50 771 Property Owner's Motion for Correction of Appraisal Roll Form 50 771 2022-2026

What is the 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771

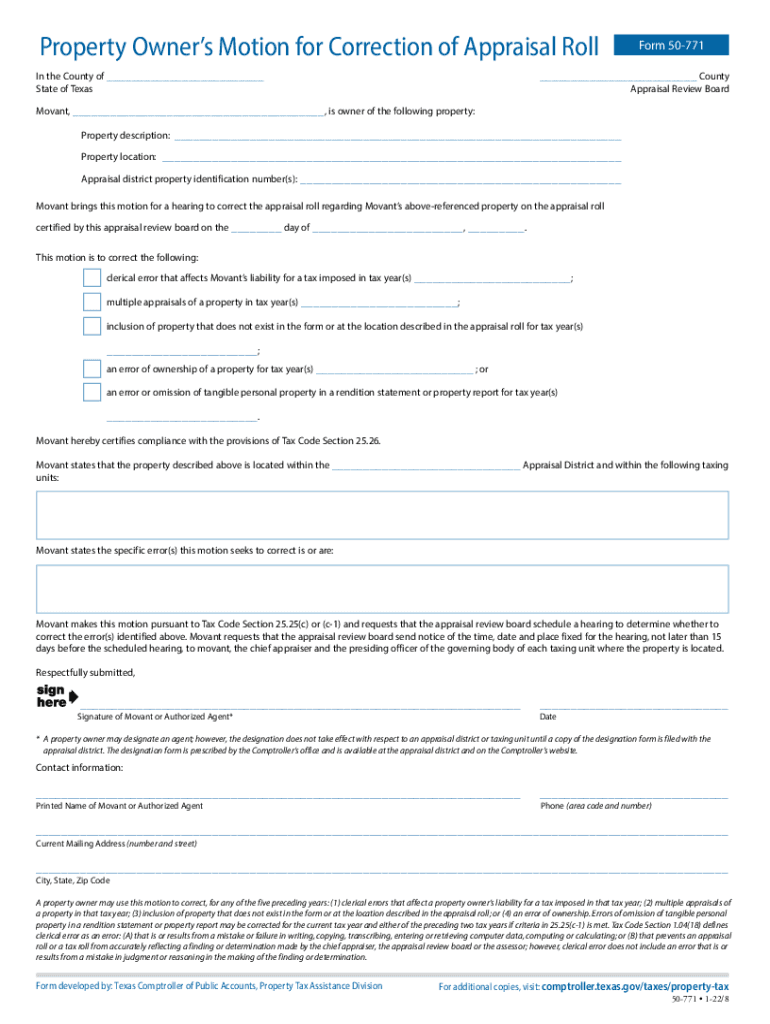

The 50 771 form, officially known as the Property Owner's Motion for Correction of Appraisal Roll, is a legal document used in Texas. This form allows property owners to formally request corrections to their property appraisal records. It is essential for ensuring that property valuations reflect accurate information, which can affect property taxes. The form is typically utilized when discrepancies arise in the appraisal roll, such as incorrect property descriptions, ownership details, or valuation amounts.

How to use the 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771

Using the 50 771 form involves several steps. First, property owners need to gather relevant documentation that supports their claim for correction. This may include previous appraisal notices, tax bills, or any evidence that demonstrates the inaccuracies in the appraisal roll. Once the necessary information is collected, the form should be filled out with accurate details regarding the property in question, including the property address and the specific corrections being requested. After completing the form, it must be submitted to the appropriate appraisal district office.

Steps to complete the 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771

Completing the 50 771 form requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by downloading the 50 771 form from the Texas Comptroller's website or obtaining a physical copy from your local appraisal office.

- Fill in your personal information, including your name, address, and contact details.

- Provide the property details, including the property address and the account number associated with the appraisal.

- Clearly state the reasons for the correction request, specifying what information is incorrect and what the correct information should be.

- Attach any supporting documents that validate your claims.

- Review the completed form for accuracy and completeness before submission.

Legal use of the 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771

The 50 771 form is legally recognized in Texas as a means for property owners to contest inaccuracies in their appraisal records. To ensure its legal validity, the form must be completed in accordance with Texas law. This includes adhering to deadlines for submission, which typically coincide with the appraisal review period. By using this form, property owners can protect their rights and ensure that their property is assessed fairly, which can ultimately affect their tax liabilities.

Key elements of the 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771

Several key elements must be included in the 50 771 form to ensure it is processed correctly. These elements include:

- Property Owner Information: Full name, address, and contact information of the property owner.

- Property Details: Accurate address, account number, and any relevant identification numbers.

- Correction Request: A detailed description of the errors in the appraisal roll and the corrections being requested.

- Supporting Documentation: Any evidence that substantiates the correction request, such as previous appraisals or tax documents.

Eligibility Criteria

To be eligible to file the 50 771 form, property owners must meet certain criteria. They must be the legal owner of the property in question and have a legitimate reason for requesting a correction. This typically includes instances where the appraisal does not accurately reflect the property's value or characteristics. Additionally, property owners must submit the form within the designated time frame established by the appraisal district, usually during the annual appraisal review period.

Quick guide on how to complete 50 771 property owners motion for correction of appraisal roll form 50 771

Effortlessly Prepare 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documentation, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to quickly create, modify, and electronically sign your documents without delays. Manage 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771 across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771 with Ease

- Obtain 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771 and then click Get Form to initiate the process.

- Utilize the provided tools to complete your document.

- Emphasize important parts of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771 and guarantee outstanding communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 50 771 property owners motion for correction of appraisal roll form 50 771

Create this form in 5 minutes!

How to create an eSignature for the 50 771 property owners motion for correction of appraisal roll form 50 771

The way to make an e-signature for your PDF file in the online mode

The way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is texas property correction and how can airSlate SignNow assist with it?

Texas property correction involves rectifying any inaccuracies related to property documents. With airSlate SignNow, you can easily eSign and send documents securely, ensuring that your property records are accurate and compliant with Texas regulations.

-

How much does airSlate SignNow cost for handling texas property correction?

airSlate SignNow offers competitive pricing tailored for businesses needing texas property correction services. Depending on your needs, you can choose from different subscription plans, each designed to provide excellent value while supporting your document management efforts.

-

What features does airSlate SignNow offer for texas property correction?

airSlate SignNow includes features such as secure eSigning, templates for property documents, and cloud storage, making texas property correction streamlined and efficient. These tools enable you to correct property documents quickly while ensuring compliance and security.

-

Can airSlate SignNow integrate with my existing property management software for texas property correction?

Yes, airSlate SignNow offers robust integrations with various property management software. This means you can easily incorporate our eSigning capabilities into your existing workflow, simplifying the texas property correction process.

-

Is airSlate SignNow secure for managing texas property correction documents?

Absolutely! Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to ensure that all documents related to texas property correction are protected from unauthorized access.

-

How does airSlate SignNow streamline the texas property correction process?

With airSlate SignNow, you can automate and simplify document workflows, reducing the time spent on texas property correction. The intuitive interface and easy-to-use features allow users to eSign and send documents quickly, enhancing overall efficiency.

-

What benefits can I expect from using airSlate SignNow for texas property correction?

Using airSlate SignNow for texas property correction provides numerous benefits, including increased accuracy, reduced time for document processing, and enhanced compliance. This results in a smoother experience when managing property-related transactions.

Get more for 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771

- Framing contract for contractor massachusetts form

- Security contract for contractor massachusetts form

- Insulation contract for contractor massachusetts form

- Paving contract for contractor massachusetts form

- Site work contract for contractor massachusetts form

- Siding contract for contractor massachusetts form

- Refrigeration contract for contractor massachusetts form

- Drainage contract for contractor massachusetts form

Find out other 50 771 Property Owner's Motion For Correction Of Appraisal Roll Form 50 771

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later