Form 1 NRPY Massachusetts NonresidentPart Year

What is the Form 1 NRPY Massachusetts Nonresident Part Year?

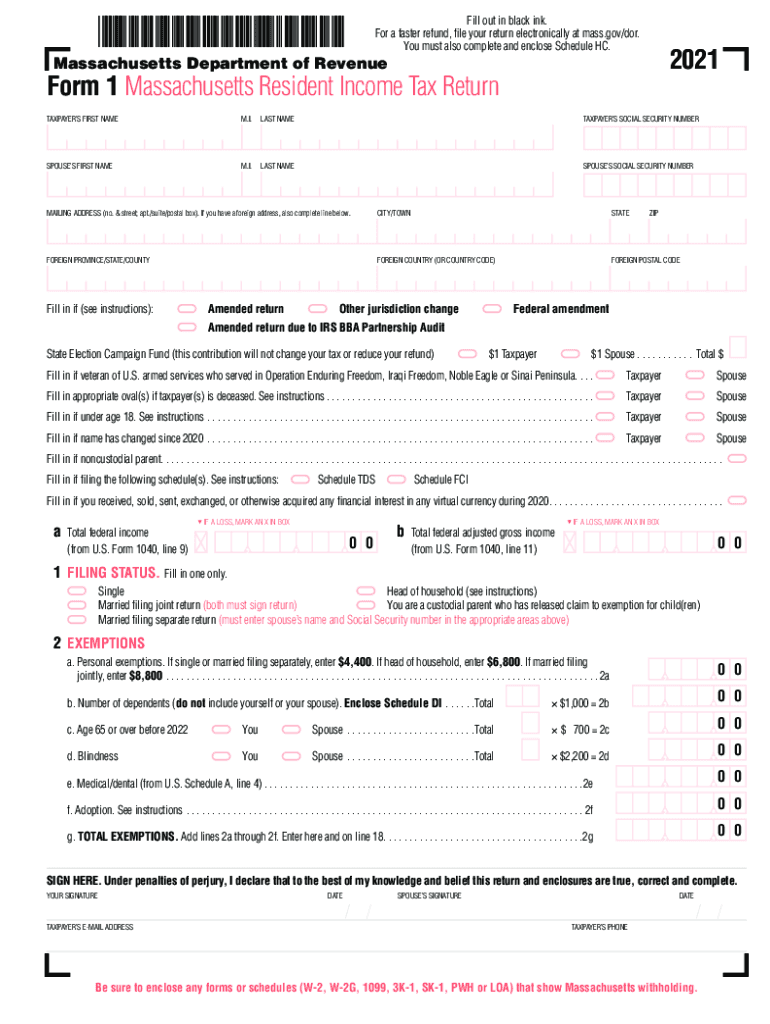

The Form 1 NRPY is a tax return specifically designed for nonresident and part-year residents of Massachusetts. This form is essential for individuals who earned income in Massachusetts but do not reside in the state for the entire year. It allows these taxpayers to report their income accurately and ensures compliance with Massachusetts tax laws. Understanding the purpose of this form is crucial for anyone who fits this category, as it directly impacts their tax obligations and potential refunds.

Steps to Complete the Form 1 NRPY Massachusetts Nonresident Part Year

Completing the Form 1 NRPY involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the period during which you were a resident of Massachusetts.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income earned while in Massachusetts, ensuring to include only the income that is taxable in the state.

- Calculate your tax liability using the appropriate tax rates and deductions applicable to nonresidents.

- Review the form for accuracy and completeness before submission.

Legal Use of the Form 1 NRPY Massachusetts Nonresident Part Year

The Form 1 NRPY is legally recognized for tax reporting purposes in Massachusetts. It must be completed accurately to reflect the taxpayer's income and residency status. Failure to use this form correctly can lead to penalties and interest on unpaid taxes. Additionally, the form must comply with state regulations regarding electronic signatures and submissions, ensuring that all necessary legal requirements are met.

Filing Deadlines / Important Dates

Timely filing of the Form 1 NRPY is crucial to avoid penalties. The typical deadline for submission is April 15 of the year following the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to state directives or extensions that may apply to specific circumstances.

Required Documents

To complete the Form 1 NRPY, several documents are necessary:

- W-2 forms from all employers for the tax year.

- 1099 forms for any freelance or contract work.

- Records of any other income earned during the year.

- Documentation of residency status, including dates of residency in Massachusetts.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form 1 NRPY through various methods. The form can be filed electronically via the Massachusetts Department of Revenue's online portal, which offers a streamlined process for submission. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided by the state. In-person submission is also an option at designated tax offices, which can be beneficial for those needing assistance with the filing process.

Quick guide on how to complete 2021 form 1 nrpy massachusetts nonresidentpart year

Complete Form 1 NRPY Massachusetts NonresidentPart Year effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly without delays. Handle Form 1 NRPY Massachusetts NonresidentPart Year on any device with airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to edit and eSign Form 1 NRPY Massachusetts NonresidentPart Year with ease

- Find Form 1 NRPY Massachusetts NonresidentPart Year and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1 NRPY Massachusetts NonresidentPart Year and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1 nrpy massachusetts nonresidentpart year

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an e-signature for a PDF file on Android

People also ask

-

What is the massachusetts state tax form 2021?

The massachusetts state tax form 2021 is a document used by residents to report their income and calculate state tax obligations for the fiscal year. It specifically relates to income earned during 2021 and must be filed by the designated deadline to avoid penalties. Users can find the form on the Massachusetts Department of Revenue's website and can fill it out electronically using tools like airSlate SignNow.

-

How do I complete the massachusetts state tax form 2021?

To complete the massachusetts state tax form 2021, gather all necessary financial documents including W-2s, 1099s, and other income statements. You can then use airSlate SignNow to fill out the form digitally, ensuring that you provide accurate information and calculations. Once completed, the form can be electronically signed and submitted.

-

Is there a cost associated with filing the massachusetts state tax form 2021 using airSlate SignNow?

Filing the massachusetts state tax form 2021 using airSlate SignNow is generally cost-effective. airSlate SignNow offers flexible pricing plans that cater to different needs, allowing users to select a plan that fits their budget. Many customers find that the convenience and efficiency offered by our platform make it well worth the investment.

-

What features does airSlate SignNow offer for the massachusetts state tax form 2021?

airSlate SignNow provides a range of features designed to simplify the filing process for the massachusetts state tax form 2021. With user-friendly templates, electronic signatures, and automated workflows, users can easily prepare and submit their tax forms without hassle. Additionally, our platform ensures that documents are secure and compliant with regulatory standards.

-

Can I integrate airSlate SignNow with other software for my massachusetts state tax form 2021?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software, facilitating the efficient preparation of the massachusetts state tax form 2021. This feature allows you to import data directly from other platforms, reducing manual entry and the potential for errors. Explore our integration options to find the best solutions for your needs.

-

What benefits does airSlate SignNow provide when filing the massachusetts state tax form 2021?

Using airSlate SignNow for the massachusetts state tax form 2021 offers a plethora of benefits, including increased accuracy, reduced processing time, and enhanced security. Our eSignature technology ensures that your documents are signed quickly and securely, while automated reminders help you stay on track with filing deadlines. The overall experience is streamlined, making tax season less stressful.

-

How can I track the status of my massachusetts state tax form 2021 after submitting?

Once you submit your massachusetts state tax form 2021 using airSlate SignNow, you can easily track the status of your submission through our platform. Real-time notifications will inform you when your document is viewed or signed, providing peace of mind throughout the process. This transparency ensures that you are always informed about your filing status.

Get more for Form 1 NRPY Massachusetts NonresidentPart Year

- Legal last will and testament form for single person with adult children massachusetts

- Legal last will and testament for married person with minor children from prior marriage massachusetts form

- Legal last will and testament for civil union partner with minor children from prior marriage massachusetts form

- Legal last will and testament form for married person with adult children from prior marriage massachusetts

- Legal last will and testament form for divorced person not remarried with adult children massachusetts

- Massachusetts legal marriage form

- Legal last will and testament form for divorced person not remarried with no children massachusetts

- Legal last will and testament form for divorced person not remarried with minor children massachusetts

Find out other Form 1 NRPY Massachusetts NonresidentPart Year

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself