1350 STATE of SOUTH CAROLINA PT 401 I Dor Sc Gov PROPERTY 2022-2026

IRS Guidelines for the 2013 Form SC1040ES

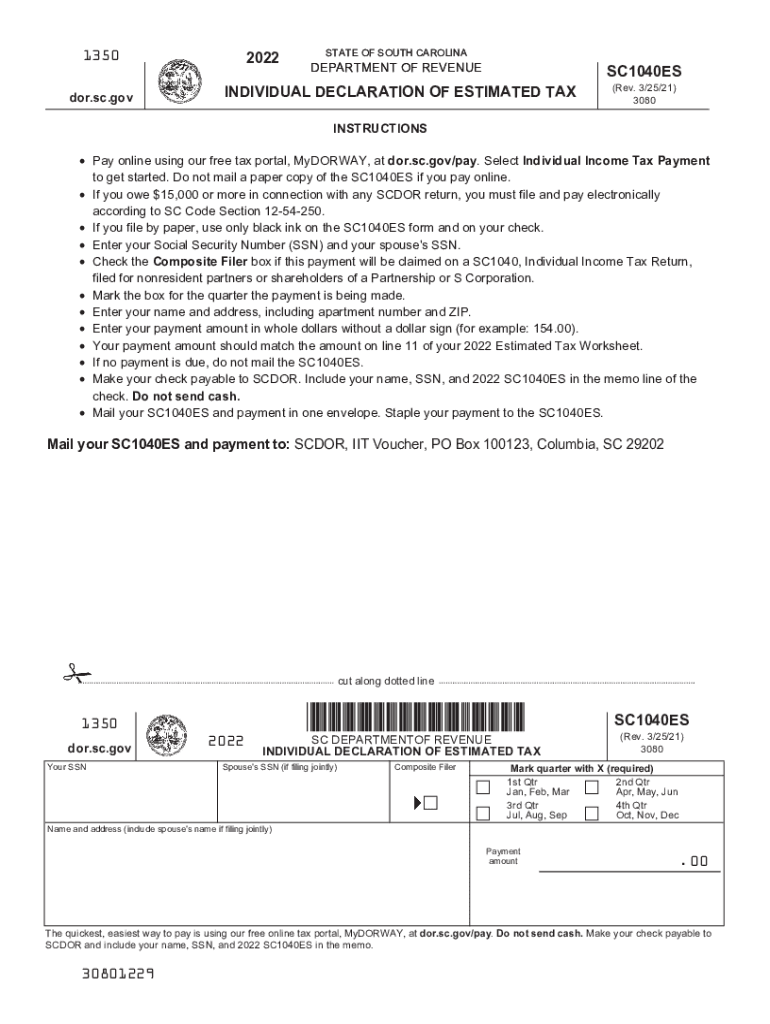

The 2013 Form SC1040ES is used by South Carolina taxpayers to report estimated tax payments. It is essential to follow IRS guidelines to ensure compliance and avoid penalties. The IRS requires taxpayers to pay estimated taxes if they expect to owe at least one thousand dollars in tax after subtracting withholding and refundable credits. This form is particularly relevant for self-employed individuals, retirees, and those with significant investment income.

Filing Deadlines / Important Dates

For the 2013 Form SC1040ES, taxpayers must adhere to specific deadlines for submitting their estimated tax payments. The estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. It is crucial to mark these dates on your calendar to avoid late payment penalties. Missing these deadlines can result in interest charges and additional fees.

Required Documents

When preparing to file the 2013 Form SC1040ES, it is important to gather all necessary documentation. Required documents may include previous tax returns, income statements, and any relevant financial records that reflect your income and deductions. Having these documents ready will streamline the process and ensure accurate reporting.

Form Submission Methods (Online / Mail / In-Person)

The 2013 Form SC1040ES can be submitted through various methods. Taxpayers have the option to file online using approved tax software, which often simplifies the process. Alternatively, the form can be mailed to the appropriate South Carolina Department of Revenue address or submitted in person at designated locations. Each method has its advantages, so choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to file the 2013 Form SC1040ES or to make the required estimated tax payments can lead to significant penalties. The South Carolina Department of Revenue imposes interest on unpaid taxes and may charge a penalty for underpayment. Understanding these consequences is important for maintaining compliance and avoiding unnecessary financial burdens.

Eligibility Criteria

To use the 2013 Form SC1040ES, taxpayers must meet specific eligibility criteria. Generally, individuals who expect to owe tax of one thousand dollars or more after withholding and credits are required to file this form. Additionally, those who had no tax liability in the previous year may not be required to make estimated payments. It is advisable to review your tax situation annually to determine your eligibility.

Quick guide on how to complete 1350 state of south carolina pt 401 i dorscgov property

Effortlessly Prepare 1350 STATE OF SOUTH CAROLINA PT 401 I Dor sc gov PROPERTY on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can find the necessary form and securely store it online. airSlate SignNow furnishes you with all the necessary tools to create, modify, and eSign your documents swiftly without holdups. Handle 1350 STATE OF SOUTH CAROLINA PT 401 I Dor sc gov PROPERTY on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and eSign 1350 STATE OF SOUTH CAROLINA PT 401 I Dor sc gov PROPERTY with Ease

- Obtain 1350 STATE OF SOUTH CAROLINA PT 401 I Dor sc gov PROPERTY and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes necessitating new document prints. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and eSign 1350 STATE OF SOUTH CAROLINA PT 401 I Dor sc gov PROPERTY to ensure clear communication at every point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1350 state of south carolina pt 401 i dorscgov property

Create this form in 5 minutes!

How to create an eSignature for the 1350 state of south carolina pt 401 i dorscgov property

The best way to generate an e-signature for your PDF document online

The best way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the sc1040es 2024 form and who needs it?

The sc1040es 2024 form is used for estimated tax payments in South Carolina. Individuals or businesses expecting to owe $100 or more in taxes must use this form to ensure compliance with state tax regulations. It is crucial for managing your tax liability effectively.

-

How can airSlate SignNow help with sc1040es 2024 documentation?

airSlate SignNow offers an efficient and user-friendly platform for electronically signing and sending the sc1040es 2024 documents. This helps streamline your filing process and ensures that all stakeholder signatures are collected quickly and securely. Enhance your productivity by using our solution for your tax-related documents.

-

What are the pricing options for using airSlate SignNow for sc1040es 2024 forms?

airSlate SignNow provides cost-effective pricing plans starting as low as $8 per month per user. Each plan includes features tailored for managing important documents like the sc1040es 2024 efficiently. This pricing ensures that customers can access premium features without breaking the bank.

-

What features does airSlate SignNow offer for sc1040es 2024 document management?

Key features for managing sc1040es 2024 documents include advanced eSigning capabilities, document templates, and compliance tracking. These tools simplify the preparation and submission of your estimated tax forms and improve accuracy. Our platform is designed to enhance your document workflow and reduce potential errors.

-

Can I integrate airSlate SignNow with other accounting software for sc1040es 2024?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions. This ensures that your data and documents related to the sc1040es 2024 form are synchronized across platforms. Such integrations help you maintain accurate records and streamline your overall financial management.

-

What are the benefits of using airSlate SignNow for sc1040es 2024 filings?

Using airSlate SignNow for your sc1040es 2024 filings offers numerous benefits, including time savings, increased efficiency, and enhanced document security. Our platform allows for real-time tracking of signatures and document status, ensuring that you meet all critical deadlines without hassle. Plus, it helps reduce the risk of paper-based errors.

-

Is airSlate SignNow compliant with legal requirements for sc1040es 2024?

Yes, airSlate SignNow complies with all necessary legal requirements for electronic signatures, ensuring that your sc1040es 2024 documents are valid and enforceable. Our platform adheres to industry standards to protect your information and meets regulatory compliance. Trust us to keep your document transactions secure and legitimate.

Get more for 1350 STATE OF SOUTH CAROLINA PT 401 I Dor sc gov PROPERTY

- Employment employee personnel file package maryland form

- Assignment of mortgage package maryland form

- Assignment of lease package maryland form

- Maryland purchase online form

- Md satisfaction mortgage form

- Maryland premarital form

- Painting contractor package maryland form

- Framing contractor package maryland form

Find out other 1350 STATE OF SOUTH CAROLINA PT 401 I Dor sc gov PROPERTY

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract