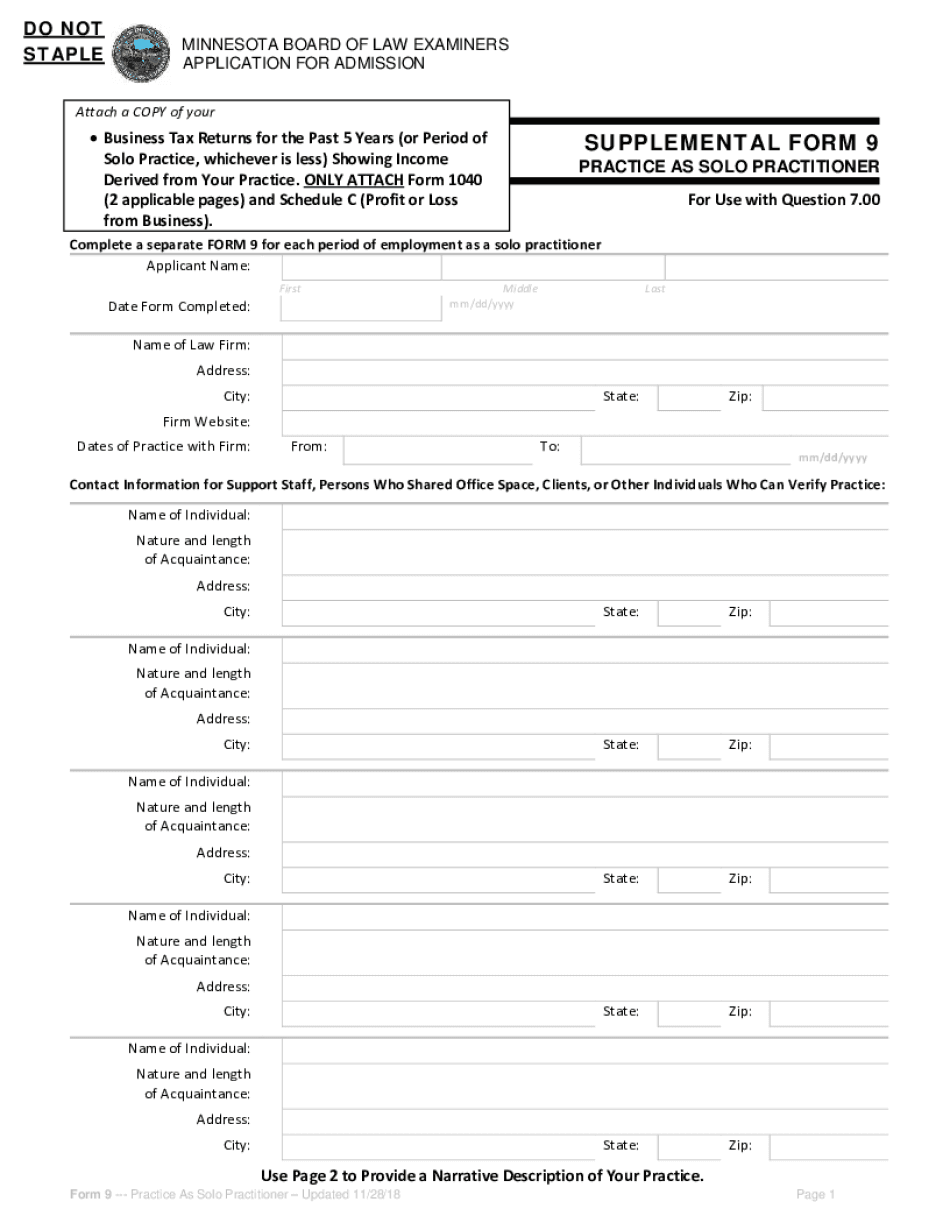

Attach a COPY of Your Business Tax Returns for the Past 5 2018-2026

What is the Attach A COPY Of Your Business Tax Returns For The Past 5

The form to attach a copy of your business tax returns for the past five years is a critical document used in various financial and legal processes. This form typically includes essential information about your business's financial performance, tax obligations, and compliance with federal and state regulations. It is often required when applying for loans, grants, or other financial assistance, as it provides lenders and investors with a clear picture of your business's financial health.

Steps to complete the Attach A COPY Of Your Business Tax Returns For The Past 5

Completing the form to attach a copy of your business tax returns for the past five years involves several key steps:

- Gather your business tax returns for the last five years, ensuring they are complete and accurate.

- Review each return for any discrepancies or missing information that may need to be addressed.

- Make copies of the tax returns, as you will need to submit these along with the form.

- Fill out any required fields on the form, ensuring that all information is current and truthful.

- Sign and date the form, confirming that the attached documents are accurate representations of your business's financial history.

Legal use of the Attach A COPY Of Your Business Tax Returns For The Past 5

The legal use of the form to attach a copy of your business tax returns for the past five years is significant. This form serves as a formal declaration of your business's financial status and is often used in legal proceedings or financial assessments. To ensure its legal validity, it must be completed accurately and submitted according to the guidelines set forth by the requesting entity, whether that be a lender, government agency, or other financial institution.

Required Documents

When preparing to attach a copy of your business tax returns for the past five years, it is essential to have the following documents ready:

- Complete copies of your business tax returns for the last five years.

- Any supporting documentation that may be required, such as schedules or additional forms.

- Identification documents, if requested, to verify the identity of the business owner or authorized signatory.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the submission of business tax returns. It is important to ensure that the attached copies comply with IRS regulations, including proper formatting and completeness. Familiarizing yourself with these guidelines can help prevent delays or issues in processing your submission.

Form Submission Methods (Online / Mail / In-Person)

The form to attach a copy of your business tax returns for the past five years can typically be submitted through various methods, depending on the requirements of the requesting entity. Common submission methods include:

- Online submission through a secure portal, if available.

- Mailing the completed form and attachments to the designated address.

- In-person delivery to the appropriate office or agency, if required.

Quick guide on how to complete attach a copy of your business tax returns for the past 5

Prepare Attach A COPY Of Your Business Tax Returns For The Past 5 with ease on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Attach A COPY Of Your Business Tax Returns For The Past 5 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Attach A COPY Of Your Business Tax Returns For The Past 5 effortlessly

- Find Attach A COPY Of Your Business Tax Returns For The Past 5 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Attach A COPY Of Your Business Tax Returns For The Past 5 while ensuring clear communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct attach a copy of your business tax returns for the past 5

Create this form in 5 minutes!

How to create an eSignature for the attach a copy of your business tax returns for the past 5

How to generate an e-signature for your PDF file in the online mode

How to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the process to attach a copy of my business tax returns for the past 5 years?

To attach a copy of your business tax returns for the past 5 years, simply upload your documents directly within the airSlate SignNow platform during the document preparation phase. You can drag and drop files or click to browse your computer. Ensure all relevant pages are included for a complete submission.

-

How secure is my information when I attach a copy of my business tax returns for the past 5?

At airSlate SignNow, your security is our top priority. When you attach a copy of your business tax returns for the past 5, all information is encrypted and stored securely to prevent unauthorized access. We adhere to industry standards for data protection, ensuring your sensitive documents are safe.

-

Are there any limitations on the file size when I attach a copy of my business tax returns for the past 5?

Yes, there are file size limits when attaching documents. Typically, you should ensure each file is no larger than 25 MB. For larger files, consider splitting your tax returns into smaller segments before uploading them to the airSlate SignNow platform.

-

Can I send documents for eSignature after I attach a copy of my business tax returns for the past 5?

Absolutely! After you attach a copy of your business tax returns for the past 5, you can easily send your documents for eSignature through airSlate SignNow. Our platform streamlines the process, allowing you to monitor signature requests and manage documents effortlessly.

-

What are the costs associated with using airSlate SignNow to attach a copy of my business tax returns for the past 5?

Pricing for using airSlate SignNow varies depending on the features you require. We offer competitive plans that accommodate various business sizes, including options tailored for those who need to attach a copy of business tax returns for the past 5 years. You can check our pricing page for detailed information on subscription levels and any additional fees.

-

How does attaching my business tax returns help with my overall document management?

Attaching your business tax returns for the past 5 years within airSlate SignNow enhances your document management efficiency. It allows for centralized storage, streamlined workflows, and easy retrieval when needed, providing a comprehensive view of important financial documents in one secure location.

-

What integration options does airSlate SignNow offer when I attach a copy of my business tax returns for the past 5?

airSlate SignNow integrates with a variety of applications, helping you manage your documents seamlessly. Whether you're using accounting software or other business tools, you can attach a copy of your business tax returns for the past 5 and easily share and collaborate across platforms. Check our integrations page for the latest compatible apps.

Get more for Attach A COPY Of Your Business Tax Returns For The Past 5

- Essential legal life documents for new parents kentucky form

- Kentucky general 497308184 form

- Small business accounting package kentucky form

- Company employment policies and procedures package kentucky form

- Revocation power attorney 497308187 form

- Newly divorced individuals package kentucky form

- Contractors forms package kentucky

- Ky vehicle enforcement form form 2

Find out other Attach A COPY Of Your Business Tax Returns For The Past 5

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document