you are interested in Digital Signal Processing, and you attended Digital Signal Processing lab and gained 10/10, Go on quote it in the form.f. A Good Statement of purpose, describing what is your interest.g. A resume for yourself (max 2 pages).5. What is a good Statement of Purpose and How to make it? How to make a good resume?Ans: Follow here: How to write a successful SOP , How to Write a Statement of PurposeRest you can post your questions in comment section for some-specific field in SOP, CV.6. When should I start to search for an Internship for Institute and Well-known Companies?Ans : When Should I Apply for Summer Internships?, Most of the interships application begin from late December till Feb beginning.For institute specific internships, there are two waya) Fill the application form of the Internship Advertisement.b) Mail the professor.The application form is different for different Institute, regarding the mailing procedure - I will like to quote an answer:( Source : Tuhin Kundu answer)While writing a mail to an IIT professor, some blueprints and strategies should be kept in mind:Show your proven academic record. Your chances increase manifold if your CGPA is >9.0 Not to lose hope if you haven’t got it. Neither did I.Showcase the major projects you have undertaken in your undergrad till date.Share links everywhere in your resume and cover letter. Links to your LinkedIn, ResearchGate, Codechef, SPOJ, Github etc are pretty useful.Upload your project reports to a cloud storage such as Google Drive and share the links in your resume.The mail you are going to write is the most critical part and is usually known as a cover letter. Professors are only going to open and see your resume only if your cover letter is strong.Talk about the technologies you’ve learned, the projects you’ve done or are doing, the collaborations you have undertaken with professors at your own college in your cover letter. This section is the one that convinces the professor of your credibility.Avoid attaching your CV in your mail.Upload your CV in Google Drive and share the links. Emails from unknown sources usually end up in Junk folder of university emails.Make sure your email stays at top.Email professors late at night such that your email will be somewhere at the top when the professor logs in into his email account in the morning.Talk about your inclination and motivation to work under a certain area/domain. Convince the professor about why you want to work in that certain field.Repeatedly spamming a professor will be of no good.Filter out the professors who match your research interest. Mailing every single professor of the entire department may result into marking your email address as a spammer by the institute email filter.An example of mail to professor can be:( Source : Rahul Goradia Answer)Subject : Regarding Internship in Embedded SystemRespected Prof.____________Sir/Madam,I am ——- from ——— pursuing ___________ and willing to do internship under ______________ posted on website for duration _____.Sir/Ma’am, You are working in ________ domain and you have carried out ______ projects. You also take interns in embedded Systems.I am wish to start internship under our guidance. My curriculum includes ____ related subjects to embedded system. I have completed __________ projects. I will be available during whole internship and will be very sincere throughout internship. (You can add reference of your faculty as well.)It will be a great pleasure to work under you.Sincerely————.Now let us focus on my IIT Bombay Internship.Actually I received internship offer from IIT Bombay, IIT Gandhinagar and IIIT-Delhi in my 2nd Year.Focusing on IIT Bombay Internship.The IIT Bombay has two ways of internship1) Ekalavya Internship Program **EKALAVYA HOME Page (EKALAVYA HOME Page)2) By mailing to the professor of your field of interest.Let me describe both one by one and all things which you requireThe Ekalavy internship mentioned : Apply for the internship only if you are completing the 3rd year in April/May 2017. Students completing 2nd year, with exceptional academic performance and other achievements may also be considered.The procedure for ekalavya internship,a) Apply for the internship.b) If you get selected for the first round.Then wait my friend , there is one round more.c) The second round is an Online Test, I was guided a lot by my seniors for the test, they helped me a lot for the test preparation.d) If you clear the online test( which has medium difficulty), congo you got selected.In order to get an internship by emailing the professor, you can look on etiquettes on how to mail a prof., how to search for one, how to get in touch.I will add links to the mailing etiquettes soon.I will edit more details soon, rest you can comment on specific topics which you want to know about, I will be happy to help.I am a student majoring in Electronics and Communication branch.Also, let me add, your present college won’t stop you from getting an Intern anywhere ( A motivation for you).Edit 1:The Art of Emailing Professors to Secure a Foreign Internship ( Source : Internshala )Email is the most under-rated, under-used tool for grabbing an internship abroad. Read all about how to utilize it effectively!There are two definitive ways to bag an internship-1. Apply to various internship programs such as MITACS, DAAD-WISE, etc. Fill up your application form in the fanciest way possible and leave the rest up to fate.OR2. Write an email to a professor as a prospective intern/student.The latter might sound easier than it reads.Being resilient: Professors are busy people. Do not lose hope if your first, second or even third email goes unanswered. You have to be resilient while contacting professors.Timing matters: The time you send out your mail matters more than you think. Never email a professor during the weekends or Friday night; that might be a convenient time for you to email the professor but it is also the professor’s day off and your mail will get buried under the numerous other student’s applications. Professors tend to check their mail during their office hours thus increasing chances of a reply if sent out at such a time.Whom not to contact: It is advisable not to contact more than one professor from the same department as, if found out, it will dampen your credibility in the eyes of both professors.Be specific: I cannot stress on this point enough. In the subject heading of email, be sure to include the specific area you want to intern in. The professor shouldn’t have to scour through the email to search for what you want . If you want to do a research project under him/her, a subject line such as ‘2015 Prospective Research Intern for xyz subject area’ would be ideal.Funding: Most professors are reluctant to provide funding and understandably so; you are an unknown candidate with only words to prove your credibility. Typing out a politely worded, technical email will help your chances. Make sure there are no grammatical errors. If you are good at academia with prior work experience pertaining to their field, then getting funded becomes much easier.The email is all about you being a student that the professor absolutely HAS to offer a position. The real question you should ask yourself is: What can I do to make the professor respond to my mail instead of ten dozen others lying in his/her inbox? Here’s what-Start Early: Consider this. You contact professors in October for an internship that starts in January. Provided one responds, confirmation of a project takes time. There are official procedures to be considered, especially if it’s a funded project. Then there might be a matter of VISA which needs a few weeks at the least. In the end, you might find yourself racing against time to get the confirmation.TIP: If you want an internship offer by January of next year, you should start with your research six months ahead. Keep in mind the vacation timings for the countries you are targeting because most professors will have their automatic vacation responders on during these months. By the time they read their mail, yours will be more than twenty thousand leagues under all other emails.Target the right country: If you desire an international internship, you have to be smart while choosing universities. Some professors just don’t have the funds to admit you. So what’s the point in setting up base camp there?TIP: At the outset, select countries which are known to provide funding to students. For example, news and statistics show that of late, Canada is an emerging tycoon in the education sector and is allocating massive funds to projects. So it could very well be your next destination.Spam emails: Most emails from unknown addresses are flagged as spam and don’t even signNow the inbox. Professors also can’t be sure whether you are truly a student or a fake.TIP: One smart preventive measure would be to use your university email ID which identifies your first and last name and also has something like ‘@iitg’ or some such credible ending. This validates both points at once.Bulk emails: A lot of students have a huge list of professors and play chance with their emails. Writing a bulk email with a set format to all professors will only result in immediate deletion from inbox.TIP: Spell the professor’s name correctly. Get the honorifics right- Professors are usually ‘Dr.’. Salutations such as ‘Dear Dr.X’ or simply ‘Dr.X’ should be used. Write about what interests you in their body of work.Do your homework: Professing interest in someone’s work by saying ‘I would be really enthused to work under you’ has absolutely no bearing unless you give evidence to support it.TIP: Run through the body of work the professor has done, select one publication or project that overlaps with your interest and READ IT. Come up with some interesting insight or query about it. Don’t be vague, use technical words. Try to add your own ideas. Nothing proves your interest more than actually doing your homework.I recently bagged my Latest 2018 Summer Internship in “France- Paris ,Lille”.I will love to share it’s detail along with 30+ Internships that a “first year student too can fill and achieve”.Meanwhile, you can ping me on Facebook or ask your questions in the comment section for any help.(facebook : Animesh Srivastava ).Thanks for all the sources:https://blog.internshala.com/201...Tuhin KunduRahul GarodiaHappy to help you all ! Cheers for an amazing life.

-

How do I get the educational loan for my higher studies?

MS applicants spend considerable time and resources preparing for the GRE, shortlisting and applying to schools, and choosing a final school (when lucky enough to receive multiple admits).The best idea is to gain an understanding of financing options while preparing applications and waiting for University responses. Knowing the options empowers MS aspirants to make the best decisions for the academic and financial futures.Type of Loans-Public sector banks: Collateral loansA number of banks offer education loans with collateral for MS studies abroad. Key features of such loan offers include:Up to 90% CoA cover. In some countries, the remaining 10% must be paid up front into the bank by the borrower; this is sometimes known as margin money.A variable interest rate of ~10.5%. In some cases, a discount may be applied for taking insurance against the loan. For, example, you may receive a 0.5% discount for such insurance although this is still an additional cost which factors into the total cost of a loan.In some countries, public sector banks require both collateral and a co-signer for loans. It’s important to be prepared for extensive paperwork and a long loan approval period.While it’s not a universal norm, the collateral requested in some countries requires a parental property to be put on the line - an option that isn’t available to everyone.Non-Banking Financial Corporation (NBFCs): co-signer loansNBFCs in some countries are enabled to provide financing for international education. Typical features of these loan offers include:An offer of up to 100% CoA cover, though a co-signer is always required, and collateral is often required for high-value loans.A proprietary interest rate which isn’t defined by a governing financial institute. It’s important to understand the full cost of any loan (including factors in hidden fees like loan sanction letter fee and currency conversion charges) to enable loan comparison.Loans might be assessed on the basis of co-signer credit score, as well as their salary and other credentials. This can be a real challenge for MS applicants whose co-signers are retired or have not built their credit histories.International lenders: No co-signer, collateral-free loansSome lenders, such as Prodigy Finance, provide loans to international students, often in the currency of the study destination country. Key features of such loan offers include:Loan cover up to 100% CoA without collateral or co-signers; these are merit-based loans provided on the basis of admission to a top-ranked international school.Customized interest rates that have a fixed component and a variable component – which is often the LIBOR rate of the loan currency.Online application processes that are often quicker than other loan providers - and typically more transparent as well.Prodigy Finance’s future earnings model assess your potential based on your post-masters income and career direction.In addition to no co-signer, collateral-free loans, Prodigy Finance borrowers are also eligible for value-added benefits like scholarships and careers support.Keep in mind that every loan offer has its own merits - and you should consider all of your options carefully. This quick guide is just a jumping off point to get you started. Education is an investment and study loans are a commitment; you’ll want to consider the future as well as the present because that acceptance letter is just the beginning.Want to see the terms Prodigy Finance can offer you?Applying for Prodigy Finance’s no-cosigner, collateral-free loans takes just 30 minutes. And, with no obligation to accept a provisional loan offer, there’s no reason to wait.Check more about Prodigy Finance- Prodigy Finance Answers your Top 10 Education-Loan Questions | YocketYou can decide about which type of Educational Loan you want as per your requirements.Share and upvote if helpful.

-

How do I fill out the German student visa form?

There are three different type of German Student Visas:-Language Course Visa:- It is useful for those students who want to learn German language in the Germany.Student Applicant Visa:- Student still finding the right option for course and waiting for the confirmation regarding the admission in the German Universities.Student Visa:- In this particular visa, student has already been invited by the German Universities.It is very easy to fill out the German Student Visa Form, as it includes only the basic information related to the student, Germany and courses.Surname Family NameSurname at BirthDate of BirthPlace of BirthCountry of BirthCurrent NationalitySexMarital statusAddress with parents nationality and nameNational Identity NumberType of Travel DocumentNumber of Travel DocumentsDate of issueExpiry DateIssued byStudents home and email addressTelephone numberResidence in Nationality of another countryCurrent OccupationLast Employers or Last Education detailsMain purpose of the GermanyMember state of the destinationMember state of the entryNumber of entries requestedDuration of planned staySchengen visa issued earlier or notFingerprint used earlier or notEntry permit for final countryIntended date of arrivalIntended date of departure from Schengen countryName of inviting person or hotelTravelling or Living costFamily member address with EU, EEA or CU citizen.Place and DateSignature of the student

Create this form in 5 minutes!

How to create an eSignature for the student statement form

How to generate an electronic signature for your Student Statement Form online

How to make an electronic signature for your Student Statement Form in Google Chrome

How to generate an eSignature for putting it on the Student Statement Form in Gmail

How to generate an eSignature for the Student Statement Form right from your mobile device

How to generate an eSignature for the Student Statement Form on iOS devices

How to generate an eSignature for the Student Statement Form on Android OS

People also ask

-

What is a Student Statement Form?

A Student Statement Form is a document used by educational institutions to gather important information from students. It typically includes personal details, academic history, and other relevant information. Using airSlate SignNow, you can easily create and eSign your Student Statement Form, ensuring a seamless submission process.

-

How can I create a Student Statement Form using airSlate SignNow?

Creating a Student Statement Form with airSlate SignNow is simple. You can start by choosing a template that fits your needs or create a custom form from scratch. With our intuitive interface, you can add fields, customize the design, and send it for eSignature in just a few clicks.

-

Is there a cost to use the Student Statement Form feature?

airSlate SignNow offers flexible pricing plans that cater to different user needs, including those who frequently use the Student Statement Form. You can choose from a free trial or various subscription plans based on your organization's requirements. This cost-effective solution ensures you get the most value out of your document management.

-

What are the benefits of using airSlate SignNow for Student Statement Forms?

Using airSlate SignNow for your Student Statement Forms streamlines the entire process, saving time and reducing paperwork. The platform allows for easy eSigning, tracking of document status, and secure storage. Additionally, you can enhance collaboration among staff and students, making information collection more efficient.

-

Can I integrate airSlate SignNow with other applications for my Student Statement Form?

Yes, airSlate SignNow offers integrations with various applications and platforms, enabling you to streamline your workflow. You can connect your Student Statement Form to tools like Google Drive, Salesforce, and more. This ensures that all your documents and data are centrally managed and easily accessible.

-

How secure is the Student Statement Form when using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially for sensitive documents like Student Statement Forms. The platform employs advanced encryption protocols and complies with industry standards to protect your data. You can trust that your information is secure throughout the eSigning process.

-

Can I customize the Student Statement Form to fit my institution's branding?

Absolutely! airSlate SignNow allows you to fully customize your Student Statement Form, including logos, colors, and layout. This personalization not only enhances your branding but also creates a consistent experience for students when submitting their information.

Get more for Student Statement Form

- University of california davis department of pathology form

- Supervisory visit generic form

- Trillium add form

- 5dot cxc contract 8 5 x 11 form

- Infectious diseases society for obstetrics and idsog form

- Dependent enrollment form dgaplansorg dgaplans

- Uconn verification enrollment form

- Child care all states form

Find out other Student Statement Form

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will