Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print 2021-2026

Understanding the Tax Affidavit

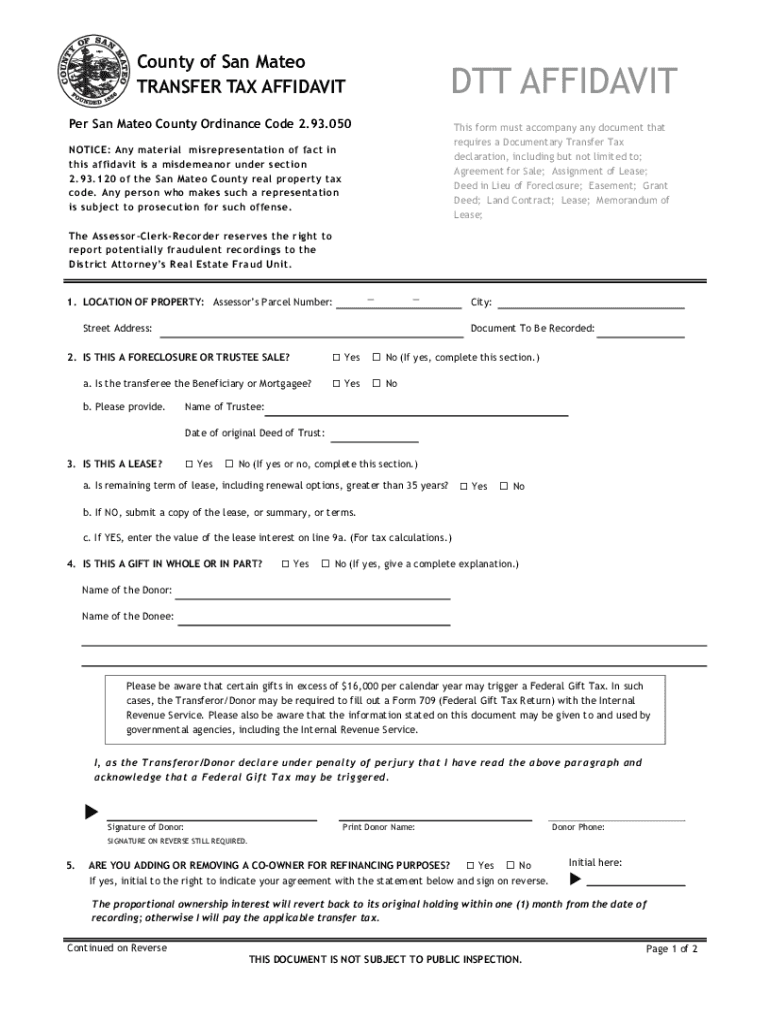

A tax affidavit is a legal document used to declare specific facts regarding tax obligations or exemptions. It is often required during property transfers or when claiming certain tax benefits. This affidavit serves as a formal declaration to the tax authorities, ensuring compliance with local and federal tax laws. The information provided in a tax affidavit must be accurate, as any discrepancies can lead to penalties or legal issues.

Steps to Complete the Tax Affidavit

Completing a tax affidavit involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including property details, tax identification numbers, and any relevant documentation.

- Fill out the tax affidavit form completely, ensuring all required fields are addressed.

- Review the completed form for accuracy, checking for any errors or omissions.

- Sign the affidavit, either electronically or in person, depending on the submission method.

- Submit the affidavit to the appropriate tax authority, following their specified guidelines.

Legal Use of the Tax Affidavit

The tax affidavit is legally binding and must be used in accordance with applicable laws. It is essential for individuals and businesses to understand the legal implications of submitting a tax affidavit. Misrepresentation or failure to provide accurate information can result in serious consequences, including fines and legal action. Therefore, it is advisable to consult with a tax professional when preparing this document.

Required Documents for the Tax Affidavit

When preparing a tax affidavit, certain documents may be required to support the claims made within the affidavit. Commonly required documents include:

- Proof of ownership or transfer of property.

- Tax identification number or Social Security number.

- Previous tax returns or tax statements.

- Any relevant legal documents, such as wills or trust agreements.

Form Submission Methods

Tax affidavits can typically be submitted through various methods, depending on the requirements of the local tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a hard copy of the completed affidavit.

- In-person submission at designated tax offices.

State-Specific Rules for the Tax Affidavit

Each state may have its own rules and regulations regarding tax affidavits. It is important to be aware of these specific requirements, as they can vary significantly. Factors such as filing deadlines, required forms, and submission methods may differ from one state to another. Checking with the local tax authority can provide clarity on the specific rules applicable in your state.

Penalties for Non-Compliance

Failing to comply with tax affidavit requirements can lead to various penalties. These may include fines, interest on unpaid taxes, or even legal action. It is crucial to ensure that all information provided in the affidavit is accurate and submitted on time to avoid any potential repercussions. Consulting with a tax advisor can help mitigate risks associated with non-compliance.

Quick guide on how to complete fillable online transfer tax affidavit fax email print

Complete Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Handle Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print on any device using airSlate SignNow Android or iOS applications and simplify any document-driven task today.

Steps to modify and eSign Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print with ease

- Find Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print and then click Get Form to begin.

- Make use of the provided tools to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools available from airSlate SignNow specifically designed for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online transfer tax affidavit fax email print

Create this form in 5 minutes!

How to create an eSignature for the fillable online transfer tax affidavit fax email print

The best way to create an e-signature for a PDF file in the online mode

The best way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is a tax affidavit and how is it used?

A tax affidavit is a legal document used to declare income or other financial information for tax purposes. Typically utilized by businesses and individuals, it helps streamline the filing process and ensures compliance with tax regulations. Using airSlate SignNow, you can easily create, send, and eSign your tax affidavit quickly and securely.

-

How does airSlate SignNow facilitate the signing of a tax affidavit?

airSlate SignNow allows users to create and send tax affidavits that can be signed electronically. With features like templates and reusable workflows, the platform simplifies the process, ensuring that all signatures are legally binding and secure. This makes it easier for businesses to manage their tax affidavit submissions efficiently.

-

What are the pricing options for using airSlate SignNow for tax affidavits?

airSlate SignNow offers various pricing plans to cater to different business needs when managing tax affidavits. Starting from a free version with essential features to comprehensive business plans, users can choose an option that aligns with their document signing and management requirements. You can visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications for tax affidavit management?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and more, allowing you to manage your tax affidavit alongside your existing workflows. This integration ensures that your documents are organized and easily accessible without the need for constant switching between platforms.

-

What security measures does airSlate SignNow implement for tax affidavits?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like tax affidavits. The platform employs encryption and secure cloud storage to protect your data. Additionally, it ensures compliance with privacy laws, providing users with peace of mind when signing and submitting their tax affidavits.

-

Are there any templates for tax affidavits in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates that can be used specifically for creating tax affidavits. These templates save time and reduce errors in document preparation, allowing users to quickly generate tax affidavits that meet their specific needs. You can modify any template to include pertinent details for your situation.

-

What benefits does airSlate SignNow offer for submitting a tax affidavit?

Using airSlate SignNow for your tax affidavit streamlines the signing process, reduces turnaround time, and ensures compliance. Its user-friendly interface enables you to manage documents effortlessly, while electronic signatures promote efficiency and security. This service is designed to help businesses focus on their core activities rather than on paperwork.

Get more for Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print

- Louisiana tenant in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497308492 form

- Letter from landlord to tenant as notice to tenant to inform landlord of tenants knowledge of condition causing damage to 497308493

- Landlord tenant law 497308494 form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497308495 form

- Letter tenant rent sample 497308496 form

- Louisiana letter lease form

- Letter landlord rental 497308498 form

Find out other Fillable Online TRANSFER TAX AFFIDAVIT Fax Email Print

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation