Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin Form

Understanding the 2020 Residence Homestead Exemption Application

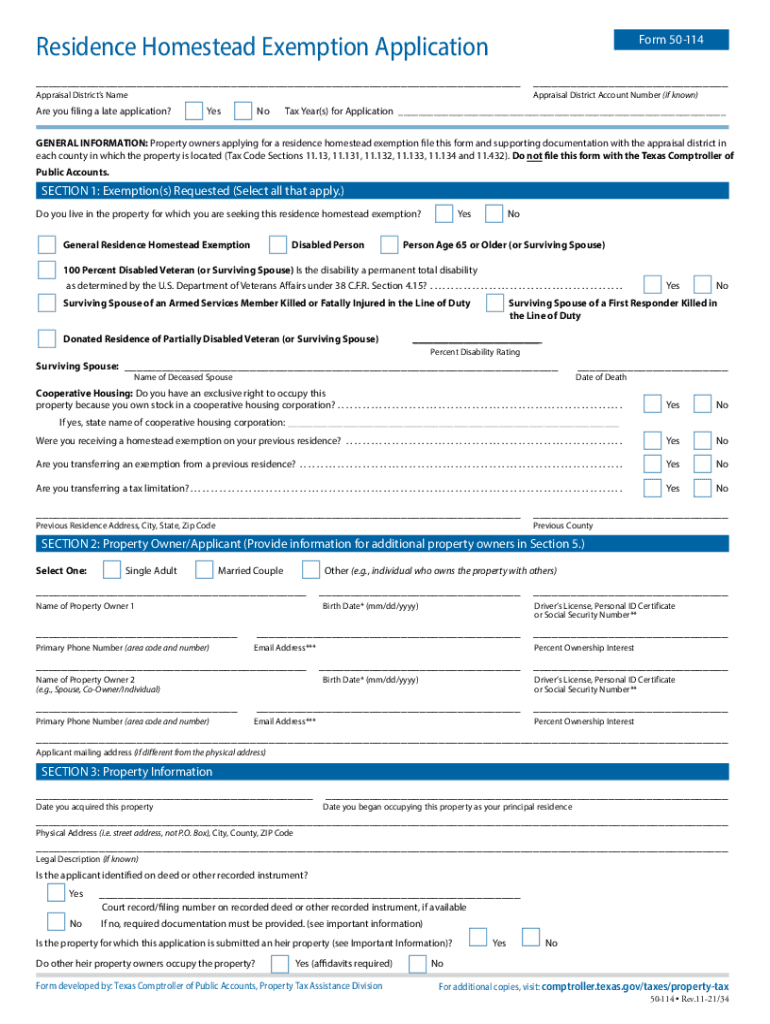

The 2020 form homestead, also known as the 114 application form, is a crucial document for homeowners seeking tax exemptions on their primary residences. This form allows eligible individuals to apply for a homestead exemption, which can significantly reduce property taxes. Homeowners must ensure they meet specific eligibility criteria, which typically include owning and occupying the property as their primary residence as of January first of the tax year.

Steps to Complete the 2020 Residence Homestead Exemption Application

Filling out the 2020 form homestead requires careful attention to detail. Here are the essential steps to ensure accurate completion:

- Gather necessary documents, including proof of identity and residency.

- Complete the application form with accurate personal information, such as your name, address, and property details.

- Provide supporting documentation as required, which may include a driver's license or utility bill.

- Review the completed form for accuracy before submission.

- Submit the form by the deadline, either online, by mail, or in person, depending on local regulations.

Required Documents for the 2020 Residence Homestead Exemption Application

To successfully file the 2020 form homestead, applicants must provide specific documentation. Commonly required documents include:

- Proof of identity, such as a government-issued ID.

- Documentation proving residency, like a utility bill or lease agreement.

- Any additional forms or paperwork as specified by the local tax authority.

Eligibility Criteria for the 2020 Residence Homestead Exemption

Eligibility for the 2020 homestead exemption typically includes several criteria that homeowners must meet:

- The property must be the applicant's primary residence.

- The applicant must own the property as of January first of the tax year.

- Applicants may need to meet income restrictions, depending on state laws.

Form Submission Methods for the 2020 Residence Homestead Exemption Application

Homeowners can submit the 2020 form homestead through various methods. The most common submission options include:

- Online submission via the local tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at the local tax office or designated locations.

Legal Use of the 2020 Residence Homestead Exemption Application

The 2020 form homestead is legally recognized as a valid application for tax exemptions when completed correctly. To ensure legal compliance, applicants must adhere to the following:

- Provide truthful and accurate information on the application.

- Submit the form within the specified deadlines set by local tax authorities.

- Retain copies of the submitted form and any supporting documents for personal records.

Quick guide on how to complete fillable residence homestead exemption application collin

Complete Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without waiting. Manage Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin on any device with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to modify and eSign Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin with ease

- Obtain Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable residence homestead exemption application collin

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF document on Android

People also ask

-

What is the 2020 form homestead, and why is it important?

The 2020 form homestead is a crucial document used to apply for property tax exemptions in various counties. It helps homeowners reduce their property taxes, making it a vital form for those looking to save on their annual expenses.

-

How can airSlate SignNow help with the 2020 form homestead?

airSlate SignNow streamlines the eSigning process, allowing you to quickly fill out and send the 2020 form homestead. With easy-to-use features, you can ensure your form is complete and submitted on time, maximizing your tax benefits.

-

Is there a cost associated with using airSlate SignNow for the 2020 form homestead?

airSlate SignNow offers flexible pricing plans, including a free trial to start. Users can choose a plan that suits their needs for submitting the 2020 form homestead, making it a cost-effective choice for individuals and businesses.

-

What features does airSlate SignNow offer for the 2020 form homestead?

With airSlate SignNow, you gain access to features like custom templates, secure document storage, and real-time tracking. These tools simplify the process of managing your 2020 form homestead and enhance the overall user experience.

-

Can I integrate airSlate SignNow with other tools for managing the 2020 form homestead?

Yes, airSlate SignNow offers seamless integration with various applications and services, allowing you to manage your documents related to the 2020 form homestead more efficiently. This flexibility can help you streamline your workflows signNowly.

-

What are the benefits of using airSlate SignNow for submitting the 2020 form homestead?

Using airSlate SignNow for your 2020 form homestead submission increases efficiency and security. The platform ensures your documents are signed and processed quickly, helping you avoid potential delays in tax exemptions.

-

How secure is airSlate SignNow when handling my 2020 form homestead?

airSlate SignNow prioritizes security with state-of-the-art encryption and compliance with legal standards. This ensures that your 2020 form homestead and other sensitive documents are protected throughout the signing process.

Get more for Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin

- Agreed written termination of lease by landlord and tenant kentucky form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497308013 form

- Kentucky violating form

- Kentucky violating 497308015 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497308016 form

- Business credit application kentucky form

- Individual credit application kentucky form

- Interrogatories to plaintiff for motor vehicle occurrence kentucky form

Find out other Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION Collin

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA