Individual E File Signature Form VA 8879 Virginia Tax 2021

Understanding the Individual E-File Signature Form VA 8879

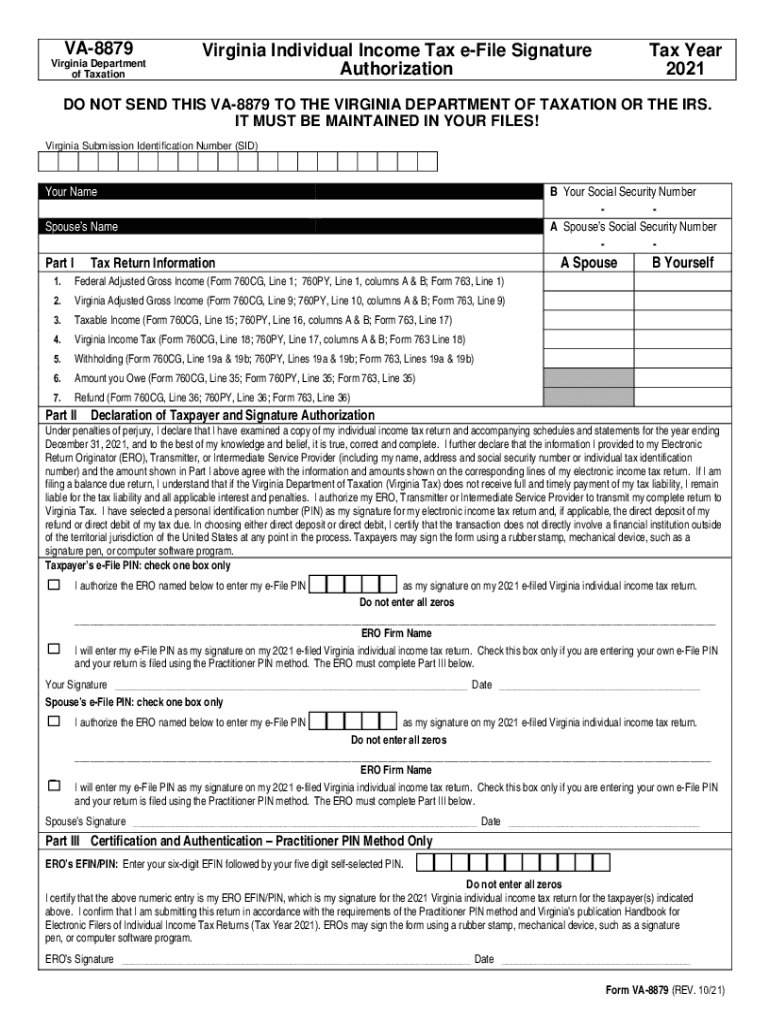

The VA 8879 form, known as the Individual E-File Signature Form, is essential for Virginia taxpayers who wish to electronically file their individual income tax returns. This form serves as an authorization for the e-filing of tax returns and is crucial for ensuring compliance with state regulations. By signing this form, taxpayers confirm their intention to file electronically and agree to the accuracy of the information provided in their tax return.

Steps to Complete the Individual E-File Signature Form VA 8879

Completing the VA 8879 form involves several straightforward steps:

- Begin by downloading the VA 8879 form from the appropriate state tax authority website.

- Fill in your personal information, including your name, address, and Social Security number.

- Review the details of your tax return to ensure accuracy.

- Sign and date the form to authorize the e-filing of your tax return.

- Submit the completed form to your tax preparer or e-filing software, as instructed.

Legal Use of the Individual E-File Signature Form VA 8879

The VA 8879 form is legally binding, provided it is completed correctly. It complies with the IRS guidelines for electronic signatures, ensuring that the e-filing process is secure and valid. This form allows taxpayers to electronically sign their tax returns, which is recognized by the state of Virginia and the IRS as a legitimate signature. It is important to retain a copy of the signed form for your records, as it serves as proof of authorization for the e-filing.

Key Elements of the Individual E-File Signature Form VA 8879

Several key elements are essential when filling out the VA 8879 form:

- Taxpayer Information: Accurate personal details, including name and Social Security number.

- Tax Return Information: Confirmation of the tax return being filed electronically.

- Signature: The taxpayer's signature, which must be dated.

- Tax Preparer Information: If applicable, details of the tax preparer must be included.

Obtaining the Individual E-File Signature Form VA 8879

The VA 8879 form can be obtained easily through the Virginia Department of Taxation's website or from your tax software if you are using one. It is advisable to ensure you are using the most current version of the form to comply with any updates in tax regulations. Once accessed, the form can be printed for completion or filled out digitally if your software supports it.

Filing Deadlines and Important Dates for VA 8879

Taxpayers must be aware of the filing deadlines associated with the VA 8879 form. Generally, the deadline for filing individual income tax returns in Virginia aligns with the federal tax deadline, which is typically April 15. If you are filing for an extension, be sure to submit the VA 8879 form by the extended deadline to avoid penalties.

Quick guide on how to complete individual e file signature form va 8879 virginia tax

Complete Individual E File Signature Form VA 8879 Virginia Tax effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Individual E File Signature Form VA 8879 Virginia Tax on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The optimal method to edit and eSign Individual E File Signature Form VA 8879 Virginia Tax seamlessly

- Locate Individual E File Signature Form VA 8879 Virginia Tax and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Leave behind the hassle of lost or misfiled documents, the tedious search for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and eSign Individual E File Signature Form VA 8879 Virginia Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual e file signature form va 8879 virginia tax

Create this form in 5 minutes!

How to create an eSignature for the individual e file signature form va 8879 virginia tax

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the va 8879 form used for?

The va 8879 form, also known as the e-file Signature Authorization, is essential for taxpayers seeking to electronically file their returns. It allows taxpayers to authorize e-filing of their tax returns by providing their electronic signatures. Using airSlate SignNow, signing and managing your va 8879 form becomes seamless and efficient.

-

How can airSlate SignNow simplify the signing of the va 8879?

With airSlate SignNow, you can send the va 8879 form for electronic signature effortlessly. Our platform ensures that the document is securely signed in compliance with tax regulations. You’ll save time and reduce paperwork by utilizing our user-friendly eSigning feature.

-

Is there a cost associated with using airSlate SignNow for the va 8879?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes to manage documents like the va 8879. We provide flexible subscription models, making it affordable to integrate eSigning into your document management. You can easily choose a plan that fits your needs.

-

Are there any benefits of using airSlate SignNow for the va 8879 over traditional methods?

Yes, using airSlate SignNow for the va 8879 offers signNow benefits over traditional signing methods. It eliminates the need for printing, signing, and scanning documents, streamlining the entire process. Additionally, it enhances security and compliance with built-in audit trails for your eSigned documents.

-

What features does airSlate SignNow provide for handling the va 8879?

airSlate SignNow includes robust features to assist you in managing the va 8879 effectively. Key features include templates for quick access, reminders for signers, and the ability to store signed documents securely in the cloud. These tools help ensure that your e-filing process is efficient and organized.

-

Can I integrate airSlate SignNow with other software for processing the va 8879?

Absolutely! airSlate SignNow offers seamless integrations with various tax preparation and document management software. This means you can easily incorporate your workflow for the va 8879 into your existing systems, enhancing operational efficiency and reducing the need for manual data entry.

-

What is the turnaround time for signing the va 8879 with airSlate SignNow?

The turnaround time for signing the va 8879 with airSlate SignNow is extremely quick. Once the document is sent to the signer, they can complete the signing process in minutes. This speed greatly simplifies the e-filing process and helps you meet deadlines efficiently.

Get more for Individual E File Signature Form VA 8879 Virginia Tax

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential massachusetts form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property massachusetts form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497309728 form

- Ma termination form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497309732 form

- Ma lease tenant form

- Massachusetts provisions form

- Ma provisions form

Find out other Individual E File Signature Form VA 8879 Virginia Tax

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy