Get the Arkansas State Withholding Form pdfFiller 2021

Key elements of the Arkansas employee withholding form

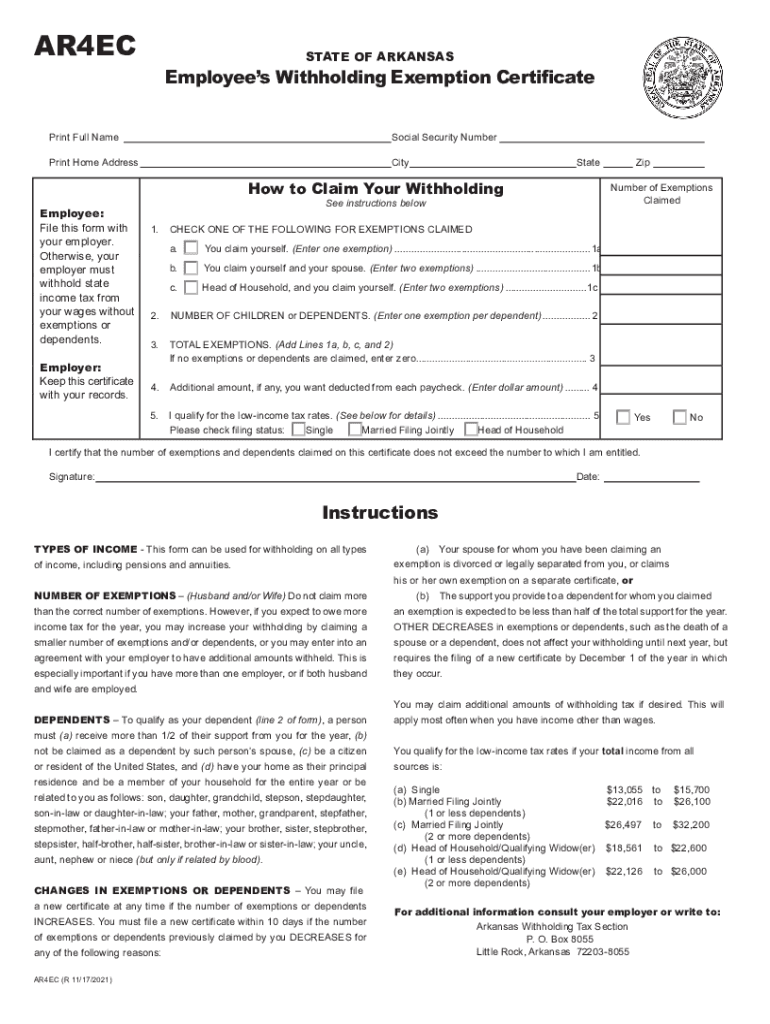

The Arkansas employee withholding form is essential for employers to accurately withhold state income tax from employees' wages. Key components of this form include:

- Employee Information: This section requires the employee's full name, address, and Social Security number.

- Filing Status: Employees must indicate their filing status, such as single, married, or head of household, which affects withholding rates.

- Exemptions: Employees can claim exemptions based on their eligibility, which may reduce the amount withheld.

- Additional Withholding: Employees may request additional amounts to be withheld from their paychecks for tax purposes.

Steps to complete the Arkansas employee withholding form

Completing the Arkansas employee withholding form involves several straightforward steps:

- Gather Required Information: Collect personal details such as your name, address, and Social Security number.

- Choose Your Filing Status: Select the appropriate filing status that reflects your tax situation.

- Claim Exemptions: Determine if you are eligible for any exemptions and fill in the corresponding section.

- Specify Additional Withholding: If desired, indicate any additional amount you wish to be withheld from your paycheck.

- Review and Sign: Carefully review the completed form for accuracy before signing and dating it.

Legal use of the Arkansas employee withholding form

The Arkansas employee withholding form is legally binding when completed accurately and submitted to the employer. It ensures compliance with state tax laws and helps employers calculate the correct amount of state income tax to withhold from employees' wages. Failure to submit this form can lead to improper withholding, resulting in potential penalties for both the employer and employee.

Form submission methods for the Arkansas employee withholding form

Employers can receive the Arkansas employee withholding form through various submission methods, including:

- In-Person Submission: Employees can hand in the completed form directly to their employer's human resources or payroll department.

- Mail: The form can be mailed to the employer's designated address, ensuring it is sent securely.

- Electronic Submission: Some employers may allow employees to submit the form electronically through secure platforms, ensuring a streamlined process.

Filing deadlines and important dates for the Arkansas employee withholding form

Understanding the filing deadlines for the Arkansas employee withholding form is crucial for compliance. Generally, employees should submit their withholding forms as soon as they start a new job or when their tax situation changes. Employers must ensure that they process these forms promptly to adjust withholding amounts accordingly. Additionally, employees should review their withholding status annually or when significant life events occur, such as marriage or the birth of a child.

Examples of using the Arkansas employee withholding form

Here are some common scenarios illustrating the use of the Arkansas employee withholding form:

- New Employment: A newly hired employee completes the form to establish their withholding preferences with their employer.

- Change in Marital Status: An employee who recently got married updates their filing status and exemptions on the form to reflect their new tax situation.

- Claiming Exemptions: An employee who qualifies for exemptions due to low income fills out the form to reduce their withholding amount.

Quick guide on how to complete get the free arkansas state withholding form pdffiller

Prepare Get The Arkansas State Withholding Form PdfFiller effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without obstacles. Manage Get The Arkansas State Withholding Form PdfFiller on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The simplest way to modify and eSign Get The Arkansas State Withholding Form PdfFiller with ease

- Locate Get The Arkansas State Withholding Form PdfFiller and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Get The Arkansas State Withholding Form PdfFiller to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free arkansas state withholding form pdffiller

Create this form in 5 minutes!

How to create an eSignature for the get the free arkansas state withholding form pdffiller

The way to generate an e-signature for a PDF file in the online mode

The way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

The way to generate an e-signature for a PDF file on Android

People also ask

-

What is the Arkansas employee withholding form?

The Arkansas employee withholding form is a document used by employers in Arkansas to determine the amount of state income tax to withhold from employees' paychecks. This form helps ensure compliance with state tax regulations and is essential for accurate payroll processing.

-

How do I complete the Arkansas employee withholding form using airSlate SignNow?

Completing the Arkansas employee withholding form with airSlate SignNow is simple. You can upload the form, fill it out electronically, and add your signature seamlessly. Our platform also allows for easy sharing and storage of completed forms.

-

What are the benefits of using airSlate SignNow for the Arkansas employee withholding form?

Using airSlate SignNow for the Arkansas employee withholding form streamlines the signing process and enhances efficiency. It reduces paper usage, ensures secure storage of documents, and provides a quick way to manage employee forms, offering a more sustainable option for businesses.

-

Are there any fees associated with using airSlate SignNow for employee forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs. There are no hidden fees associated with using the platform to manage the Arkansas employee withholding form, ensuring users receive transparent pricing for their e-signature solutions.

-

Can I integrate airSlate SignNow with other applications for managing the Arkansas employee withholding form?

Yes, airSlate SignNow integrates seamlessly with a variety of applications to enhance your document management process. You can connect it with payroll systems, HR software, and other tools to automate the workflow related to the Arkansas employee withholding form.

-

Is it secure to use airSlate SignNow for the Arkansas employee withholding form?

Absolutely! airSlate SignNow prioritizes security by employing encryption and secure access protocols. This ensures that your Arkansas employee withholding forms and any sensitive employee data remain protected throughout the signing process.

-

Can multiple employees use airSlate SignNow to fill out their Arkansas employee withholding form?

Yes, airSlate SignNow allows multiple employees to fill out and sign their Arkansas employee withholding forms simultaneously. This feature makes it easier for HR teams to manage paperwork efficiently and ensures timely compliance with tax regulations.

Get more for Get The Arkansas State Withholding Form PdfFiller

- Living trust for individual as single divorced or widow or widower with no children louisiana form

- Living trust for individual who is single divorced or widow or widower with children louisiana form

- Living trust for husband and wife with one child louisiana form

- Living trust for husband and wife with minor and or adult children louisiana form

- La trust form

- Living trust property record louisiana form

- Financial account transfer to living trust louisiana form

- Assignment to living trust louisiana form

Find out other Get The Arkansas State Withholding Form PdfFiller

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later