NJ Form 2210 Underpayment of Estimated Tax EFile Com

Understanding the NJ Form 2210 Underpayment of Estimated Tax

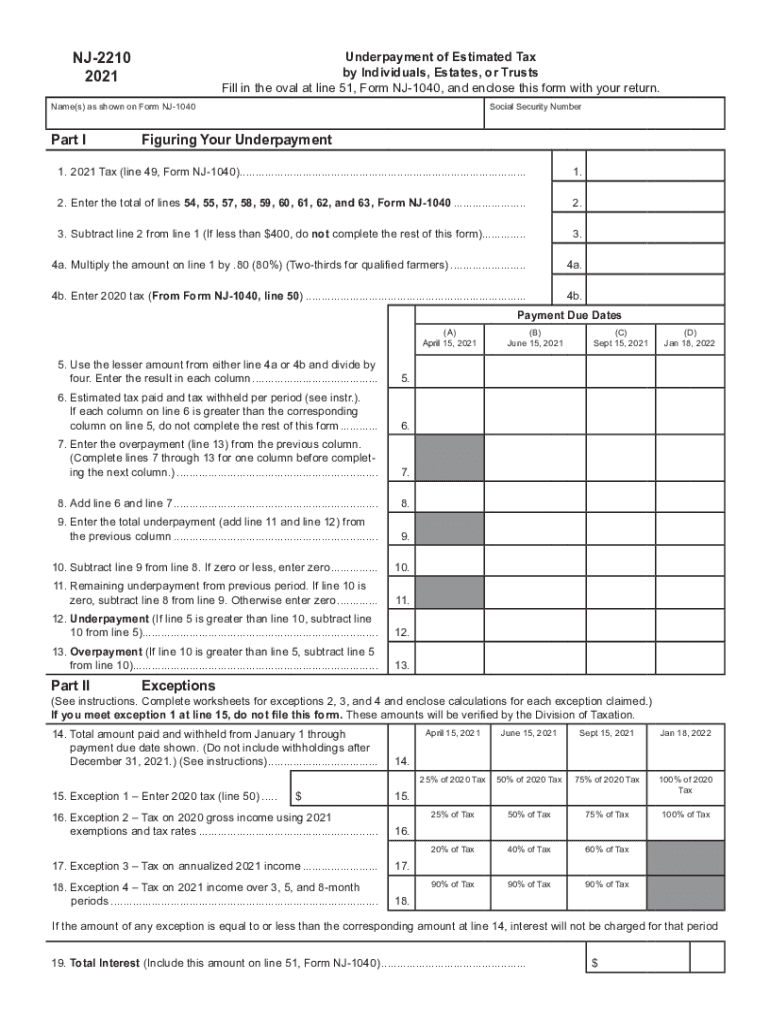

The NJ Form 2210 is designed for taxpayers who may not have paid enough estimated tax throughout the year. This form helps calculate any penalties for underpayment of estimated tax in New Jersey. It is essential for individuals and businesses to understand their tax obligations to avoid unexpected liabilities. The form outlines the specific criteria for determining whether an underpayment has occurred and the penalties associated with it.

Steps to Complete the NJ Form 2210

Completing the NJ Form 2210 involves several steps to ensure accuracy and compliance with state tax regulations. First, gather all relevant financial documents, including income statements and previous tax returns. Next, calculate your total estimated tax liability for the year. Then, determine the amount of estimated tax you have already paid. Finally, use the form to calculate any underpayment and the corresponding penalty, if applicable. Ensure all calculations are double-checked for accuracy before submission.

State-Specific Rules for the NJ Form 2210

New Jersey has specific rules regarding the use of the NJ Form 2210. Taxpayers must be aware of the estimated tax payment thresholds and the criteria that define underpayment. For example, if your total tax liability exceeds a certain amount, you are required to make estimated payments. Additionally, New Jersey allows for certain exemptions and credits that can affect your overall tax liability. Familiarizing yourself with these state-specific rules can help in accurately completing the form.

Filing Deadlines and Important Dates

Timely filing of the NJ Form 2210 is crucial to avoid penalties. The form must be submitted by the same deadline as your annual tax return. For most taxpayers, this is typically April 15. However, if you file for an extension, the deadline may vary. It is important to keep track of any changes to filing dates, especially in light of any state-specific announcements or changes in tax law.

Penalties for Non-Compliance

Failure to file the NJ Form 2210 when required can result in significant penalties. New Jersey imposes interest on any unpaid tax, which accrues from the due date of the payment until it is paid in full. Additionally, there may be a specific penalty for underpayment of estimated tax, which can increase the overall tax liability. Understanding these penalties can motivate timely and accurate filing to avoid unnecessary financial burdens.

Examples of Using the NJ Form 2210

Practical examples can help clarify the use of the NJ Form 2210. For instance, a self-employed individual may find that their income fluctuates significantly, leading to potential underpayment of estimated taxes. In this case, using the NJ Form 2210 allows them to assess their tax situation and determine if they owe any penalties. Similarly, retirees with varying income sources can also benefit from the form to ensure they meet their estimated tax obligations throughout the year.

Quick guide on how to complete nj form 2210 underpayment of estimated tax efilecom

Complete NJ Form 2210 Underpayment Of Estimated Tax EFile com effortlessly on any gadget

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, as you can easily access the necessary template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage NJ Form 2210 Underpayment Of Estimated Tax EFile com on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and electronically sign NJ Form 2210 Underpayment Of Estimated Tax EFile com with ease

- Find NJ Form 2210 Underpayment Of Estimated Tax EFile com and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to confirm your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign NJ Form 2210 Underpayment Of Estimated Tax EFile com and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj form 2210 underpayment of estimated tax efilecom

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the nj2210 and how does it relate to airSlate SignNow?

The nj2210 is a specific form used in New Jersey for filing income tax returns. Using airSlate SignNow, you can easily eSign and send your nj2210 documents securely and efficiently, making tax filing simpler.

-

How much does airSlate SignNow cost for nj2210 document processing?

airSlate SignNow offers flexible pricing plans that can accommodate businesses of all sizes when processing nj2210 documents. Depending on the features you need, plans start at an affordable rate, ensuring cost-effective solutions for your eSigning needs.

-

What features does airSlate SignNow offer for handling the nj2210?

With airSlate SignNow, you have access to features like customizable templates, advanced eSigning options, and real-time tracking that streamline the nj2210 signing process. These features enhance your ability to manage document workflows efficiently.

-

Can I integrate airSlate SignNow with other software for nj2210 submissions?

Yes, airSlate SignNow supports various integrations with popular software applications, making it easy to submit your nj2210 electronically. This seamless integration helps businesses enhance their workflow and increase productivity.

-

What are the benefits of using airSlate SignNow for nj2210 forms?

Using airSlate SignNow for your nj2210 forms offers numerous benefits, including improved turnaround times, reduced paperwork, and enhanced security for your sensitive information. These advantages result in a more efficient and reliable eSigning process.

-

Is airSlate SignNow mobile-friendly for completing nj2210 documents?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to complete and eSign your nj2210 documents on-the-go. This feature ensures that you're not tied to a desk and can manage your documents from anywhere.

-

How does airSlate SignNow protect my nj2210 information?

airSlate SignNow employs advanced security measures, including data encryption and secure server storage, to protect your nj2210 information. This commitment to security enables users to sign with confidence knowing their sensitive data is safe.

Get more for NJ Form 2210 Underpayment Of Estimated Tax EFile com

Find out other NJ Form 2210 Underpayment Of Estimated Tax EFile com

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF