Arkansas GovdfaincometaxSTATE of ARKANSAS AR4EC Employees Withholding Exemption 2022-2026

Understanding the Arkansas AR4EC Employee Withholding Exemption

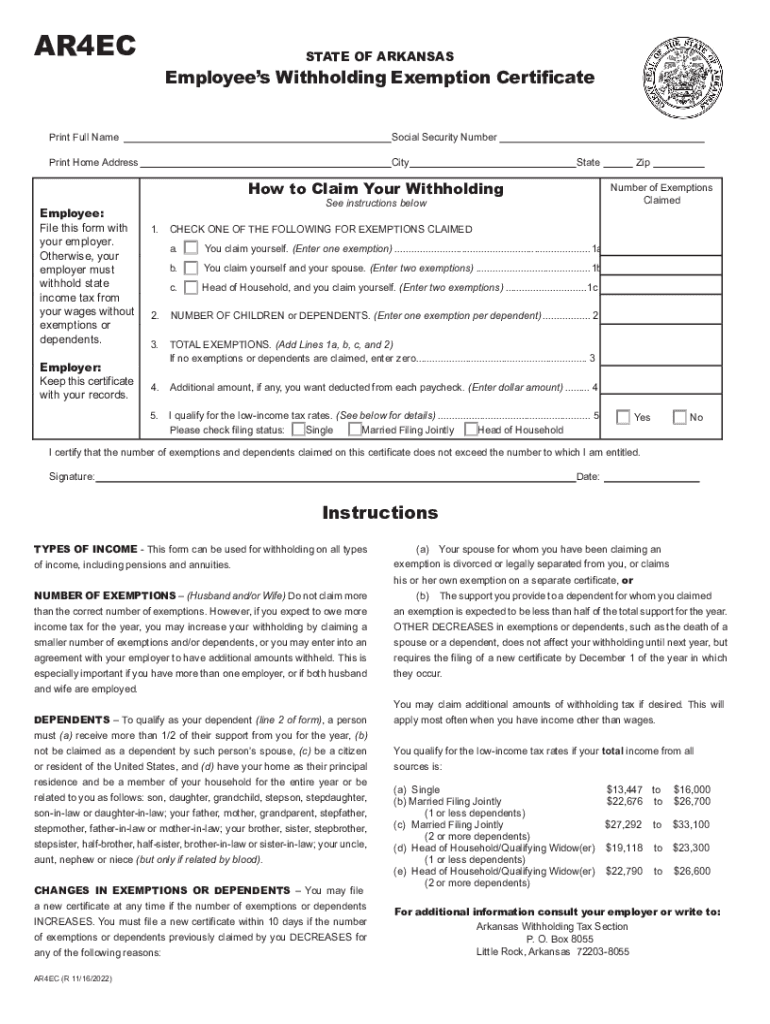

The Arkansas AR4EC form is essential for employees who wish to claim an exemption from state income tax withholding. This form is specifically designed for individuals who meet certain criteria, such as having no tax liability in the previous year and expecting none in the current year. By completing the AR4EC, employees can ensure that their employers do not withhold state income tax from their paychecks, allowing for better cash flow management throughout the year.

Steps to Complete the Arkansas AR4EC Form

Filling out the Arkansas AR4EC form requires careful attention to detail to ensure accuracy. Follow these steps:

- Obtain the AR4EC form from your employer or the Arkansas Department of Finance and Administration website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your eligibility for the exemption by checking the appropriate box.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Eligibility Criteria for the Arkansas AR4EC Exemption

To qualify for the Arkansas AR4EC exemption, employees must meet specific eligibility requirements. These include:

- Having no tax liability in the previous tax year.

- Expecting to owe no state income tax in the current tax year.

- Being a resident of Arkansas or earning income from Arkansas sources.

It is crucial to evaluate your tax situation carefully before claiming this exemption to avoid potential penalties.

Legal Use of the Arkansas AR4EC Form

The Arkansas AR4EC form is legally binding when completed accurately and submitted correctly. It adheres to state tax laws, ensuring that employees who qualify for the exemption can legally avoid state income tax withholding. Employers are required to maintain proper documentation of the forms submitted by their employees and must comply with state regulations regarding tax withholding.

Form Submission Methods for the Arkansas AR4EC

Submitting the Arkansas AR4EC form can be done through various methods, depending on your employer's policies:

- In-Person: Deliver the completed form directly to your employer's HR or payroll department.

- Mail: Send the form via postal service if your employer accepts submissions by mail.

- Digital Submission: Some employers may allow electronic submission through secure portals or email.

It is advisable to confirm the preferred submission method with your employer to ensure proper processing.

Common Scenarios for Using the Arkansas AR4EC Form

Employees in various situations may benefit from the Arkansas AR4EC form. Common scenarios include:

- Recent graduates entering the workforce who may not have tax liabilities.

- Individuals who have experienced significant life changes, such as marriage or retirement, affecting their tax situation.

- Part-time workers or freelancers earning below the taxable threshold.

Understanding how the AR4EC applies to your specific situation can help you make informed decisions regarding your tax withholding.

Quick guide on how to complete arkansasgovdfaincometaxstate of arkansas ar4ec employees withholding exemption

Effortlessly Prepare Arkansas govdfaincometaxSTATE OF ARKANSAS AR4EC Employees Withholding Exemption on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without any holdups. Handle Arkansas govdfaincometaxSTATE OF ARKANSAS AR4EC Employees Withholding Exemption on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Edit and eSign Arkansas govdfaincometaxSTATE OF ARKANSAS AR4EC Employees Withholding Exemption with Ease

- Obtain Arkansas govdfaincometaxSTATE OF ARKANSAS AR4EC Employees Withholding Exemption and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specially provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you prefer to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Arkansas govdfaincometaxSTATE OF ARKANSAS AR4EC Employees Withholding Exemption to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansasgovdfaincometaxstate of arkansas ar4ec employees withholding exemption

Create this form in 5 minutes!

People also ask

-

What is ar4ec 2024 and how does it relate to airSlate SignNow?

Ar4ec 2024 is a forward-thinking initiative designed to streamline eSigning processes for businesses. With airSlate SignNow, you can make the most of the ar4ec 2024 framework to enhance your document workflows, ensuring efficiency and compliance.

-

How much does airSlate SignNow cost under the ar4ec 2024 plan?

The pricing for airSlate SignNow's ar4ec 2024 plan is tailored to fit various business sizes and needs. We offer flexible pricing options, allowing you to choose a package that best meets your requirements while maximizing the value of your investment in eSignature solutions.

-

What features does airSlate SignNow offer in relation to ar4ec 2024?

AirSlate SignNow provides a suite of robust eSigning features that align with the goals of ar4ec 2024. Key features include customizable templates, secure storage, audit trails, and integrations, all designed to enhance your document management experience.

-

What benefits can my business gain from adopting airSlate SignNow for ar4ec 2024?

By adopting airSlate SignNow within the ar4ec 2024 framework, your business can improve operational efficiency and reduce turnaround times for document approvals. Additionally, you'll benefit from enhanced collaboration and improved user experiences, leading to higher satisfaction rates among employees and clients.

-

Is airSlate SignNow compatible with other software under the ar4ec 2024 initiative?

Yes, airSlate SignNow offers seamless integrations with various business applications that are in line with the goals of ar4ec 2024. This compatibility ensures that you can easily connect your existing tools, enhancing your overall workflow efficiency and productivity.

-

Can airSlate SignNow help our business comply with new regulations introduced in ar4ec 2024?

Absolutely! AirSlate SignNow is designed to help businesses stay compliant with current regulations, including those emerging under ar4ec 2024. Our platform provides audit trails and secure encryption, ensuring that your documents meet all necessary regulatory standards.

-

How does airSlate SignNow simplify the eSigning process considering ar4ec 2024?

AirSlate SignNow simplifies the eSigning process by providing an intuitive interface that supports users across various devices. Within the context of ar4ec 2024, this streamlined approach minimizes friction, allowing all stakeholders to sign documents quickly and securely.

Get more for Arkansas govdfaincometaxSTATE OF ARKANSAS AR4EC Employees Withholding Exemption

Find out other Arkansas govdfaincometaxSTATE OF ARKANSAS AR4EC Employees Withholding Exemption

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template