TAXABLE YEAR SCHEDULE California Capital Gain or Loss Form

What is the 540NR Schedule D?

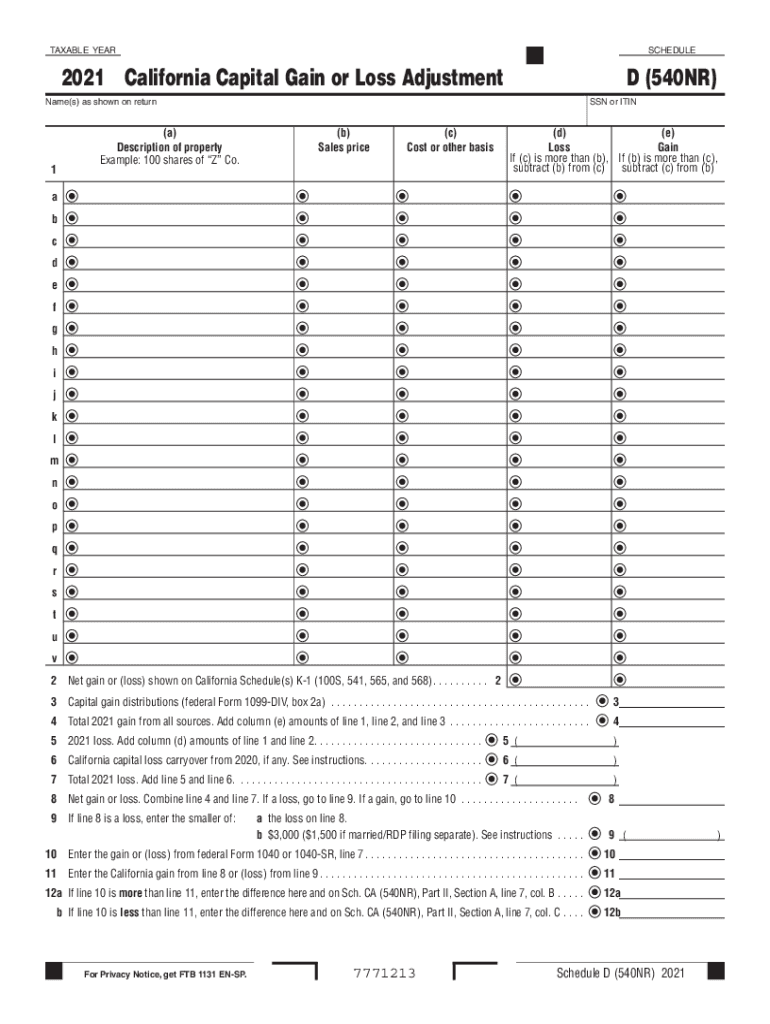

The 540NR Schedule D is a tax form used by non-resident individuals in California to report capital gains and losses. This form is part of the California state tax return process and is specifically designed for those who have earned income from California sources but do not reside in the state. It helps in calculating the tax owed on capital gains from the sale of assets, such as stocks, real estate, or other investments.

Steps to Complete the 540NR Schedule D

Completing the 540NR Schedule D involves several key steps:

- Gather all relevant financial documents, including records of asset sales, purchase prices, and dates of transactions.

- Calculate your total capital gains and losses by subtracting the purchase price from the sale price for each asset.

- Fill out the form by entering your total gains and losses in the appropriate sections.

- Ensure that you accurately report any adjustments, such as carryover losses from previous years.

- Review the completed form for accuracy before submission.

Legal Use of the 540NR Schedule D

The 540NR Schedule D must be completed and submitted in compliance with California tax laws. The form is legally binding when signed and submitted, and it is essential to ensure that all information is accurate to avoid potential penalties. Digital signatures are accepted, provided they meet the legal requirements outlined by the state. Using a reliable eSignature solution can help ensure compliance and security when submitting your tax forms.

Filing Deadlines / Important Dates

Filing deadlines for the 540NR Schedule D typically align with the general tax return deadlines in California. For most taxpayers, the deadline is April 15 of the year following the tax year being reported. It is crucial to be aware of any extensions or changes to deadlines, especially for non-residents, as these may vary based on individual circumstances or state regulations.

Required Documents

To complete the 540NR Schedule D, you will need several documents, including:

- Records of all asset sales, including purchase and sale prices.

- Documentation of any carryover losses from previous tax years.

- Any relevant tax forms that report income from California sources.

Examples of Using the 540NR Schedule D

Common scenarios for using the 540NR Schedule D include:

- Non-residents who sell California real estate and need to report capital gains.

- Individuals who sell stocks or bonds that were purchased while residing outside California but sold during the tax year.

- Taxpayers who have incurred capital losses from investments that can offset gains reported on the form.

Quick guide on how to complete taxable year schedule 2012 california capital gain or loss

Prepare TAXABLE YEAR SCHEDULE California Capital Gain Or Loss seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage TAXABLE YEAR SCHEDULE California Capital Gain Or Loss on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign TAXABLE YEAR SCHEDULE California Capital Gain Or Loss effortlessly

- Obtain TAXABLE YEAR SCHEDULE California Capital Gain Or Loss and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight key sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from a device of your choice. Edit and eSign TAXABLE YEAR SCHEDULE California Capital Gain Or Loss and ensure efficient communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxable year schedule 2012 california capital gain or loss

How to generate an e-signature for a PDF document online

How to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

How to make an e-signature for a PDF file on Android OS

People also ask

-

What is the 540nr schedule d?

The 540nr schedule d is a form used by non-resident taxpayers in California to report capital gains and losses. It is essential for accurately reflecting your financial situation when filing state taxes, especially if you have sold assets during the tax year.

-

How do I fill out the 540nr schedule d using airSlate SignNow?

Filling out the 540nr schedule d with airSlate SignNow is streamlined with our easy-to-use platform. You can upload your tax documents, fill in the necessary details electronically, and utilize eSignatures for a legally binding submission.

-

What features does airSlate SignNow offer for managing 540nr schedule d documents?

airSlate SignNow offers features like document sharing, real-time collaboration, and secure eSigning, making managing your 540nr schedule d simple and efficient. You can also track document status and get notified once your forms are signed.

-

Is there a cost to use airSlate SignNow for my 540nr schedule d?

Yes, airSlate SignNow offers various pricing plans tailored to fit the needs of individuals and businesses. By selecting a plan, you gain access to unlimited document signing and advanced features that help you efficiently manage your 540nr schedule d.

-

Can I integrate airSlate SignNow with other applications for my 540nr schedule d?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive and Dropbox, allowing you to easily store and manage your 540nr schedule d alongside other important documents in your preferred platforms.

-

What are the benefits of using airSlate SignNow for my 540nr schedule d?

Using airSlate SignNow for your 540nr schedule d offers several benefits, including enhanced security, efficient document handling, and reduced turnaround time for eSigning. This means you can focus on other areas of your tax preparation with confidence.

-

How secure is airSlate SignNow when handling my 540nr schedule d?

AirSlate SignNow prioritizes the security of your documents. We use advanced encryption technologies and comply with industry regulations to ensure your 540nr schedule d is handled with maximum confidentiality and protection.

Get more for TAXABLE YEAR SCHEDULE California Capital Gain Or Loss

- Massachusetts name change 497309875 form

- Family name change 497309876 form

- Change name minor massachusetts form

- Name change minor 497309878 form

- Massachusetts note 497309879 form

- Massachusetts installments fixed rate promissory note secured by residential real estate massachusetts form

- Massachusetts installments fixed rate promissory note secured by personal property massachusetts form

- Ma note form

Find out other TAXABLE YEAR SCHEDULE California Capital Gain Or Loss

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT