Cooperative Loan Application Form PDF

What is the Cooperative Loan Application Form?

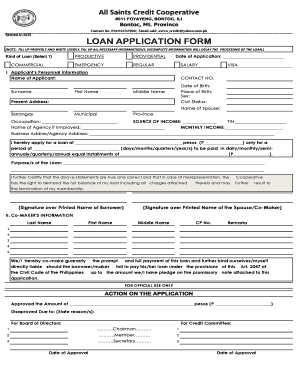

The cooperative loan application form is a crucial document used by individuals seeking financial assistance from credit cooperatives. This form collects essential information about the applicant, including personal details, financial status, and the purpose of the loan. By completing this form, applicants provide the cooperative with the necessary data to assess their eligibility for a loan and determine the terms of the financing. Understanding the components of this form is vital for ensuring a smooth application process.

Key Elements of the Cooperative Loan Application Form

Several key elements must be included in the cooperative loan application form to ensure it meets the requirements of the lending institution. These elements typically include:

- Personal Information: Name, address, contact details, and Social Security number.

- Financial Information: Income details, employment status, and existing debts.

- Loan Details: Amount requested, purpose of the loan, and repayment terms.

- Consent and Signature: A section where the applicant provides consent for the cooperative to verify the provided information.

Each of these components plays a significant role in the assessment of the application and the overall decision-making process of the cooperative.

Steps to Complete the Cooperative Loan Application Form

Filling out the cooperative loan application form involves several important steps to ensure accuracy and completeness. Here is a straightforward process to follow:

- Gather Required Documents: Collect necessary documents such as proof of income, identification, and any other relevant financial information.

- Fill Out the Form: Carefully enter your personal and financial details in the application form, ensuring all information is accurate.

- Review the Application: Double-check all entries for errors or omissions before submission.

- Submit the Application: Depending on the cooperative's policies, submit the form online, via mail, or in person.

Following these steps can help streamline the application process and improve the chances of approval.

Legal Use of the Cooperative Loan Application Form

The cooperative loan application form must adhere to legal standards to be considered valid. In the United States, eSignature laws such as the ESIGN Act and UETA provide the framework for electronic signatures, ensuring that digital submissions are legally binding. It is crucial for applicants to understand that simply typing their name does not constitute a valid signature unless it complies with these regulations. Using a trusted platform for electronic submissions can enhance the security and legality of the application process.

Form Submission Methods

Applicants can submit the cooperative loan application form through various methods, depending on the cooperative's requirements. Common submission methods include:

- Online Submission: Many cooperatives allow applicants to complete and submit the form digitally through their website.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Some cooperatives may require or allow applicants to submit the form in person at their local branch.

Understanding these options can help applicants choose the most convenient method for their situation.

Eligibility Criteria for the Cooperative Loan Application

Eligibility criteria for a cooperative loan can vary by institution but generally include several common factors. Applicants are typically required to meet the following conditions:

- Membership: Applicants must usually be members of the cooperative or meet specific membership requirements.

- Creditworthiness: A review of the applicant's credit history and score may be conducted to assess their ability to repay the loan.

- Income Verification: Proof of stable income is often necessary to demonstrate financial capability.

Being aware of these criteria can help applicants prepare their application effectively and increase their chances of approval.

Quick guide on how to complete cooperative loan application form pdf

Complete Cooperative Loan Application Form Pdf effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your files swiftly without any delays. Manage Cooperative Loan Application Form Pdf on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Cooperative Loan Application Form Pdf easily

- Locate Cooperative Loan Application Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Cooperative Loan Application Form Pdf and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cooperative loan application form pdf

The best way to generate an e-signature for a PDF file in the online mode

The best way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is a cooperative loan application form?

A cooperative loan application form is a document that applicants fill out to seek financial support from a cooperative lending institution. This form typically requires essential information about the applicant's financial status, personal details, and the specific loan being requested. By utilizing a collaborative approach, cooperatives aim to streamline the loan application process.

-

How can airSlate SignNow simplify the cooperative loan application form process?

airSlate SignNow simplifies the cooperative loan application form process by providing a user-friendly platform to create, send, and eSign documents. With its intuitive interface, you can manage all your loan forms efficiently, reducing the time needed for approvals. This ensures that your application is processed swiftly and securely.

-

What are the costs associated with using airSlate SignNow for a cooperative loan application form?

airSlate SignNow offers affordable pricing plans tailored for businesses, allowing you to handle cooperative loan application forms without breaking the bank. Various tiers are available, giving you the flexibility to choose a plan that suits your needs. Consider starting with a free trial to explore its features before committing.

-

Can I customize the cooperative loan application form with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your cooperative loan application form to suit your specific requirements. You can add fields, modify templates, and incorporate branding elements, ensuring your form aligns with your organization's identity. This functionality enhances user experience and promotes your brand.

-

What features does airSlate SignNow offer for managing cooperative loan application forms?

airSlate SignNow offers a variety of features for managing cooperative loan application forms, including template creation, real-time tracking, and automated reminders. These tools help streamline the application process and ensure that every loan request is handled in a timely manner. Additionally, you can store and access forms securely in the cloud.

-

Is it possible to integrate airSlate SignNow with other applications for cooperative loan application forms?

Absolutely! airSlate SignNow can be easily integrated with various third-party applications to enhance the management of cooperative loan application forms. Integrations with platforms like CRM systems and accounting software help centralize your document workflows. This ensures seamless data flow and improves operational efficiency.

-

What are the benefits of using airSlate SignNow for cooperative loan application forms?

Using airSlate SignNow for cooperative loan application forms offers numerous benefits, including increased efficiency, cost reduction, and enhanced security. The platform reduces the paperwork burden, enabling quicker processing times. Along with eSigning capabilities, it protects sensitive information, ensuring compliance with legal standards.

Get more for Cooperative Loan Application Form Pdf

- Revocation of premarital or prenuptial agreement idaho form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children idaho form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497305388 form

- Idaho pre incorporation agreement shareholders agreement and confidentiality agreement idaho form

- Idaho bylaws form

- Corporate records maintenance package for existing corporations idaho form

- Idaho operating form

- Single member limited liability company llc operating agreement idaho form

Find out other Cooperative Loan Application Form Pdf

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe