Guide to Sales Tax in New York State for Exempt Organizations 2021-2026

Understanding the st 5 Form for Sales Tax Exemption

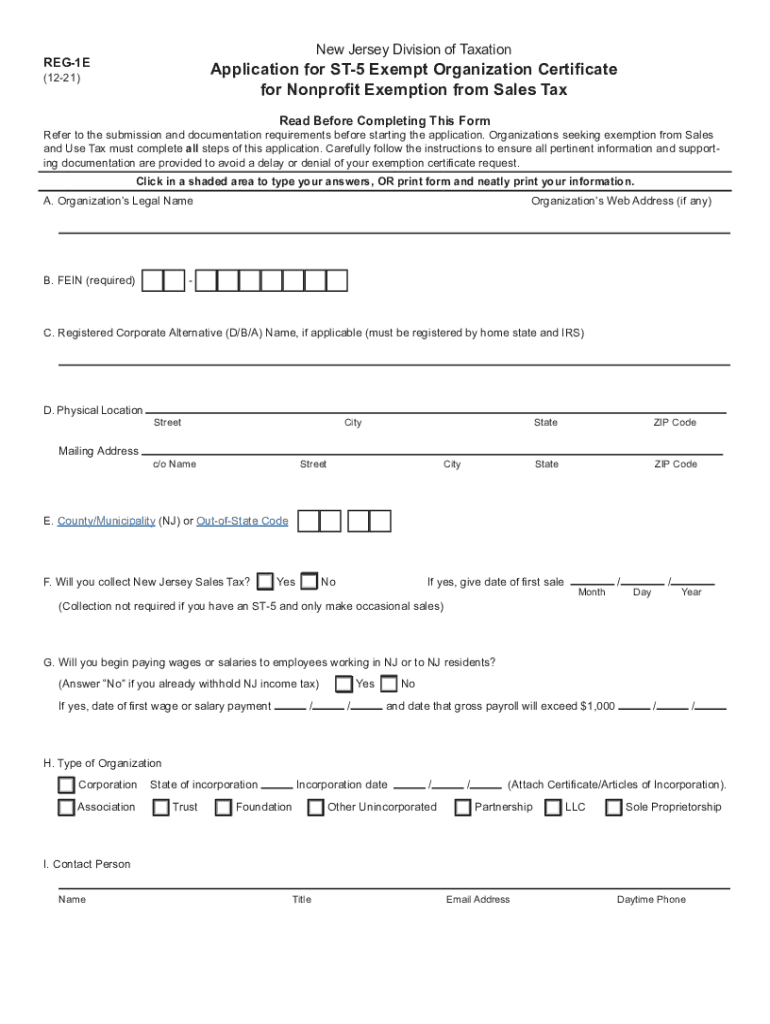

The st 5 form, also known as the New Jersey Sales Tax Exempt Certificate, is essential for organizations that qualify for sales tax exemption in New Jersey. This form allows eligible entities, such as non-profit organizations, to make tax-exempt purchases. Understanding the legal framework surrounding the st 5 form is crucial for ensuring compliance with state tax laws.

To qualify for the exemption, organizations must meet specific criteria set by the New Jersey Division of Taxation. These criteria include being a recognized non-profit entity or an exempt organization under IRS guidelines. Proper completion of the st 5 form is necessary to avoid potential penalties and ensure that purchases are recognized as tax-exempt.

Steps to Complete the st 5 Form

Filling out the st 5 form requires attention to detail to ensure accuracy and compliance. Here are the key steps to follow:

- Obtain the Form: Download the blank st 5 form from a reliable source.

- Provide Organization Information: Fill in the legal name, address, and type of organization.

- Specify the Purpose: Clearly state the reason for the tax exemption, referencing the applicable tax laws.

- Signature: Ensure that an authorized representative signs the form, affirming the accuracy of the information provided.

Once completed, the form should be presented to vendors at the time of purchase to validate the tax-exempt status.

Legal Use of the st 5 Form

The st 5 form is legally binding when filled out correctly and used in accordance with New Jersey tax laws. It serves as proof that the purchaser is exempt from sales tax for specific transactions. Organizations must retain a copy of the completed form for their records and may need to provide it during audits or reviews by tax authorities.

Failure to adhere to the legal requirements surrounding the st 5 form can result in penalties, including back taxes owed and fines. Therefore, it is essential for organizations to ensure that they are eligible for the exemption before using the form.

Eligibility Criteria for the st 5 Form

To qualify for using the st 5 form, organizations must meet certain eligibility criteria as defined by the New Jersey Division of Taxation. Key eligibility factors include:

- Being a non-profit organization recognized by the IRS.

- Engaging in activities that are primarily charitable, educational, or religious in nature.

- Maintaining proper documentation to support the tax-exempt status.

Organizations should regularly review their eligibility to ensure compliance with any changes in tax laws or regulations.

Form Submission Methods for the st 5 Form

The st 5 form does not require formal submission to the state; instead, it is presented to vendors during purchases. However, it is important to keep the form on file in case of audits. Organizations should ensure that they have a reliable method for storing and retrieving completed forms.

For record-keeping, organizations may choose to maintain digital copies of the st 5 form, ensuring they are easily accessible for future reference or compliance checks.

Quick guide on how to complete guide to sales tax in new york state for exempt organizations

Effortlessly Prepare Guide To Sales Tax In New York State For Exempt Organizations on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Guide To Sales Tax In New York State For Exempt Organizations on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Guide To Sales Tax In New York State For Exempt Organizations with Ease

- Locate Guide To Sales Tax In New York State For Exempt Organizations and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the document or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Revise and eSign Guide To Sales Tax In New York State For Exempt Organizations to maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct guide to sales tax in new york state for exempt organizations

Create this form in 5 minutes!

How to create an eSignature for the guide to sales tax in new york state for exempt organizations

The way to make an e-signature for your PDF document online

The way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the New Jersey ST5 form and why is it important?

The New Jersey ST5 form is a pivotal document used for tax-exempt sales in the state of New Jersey. It serves as a certificate to claim exemption from sales tax, making it crucial for businesses engaged in transactions that qualify for tax exemption. Understanding and using the New Jersey ST5 form correctly can help businesses save money on taxable purchases.

-

How can airSlate SignNow assist with the New Jersey ST5 form?

airSlate SignNow offers a seamless platform for businesses to manage, send, and eSign the New Jersey ST5 form efficiently. Our user-friendly interface allows for easy customization, ensuring that all necessary information is captured accurately. This streamlined process helps businesses save time and reduce paperwork errors when handling the New Jersey ST5 form.

-

Is there a cost associated with using airSlate SignNow for the New Jersey ST5 form?

Yes, there is a straightforward pricing model for using airSlate SignNow, which varies based on the features and services included. However, the investment is worthwhile as our platform provides signNow time savings and efficiency improvements when managing the New Jersey ST5 form. Check our website for specific pricing plans tailored to your business needs.

-

What features does airSlate SignNow offer for handling documents like the New Jersey ST5 form?

AirSlate SignNow provides robust features such as customizable templates, secure eSigning, and real-time tracking for documents like the New Jersey ST5 form. Additionally, our integration capabilities with various applications streamline workflows, allowing businesses to automatically fill out and route the New Jersey ST5 form as needed. These features enhance productivity and efficiency.

-

Are there integrations available with airSlate SignNow for managing the New Jersey ST5 form?

Yes, airSlate SignNow supports a wide range of integrations with popular business applications that facilitate the management of documents like the New Jersey ST5 form. Integrating our solution with your existing tools simplifies your workflow and ensures that data is accurately shared across platforms. Explore our integration options to optimize your document management processes.

-

What are the advantages of eSigning the New Jersey ST5 form with airSlate SignNow?

eSigning the New Jersey ST5 form with airSlate SignNow offers numerous advantages, including enhanced security, faster processing times, and legal compliance. Our platform ensures that your eSignatures are secure and legally binding, eliminating the need for physical paperwork. This not only saves time but also fosters a more organized document management process.

-

Can I access airSlate SignNow from mobile devices for the New Jersey ST5 form?

Absolutely! airSlate SignNow is accessible from mobile devices, allowing you to manage the New Jersey ST5 form on the go. Whether you're at the office or out in the field, our mobile-friendly platform ensures you can easily send, receive, and eSign documents without missing a beat. This flexibility enhances productivity for your business.

Get more for Guide To Sales Tax In New York State For Exempt Organizations

- Quitclaim deed from individual to llc missouri form

- Warranty deed from individual to llc missouri form

- Missouri waiver form

- Mo husband wife form

- Warranty deed from husband and wife to corporation missouri form

- Missouri case form

- Missouri lien 497313130 form

- Quitclaim deed from husband and wife to llc missouri form

Find out other Guide To Sales Tax In New York State For Exempt Organizations

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template