Form Nyc 204ez Unincorporated Business Tax Return for

What is the Form NYC 204ez Unincorporated Business Tax Return For

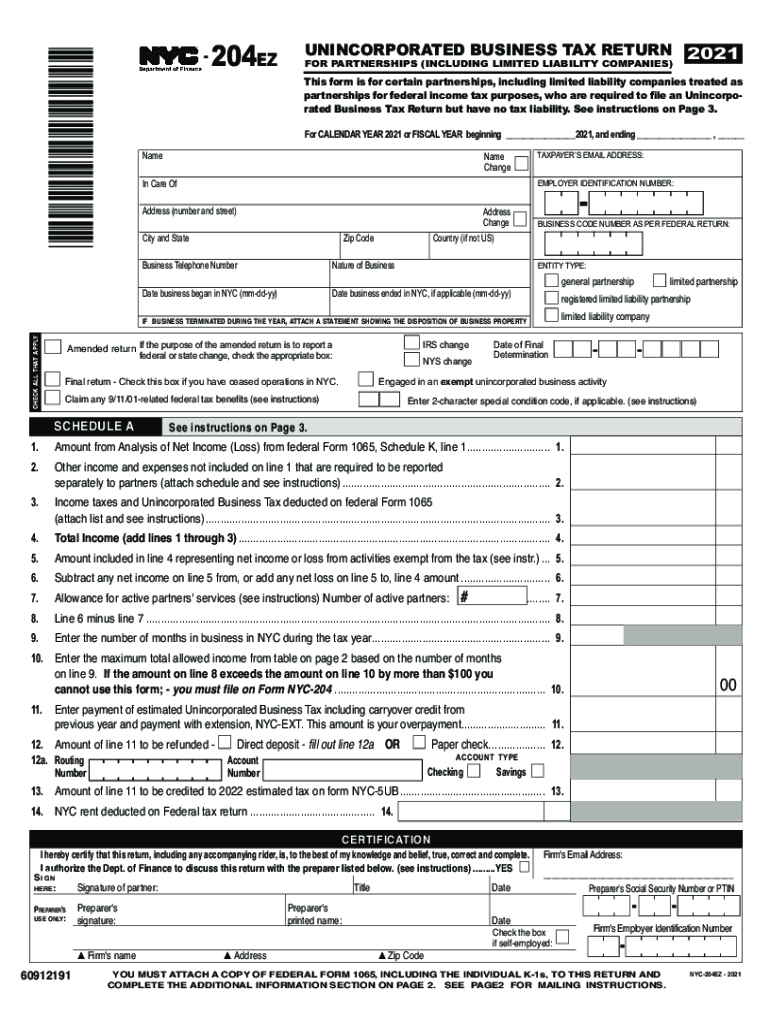

The NYC 204ez is a simplified tax return form specifically designed for unincorporated businesses operating in New York City. This form is used to report income generated by sole proprietorships, partnerships, and other unincorporated entities. It allows businesses to calculate their unincorporated business tax (UBT) liability, ensuring compliance with local tax regulations. The NYC 204ez is particularly beneficial for smaller businesses, as it streamlines the filing process and reduces the complexity typically associated with tax returns.

Steps to Complete the Form NYC 204ez Unincorporated Business Tax Return For

Completing the NYC 204ez involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and any relevant tax documents.

- Fill out the form by providing accurate information regarding your business income, deductions, and credits.

- Calculate your UBT liability based on the instructions provided within the form.

- Review the completed form for accuracy to avoid potential penalties or delays.

- Submit the form by the designated deadline, either electronically or via mail, as per the submission methods outlined by the NYC Department of Finance.

Legal Use of the Form NYC 204ez Unincorporated Business Tax Return For

The NYC 204ez is legally recognized as a valid method for reporting unincorporated business income and calculating tax liabilities. To ensure its legal validity, it is essential to adhere to the guidelines set forth by the New York City Department of Finance. This includes maintaining accurate records, submitting the form on time, and ensuring that all information provided is truthful and complete. Compliance with these regulations protects businesses from potential audits and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 204ez are crucial for compliance. Typically, the form must be submitted by the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these dates, as local regulations may adjust deadlines based on specific circumstances or events.

Required Documents

To successfully complete the NYC 204ez, certain documents are required. These may include:

- Income statements detailing all revenue generated by the business.

- Expense records that outline all business-related costs.

- Previous tax returns, if applicable, to provide context for current filings.

- Any additional documentation requested by the NYC Department of Finance.

Form Submission Methods (Online / Mail / In-Person)

The NYC 204ez can be submitted through various methods to accommodate different preferences. Businesses can file the form online through the NYC Department of Finance website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has specific instructions and requirements, so it is essential to choose the one that best fits your business needs.

Quick guide on how to complete form nyc 204ez unincorporated business tax return for

Accomplish Form Nyc 204ez Unincorporated Business Tax Return For seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to access the proper template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without interruptions. Handle Form Nyc 204ez Unincorporated Business Tax Return For on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to edit and eSign Form Nyc 204ez Unincorporated Business Tax Return For effortlessly

- Find Form Nyc 204ez Unincorporated Business Tax Return For and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal validity as a traditional wet ink signature.

- Review all information and then click the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Form Nyc 204ez Unincorporated Business Tax Return For and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nyc 204ez unincorporated business tax return for

The best way to make an e-signature for your PDF file in the online mode

The best way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What are the 'NYC 204 instructions 2024' and how do they relate to airSlate SignNow?

The 'NYC 204 instructions 2024' provide guidelines for filing certain business tax documents in New York City. airSlate SignNow simplifies this process by allowing users to electronically sign and send the required paperwork efficiently, ensuring compliance with the latest NYC 204 instructions 2024.

-

How can airSlate SignNow help me with completing the NYC 204 instructions 2024?

airSlate SignNow offers streamlined document workflows that can help you complete and submit the NYC 204 instructions 2024 smoothly. With features like templates and easy document sharing, you can ensure that all necessary steps are followed without delay.

-

Is there a cost associated with using airSlate SignNow for NYC 204 instructions 2024?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling the NYC 204 instructions 2024. The plans are designed to be cost-effective, providing excellent value for businesses looking to streamline their documentation processes.

-

What features does airSlate SignNow offer for complying with NYC 204 instructions 2024?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and document tracking, all essential for working with the NYC 204 instructions 2024. These features enhance efficiency, reduce errors, and ensure documents are processed on time.

-

Can airSlate SignNow help with other tax instructions besides the NYC 204 instructions 2024?

Absolutely! airSlate SignNow is versatile and can assist in managing various tax paperwork, not just the NYC 204 instructions 2024. This flexibility makes it an ideal tool for businesses navigating multiple compliance requirements.

-

Are there integrations available with airSlate SignNow for NYC 204 instructions 2024?

Yes, airSlate SignNow integrates with various platforms, enhancing your workflow when dealing with the NYC 204 instructions 2024. Integrations with popular tools like Google Workspace, Salesforce, and more can streamline document management across your organization.

-

What benefits can I expect from using airSlate SignNow for NYC 204 instructions 2024?

By using airSlate SignNow for your NYC 204 instructions 2024, you can expect increased efficiency, reduced paperwork errors, and faster turnaround times. This user-friendly platform supports better collaboration among team members, ultimately saving you time and increasing productivity.

Get more for Form Nyc 204ez Unincorporated Business Tax Return For

- Last will and testament spouse no children louisiana form

- Medical authorization sample form

- Louisiana memorandum form

- Memorandum in support of motion to reconsider sentence louisiana form

- Louisiana court case form

- Motion suppress hearing form

- Memorandum on behalf of plaintiff for custody louisiana form

- Rule contempt form

Find out other Form Nyc 204ez Unincorporated Business Tax Return For

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself