Form 202 Maryland

What is the Form 202 Maryland

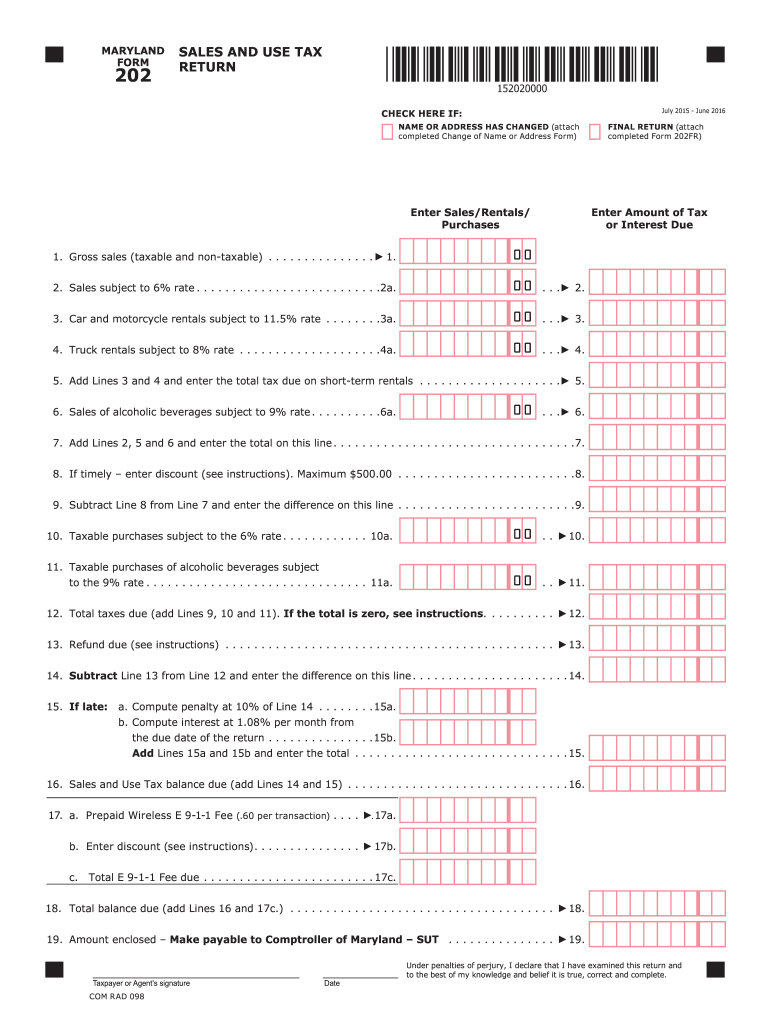

The Maryland Form 202, also known as the Maryland Sales and Use Tax Return, is a crucial document for businesses operating in Maryland. This form is used to report and remit sales tax collected from customers on taxable sales. It is essential for compliance with state tax regulations and helps businesses maintain accurate financial records. The form must be completed accurately to ensure that the correct amount of tax is reported and paid to the state.

How to use the Form 202 Maryland

To effectively use the Maryland Form 202, businesses must first gather all necessary sales data for the reporting period. This includes total sales, exempt sales, and any sales tax collected. The form requires specific entries for each category, ensuring that all taxable and exempt transactions are accounted for. After filling out the form, it should be submitted to the Maryland Comptroller's Office along with any payment due. Businesses can also utilize electronic filing options for convenience.

Steps to complete the Form 202 Maryland

Completing the Maryland Form 202 involves several key steps:

- Gather sales records for the reporting period, including total sales and exempt sales.

- Calculate the total sales tax collected based on the applicable tax rate.

- Fill out the form by entering the required information in each section accurately.

- Review the completed form for any errors or omissions.

- Submit the form either online or via mail, ensuring that payment is included if applicable.

Legal use of the Form 202 Maryland

The Maryland Form 202 is legally binding and must be filed according to state regulations. Businesses are required to follow the guidelines set forth by the Maryland Comptroller's Office to ensure compliance. Failing to file the form accurately or on time can result in penalties and interest charges. It is important for businesses to stay informed about any changes in tax laws that may affect their reporting obligations.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Maryland Form 202. The most efficient method is electronic filing through the Maryland Comptroller's website, which allows for immediate processing and confirmation. Alternatively, businesses can mail the completed form to the appropriate address, ensuring it is postmarked by the due date. In-person submissions are also accepted at local Comptroller offices, providing a direct way to handle tax filings and payments.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 202 are typically set quarterly. Businesses must be aware of these dates to ensure timely submissions and avoid penalties. The deadlines are as follows:

- First quarter: April 15

- Second quarter: July 15

- Third quarter: October 15

- Fourth quarter: January 15 of the following year

It is important for businesses to mark these dates on their calendars and prepare their filings in advance to ensure compliance.

Quick guide on how to complete form 202 maryland

Complete Form 202 Maryland effortlessly on any platform

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents promptly and without hindrance. Manage Form 202 Maryland on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to edit and eSign Form 202 Maryland with ease

- Find Form 202 Maryland and then click Get Form to begin.

- Make use of the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or conceal sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all details and then click on the Done button to store your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your device.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 202 Maryland and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 202 maryland

How to make an e-signature for your PDF online

How to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Maryland Form 202 and how can airSlate SignNow assist with it?

The Maryland Form 202 is a critical document required for businesses when filing taxes. airSlate SignNow can simplify the process by enabling users to eSign and send the Maryland Form 202 securely and efficiently. Our platform ensures that all signatures are legally binding and compliant with Maryland's regulations.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form 202?

Yes, airSlate SignNow offers various pricing plans designed to suit different business needs. Depending on the features you choose, you can efficiently manage the signing and sending of the Maryland Form 202 without breaking your budget. The cost-effective solution provides excellent value for managing important documents.

-

What features does airSlate SignNow offer for managing Maryland Form 202?

airSlate SignNow provides features like customizable templates, secure eSigning, and document tracking for the Maryland Form 202. These functionalities allow users to streamline their document management process and keep track of revisions and signatures efficiently. Additionally, the user-friendly interface makes it easy for anyone to navigate.

-

Can airSlate SignNow integrate with other applications for Maryland Form 202 processing?

Absolutely! airSlate SignNow can integrate seamlessly with various applications such as CRM systems, cloud storage services, and more. This means you can automatically send your Maryland Form 202 for eSignature from your existing tools, enhancing workflow and productivity.

-

How does airSlate SignNow ensure the security of my Maryland Form 202?

Security is a top priority for airSlate SignNow. We utilize encryption and robust authentication methods to protect your Maryland Form 202 and other sensitive documents. This ensures that your information remains confidential while you eSign and manage your forms.

-

What are the benefits of using airSlate SignNow for the Maryland Form 202?

Using airSlate SignNow for the Maryland Form 202 offers numerous benefits, such as saving time and reducing paper usage. The platform allows for faster turnaround times on document signing, enabling your business to operate more efficiently. Furthermore, the ease of access from any device ensures that you can manage your documents anytime, anywhere.

-

Is there customer support available for issues related to the Maryland Form 202?

Yes, airSlate SignNow provides dedicated customer support to assist you with any issues related to the Maryland Form 202. Our team is available to help with technical questions or guidance on using our platform effectively. You can signNow out via chat, email, or phone for prompt assistance.

Get more for Form 202 Maryland

- Conditional waiver and release of lien upon final payment iowa form

- Ia landlord form

- Unconditional waiver and release of lien upon final payment iowa form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497305012 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497305013 form

- Iowa notice cure form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497305015 form

- Business credit application iowa form

Find out other Form 202 Maryland

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template