Massachusetts Department of Revenue Form M 8379 Nondebtor

What is the Massachusetts Department of Revenue Form M-8379 Nondebtor?

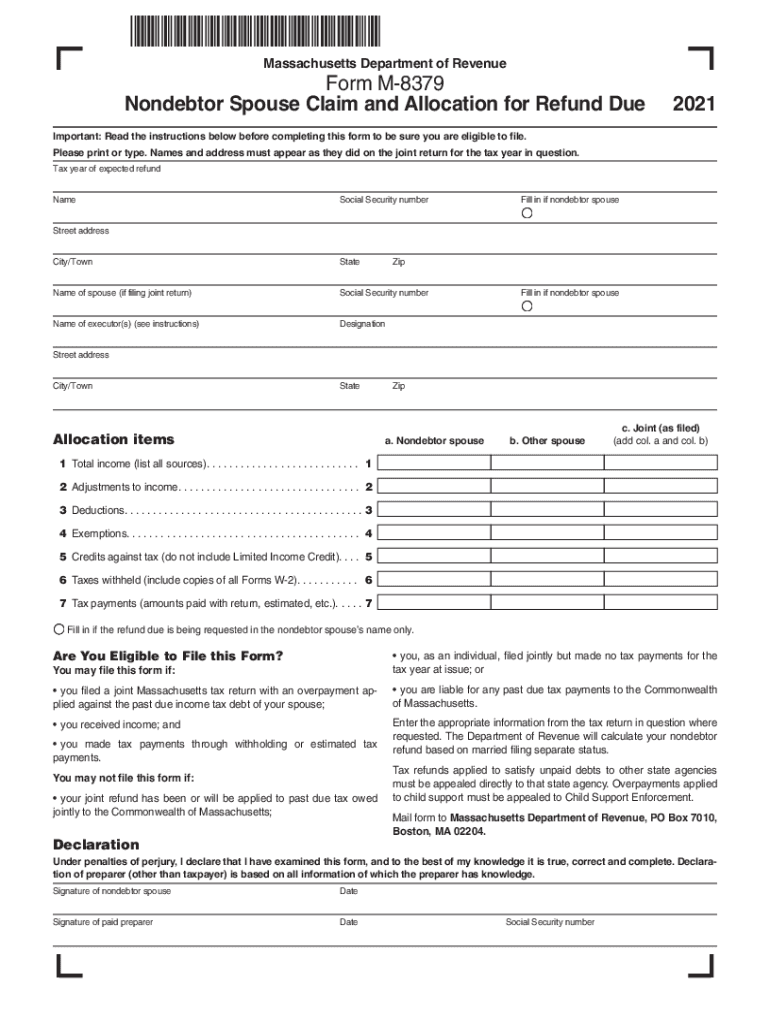

The Massachusetts Department of Revenue Form M-8379 is designed for nondebtor spouses to claim their share of a tax refund that may be withheld due to the debts of their partner. This form is particularly relevant for couples filing jointly, where one spouse has outstanding tax obligations. By using the M-8379 form, the nondebtor spouse can assert their right to a portion of the refund, ensuring they are not unfairly penalized for the other's financial responsibilities.

Steps to Complete the Massachusetts Department of Revenue Form M-8379 Nondebtor

Completing the Massachusetts M-8379 form involves several important steps:

- Gather necessary personal information, including Social Security numbers for both spouses and details of the tax return.

- Clearly indicate the amount of the refund you believe you are entitled to, based on your income and contributions.

- Provide any required documentation that supports your claim, such as proof of income or tax payments.

- Sign and date the form, ensuring that both spouses review the information for accuracy.

How to Obtain the Massachusetts Department of Revenue Form M-8379 Nondebtor

The Massachusetts M-8379 form can be obtained directly from the Massachusetts Department of Revenue website. It is available in a downloadable PDF format, which can be printed for completion. Additionally, physical copies may be requested through local tax offices or by contacting the Department of Revenue directly.

Eligibility Criteria for the Massachusetts Department of Revenue Form M-8379 Nondebtor

To be eligible to file the M-8379 form, the nondebtor spouse must meet certain criteria:

- Be legally married to the debtor spouse at the time of filing.

- Have filed a joint tax return with the debtor spouse.

- Demonstrate that they are entitled to a portion of the tax refund based on their income and contributions to the household.

Legal Use of the Massachusetts Department of Revenue Form M-8379 Nondebtor

The M-8379 form is legally recognized as a valid claim for a nondebtor spouse seeking their fair share of a tax refund. It is essential that the form is completed accurately and submitted in accordance with Massachusetts tax laws. Compliance with legal requirements ensures that the claim is processed effectively, protecting the rights of the nondebtor spouse.

Form Submission Methods for the Massachusetts Department of Revenue Form M-8379 Nondebtor

The completed Massachusetts M-8379 form can be submitted in various ways:

- Online submission through the Massachusetts Department of Revenue’s e-filing system, if applicable.

- Mailing the form to the appropriate address provided by the Department of Revenue.

- In-person submission at designated tax offices for immediate processing.

Quick guide on how to complete massachusetts department of revenue form m 8379 nondebtor

Complete Massachusetts Department Of Revenue Form M 8379 Nondebtor effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Massachusetts Department Of Revenue Form M 8379 Nondebtor on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Massachusetts Department Of Revenue Form M 8379 Nondebtor with ease

- Obtain Massachusetts Department Of Revenue Form M 8379 Nondebtor and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive data with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Massachusetts Department Of Revenue Form M 8379 Nondebtor and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 8379 nondebtor

How to make an e-signature for a PDF file in the online mode

How to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the 2021 8379 claim, and why is it important?

The 2021 8379 claim is a form used for filing tax refunds for injured spouses. It is crucial for individuals who want to protect their portion of a tax refund from being applied to a partner's tax debts. Understanding how to fill out and submit this claim can prevent unwanted financial complications.

-

How can airSlate SignNow help with the 2021 8379 claim process?

airSlate SignNow simplifies the process of completing a 2021 8379 claim by allowing users to electronically sign and send documents securely. The platform streamlines document management, ensuring you're ready to submit your claim quickly and efficiently. With easy templates, it eliminates errors often found in paper submissions.

-

What features does airSlate SignNow offer for managing the 2021 8379 claim?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure eSigning options, all designed to facilitate the 2021 8379 claim process. Users can also store documents safely and access them from any device, making it convenient to manage the necessary paperwork. These features enhance efficiency and reduce processing time.

-

Is airSlate SignNow cost-effective for filing my 2021 8379 claim?

Yes, airSlate SignNow provides a cost-effective solution for managing your 2021 8379 claim. With flexible pricing plans, businesses can choose the option that best fits their needs without overspending. This affordability is ideal for both individuals and companies looking to streamline their tax refund processes.

-

Does airSlate SignNow integrate with other tools for the 2021 8379 claim?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easier to handle your 2021 8379 claim alongside your other financial tools. This integration ensures that all relevant data is accessible in one place, improving your overall document management experience.

-

What are the benefits of using airSlate SignNow for my 2021 8379 claim?

Using airSlate SignNow for your 2021 8379 claim offers numerous benefits, such as saving time and reducing paperwork hassles. The platform’s user-friendly interface allows for quick document preparation and submission, which can expedite your claim process. Additionally, enhanced security features protect your sensitive information.

-

Can I track the status of my 2021 8379 claim with airSlate SignNow?

Yes, airSlate SignNow provides tracking functionality for documents, allowing you to monitor the status of your 2021 8379 claim in real-time. Users receive notifications when documents are viewed or signed, ensuring you are always informed about your claim's progress. This feature enhances communication and accountability.

Get more for Massachusetts Department Of Revenue Form M 8379 Nondebtor

- Bill of sale for automobile or vehicle including odometer statement and promissory note maryland form

- Promissory note in connection with sale of vehicle or automobile maryland form

- Bill of sale for watercraft or boat maryland form

- Bill of sale of automobile and odometer statement for as is sale maryland form

- Construction contract cost plus or fixed fee maryland form

- Painting contract for contractor maryland form

- Trim carpenter contract for contractor maryland form

- Fencing contract for contractor maryland form

Find out other Massachusetts Department Of Revenue Form M 8379 Nondebtor

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement