Www pdfFiller Com506764396 Transient Occupancy2020 Form CA Transient Occupancy Tax Return Fill Online

Understanding the transient occupancy tax return form

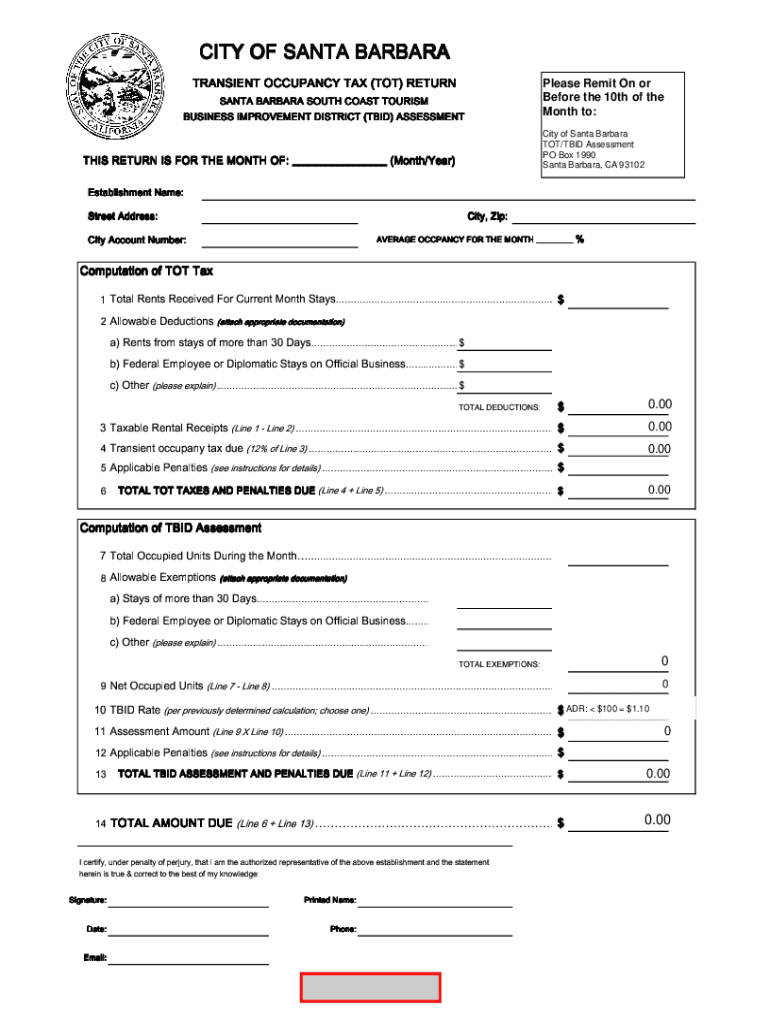

The transient occupancy tax return form is a crucial document for businesses and individuals who rent out accommodations for short periods. This form is typically required by local government agencies to report the tax collected from guests. Understanding the purpose of this form is essential for compliance with local tax regulations. It helps ensure that the appropriate taxes are remitted to the relevant authorities, thereby avoiding potential penalties.

Key elements of the transient occupancy tax return form

When completing the transient occupancy tax return form, several key elements must be included to ensure accuracy and compliance. These elements typically consist of:

- Property Information: Details about the property being rented, including the address and type of accommodation.

- Tax Period: The specific time frame for which the tax is being reported.

- Gross Rental Income: Total income earned from rentals during the reporting period.

- Tax Rate: The applicable transient occupancy tax rate set by the local government.

- Total Tax Due: The calculated amount of tax owed based on the gross rental income and tax rate.

Steps to complete the transient occupancy tax return form

Completing the transient occupancy tax return form involves several straightforward steps:

- Gather all necessary information about your property and rental income.

- Obtain the correct version of the form from your local tax authority.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Calculate the total tax due based on the gross rental income and applicable tax rate.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the due date through the required method, whether online, by mail, or in person.

Filing deadlines and important dates

Filing deadlines for the transient occupancy tax return form can vary by jurisdiction. It is essential to be aware of these dates to avoid penalties. Most localities require the form to be submitted on a monthly or quarterly basis. Check with your local tax authority for specific deadlines and any grace periods that may apply.

Penalties for non-compliance

Failure to file the transient occupancy tax return form on time can result in significant penalties. These may include:

- Late Fees: Additional charges for submitting the form past the deadline.

- Interest Charges: Accumulated interest on unpaid taxes, increasing the total amount owed.

- Legal Action: Potential legal consequences for continued non-compliance, which may include liens against property.

Digital vs. paper version of the transient occupancy tax return form

Choosing between a digital or paper version of the transient occupancy tax return form can impact the ease of submission. Digital forms often allow for quicker processing and may include features such as automatic calculations. In contrast, paper forms may require manual calculations and can take longer to process. Many jurisdictions now encourage or require electronic submissions for efficiency.

Quick guide on how to complete wwwpdffillercom506764396 transient occupancy2020 2022 form ca transient occupancy tax return fill online

Complete Www pdffiller com506764396 transient occupancy2020 Form CA Transient Occupancy Tax Return Fill Online effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Www pdffiller com506764396 transient occupancy2020 Form CA Transient Occupancy Tax Return Fill Online on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Www pdffiller com506764396 transient occupancy2020 Form CA Transient Occupancy Tax Return Fill Online with ease

- Obtain Www pdffiller com506764396 transient occupancy2020 Form CA Transient Occupancy Tax Return Fill Online and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Www pdffiller com506764396 transient occupancy2020 Form CA Transient Occupancy Tax Return Fill Online and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwpdffillercom506764396 transient occupancy2020 2022 form ca transient occupancy tax return fill online

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an e-signature for a PDF file on Android

People also ask

-

What is a transient occupancy tax return form?

A transient occupancy tax return form is a document that hosts or property owners use to report transient occupancy taxes to local authorities. It typically includes information about the rental income, occupancy rates, and applicable taxes. Utilizing airSlate SignNow can streamline the completion and eSigning of this form, ensuring compliance and efficiency.

-

How can airSlate SignNow help with the transient occupancy tax return form?

airSlate SignNow supports the seamless creation, editing, and signing of transient occupancy tax return forms. Our platform allows you to collaborate and send documents electronically, reducing the time spent on paperwork. This ensures that your tax documents are filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the transient occupancy tax return form?

Yes, airSlate SignNow offers a variety of pricing plans based on your business needs. Each plan provides access to features that can simplify the process of filling out and signing the transient occupancy tax return form. You can choose a plan that fits your usage requirements and budget.

-

Are there templates available for transient occupancy tax return forms on airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates for the transient occupancy tax return form, making it easier for users to fill in required information. These templates streamline the process and ensure that all necessary fields are completed before submission.

-

Can I integrate airSlate SignNow with other software for managing transient occupancy tax return forms?

Yes, airSlate SignNow easily integrates with various software applications that you may currently use. This integration allows for an efficient workflow when managing your transient occupancy tax return forms, from client communication to data processing.

-

What are the benefits of using airSlate SignNow for my transient occupancy tax return form?

Using airSlate SignNow for your transient occupancy tax return form offers multiple benefits, including improved accuracy, reduced time spent on manual entries, and enhanced compliance. It helps keep your documents organized and easily accessible, ensuring you never miss submission deadlines.

-

How secure is airSlate SignNow when handling transient occupancy tax return forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your transient occupancy tax return forms and other sensitive documents. Additionally, our platform complies with industry standards to ensure that your data remains safe from unauthorized access.

Get more for Www pdffiller com506764396 transient occupancy2020 Form CA Transient Occupancy Tax Return Fill Online

- Letter regarding appointment form

- Indigent 497308830 form

- Louisiana pending form

- Motion and order for an in camera inspection of information provided by confidential informant louisiana

- Louisiana promissory note sample form

- Louisiana petition form

- Motion and order for interpreter to interview hearing impaired indigent defendant louisiana form

- Interrogatories louisiana form

Find out other Www pdffiller com506764396 transient occupancy2020 Form CA Transient Occupancy Tax Return Fill Online

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors