Summary of Federal Form 1099 R Statements Department of

Understanding the Summary of Federal Form 1099-R Statements

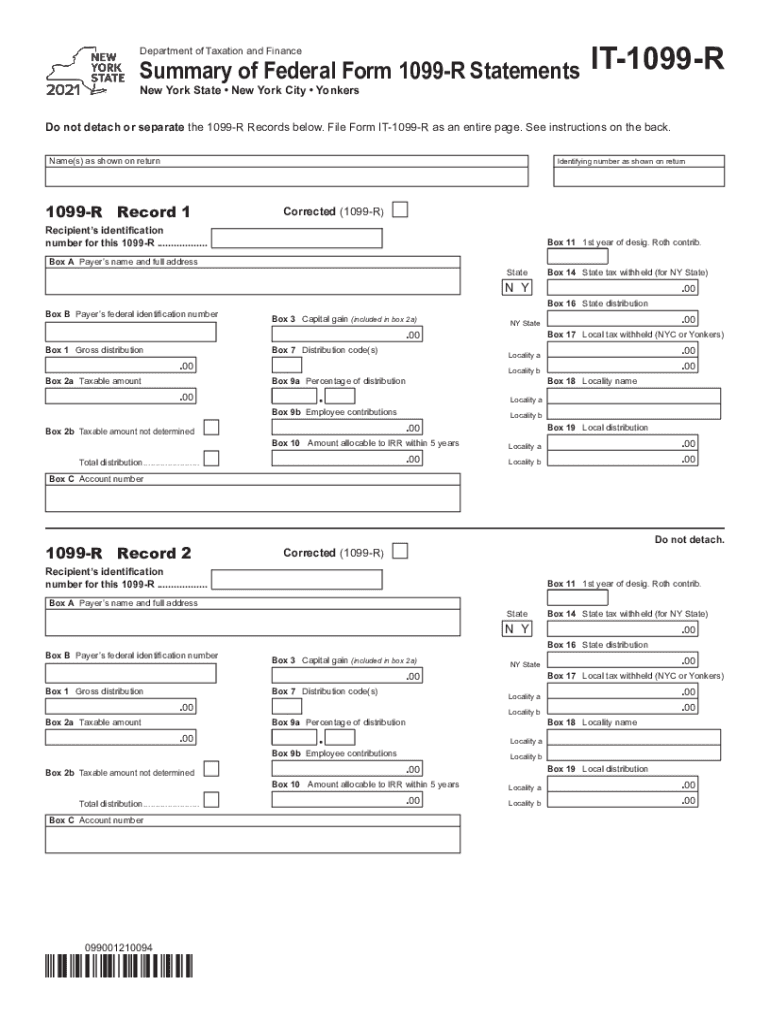

The Summary of Federal Form 1099-R Statements is a crucial document for reporting distributions from pensions, annuities, retirement plans, or other similar sources. This form provides a summary of the total distributions made during the tax year, which is essential for both the taxpayer and the IRS. It includes important details such as the payer's information, the recipient's information, and the total amount distributed. Understanding this form is vital for ensuring accurate tax reporting and compliance with federal regulations.

Steps to Complete the Summary of Federal Form 1099-R Statements

Completing the Summary of Federal Form 1099-R involves several steps to ensure accuracy and compliance. First, gather all relevant information, including the recipient's taxpayer identification number (TIN), the total distribution amount, and any applicable tax withheld. Next, accurately fill out each section of the form, ensuring that all details match the supporting documents. After completing the form, review it for errors before submitting it to the IRS and providing a copy to the recipient. This careful process helps prevent issues with tax reporting.

Legal Use of the Summary of Federal Form 1099-R Statements

The Summary of Federal Form 1099-R Statements serves a legal purpose in documenting retirement and pension distributions. It is essential for both the payer and the recipient to maintain accurate records of these distributions for tax purposes. Failure to properly report these amounts can lead to penalties and interest on unpaid taxes. Additionally, the form must be filed in accordance with IRS guidelines to ensure compliance with federal tax laws.

IRS Guidelines for the Summary of Federal Form 1099-R Statements

The IRS provides specific guidelines for completing and submitting the Summary of Federal Form 1099-R Statements. These guidelines include deadlines for filing, requirements for electronic versus paper submissions, and instructions for correcting errors. It is important for taxpayers and businesses to stay informed about these guidelines to avoid penalties and ensure that their tax reporting is accurate and timely.

Filing Deadlines for the Summary of Federal Form 1099-R Statements

Filing deadlines for the Summary of Federal Form 1099-R Statements are critical for compliance. Generally, the form must be submitted to the IRS by the end of February if filed on paper or by the end of March if filed electronically. Additionally, recipients should receive their copies by January 31. Adhering to these deadlines helps avoid late filing penalties and ensures that all parties meet their tax obligations.

Examples of Using the Summary of Federal Form 1099-R Statements

Examples of using the Summary of Federal Form 1099-R Statements include reporting distributions from a 401(k) plan, pension payments, or annuity distributions. For instance, if an individual receives a distribution from their retirement account, the financial institution will issue a 1099-R form summarizing the total amount distributed and any taxes withheld. This information is then used by the recipient to accurately report their income on their tax return.

Quick guide on how to complete summary of federal form 1099 r statements department of

Prepare Summary Of Federal Form 1099 R Statements Department Of effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without hold-ups. Manage Summary Of Federal Form 1099 R Statements Department Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The optimal way to modify and electronically sign Summary Of Federal Form 1099 R Statements Department Of with ease

- Obtain Summary Of Federal Form 1099 R Statements Department Of and then click Get Form to initiate the process.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure private information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal weight as a conventional ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that necessitate the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Summary Of Federal Form 1099 R Statements Department Of and ensure seamless communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the summary of federal form 1099 r statements department of

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the IT 1099 R form printable used for?

The IT 1099 R form printable is used to report distributions from pensions, annuities, retirement plans, or other deferred income. It helps taxpayers accurately report their income during tax season. With our solution, you can easily generate and eSign this form for a seamless filing process.

-

How can I access the IT 1099 R form printable through airSlate SignNow?

To access the IT 1099 R form printable through airSlate SignNow, simply sign up for an account, choose the form from our templates, and fill it out as needed. Our platform allows for easy customization to ensure all necessary information is included. Once completed, you can eSign it instantly.

-

Is the IT 1099 R form printable option free to use?

While airSlate SignNow offers various pricing plans, the ability to generate an IT 1099 R form printable is included in our services. Explore our plans to find one that fits your needs, as we provide competitive pricing for businesses needing document signing solutions.

-

Can I integrate the IT 1099 R form printable with my accounting software?

Yes, airSlate SignNow allows for integration with various accounting software platforms. This integration streamlines the process of managing your finances and ensures that the IT 1099 R form printable can be easily stored and accessed alongside your financial records.

-

What are the benefits of using airSlate SignNow for the IT 1099 R form printable?

Using airSlate SignNow for the IT 1099 R form printable provides numerous benefits, including easy eSigning, secure storage, and quick access to documents. Additionally, our platform enhances productivity by simplifying the workflow, allowing you to focus on important tasks instead of paperwork.

-

Is it safe to eSign the IT 1099 R form printable on airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security when handling the IT 1099 R form printable and other sensitive documents. Our platform utilizes advanced encryption and compliance standards to ensure that your eSignatures and information are safe and protected throughout the process.

-

Can multiple users collaborate on the IT 1099 R form printable?

Yes, multiple users can collaborate on the IT 1099 R form printable using airSlate SignNow. You can invite team members to review and eSign the document, ensuring that everyone involved has a clear understanding and can contribute as needed. This feature enhances teamwork and expedites the document completion process.

Get more for Summary Of Federal Form 1099 R Statements Department Of

Find out other Summary Of Federal Form 1099 R Statements Department Of

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template