Pay Online Using Our Tax Portal, MyDORWAY, at Dor 2021

Filing Deadlines / Important Dates

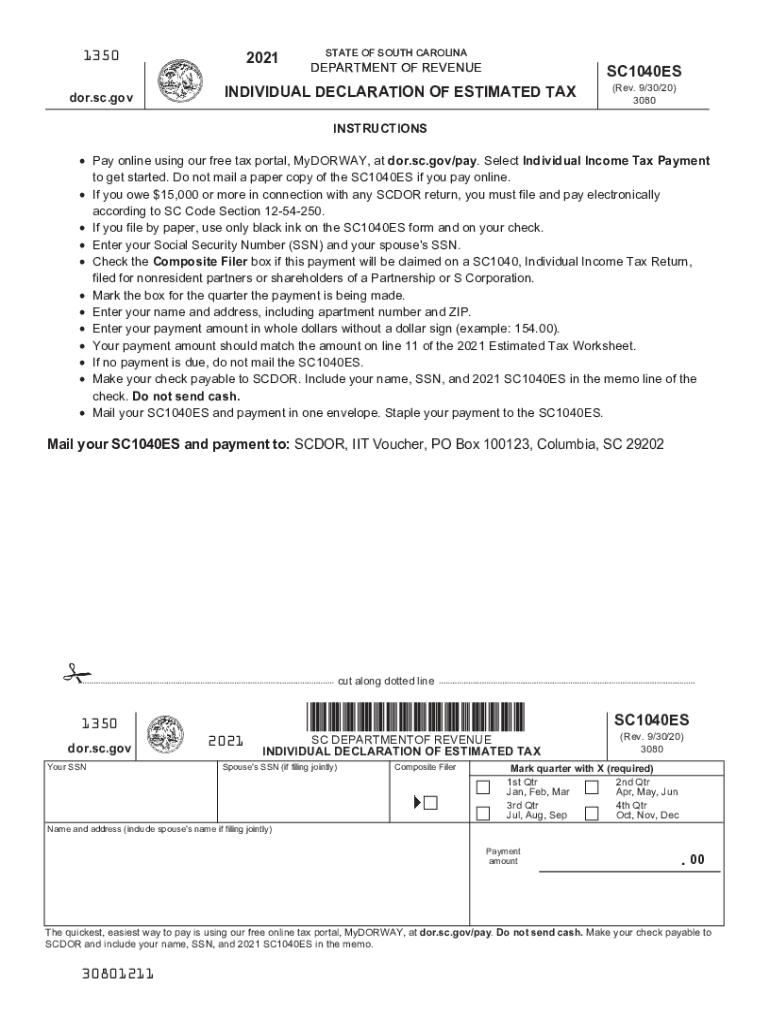

When dealing with South Carolina estimated tax forms 2019, it is crucial to be aware of the filing deadlines to avoid penalties. The South Carolina Department of Revenue typically sets specific dates for estimated tax payments. For the 2019 tax year, payments are generally due on the fifteenth day of April, June, September, and January of the following year. Missing these deadlines can lead to interest and penalties on unpaid taxes, making it essential to stay organized and informed.

Required Documents

To complete the sc estimated tax forms 2019, you will need several key documents. These include your previous year's tax return, income statements such as W-2s or 1099s, and any relevant deductions or credits you plan to claim. Having these documents on hand will streamline the process and ensure that you provide accurate information on your sc1040es.

Form Submission Methods (Online / Mail / In-Person)

There are multiple methods to submit your South Carolina estimated tax forms 2019. You can file online through the South Carolina Department of Revenue's website, which is often the quickest option. Alternatively, you can mail your completed forms to the appropriate address provided by the department. In-person submissions may also be possible at designated offices, allowing for direct assistance if needed. Each method has its own processing times, so consider your timeline when choosing how to submit.

Penalties for Non-Compliance

Failure to comply with the requirements for sc estimated tax forms 2019 can result in significant penalties. If you do not file your estimated taxes on time, you may incur late fees and interest charges. Additionally, if you underpay your estimated taxes, the state may impose further penalties. Understanding these consequences can motivate timely and accurate submissions, helping you avoid unnecessary financial burdens.

IRS Guidelines

While filing your sc estimated tax forms 2019, it is important to adhere to IRS guidelines as well. The IRS outlines specific rules for estimated tax payments, including how to calculate your expected tax liability and the frequency of payments. Familiarizing yourself with these guidelines can help ensure that you meet both state and federal requirements, reducing the risk of issues down the line.

Digital vs. Paper Version

Choosing between the digital and paper versions of the sc estimated tax forms 2019 can significantly impact your filing experience. The digital version allows for easier completion and submission, often with built-in error checks to minimize mistakes. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the choice, ensure that you follow all instructions carefully to maintain compliance.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can affect how you approach your sc estimated tax forms 2019. For instance, self-employed individuals often have more complex tax situations and may need to estimate their taxes based on varying income levels. Retired individuals might have different sources of income, such as pensions or Social Security, which can also influence their estimated tax calculations. Understanding your specific situation can help you accurately complete the forms and avoid pitfalls.

Quick guide on how to complete pay online using our free tax portal mydorway at dor

Effortlessly Prepare Pay Online Using Our Tax Portal, MyDORWAY, At Dor on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage Pay Online Using Our Tax Portal, MyDORWAY, At Dor across any platform utilizing airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The easiest way to modify and electronically sign Pay Online Using Our Tax Portal, MyDORWAY, At Dor seamlessly

- Obtain Pay Online Using Our Tax Portal, MyDORWAY, At Dor and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you choose. Alter and electronically sign Pay Online Using Our Tax Portal, MyDORWAY, At Dor while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pay online using our free tax portal mydorway at dor

Create this form in 5 minutes!

How to create an eSignature for the pay online using our free tax portal mydorway at dor

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What are SC estimated tax forms 2019?

SC estimated tax forms 2019 are documents used by South Carolina residents to report their estimated tax liability for the year 2019. These forms help individuals and businesses calculate how much tax they might owe and remit payments accordingly. Properly filling out these forms can prevent underpayment penalties.

-

How can airSlate SignNow assist with SC estimated tax forms 2019?

airSlate SignNow provides a user-friendly platform for electronically signing and sending SC estimated tax forms 2019. This allows you to manage your tax documentation efficiently, ensuring secure submissions and prompt receipt confirmations. The platform’s features streamline the signing process, making tax filing easier.

-

Is airSlate SignNow affordable for filing SC estimated tax forms 2019?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to varying business needs when managing SC estimated tax forms 2019. With subscription options that are flexible, you can choose a plan that best fits your budget. The value gained from ease of use and efficiency justifies the investment.

-

What features does airSlate SignNow offer for handling SC estimated tax forms 2019?

airSlate SignNow includes features like document templates, secure eSigning, and easy sharing capabilities, all of which enhance the management of SC estimated tax forms 2019. Additionally, users can track document status and receive notifications, making it easy to ensure timely filing. These features simplify the entire process signNowly.

-

Can airSlate SignNow be integrated with other software for SC estimated tax forms 2019?

Absolutely! airSlate SignNow integrates with a variety of platforms and applications to facilitate the management of SC estimated tax forms 2019. These integrations allow for seamless data transfer and improved workflow, ensuring that you can access and utilize all necessary tools from one central place.

-

What are the benefits of using airSlate SignNow for SC estimated tax forms 2019?

Using airSlate SignNow for SC estimated tax forms 2019 offers several benefits, including improved efficiency, reduced paperwork, and enhanced accuracy in documentation. The easy-to-use interface allows users of all skill levels to navigate and complete their tax forms effectively. Additionally, the secure platform protects sensitive information during the signing process.

-

How does airSlate SignNow ensure the security of SC estimated tax forms 2019?

Security is a priority for airSlate SignNow when it comes to SC estimated tax forms 2019. The platform employs robust encryption protocols and complies with industry standards to protect your data during transmission and storage. This commitment ensures that sensitive tax information remains confidential and secure.

Get more for Pay Online Using Our Tax Portal, MyDORWAY, At Dor

- Emory reynolds big 10 geriatric assessment tool form

- Limestone county pistol permit form

- Form 12c download

- Municipality proof of residence online form

- Cec 101 structural mechanics pdf form

- State case reg amp vital statistics form

- 5 year warranty registration for condensers form

- Naca registration application use one application form for corriente

Find out other Pay Online Using Our Tax Portal, MyDORWAY, At Dor

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now