Corporation Tax Forms PA Department of Revenue 2021-2026

Understanding the Corporation Tax Forms from the PA Department of Revenue

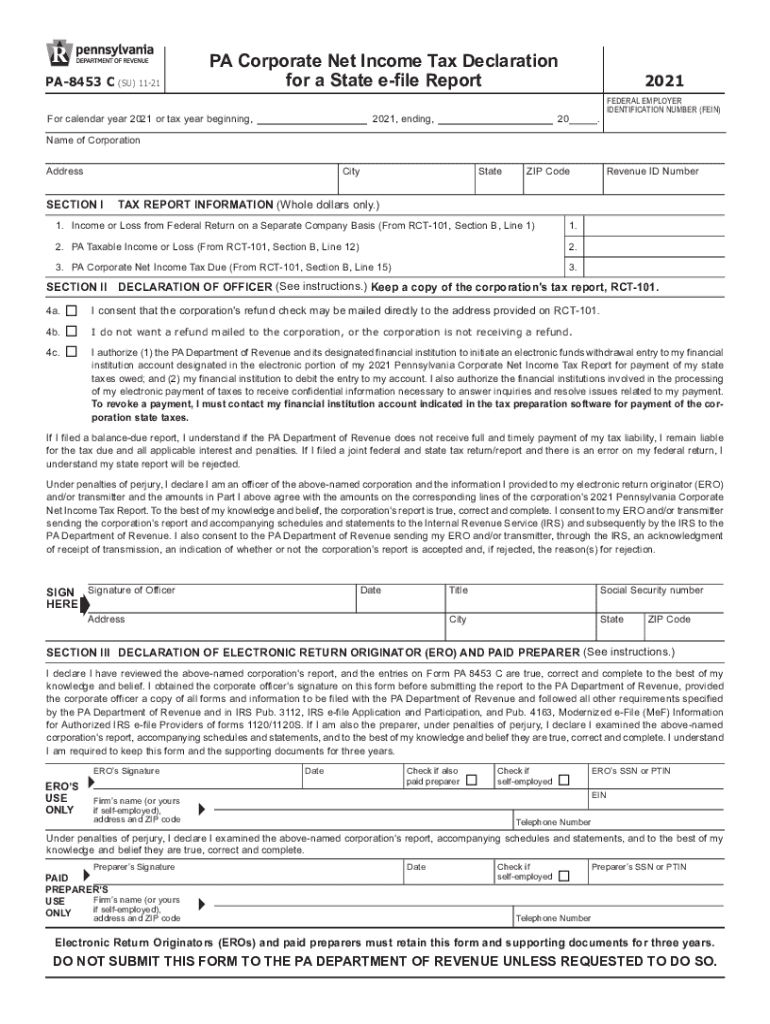

The Corporation Tax Forms issued by the Pennsylvania Department of Revenue are essential for businesses operating within the state. These forms are used to report income, calculate tax liabilities, and ensure compliance with state tax laws. The primary form for corporate tax reporting is the PA-20S/PA-65, which is specifically designed for S corporations and partnerships. Understanding the purpose and requirements of these forms is crucial for accurate tax reporting and avoiding penalties.

Steps to Complete the Corporation Tax Forms from the PA Department of Revenue

Completing the Corporation Tax Forms requires careful attention to detail. Here are the key steps to follow:

- Gather necessary financial documents, including income statements and balance sheets.

- Determine the appropriate form based on your business structure (e.g., PA-20S/PA-65 for S corporations).

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the Corporation Tax Forms from the PA Department of Revenue

The legal use of Corporation Tax Forms is governed by Pennsylvania tax laws. These forms must be completed and filed by all corporations operating in the state, ensuring compliance with local regulations. Failure to file these forms can result in penalties, including fines and interest on unpaid taxes. It is important to understand the legal implications of these forms to maintain good standing with the state.

Required Documents for Corporation Tax Forms from the PA Department of Revenue

When preparing to complete the Corporation Tax Forms, certain documents are required to ensure accurate reporting. These typically include:

- Income statements for the reporting period.

- Balance sheets detailing assets and liabilities.

- Documentation of any deductions or credits being claimed.

- Previous tax returns for reference.

Filing Deadlines for Corporation Tax Forms from the PA Department of Revenue

Timely filing of the Corporation Tax Forms is essential to avoid penalties. The typical deadline for filing is the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable to check for any changes in deadlines or extensions that may be applicable.

Form Submission Methods for Corporation Tax Forms from the PA Department of Revenue

Corporation Tax Forms can be submitted through various methods, allowing flexibility for businesses. The available submission methods include:

- Online submission via the Pennsylvania Department of Revenue’s e-filing system.

- Mailing the completed forms to the appropriate address specified by the Department of Revenue.

- In-person submission at designated Pennsylvania Department of Revenue offices.

Quick guide on how to complete 2020 corporation tax forms pa department of revenue

Effortlessly Prepare Corporation Tax Forms PA Department Of Revenue on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the essential tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Corporation Tax Forms PA Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Corporation Tax Forms PA Department Of Revenue with Ease

- Locate Corporation Tax Forms PA Department Of Revenue and click on Get Form to initiate.

- Make use of the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the specific tools provided by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Corporation Tax Forms PA Department Of Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 corporation tax forms pa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 2020 corporation tax forms pa department of revenue

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF document on Android OS

People also ask

-

What is a 'potvrda o životu na engleskom' and why is it important?

A 'potvrda o životu na engleskom' is a document that certifies an individual's existence, typically required for various legal and administrative purposes. It is important for verifying identity and eligibility for services, particularly in contexts where English documentation is necessary, such as international legal matters.

-

How does airSlate SignNow facilitate obtaining a 'potvrda o životu na engleskom'?

AirSlate SignNow streamlines the process of obtaining a 'potvrda o životu na engleskom' by allowing users to create, sign, and send documents electronically. The platform simplifies the steps, making it easy to gather the required signatures and ensure that the document is legally binding.

-

What features does airSlate SignNow offer for creating a 'potvrda o životu na engleskom'?

AirSlate SignNow offers a variety of features including customizable templates, secure eSignature capabilities, and real-time tracking. These features help ensure that your 'potvrda o životu na engleskom' is completed efficiently and securely, allowing users to manage their documents with ease.

-

Is there a cost associated with creating a 'potvrda o životu na engleskom' using airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model that offers cost-effective plans for businesses of all sizes. The pricing varies based on the features you choose, but creating a 'potvrda o životu na engleskom' can be done affordably, ensuring value for your documentation needs.

-

Can I integrate airSlate SignNow with other applications to manage 'potvrda o životu na engleskom'?

Absolutely! AirSlate SignNow offers integrations with numerous applications and services. This allows you to streamline your workflow for managing a 'potvrda o životu na engleskom' by linking it with your existing systems, enhancing productivity.

-

What benefits does using airSlate SignNow provide for eSigning a 'potvrda o životu na engleskom'?

Using airSlate SignNow for eSigning a 'potvrda o životu na engleskom' provides several benefits including faster turnaround times, enhanced security, and improved document tracking. This ensures that your document remains accessible and compliant with legal standards.

-

How secure is the airSlate SignNow platform for handling sensitive documents like 'potvrda o životu na engleskom'?

AirSlate SignNow prioritizes security by implementing industry-standard encryption and authentication measures. This ensures that your 'potvrda o životu na engleskom' is securely handled, safeguarding sensitive information throughout the document lifecycle.

Get more for Corporation Tax Forms PA Department Of Revenue

- Massachusetts affidavit form

- Entry of special appearance massachusetts form

- Ma corporation 497309585 form

- Substantial completion form

- Ma quitclaim deed form

- Warranty deed from individual to individual massachusetts form

- Quitclaim deed husband and wife to trust massachusetts form

- Discovery interrogatories from plaintiff to defendant with production requests massachusetts form

Find out other Corporation Tax Forms PA Department Of Revenue

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now