PA Corporate Net Income Tax Declaration for a State E File Report PA 8453 C PA Department of Revenue 2020

What is the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

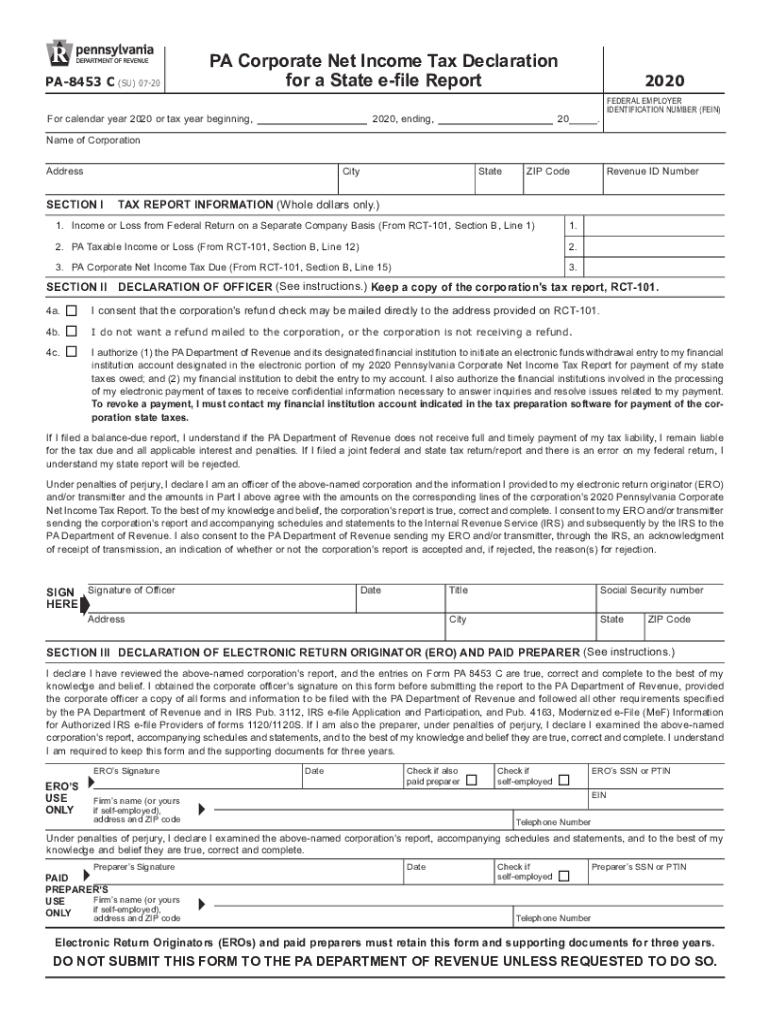

The PA Corporate Net Income Tax Declaration for a State E-file Report PA 8453 C is a crucial document required by the Pennsylvania Department of Revenue. This form serves as a declaration for corporate net income tax when filing electronically. It ensures that the submitted electronic return is valid and compliant with state tax regulations. By utilizing this form, businesses can confirm their intent to file electronically and provide necessary information for processing their tax returns.

Steps to complete the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

Completing the PA Corporate Net Income Tax Declaration requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and balance sheets.

- Fill out the PA 8453 C form accurately, ensuring all required fields are completed.

- Review the information for accuracy to avoid potential issues with your tax return.

- Sign the form electronically using a secure eSignature solution to validate your submission.

- Submit the completed form along with your electronic tax return to the Pennsylvania Department of Revenue.

Legal use of the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

The PA Corporate Net Income Tax Declaration is legally binding when completed and signed according to the requirements set forth by the Pennsylvania Department of Revenue. To ensure its validity, businesses must adhere to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). By utilizing a compliant eSignature platform, businesses can ensure their submissions are recognized as legally enforceable.

Key elements of the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

Understanding the key elements of the PA 8453 C form is essential for proper completion. The form typically includes:

- Taxpayer identification information, including name and address.

- Details regarding the corporate entity, such as the type of business and federal employer identification number (EIN).

- Confirmation of the electronic filing method selected.

- Signature fields for electronic validation.

How to obtain the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

The PA Corporate Net Income Tax Declaration can be obtained through the Pennsylvania Department of Revenue's official website. Businesses can access the form in a downloadable format, making it easy to fill out electronically. Additionally, many tax preparation software solutions include the PA 8453 C form as part of their offerings, streamlining the filing process for users.

Filing Deadlines / Important Dates

It is important for businesses to be aware of filing deadlines associated with the PA Corporate Net Income Tax Declaration. Typically, the deadline for filing corporate tax returns in Pennsylvania is the fifteenth day of the fourth month following the end of the fiscal year. Businesses should also consider any extensions that may apply, ensuring timely submission to avoid penalties.

Quick guide on how to complete 2020 pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue

Effortlessly Prepare PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

Steps to Modify and eSign PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue with Ease

- Locate PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searching, or mistakes necessitating the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 2020 pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue

The way to create an e-signature for a PDF online

The way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to 8453 c?

airSlate SignNow is an eSignature solution designed to empower businesses by simplifying the process of sending and signing documents electronically. The term '8453 c' refers to specific IRS forms that can benefit from digital signatures, streamlining tax-related processes for organizations.

-

How does airSlate SignNow ensure the security of documents, including those related to 8453 c?

Security is a top priority at airSlate SignNow, especially for sensitive documents such as the 8453 c forms. We incorporate advanced encryption, secure data storage, and compliance with industry standards to ensure your documents are safe from unauthorized access.

-

What are the pricing options for airSlate SignNow for handling 8453 c documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. For handling documents like 8453 c, you can choose a plan that fits your needs, whether it's monthly or annual billing, ensuring cost-effectiveness and value for your investment.

-

Can airSlate SignNow be integrated with other software for managing 8453 c?

Yes, airSlate SignNow easily integrates with various software solutions, enhancing your workflow. This allows you to seamlessly manage 8453 c documents alongside your existing systems, boosting productivity and making document handling more efficient.

-

What features does airSlate SignNow provide for signing 8453 c forms?

airSlate SignNow offers intuitive features such as customizable templates, in-person signing options, and audit trails. These features simplify the signing process for 8453 c forms, ensuring compliance and efficiency for your business transactions.

-

Is airSlate SignNow user-friendly for completing 8453 c documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete 8453 c documents without extensive training. Our intuitive interface guides users through the process, ensuring a smooth and hassle-free experience.

-

What benefits does airSlate SignNow offer for businesses utilizing 8453 c?

Using airSlate SignNow for 8453 c documents enhances efficiency, reduces processing time, and minimizes paper usage. The convenience of electronic signatures also streamlines workflows, allowing businesses to stay compliant and focused on growth.

Get more for PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

- Ca business llc 497298283 form

- 10 day work california form

- Trust to individual 497298285 form

- Grant deed one individual to two individuals california form

- 10 day stop work order business entity corporation or llc california form

- Notice 10 day form

- Quitclaim deed four individuals to one individual california form

- Special warranty deed two individuals to husband and wife california form

Find out other PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT