TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM

What is the Maryland estimated tax form?

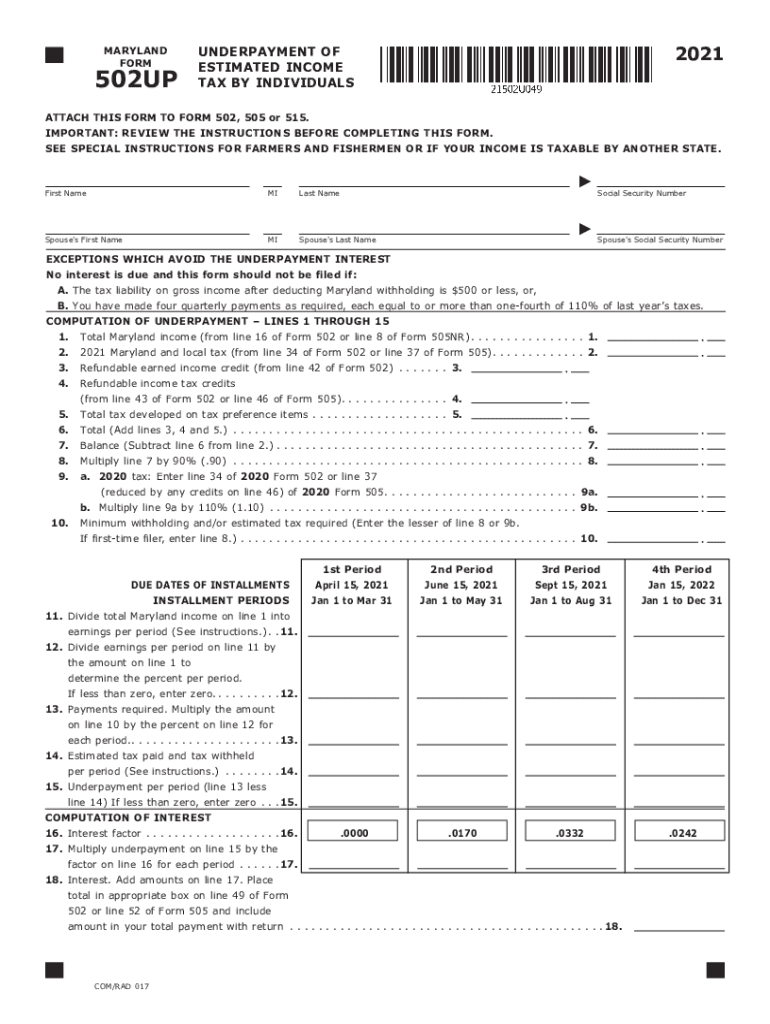

The Maryland estimated tax form, specifically the MD Form 502UP, is designed for individuals who expect to owe tax of $500 or more when filing their annual income tax return. This form allows taxpayers to report their estimated income tax liability and make payments throughout the year. It is essential for those who have income that is not subject to withholding, such as self-employment income, rental income, or investment income. By using this form, individuals can avoid penalties for underpayment of taxes and ensure they meet their tax obligations in a timely manner.

How to use the Maryland estimated tax form

Using the Maryland estimated tax form involves several steps. First, taxpayers need to estimate their total income for the year, including all sources of income. Next, they must calculate their expected tax liability based on Maryland tax rates. Once the estimated tax is determined, individuals can fill out the MD Form 502UP, detailing their income, deductions, and credits. After completing the form, taxpayers should submit it along with their estimated tax payments by the specified deadlines to ensure compliance with state tax regulations.

Steps to complete the Maryland estimated tax form

Completing the Maryland estimated tax form requires careful attention to detail. Here are the steps to follow:

- Gather financial information: Collect documents that detail your income, deductions, and any credits you may qualify for.

- Estimate your income: Calculate your expected income for the tax year, including wages, self-employment income, and any other sources.

- Determine your tax liability: Use Maryland tax tables or tax software to estimate your tax based on your projected income.

- Fill out the form: Input your estimated income and tax liability into the MD Form 502UP, ensuring all sections are completed accurately.

- Submit the form: Send the completed form along with your estimated tax payment to the Maryland Comptroller's office by the due date.

Filing deadlines for the Maryland estimated tax form

It is crucial to adhere to the filing deadlines for the Maryland estimated tax form to avoid penalties. Generally, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. Taxpayers should ensure that their payments are made on time to prevent interest and penalties for late payments. Keeping track of these deadlines can help maintain compliance with Maryland tax laws.

Legal use of the Maryland estimated tax form

The Maryland estimated tax form is legally binding when completed and submitted in accordance with state tax regulations. It serves as a formal declaration of an individual's estimated tax liability and is used to calculate the necessary payments to the state. To ensure legal compliance, taxpayers should accurately report their income and follow all instructions provided on the form. Failure to do so may result in penalties or legal repercussions.

Who issues the Maryland estimated tax form?

The Maryland estimated tax form, MD Form 502UP, is issued by the Comptroller of Maryland. This state agency is responsible for collecting taxes and managing state revenue. Taxpayers can obtain the form directly from the Comptroller's website or through authorized tax preparation software. It is important to use the most current version of the form to ensure compliance with any recent changes in tax law.

Quick guide on how to complete ty 2021 502up tax year 2021 502up individual taxpayer form

Complete TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM effortlessly on any gadget

Online document management has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling users to access the necessary forms and securely store them online. airSlate SignNow offers all the resources required to create, modify, and electronically sign your documents swiftly without holdups. Manage TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM without any hassle

- Locate TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM and click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Adjust and electronically sign TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM and ensure outstanding communication throughout any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ty 2021 502up tax year 2021 502up individual taxpayer form

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an e-signature for a PDF file on Android OS

People also ask

-

What is a Maryland estimated tax form and why do I need it?

A Maryland estimated tax form is used by individuals and businesses to prepay their income taxes based on expected earnings. It is essential for managing tax obligations and avoiding penalties. By accurately filling out this form, you can better plan your finances and ensure compliance with Maryland tax laws.

-

How can airSlate SignNow help me with my Maryland estimated tax form?

airSlate SignNow provides a user-friendly platform to fill out and eSign your Maryland estimated tax form quickly and securely. With our intuitive features, you can easily manage and submit your tax documents, ensuring that your information is accurate and filed on time. Our solution streamlines the process, making tax season less stressful.

-

What are the costs associated with using airSlate SignNow for my Maryland estimated tax forms?

airSlate SignNow offers a cost-effective solution for managing your Maryland estimated tax forms. Our pricing plans are transparent and affordable, catering to both individuals and businesses. By choosing our service, you gain access to a range of features that simplify document management without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software for my Maryland estimated tax form?

Yes, airSlate SignNow seamlessly integrates with various tax software, allowing for efficient management of your Maryland estimated tax form. This integration facilitates data sharing, reducing the chance of errors and streamlining your workflow. Our platform supports a variety of applications to enhance your tax filing experience.

-

What features does airSlate SignNow offer for my Maryland estimated tax forms?

airSlate SignNow offers several features designed to assist with your Maryland estimated tax forms, including electronic signatures, document templates, and secure cloud storage. These features help you create, send, and manage your tax documents efficiently. Our platform is designed to make the entire process quick and hassle-free.

-

Is airSlate SignNow secure for handling my Maryland estimated tax forms?

Absolutely! airSlate SignNow employs top-notch security measures to ensure that your Maryland estimated tax forms are protected. We use encryption and secure data storage to keep your sensitive information safe. You can trust our platform for a secure and compliant document management experience.

-

How do I get started with airSlate SignNow for my Maryland estimated tax form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, navigate to our document creation tools, and begin filling out your Maryland estimated tax form. Our intuitive interface will guide you through the process, ensuring that you have everything you need to complete your tax documents efficiently.

Get more for TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children maryland form

- Mutual wills or last will and testaments for unmarried persons living together with minor children maryland form

- Cohabitation agreement maryland form

- Paternity law and procedure handbook maryland form

- Bill of sale in connection with sale of business by individual or corporate seller maryland form

- Md settlement form

- Office lease agreement maryland form

- Uncontested hearing form

Find out other TY 502UP TAX YEAR 502UP INDIVIDUAL TAXPAYER FORM

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free