Form ST 809 New York State and Local Sales and Use Tax

What is the Form ST 809 New York State And Local Sales And Use Tax

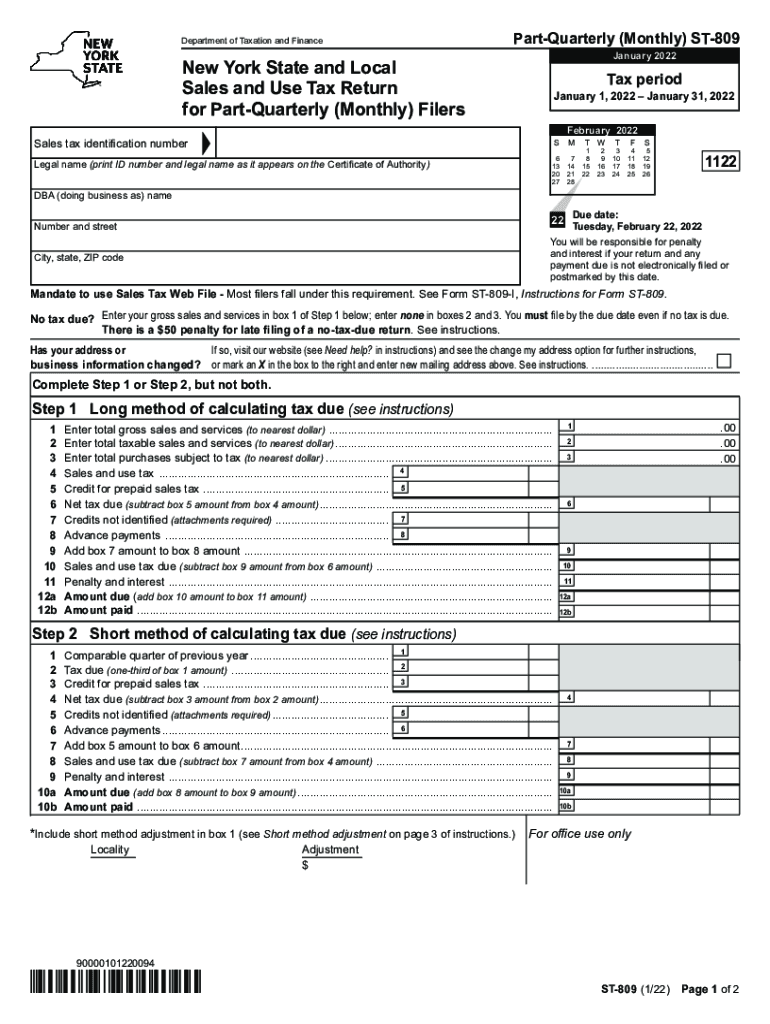

The Form ST 809 is a crucial document used in New York for reporting and remitting state and local sales and use tax. This form is primarily utilized by businesses that collect sales tax from customers and need to report these collections to the New York State Department of Taxation and Finance. It serves as a declaration of the sales tax collected during a specific period and ensures compliance with state tax regulations.

The form is applicable to various types of sales transactions, including retail sales, leases, and services subject to sales tax. Understanding the purpose and requirements of the ST 809 is essential for businesses to maintain accurate tax records and avoid potential penalties.

Steps to complete the Form ST 809 New York State And Local Sales And Use Tax

Completing the Form ST 809 involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary information: Collect all relevant sales data, including total sales, exempt sales, and sales tax collected during the reporting period.

- Fill in business details: Provide your business's name, address, and identification number at the top of the form.

- Report sales figures: Accurately enter the total sales amount and the corresponding sales tax collected in the designated fields.

- Calculate total tax due: Ensure that the calculations reflect the correct amounts owed to the state and local jurisdictions.

- Review and verify: Double-check all entries for accuracy to prevent errors that could lead to compliance issues.

- Sign and date: Ensure that the form is signed by an authorized representative of the business to validate the submission.

How to obtain the Form ST 809 New York State And Local Sales And Use Tax

Obtaining the Form ST 809 is a straightforward process. Businesses can access the form through the New York State Department of Taxation and Finance website. The form is available as a downloadable PDF, allowing for easy printing and completion. Additionally, businesses may request physical copies of the form by contacting the department directly or visiting a local office.

It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations or reporting requirements.

Legal use of the Form ST 809 New York State And Local Sales And Use Tax

The legal use of the Form ST 809 is governed by New York State tax laws. To be considered valid, the form must be completed accurately and submitted within the required deadlines. Electronic signatures are acceptable, provided they comply with the Electronic Signatures and Records Act (ESRA) and other relevant regulations.

Using the form correctly ensures that businesses fulfill their tax obligations, thereby avoiding penalties for non-compliance. It is advisable for businesses to keep a copy of the completed form and any supporting documents for their records.

Filing Deadlines / Important Dates

Timely submission of the Form ST 809 is critical for compliance. The filing deadlines typically align with the reporting periods, which can be monthly, quarterly, or annually, depending on the volume of sales. It is essential to check the New York State Department of Taxation and Finance website for specific due dates, as they may vary based on the business's filing frequency.

Missing a deadline can result in penalties and interest on the unpaid tax amount, making it crucial for businesses to stay informed about their filing obligations.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Form ST 809. The form can be filed electronically through the New York State Department of Taxation and Finance's online services, which is often the quickest method. Alternatively, businesses may choose to mail the completed form to the designated address provided on the form or submit it in person at a local tax office.

Each submission method has its own processing times and requirements, so businesses should select the option that best suits their needs while ensuring compliance with all regulations.

Quick guide on how to complete form st 809 new york state and local sales and use tax

Accomplish Form ST 809 New York State And Local Sales And Use Tax easily on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form ST 809 New York State And Local Sales And Use Tax on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

Ways to modify and eSign Form ST 809 New York State And Local Sales And Use Tax effortlessly

- Obtain Form ST 809 New York State And Local Sales And Use Tax and click on Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize relevant parts of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Alter and eSign Form ST 809 New York State And Local Sales And Use Tax and ensure seamless communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an e-signature for a PDF on Android devices

People also ask

-

What is the ST 809 sales tax form?

The ST 809 sales tax form is a document used in certain states for reporting sales tax exemptions. This form allows businesses to claim specific sales tax exemptions when purchasing goods or services. Understanding how to utilize the ST 809 sales tax form can help companies save money and remain compliant with tax regulations.

-

How does airSlate SignNow help with ST 809 sales tax documentation?

airSlate SignNow streamlines the process of sending and signing the ST 809 sales tax form digitally. With its intuitive interface, users can easily create, manage, and store their ST 809 sales tax documents securely. This efficiency reduces paperwork and enhances the compliance process for businesses dealing with sales tax.

-

What features does airSlate SignNow offer for managing ST 809 sales tax forms?

airSlate SignNow offers features such as customizable templates for ST 809 sales tax forms, secure electronic signatures, and automated reminders for important deadlines. These features ensure that you can efficiently handle your sales tax documents while keeping them organized and easily accessible. This way, businesses can focus more on their core operations and less on paperwork.

-

Is there a cost associated with using airSlate SignNow for ST 809 sales tax?

Yes, there is a cost associated with using airSlate SignNow, but the pricing is designed to be cost-effective for businesses of all sizes. Various subscription tiers provide access to different features, making it adaptable to your needs for managing ST 809 sales tax documents. Investing in this solution can lead to long-term savings through improved efficiencies.

-

Can I integrate airSlate SignNow with my accounting software for ST 809 sales tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing for easy management of ST 809 sales tax forms. This integration ensures that your sales tax calculations and documentation flow smoothly between systems, reducing the risk of errors and saving valuable time for your business.

-

How can airSlate SignNow benefit my business in relation to ST 809 sales tax?

Using airSlate SignNow to manage ST 809 sales tax forms can greatly improve your operational efficiency. By automating document workflows and enabling electronic signatures, your team can process sales tax exemptions faster, eliminating delays associated with traditional paper methods. This optimization leads to better compliance and lowers the risk of issues with tax authorities.

-

Is there customer support available for ST 809 sales tax queries?

Yes, airSlate SignNow offers robust customer support to assist with any queries around ST 809 sales tax forms. Whether you need help with document setup, troubleshooting issues, or general inquiries, their support team is available to guide you. This resource can be invaluable in ensuring that your sales tax documentation is handled correctly.

Get more for Form ST 809 New York State And Local Sales And Use Tax

Find out other Form ST 809 New York State And Local Sales And Use Tax

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple