PDF Form it 203 S Group Return for Nonresident Shareholders of New

What is the PDF Form IT 203 S Group Return For Nonresident Shareholders Of New?

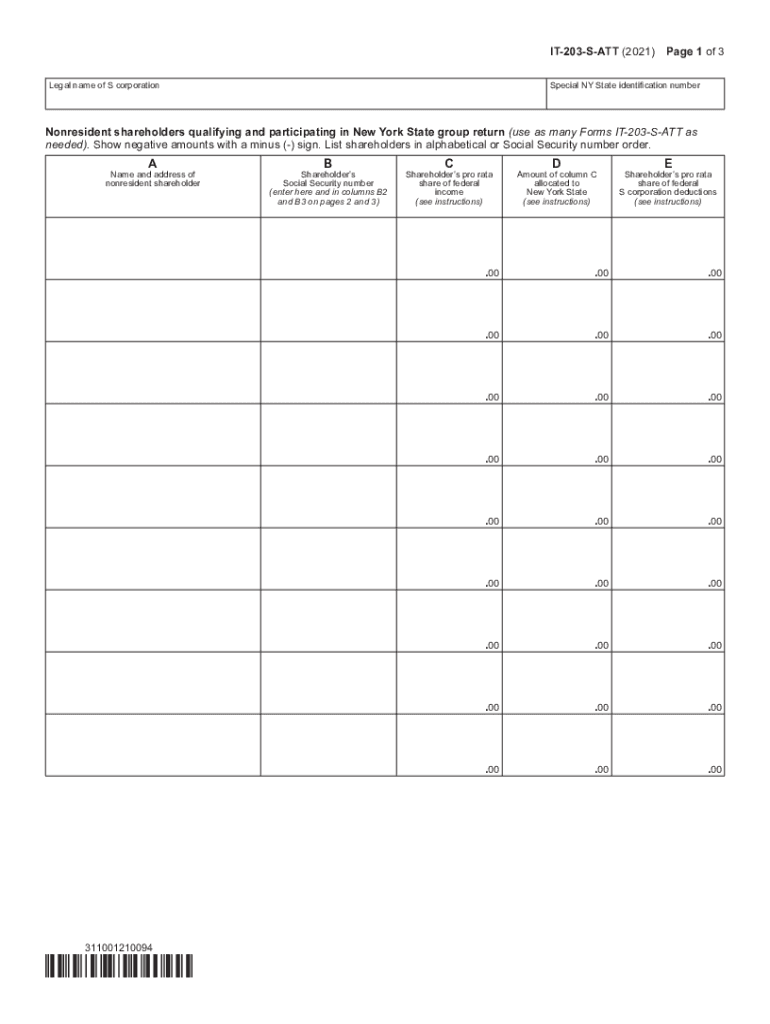

The PDF Form IT 203 S is a group return designed specifically for nonresident shareholders of New York corporations. This form allows eligible corporations to file a single return on behalf of multiple shareholders who do not reside in New York State. By consolidating the information into one return, it simplifies the tax filing process for both the corporation and its nonresident shareholders. This form is particularly useful for foreign investors and corporations with shareholders located outside of the United States, ensuring compliance with state tax regulations while minimizing administrative burdens.

How to use the PDF Form IT 203 S Group Return For Nonresident Shareholders Of New

To effectively use the PDF Form IT 203 S, corporations must first verify their eligibility to file as a group. This involves confirming that all shareholders included in the return meet the criteria set by the New York State Department of Taxation and Finance. Once eligibility is established, the corporation should gather the necessary information for each shareholder, including their names, addresses, and the number of shares held. The form must be completed accurately, ensuring that all required fields are filled out. After completing the form, it should be submitted according to the guidelines provided by the state, either electronically or by mail.

Steps to complete the PDF Form IT 203 S Group Return For Nonresident Shareholders Of New

Completing the PDF Form IT 203 S involves several key steps:

- Gather all necessary information for each nonresident shareholder, including personal details and shareholding information.

- Access the PDF Form IT 203 S from the official New York State Department of Taxation and Finance website.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the state’s e-filing system or mail it to the designated address.

Legal use of the PDF Form IT 203 S Group Return For Nonresident Shareholders Of New

The legal use of the PDF Form IT 203 S is governed by New York State tax laws. This form must be filed in accordance with the regulations set forth by the New York State Department of Taxation and Finance. It is essential that corporations ensure compliance with all applicable laws to avoid potential penalties. The form serves as a legal document that must accurately reflect the tax obligations of the nonresident shareholders, and any discrepancies could lead to legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the PDF Form IT 203 S are critical to ensure compliance with state tax regulations. Typically, the form must be filed by the due date of the corporation's tax return. For most corporations, this is the fifteenth day of the third month following the end of the tax year. It is important for corporations to keep track of these deadlines to avoid late fees and penalties. Additionally, any changes to the tax laws or filing requirements should be monitored to ensure timely submissions.

Key elements of the PDF Form IT 203 S Group Return For Nonresident Shareholders Of New

The key elements of the PDF Form IT 203 S include:

- Shareholder Information: Names, addresses, and shareholding details for each nonresident shareholder.

- Corporate Information: Details about the corporation filing the return, including its name and identification number.

- Income Reporting: Accurate reporting of income allocated to nonresident shareholders.

- Signature Section: Required signatures from authorized representatives of the corporation.

Quick guide on how to complete pdf form it 203 s group return for nonresident shareholders of new

Accomplish PDF Form IT 203 S Group Return For Nonresident Shareholders Of New effortlessly on any device

Online document organization has become increasingly favored by businesses and individuals alike. It offers a seamless eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage PDF Form IT 203 S Group Return For Nonresident Shareholders Of New on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign PDF Form IT 203 S Group Return For Nonresident Shareholders Of New with ease

- Locate PDF Form IT 203 S Group Return For Nonresident Shareholders Of New and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to store your changes.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from whatever device you prefer. Modify and eSign PDF Form IT 203 S Group Return For Nonresident Shareholders Of New and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf form it 203 s group return for nonresident shareholders of new

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an e-signature for a PDF file on Android OS

People also ask

-

What is it 203 s and how does it work?

The term 'it 203 s' refers to a set of features within airSlate SignNow that streamline the eSigning process. With this solution, users can easily create, send, and sign documents electronically, saving time and reducing paper usage. It leverages advanced technology to ensure a secure and efficient signing experience for all parties involved.

-

How much does it cost to use it 203 s?

Pricing for the it 203 s features in airSlate SignNow is quite competitive. We offer different plans tailored to meet the needs of various business sizes, from startups to enterprises. By choosing the plan that best fits your requirements, you can effectively manage costs while maximizing the benefits of our eSigning solution.

-

What are the main features of it 203 s?

The it 203 s functionality includes template creation, bulk sending, and team collaboration on documents. Additionally, it offers reminders, status tracking, and compliance with industry standards. These features collectively simplify the eSigning process, making it accessible for any business user.

-

What are the benefits of using it 203 s for eSigning?

Using it 203 s enhances the efficiency of your document workflows, making it easier to get agreements signed quickly. It reduces overhead costs and minimizes the need for physical resources. Furthermore, businesses experience improved turnaround times, leading to better customer satisfaction.

-

Is it 203 s secure for handling sensitive information?

Absolutely, it 203 s prioritizes security by implementing advanced encryption protocols and secure storage. Our platform adheres to strict compliance regulations to protect sensitive information. Users can confidently send and receive documents without worrying about data bsignNowes.

-

Can it 203 s integrate with other software tools?

Yes, it 203 s easily integrates with popular software solutions like CRM, project management tools, and document storage services. This capability allows businesses to enhance their existing workflows and leverage the complete functionality of airSlate SignNow. Integration ensures seamless transitions between applications.

-

How can I get started with it 203 s?

Getting started with it 203 s is simple! You can sign up for a free trial on our website, where you’ll receive access to all features to explore. Once you're comfortable with the functionalities, you can choose the plan that best suits your business needs.

Get more for PDF Form IT 203 S Group Return For Nonresident Shareholders Of New

Find out other PDF Form IT 203 S Group Return For Nonresident Shareholders Of New

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form