MO 1041 Fiduciary Income Tax Return Form

What is the MO 1041 Fiduciary Income Tax Return

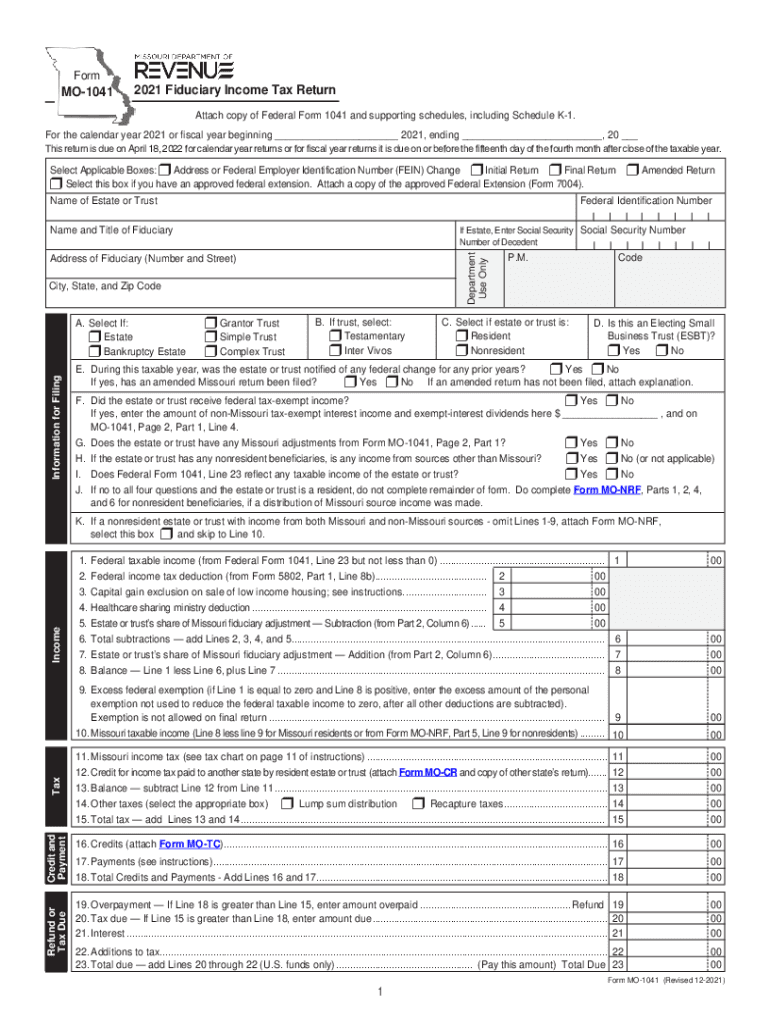

The MO 1041 Fiduciary Income Tax Return is a tax form used by fiduciaries in Missouri to report income generated by estates and trusts. This form is essential for ensuring that the income earned by these entities is appropriately taxed according to state regulations. Fiduciaries, such as executors or trustees, are responsible for filing this return on behalf of the estate or trust to comply with Missouri tax laws. The income reported on this form may include interest, dividends, and capital gains, which are subject to Missouri income tax.

Steps to Complete the MO 1041 Fiduciary Income Tax Return

Completing the MO 1041 involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and records of expenses related to the estate or trust. Next, fill out the form by entering the required information, such as the fiduciary's name, address, and identification number. It is important to report all sources of income accurately. After completing the form, review it for any errors and ensure all necessary attachments are included. Finally, submit the form by the designated deadline to avoid penalties.

Legal Use of the MO 1041 Fiduciary Income Tax Return

The MO 1041 is legally binding when completed and submitted according to Missouri tax laws. To ensure its legal validity, the fiduciary must sign the return, affirming that the information provided is accurate and complete. Additionally, the form must comply with the relevant legal frameworks governing fiduciary responsibilities and tax reporting. Utilizing a reliable eSignature solution can enhance the legal standing of the document, providing a digital certificate that verifies the authenticity of the signature.

Filing Deadlines / Important Dates

Filing deadlines for the MO 1041 are crucial for compliance. Typically, the return is due on the 15th day of the fourth month following the end of the tax year for the estate or trust. For estates and trusts operating on a calendar year, this means the return is generally due by April 15. It is important for fiduciaries to be aware of any extensions or changes to these deadlines, as failure to file on time may result in penalties or interest on unpaid taxes.

Required Documents

To complete the MO 1041 Fiduciary Income Tax Return, several documents are necessary. These include financial statements detailing the income and expenses of the estate or trust, documentation of any deductions or credits claimed, and prior year tax returns if applicable. Additionally, any supporting schedules that provide further breakdowns of income sources or deductions should be included to ensure a comprehensive filing.

Form Submission Methods

The MO 1041 can be submitted through various methods, including online filing, mailing, or in-person submission. For online filing, fiduciaries can utilize authorized e-filing services that comply with Missouri tax regulations. Alternatively, the completed form can be printed and mailed to the appropriate tax office. In-person submissions may also be made at designated tax offices, providing an option for those who prefer direct interaction.

Penalties for Non-Compliance

Failure to file the MO 1041 Fiduciary Income Tax Return on time or inaccurately reporting income can lead to significant penalties. These may include monetary fines and interest on any unpaid taxes. The Missouri Department of Revenue may also impose additional penalties for late filings or for failing to provide required documentation. It is essential for fiduciaries to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete mo 1041 2021 fiduciary income tax return

Prepare MO 1041 Fiduciary Income Tax Return seamlessly on any device

Web document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct template and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without hindrance. Manage MO 1041 Fiduciary Income Tax Return on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign MO 1041 Fiduciary Income Tax Return effortlessly

- Obtain MO 1041 Fiduciary Income Tax Return and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign MO 1041 Fiduciary Income Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1041 2021 fiduciary income tax return

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The best way to generate an e-signature for a PDF on Android

People also ask

-

What is the mo 1041 form and why do I need it?

The mo 1041 form is a tax document used for filing income tax returns for estates and trusts in Missouri. It is essential for ensuring compliance with state tax laws and allows trustees to report income, deductions, and credits. Using airSlate SignNow can simplify the process of signing and sending this important document securely.

-

How does airSlate SignNow simplify the completion of the mo 1041 form?

airSlate SignNow offers an intuitive platform that allows users to electronically fill out and sign the mo 1041 form. Its user-friendly interface helps reduce errors during completion and ensures that forms are submitted in a timely manner. This efficiency can save valuable time and resources for individuals and organizations.

-

Is there a cost associated with using airSlate SignNow for the mo 1041?

Yes, airSlate SignNow offers different pricing plans based on the features and usage level that best suit your needs. Each plan provides a cost-effective solution for managing documents, including the mo 1041 form. Sign up today to explore any available discounts or free trials before committing.

-

What features does airSlate SignNow offer for handling the mo 1041?

airSlate SignNow provides features such as electronic signatures, document templates, and secure storage to streamline the process of managing the mo 1041 form. Additionally, you can track document status in real-time, ensuring that all parties involved are kept in the loop. These features make processing tax documents easier and more efficient.

-

Can I integrate airSlate SignNow with other software I use for tax purposes?

Yes, airSlate SignNow offers integrations with various popular software solutions to enhance your workflow. This means you can connect your accounting or tax software with airSlate SignNow to manage the mo 1041 form seamlessly. Integrations help centralize your operations, saving you time and minimizing errors.

-

What are the benefits of using airSlate SignNow for the mo 1041?

Using airSlate SignNow for the mo 1041 form provides benefits such as enhanced security, reduced turnaround times, and increased efficiency in document management. The platform ensures that your sensitive tax information is protected while allowing for quick and easy signatures. This results in a smoother filing process, helping you meet deadlines with confidence.

-

How can I ensure my mo 1041 form is securely signed with airSlate SignNow?

airSlate SignNow employs industry-leading security measures such as encryption and multi-factor authentication to ensure that your mo 1041 form is securely signed. User access controls and comprehensive audit trails also help maintain document integrity and security. You can confidently manage your sensitive tax documents knowing robust security is in place.

Get more for MO 1041 Fiduciary Income Tax Return

- Hvac contractor package minnesota form

- Landscaping contractor package minnesota form

- Commercial contractor package minnesota form

- Excavation contractor package minnesota form

- Minnesota contractor 497312847 form

- Concrete mason contractor package minnesota form

- Demolition contractor package minnesota form

- Security contractor package minnesota form

Find out other MO 1041 Fiduciary Income Tax Return

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online